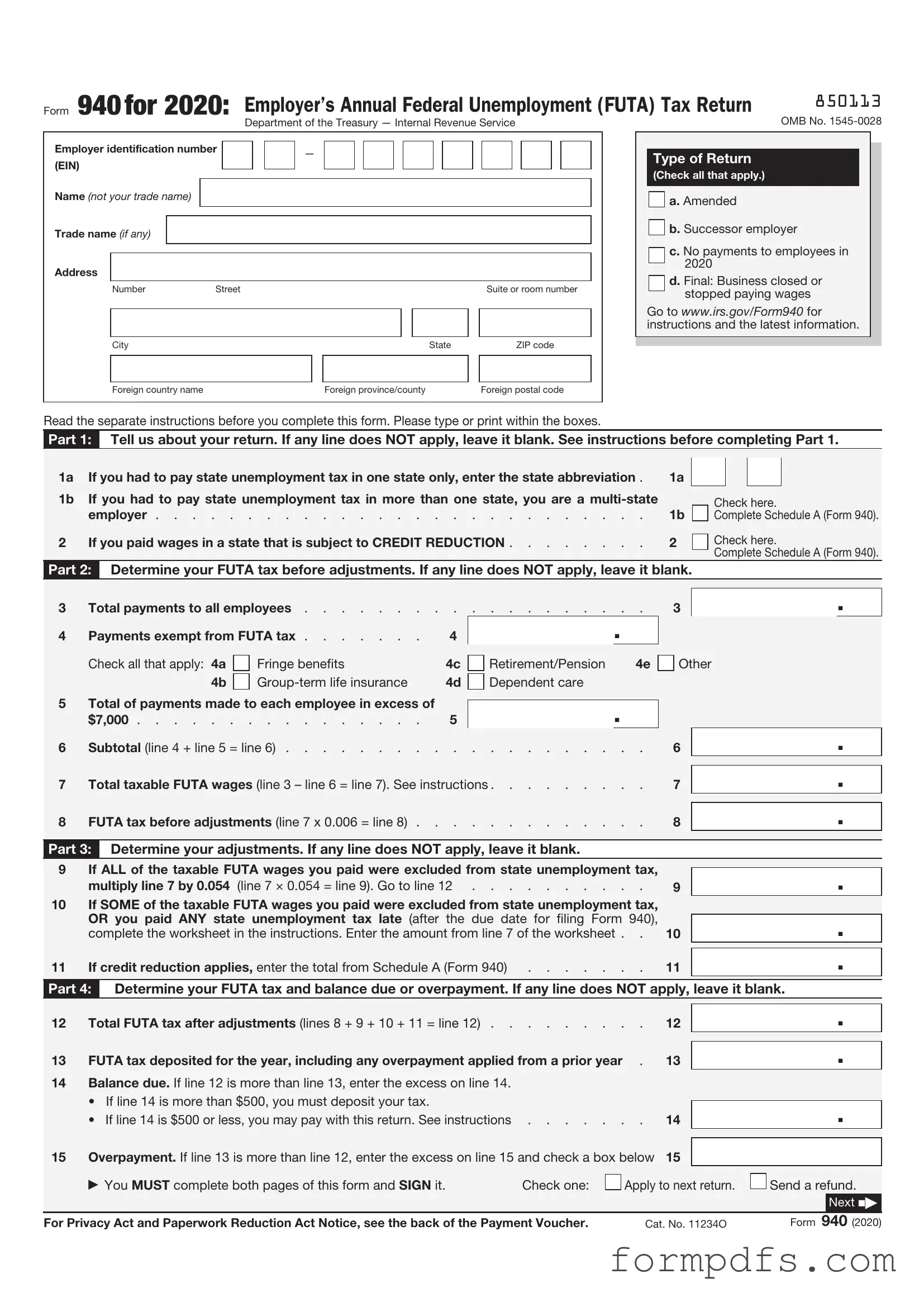

Blank IRS 940 PDF Form

The IRS 940 form plays a crucial role in the annual reporting process for employers regarding federal unemployment tax obligations. This form is primarily used to report and pay the Federal Unemployment Tax Act (FUTA) tax, which funds unemployment benefits for workers who have lost their jobs. Employers must file Form 940 if they paid wages of $1,500 or more in any calendar quarter or if they had at least one employee for some part of a day in any 20 or more weeks during the current or preceding calendar year. The form requires detailed information, including the total amount of wages paid, the taxable FUTA wages, and any adjustments for state unemployment taxes. Understanding how to accurately complete and submit Form 940 is essential for compliance with federal regulations, as failure to file or inaccuracies can result in penalties. Additionally, the form is typically due by January 31 of the following year, making timely submission a key aspect of maintaining good standing with the IRS.

More PDF Templates

Cease and Desist Letter to Neighbor - Serve this letter to inform others about your property boundaries effectively.

Filing the necessary documents to update your address can be a straightforward process with the right information. Ensuring compliance with the regulations of the California Board of Accountancy is essential, and utilizing the Address Change California form is a critical step in this process. For those looking for more resources related to their documentation needs, you can access All California Forms to find further assistance.

Profits or Loss From Business - It can also be a valuable tool for understanding cash flow and overall business profitability.

