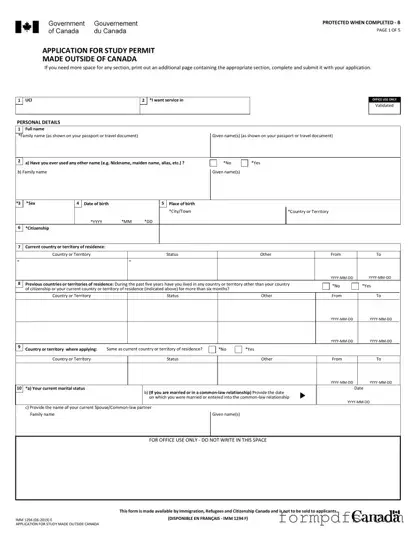

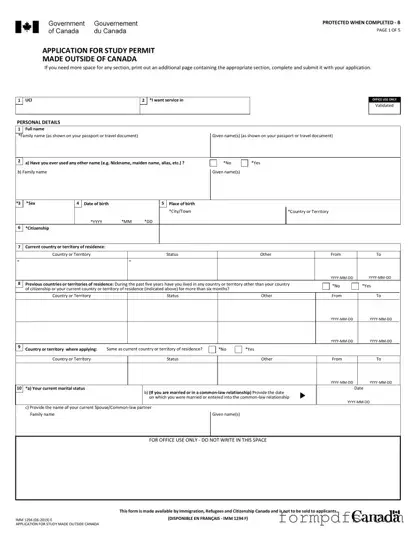

The IMM 1294 form is an application for a study permit made outside of Canada. This form is essential for individuals seeking to study in Canada, as it collects necessary personal and educational information. Completing the IMM 1294 accurately is...

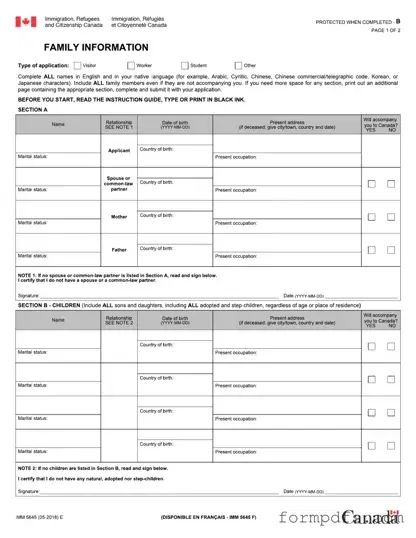

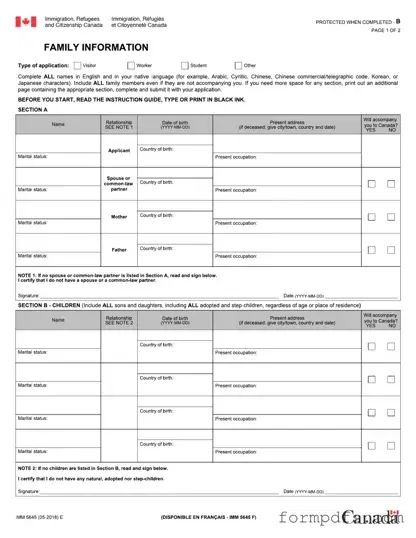

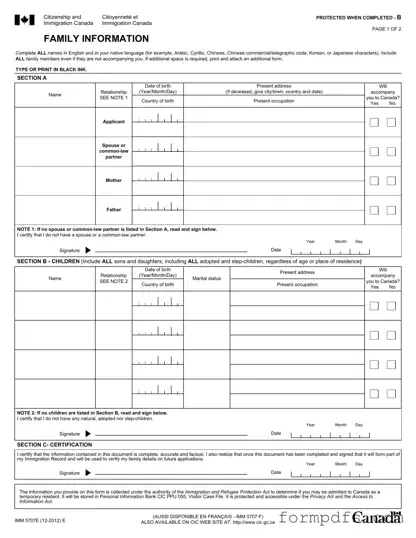

The IMM 5645 form is a document required by Immigration, Refugees and Citizenship Canada that collects family information from applicants. It includes details about your family members, such as names, dates of birth, and occupations, whether or not they will...

