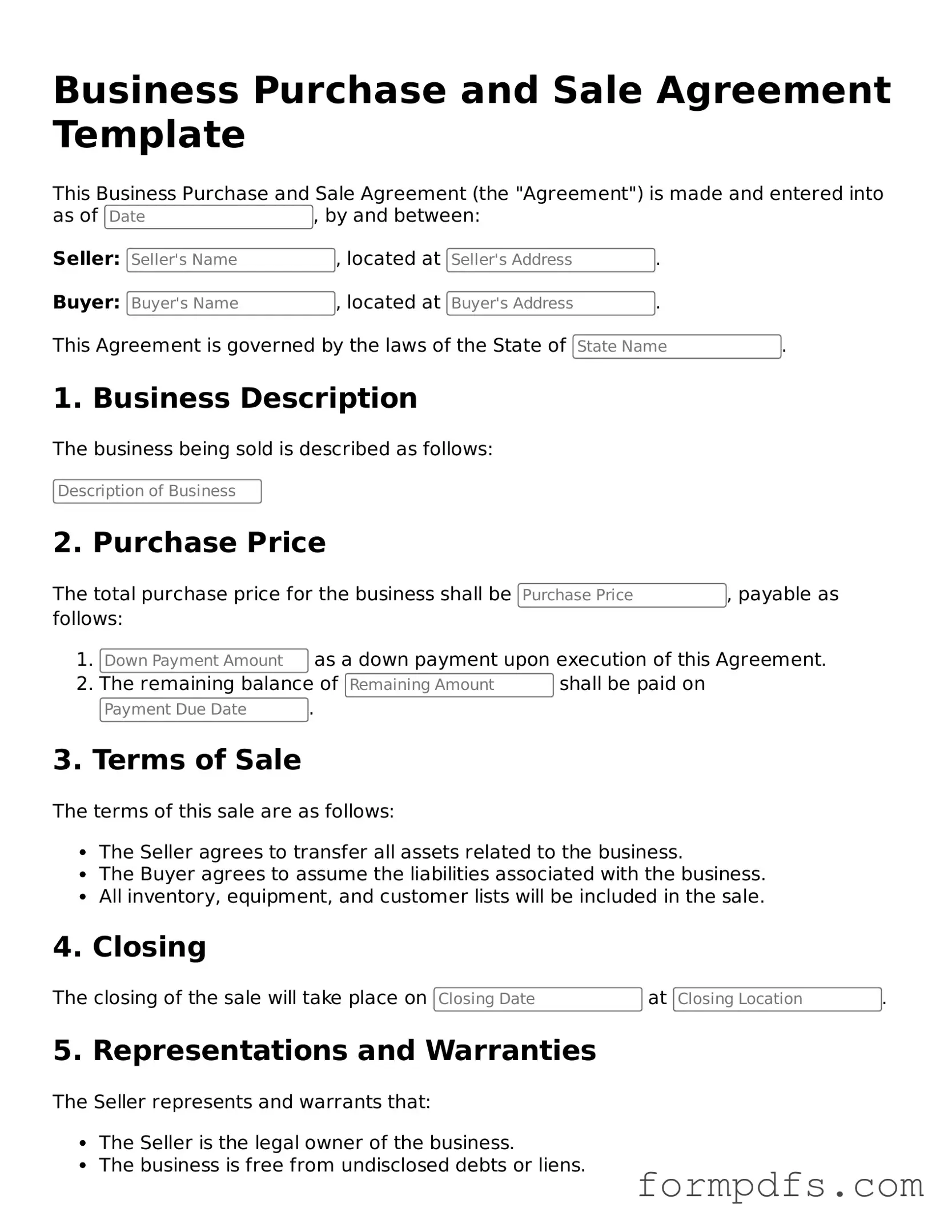

Valid Business Purchase and Sale Agreement Template

When considering the acquisition or divestiture of a business, the Business Purchase and Sale Agreement serves as a critical document that outlines the terms and conditions governing the transaction. This agreement typically details the purchase price, payment terms, and the specific assets or shares being transferred, ensuring that both the buyer and seller have a clear understanding of their obligations. Additionally, it often includes representations and warranties from both parties, providing assurances regarding the business's financial status and operational integrity. Key aspects such as contingencies, closing procedures, and any post-sale obligations are also addressed within this form, helping to mitigate risks and clarify expectations. By meticulously outlining these elements, the Business Purchase and Sale Agreement not only facilitates a smoother transaction process but also serves as a protective measure for both parties involved, ultimately laying the groundwork for a successful transfer of ownership.

More Forms:

Profit and Loss Form - Schedule C is for reporting income or loss from a business you operated as a sole proprietor.

To ensure compliance when establishing an LLC in California, it is essential to correctly complete and file the California LLC-1 form. This document is pivotal for the formation of your limited liability company, and it is important to reference resources such as All California Forms for guidance during the filing process.

How Do I Write a Character Reference Letter for Court - When drafting, it is essential to be honest and provide specific examples to support claims.

Vehicle Sales Agreement - Documents any promises made beyond the written agreement.