Documents used along the form

The IRS 940 form is essential for employers, as it is used to report annual Federal Unemployment Tax Act (FUTA) taxes. However, it is often accompanied by other important forms and documents that help ensure compliance with federal tax regulations. Below is a list of commonly used forms that may be necessary when filing the IRS 940 form.

- IRS Form 941: This form is used to report quarterly federal payroll taxes. Employers must file it to report income taxes, Social Security, and Medicare taxes withheld from employee wages.

- IRS Form 944: Smaller employers may use this form to report annual payroll taxes instead of the quarterly Form 941. It simplifies the process for those with lower tax liabilities.

- IRS Form W-2: Employers must provide this form to employees to report their annual wages and the taxes withheld. It is crucial for employees when they file their personal income tax returns.

- IRS Form W-3: This is a summary form that accompanies the W-2s when they are submitted to the Social Security Administration. It provides a total of all wages and taxes withheld for the year.

- IRS Form 1099-MISC: For independent contractors or freelancers, this form reports payments made to them. Employers must file it if they paid $600 or more to a contractor during the year.

- IRS Form 1096: This is a summary form that accompanies certain types of 1099 forms when filed by paper. It provides the IRS with a summary of the information reported on the 1099s.

- New York Dirt Bike Bill of Sale: This form serves as proof of purchase and transfer of ownership for dirt bikes in New York State, ensuring both parties' rights are protected. More details can be found at https://smarttemplates.net/fillable-new-york-dirt-bike-bill-of-sale/.

- State Unemployment Tax Forms: Each state has its own forms for reporting state unemployment taxes. These forms are essential for complying with state laws and regulations.

- Payroll Records: While not a formal IRS document, maintaining accurate payroll records is vital. These records support the information reported on various tax forms and ensure compliance during audits.

- Employer Identification Number (EIN): This unique number is assigned to businesses by the IRS. It is necessary for filing tax forms and is often required on various documents related to employment taxes.

Understanding these forms and their purposes can help employers navigate the complexities of tax reporting. Keeping accurate records and filing the necessary documents in a timely manner is crucial for maintaining compliance and avoiding potential penalties. By being proactive and organized, employers can ensure a smoother tax filing experience.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 940 is used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax liability. |

| Filing Deadline | Employers must file Form 940 by January 31 of the following year, but if deposits are made on time, the deadline can be extended to February 10. |

| State-Specific Forms | While Form 940 is federal, states may have their own unemployment tax forms governed by state laws, such as the California Unemployment Insurance Code. |

| Penalties | Failure to file Form 940 on time can result in penalties, including fines and interest on unpaid taxes. |

More About IRS 940

What is the IRS 940 form?

The IRS 940 form is an annual report used by employers to report their Federal Unemployment Tax Act (FUTA) tax liability. This form helps the IRS track unemployment taxes collected from employers to fund unemployment benefits.

Who needs to file Form 940?

Employers who pay wages of $1,500 or more in any calendar quarter or have at least one employee for some part of a day in any 20 or more weeks during the current or preceding year must file Form 940.

When is Form 940 due?

Form 940 is due on January 31 of the year following the tax year being reported. If you file your form on time and pay any taxes owed, you may receive an extension until February 10.

How do I file Form 940?

You can file Form 940 either electronically or by mail. If you choose to file by mail, send the completed form to the address specified in the form's instructions. Electronic filing is often faster and can help ensure accuracy.

What if I made a mistake on my Form 940?

If you realize there’s an error on your Form 940 after filing, you can correct it by filing Form 940-X, which is the amended version of the form. This allows you to report any changes and adjust your tax liability accordingly.

What are the penalties for not filing Form 940?

Failure to file Form 940 on time can result in penalties. The penalty is generally 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. Interest may also accrue on any unpaid tax.

Can I get help with Form 940?

What information do I need to complete Form 940?

To complete Form 940, you will need information about your business, including the total wages paid, the number of employees, and any adjustments for state unemployment taxes. Keeping accurate payroll records will make this process easier.

IRS 940: Usage Steps

Filling out the IRS 940 form is an essential step for employers who need to report their federal unemployment taxes. Completing this form accurately helps ensure compliance with tax obligations. Here’s a straightforward guide to assist you through the process.

- Gather Necessary Information: Collect your business details, including your Employer Identification Number (EIN), business name, and address. Make sure to have your payroll records handy as well.

- Download the Form: Access the IRS website to download the latest version of Form 940. Ensure you have the correct year’s form to avoid any issues.

- Fill in Your Business Information: In the top section of the form, enter your business name, EIN, and address. Double-check for accuracy.

- Report Taxable Wages: In Part 1, calculate your total taxable wages for the year. Include all wages subject to unemployment tax.

- Calculate Your Tax: In Part 2, apply the appropriate tax rate to the taxable wages you reported. This will help you determine your total tax liability.

- Account for Payments: In Part 3, report any payments made towards your unemployment tax throughout the year. This includes any credits or adjustments.

- Complete the Signature Section: Ensure that someone authorized to sign for your business completes the signature section at the end of the form.

- Review the Form: Before submitting, carefully review the entire form for any errors or missing information. Accuracy is crucial.

- Submit the Form: Mail the completed form to the address specified in the instructions or file it electronically if that option is available.

Once the form is submitted, keep a copy for your records. It’s important to stay organized and retain all documentation related to your employment taxes for future reference.