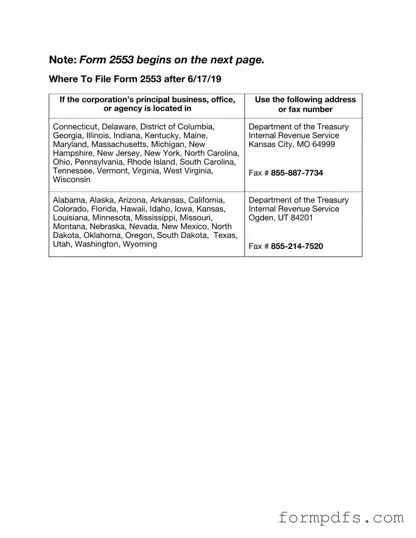

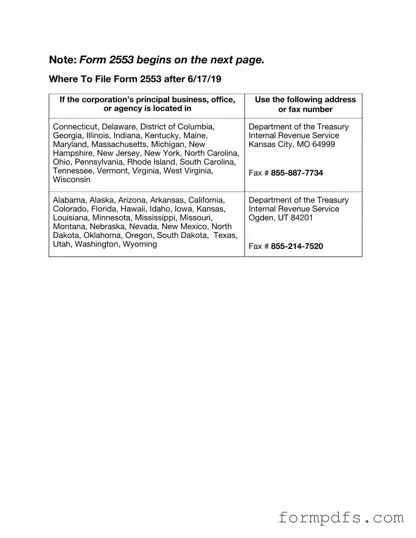

The IRS 2553 form is a document used by small businesses to elect S corporation status for federal tax purposes. By completing this form, eligible entities can potentially benefit from tax advantages while avoiding double taxation. For those interested in...

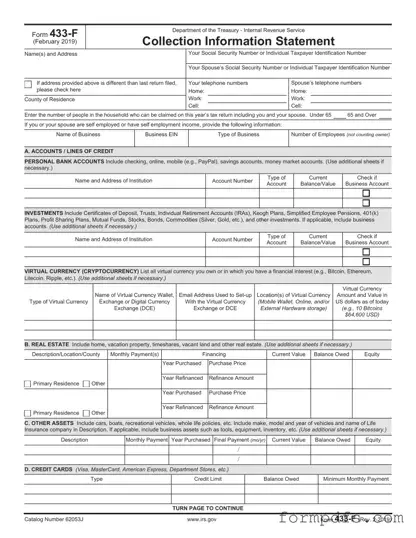

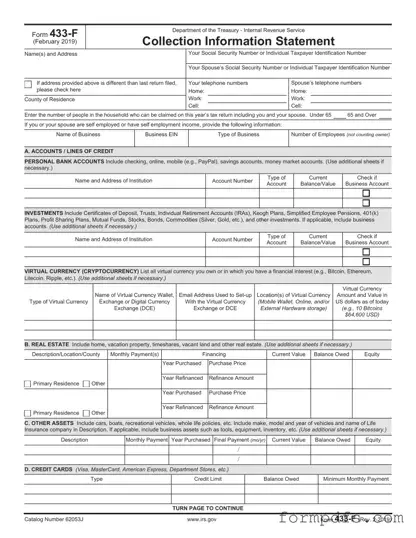

The IRS 433-F form is a financial disclosure document used by taxpayers to provide the Internal Revenue Service with detailed information about their income, expenses, and assets. This form is essential for those seeking to establish a payment plan or...

