Valid Vehicle Repayment Agreement Template

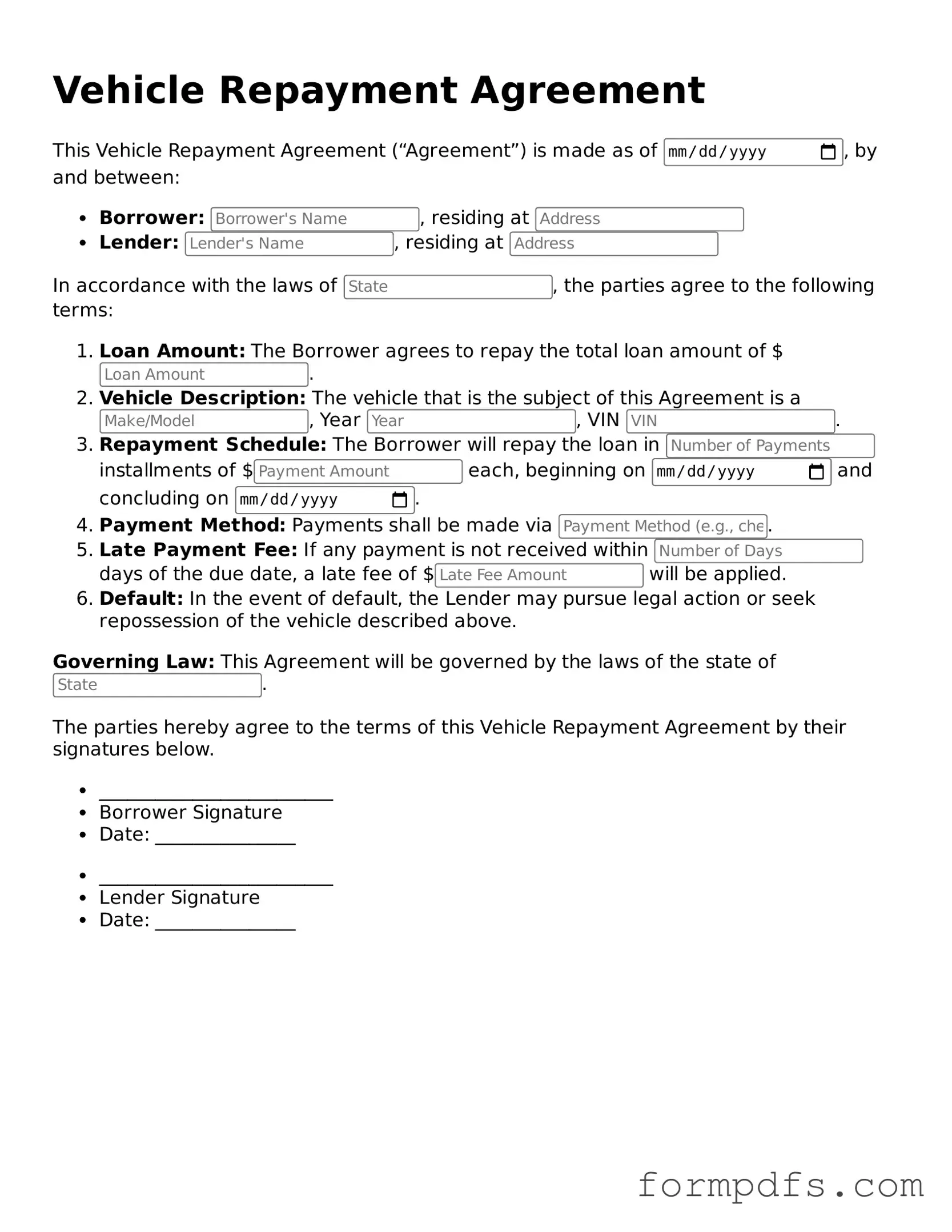

The Vehicle Repayment Agreement form plays a crucial role in the process of financing a vehicle. This document outlines the terms and conditions under which a borrower agrees to repay a loan taken out to purchase a vehicle. It typically includes important details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. Borrowers must understand their rights and responsibilities as outlined in the agreement. Additionally, the form may specify the consequences of defaulting on the loan, which can include repossession of the vehicle. Clear communication between the lender and borrower is essential, and this form serves as a binding contract that protects both parties. By carefully reviewing the Vehicle Repayment Agreement, individuals can make informed decisions and avoid potential pitfalls associated with vehicle financing.

More Forms:

Wage and Tax Statement - The W-2 is an important document in the overall tax process for individuals.

When engaging in the sale or purchase of a vessel in New York, utilizing the New York Boat Bill of Sale form is imperative to ensure a smooth transaction. This legal document not only safeguards the interests of both the buyer and seller but also delineates important aspects of the sale. For more information and to access the form, you can visit https://smarttemplates.net/fillable-new-york-boat-bill-of-sale, which provides the necessary template for your needs.

Roofing Warranty - Inquiries about roof problems should be reported promptly to maintain your warranty.