Documents used along the form

When engaging in a business transaction, several forms and documents complement the Business Purchase and Sale Agreement. These documents provide clarity and ensure that all parties are aligned on the terms of the sale. Below is a list of commonly used documents in conjunction with the agreement.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller before the formal agreement is drafted. It typically includes key terms such as purchase price and timeline.

- Vehicle Release of Liability: When transferring ownership, be sure to complete the essential Vehicle Release of Liability documentation to safeguard against future claims.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document protects sensitive information shared during negotiations. It ensures that both parties keep proprietary information confidential.

- Due Diligence Checklist: This checklist helps the buyer assess the business's financial health and operational status. It includes items such as financial statements, contracts, and employee records.

- Bill of Sale: This document serves as proof of the transfer of ownership from the seller to the buyer. It includes details about the business assets being sold.

- Closing Statement: This statement summarizes the financial aspects of the transaction, including the final purchase price, adjustments, and any fees. It is presented at the closing of the sale.

These documents play a crucial role in facilitating a smooth transaction. They help protect the interests of both the buyer and the seller, ensuring that all necessary information is disclosed and understood.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold and purchased. |

| Parties Involved | The agreement typically involves a seller, who is selling the business, and a buyer, who is purchasing it. |

| Key Components | Important elements include the purchase price, payment terms, and details about the assets being transferred. |

| Governing Law | The agreement is usually governed by the laws of the state in which the business operates, such as California or New York. |

| Confidentiality Clause | Many agreements include a confidentiality clause to protect sensitive information shared during negotiations. |

| Due Diligence | Buyers often conduct due diligence to verify the financial and operational status of the business before finalizing the purchase. |

| Closing Date | The agreement specifies a closing date, which is when the ownership officially transfers from the seller to the buyer. |

| Contingencies | Common contingencies may include financing approval or regulatory approvals that must be met for the sale to proceed. |

| Legal Review | It is advisable for both parties to have the agreement reviewed by legal professionals to ensure their interests are protected. |

More About Business Purchase and Sale Agreement

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is bought or sold. It serves as a roadmap for both the buyer and the seller, detailing everything from the purchase price to the responsibilities of each party involved. This agreement helps to ensure that both sides understand their obligations and protects their interests throughout the transaction process.

Why is it important to have a Business Purchase and Sale Agreement?

This agreement is crucial because it minimizes misunderstandings and disputes that may arise during the sale. By clearly defining the terms of the sale, both the buyer and seller can avoid potential legal issues down the road. Additionally, having a formal agreement provides a sense of security for both parties, as it outlines what is expected and protects their investment.

What key elements should be included in the agreement?

Several important components should be included in a Business Purchase and Sale Agreement. These typically consist of the purchase price, payment terms, a description of the business being sold, any assets included in the sale, and any liabilities the buyer will assume. It’s also wise to include representations and warranties from both parties, as well as any conditions that must be met before the sale can be finalized.

Who should draft the Business Purchase and Sale Agreement?

While it’s possible for either party to draft the agreement, it’s highly recommended that a legal professional experienced in business transactions be involved. They can ensure that the agreement complies with local laws and regulations and that all necessary elements are included. This can save time and prevent issues that may arise from improperly drafted agreements.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to the changes. It’s important to document any modifications in writing and have both parties sign the updated agreement. This helps maintain clarity and ensures that all parties are on the same page regarding the new terms.

What happens if one party fails to fulfill their obligations?

If one party fails to meet their obligations as outlined in the agreement, the other party may have legal recourse. This could involve seeking damages or enforcing the terms of the agreement through legal action. To avoid such situations, it’s essential for both parties to clearly understand their responsibilities and to communicate openly throughout the process.

Is it necessary to have a lawyer review the agreement?

While it’s not legally required to have a lawyer review the agreement, it is highly advisable. A legal professional can identify any potential pitfalls or areas of concern that you may not have considered. Their expertise can provide peace of mind, ensuring that your interests are adequately protected during the transaction.

Business Purchase and Sale Agreement: Usage Steps

Completing a Business Purchase and Sale Agreement form is a critical step in ensuring that both the buyer and seller are protected during the transaction. It is essential to provide accurate information and to understand the implications of each section of the form. The following steps will guide you through the process of filling out this important document.

- Begin by entering the date of the agreement at the top of the form.

- Identify the parties involved in the transaction. Clearly state the names and addresses of both the seller and the buyer.

- Provide a detailed description of the business being sold. This should include the name, location, and any relevant identifiers like the business license number.

- Outline the purchase price of the business. Specify the total amount and any terms regarding payment, such as deposits or installments.

- Include any contingencies that must be met for the sale to proceed. This might involve financing, inspections, or approvals from third parties.

- Detail any assets included in the sale. This may encompass inventory, equipment, intellectual property, or real estate.

- Specify the closing date for the transaction. This is the date when the sale will be finalized and ownership will be transferred.

- Include any representations and warranties made by the seller regarding the business’s condition, financial status, or legal compliance.

- Provide space for both parties to sign and date the agreement, ensuring that all necessary witnesses or notaries are accounted for.

After completing the form, review it carefully to ensure that all information is accurate and complete. Both parties should retain a copy for their records, as this agreement will serve as a crucial reference throughout the transaction process.