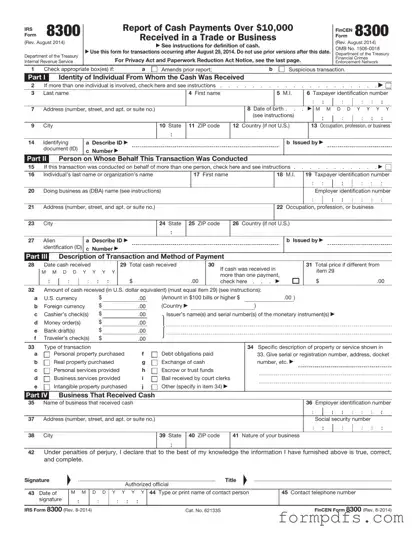

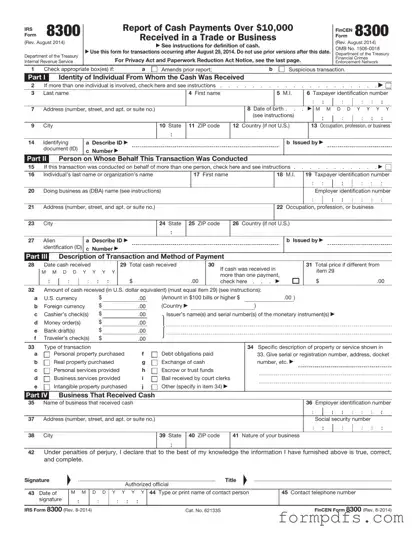

The IRS 8300 form is a document that businesses must file when they receive more than $10,000 in cash from a single transaction or related transactions. This form helps the IRS track large cash transactions to prevent money laundering and...

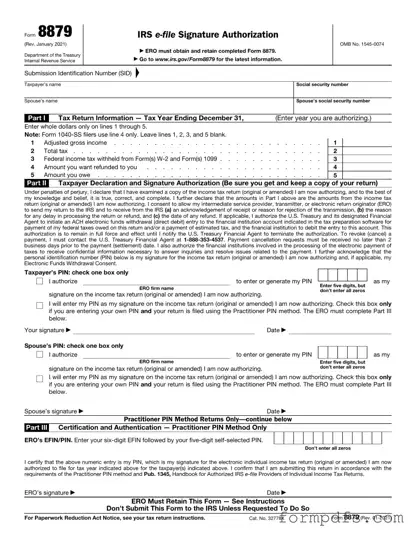

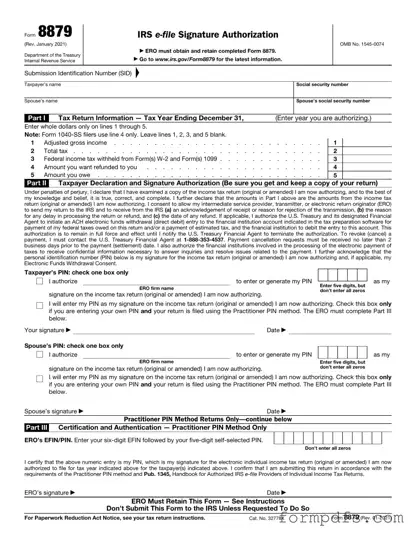

The IRS 8879 form, also known as the e-file Signature Authorization, is a crucial document that allows taxpayers to electronically sign their tax returns. By completing this form, individuals can authorize their tax preparers to submit their returns on their...

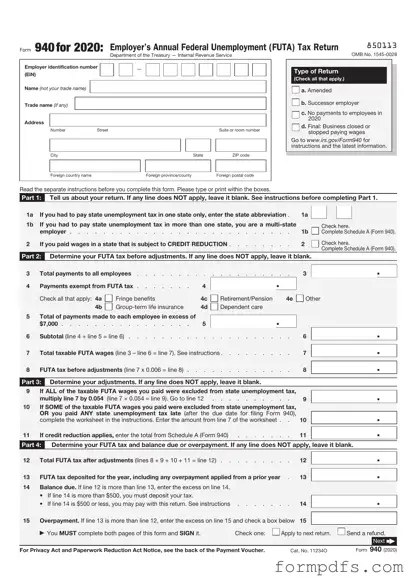

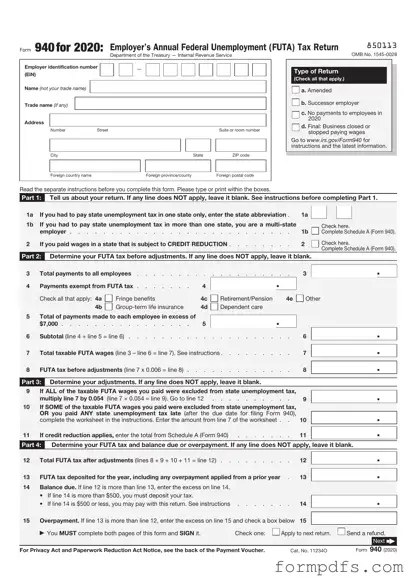

The IRS 940 form is an annual report used by employers to report their Federal Unemployment Tax Act (FUTA) tax obligations. This form is essential for tracking and ensuring compliance with federal unemployment tax requirements. Understanding its purpose and requirements...