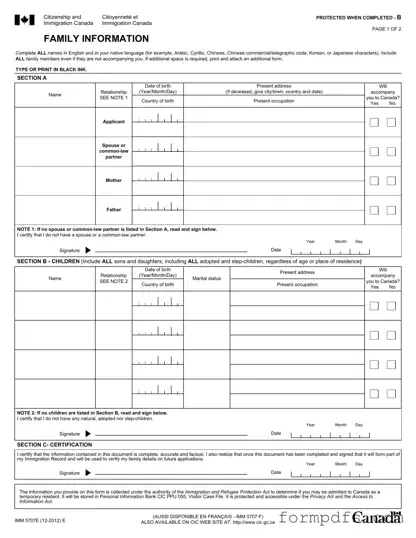

The IMM5707 form, also known as the Additional Family Information form, is essential for individuals applying for a Temporary Resident Visa to Canada. This form collects vital details about your family members, ensuring that all relevant information is included in...

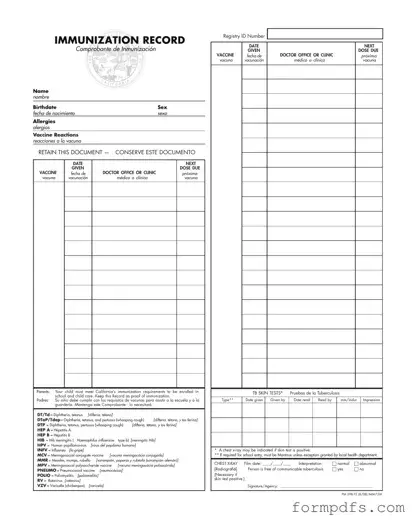

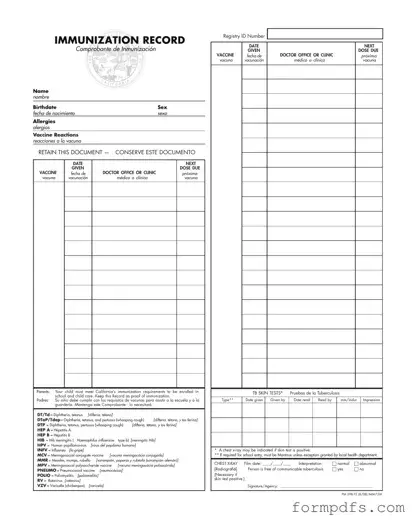

The Immunization Record form is a crucial document that tracks a child's vaccinations, ensuring they meet the requirements for school and child care enrollment in California. This form not only serves as proof of immunization but also includes important information...

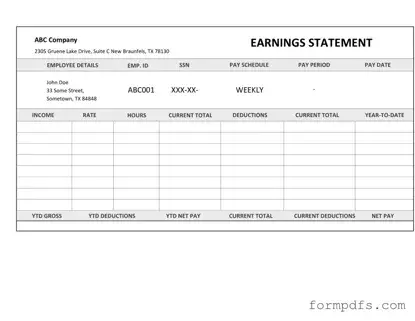

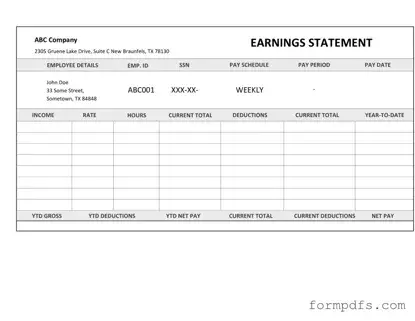

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for individuals working as independent contractors. This form provides essential information regarding payment details, ensuring transparency between contractors and clients. To streamline your payment process,...