Documents used along the form

The Vehicle Repayment Agreement form is a crucial document for individuals entering into a repayment plan for a vehicle. However, several other forms and documents often accompany this agreement to ensure clarity and legal compliance. Below is a list of these related documents, each serving a specific purpose in the vehicle financing process.

- Loan Application Form: This document collects personal and financial information from the borrower, allowing lenders to assess creditworthiness and determine loan eligibility.

- Credit Report Authorization: This form grants permission for the lender to obtain the borrower’s credit report, which is essential for evaluating the borrower’s financial history.

- General Bill of Sale: This form is pivotal in the vehicle ownership transfer process, serving as a legal record that the seller has relinquished all rights to the vehicle to the buyer. It is essential for both parties' documentation and can be found at TopTemplates.info.

- Promissory Note: A legal document in which the borrower agrees to repay the loan amount under specified terms, including interest rates and payment schedules.

- Title Transfer Document: This document facilitates the transfer of ownership of the vehicle from the seller to the buyer, ensuring that the title reflects the new owner's information.

- Insurance Verification Form: This form confirms that the vehicle is adequately insured, protecting both the lender and borrower in case of accidents or damages.

- Disclosure Statement: A document that outlines the terms and conditions of the loan, including fees, interest rates, and any penalties for late payments.

- Payment Schedule: This document details the timeline and amount of each payment due, helping borrowers manage their repayment obligations effectively.

- Default Notice: A formal notification sent to the borrower if payments are missed, outlining the consequences of default and potential actions the lender may take.

Understanding these documents is essential for both borrowers and lenders. Each serves to protect the interests of all parties involved and ensures a smoother transaction process. Familiarity with these forms can lead to better decision-making and a more positive borrowing experience.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form outlines the terms under which a borrower agrees to repay a loan for a vehicle. |

| Parties Involved | This agreement typically involves the lender and the borrower, who is purchasing the vehicle. |

| Governing Law | The agreement is subject to state-specific laws, which vary by jurisdiction. For example, in California, the governing law is the California Civil Code. |

| Payment Terms | The form specifies the payment schedule, including due dates and amounts, ensuring clarity for both parties. |

| Interest Rates | It may outline the interest rate applicable to the loan, which can affect the total repayment amount. |

| Default Conditions | The agreement details what constitutes a default, such as missed payments, and the consequences that follow. |

| Signatures Required | Both parties must sign the form for it to be legally binding, indicating their agreement to the terms. |

| Modification Clause | It often includes a clause about how the agreement can be modified, ensuring that changes are documented and agreed upon. |

More About Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a document that outlines the terms and conditions under which a borrower agrees to repay a loan taken out to purchase a vehicle. It details the repayment schedule, interest rates, and any other relevant terms that both the lender and borrower must adhere to during the loan period.

Who needs to fill out the Vehicle Repayment Agreement form?

This form is typically filled out by individuals who are financing a vehicle purchase. Both the buyer and the lender must complete and sign the agreement to ensure that both parties understand their obligations and rights regarding the loan repayment.

What information is required to complete the form?

To complete the Vehicle Repayment Agreement form, you will need to provide personal information such as your name, address, and contact details. Additionally, you will need to include details about the vehicle, the loan amount, interest rate, repayment schedule, and any applicable fees or penalties for late payments.

How is the repayment schedule structured?

The repayment schedule is usually structured based on the terms agreed upon by both parties. It typically includes the total loan amount, the duration of the loan, and the frequency of payments, which can be monthly, bi-weekly, or otherwise. Each payment will generally consist of both principal and interest portions.

What happens if I miss a payment?

If a payment is missed, the lender may impose late fees or penalties as outlined in the agreement. Additionally, missing payments can negatively affect your credit score. It is important to communicate with the lender as soon as possible if you anticipate difficulty in making a payment to discuss potential options.

Can the terms of the agreement be modified after signing?

Yes, the terms of the Vehicle Repayment Agreement can be modified, but both parties must agree to any changes. It is essential to document any modifications in writing and have both parties sign the revised agreement to ensure clarity and enforceability.

What should I do if I want to pay off my loan early?

If you wish to pay off your loan early, review the agreement for any prepayment penalties. Many lenders allow early repayment without penalties, but it’s crucial to confirm this. Contact your lender to discuss the process and ensure that you follow the correct steps to settle the loan early.

Where can I obtain a Vehicle Repayment Agreement form?

You can typically obtain a Vehicle Repayment Agreement form from your lender, financial institution, or online legal resources. Ensure that the form you use complies with your state’s regulations and is tailored to your specific situation.

Vehicle Repayment Agreement: Usage Steps

Completing the Vehicle Repayment Agreement form is an important step in managing your vehicle financing. After you fill out the form, it will be submitted to the appropriate parties for review and processing. Make sure to provide accurate information to avoid delays.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- Fill in your contact information, including a phone number and email address.

- Next, enter the details of the vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

- Indicate the total amount due on the vehicle and the payment terms you are proposing.

- Sign and date the form at the bottom to confirm your agreement.

- Make a copy of the completed form for your records before submission.