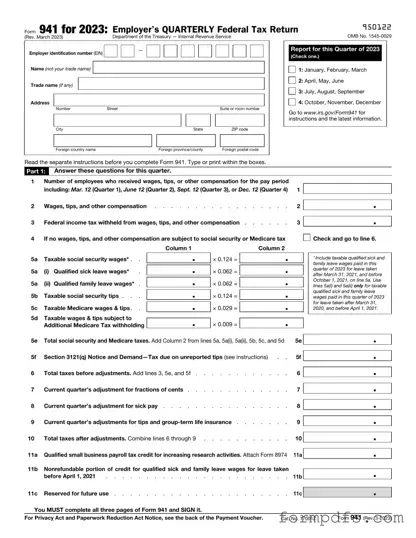

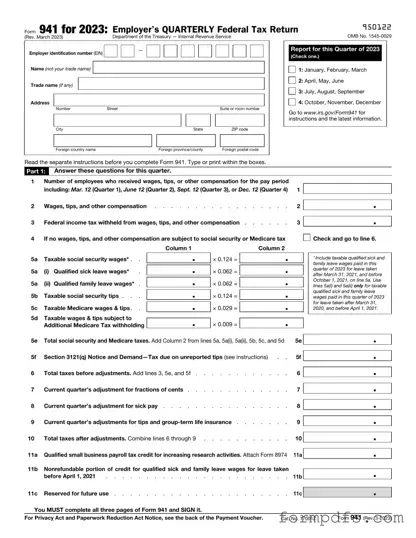

The IRS Form 941 is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form helps the IRS track the taxes that businesses owe and ensures compliance...

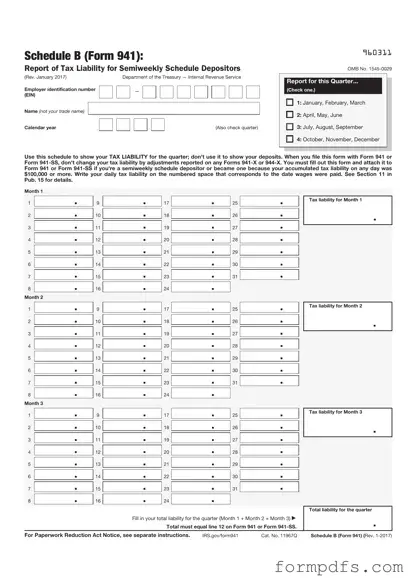

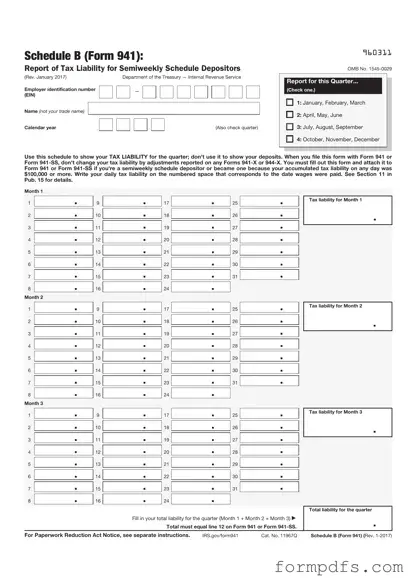

The IRS Schedule B (Form 941) is a supplemental form used by employers to report their tax liabilities for Social Security, Medicare, and federal income tax withholding. This form provides detailed information on the wages paid to employees and the...