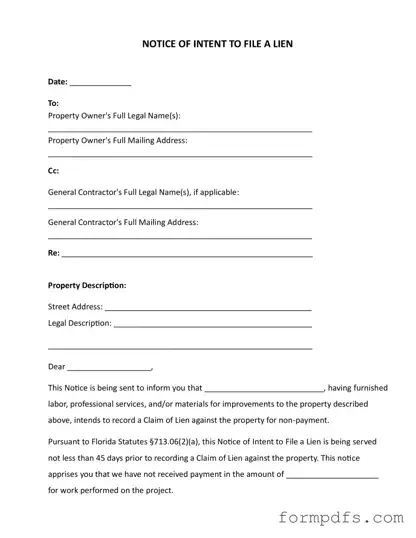

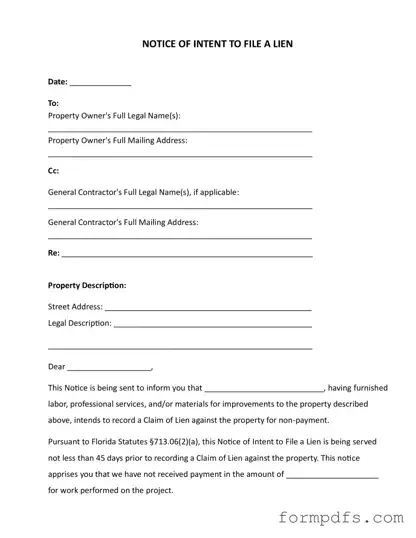

The Intent To Lien Florida form serves as a formal notification to property owners regarding the intention to file a lien due to non-payment for services rendered or materials supplied. This document is crucial for contractors and suppliers, as it...

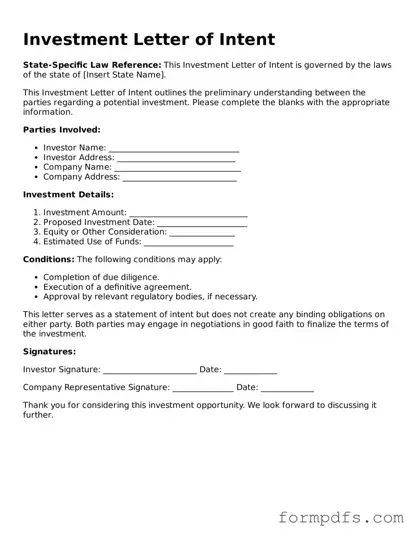

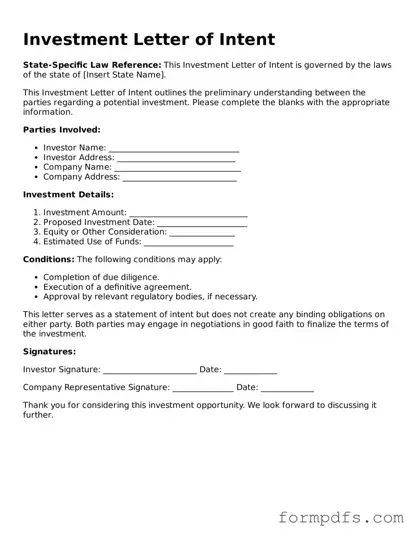

An Investment Letter of Intent is a document that outlines the preliminary terms and conditions of an investment agreement between parties. It serves as a foundation for further negotiations and helps clarify the intentions of both investors and recipients. To...

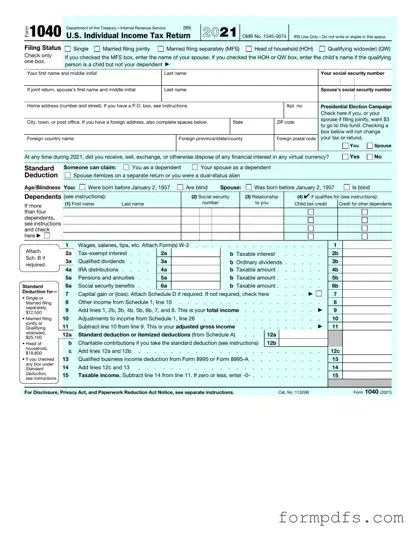

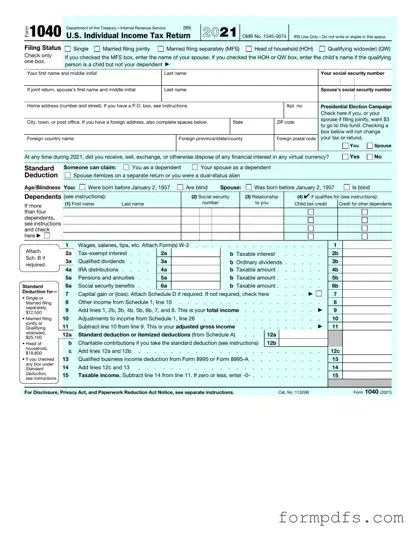

The IRS 1040 form is the standard individual income tax return used by U.S. taxpayers to report their annual income. It allows individuals to calculate their tax liability and claim various deductions and credits. To ensure accurate filing, consider filling...

The IRS 1095-A form is a tax document that provides information about your health insurance coverage through the Health Insurance Marketplace. This form is essential for individuals who received premium tax credits or enrolled in a Marketplace plan, as it...

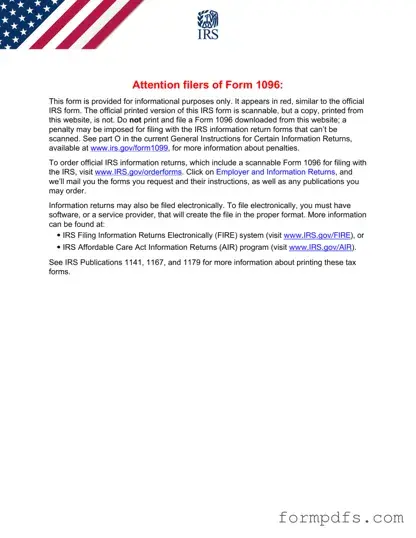

The IRS 1096 form is a summary transmittal form used to report various types of information returns to the Internal Revenue Service. This form consolidates the data from forms such as 1099, 1098, and W-2G, ensuring that the IRS receives...

The IRS 1099-MISC form is a tax document used to report various types of income other than wages, salaries, and tips. This form is typically issued to independent contractors, freelancers, and other non-employees who have received payments during the tax...

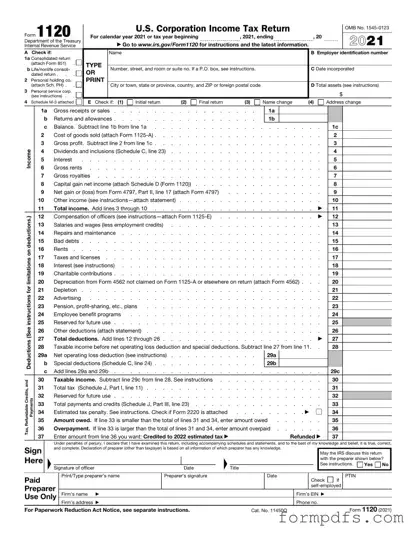

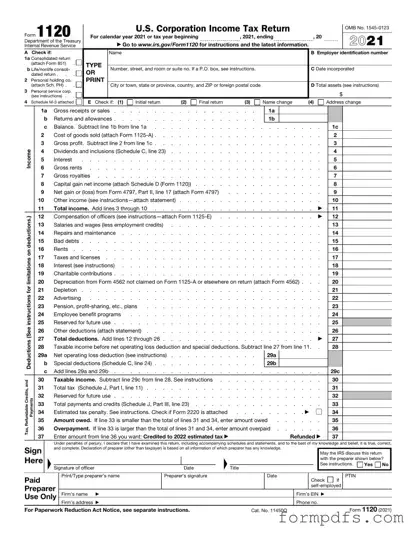

The IRS 1120 form is a tax return used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form is essential for corporations seeking to comply with federal tax regulations and accurately...