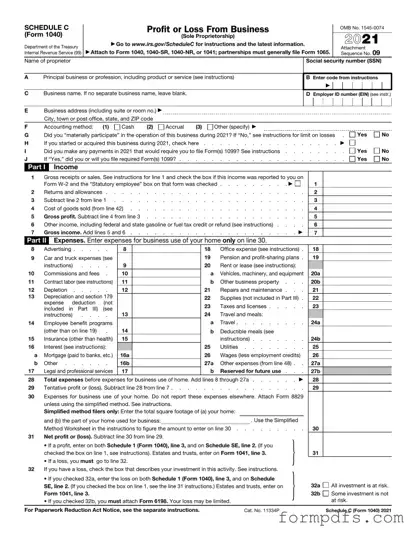

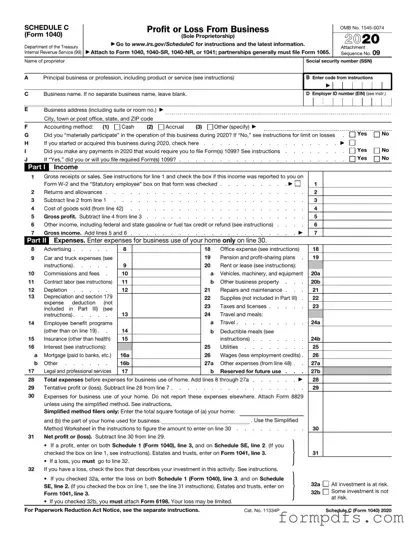

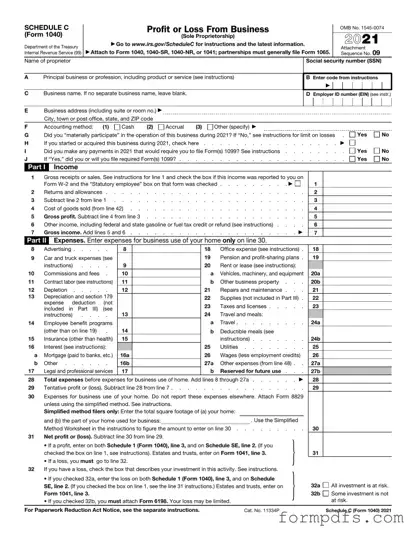

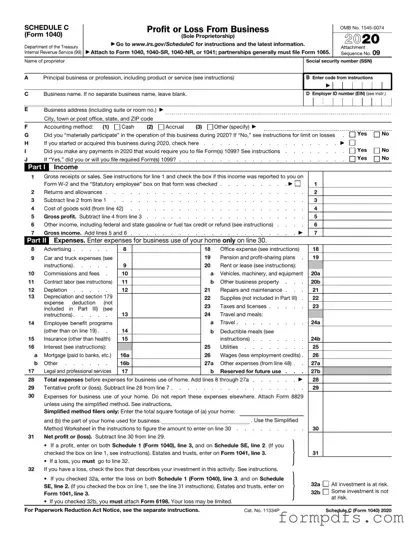

The IRS Schedule C 1040 form is a tax document used by sole proprietors to report income or loss from their business activities. This form allows individuals to detail their earnings, expenses, and ultimately determine their taxable income. Understanding how...

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business activities. This form provides a detailed account of business revenue, expenses, and net profit or loss, which ultimately...

The IRS W-2 form is a tax document that employers use to report an employee's annual wages and the taxes withheld from their paychecks. This form provides essential information for employees to accurately file their income tax returns. Ensure you...

The IRS W-3 form is a summary of all W-2 forms issued by an employer, providing the Social Security Administration with essential information about wages paid and taxes withheld. This form ensures accurate reporting of employee earnings and tax contributions....

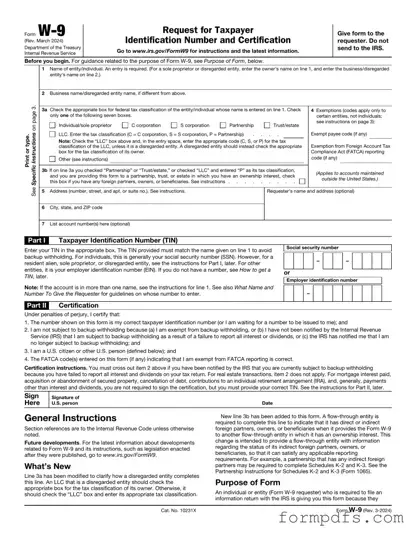

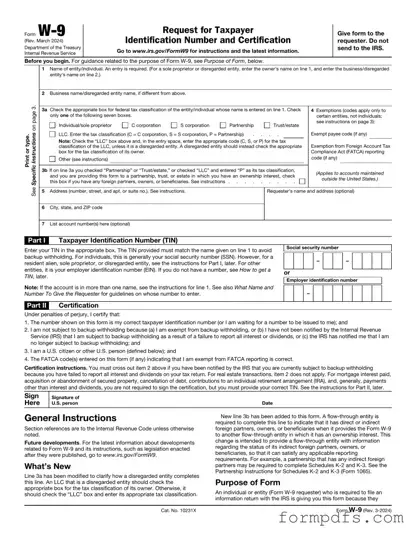

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others, typically for tax reporting purposes. Completing this form ensures that the correct information is reported to the IRS, helping to...