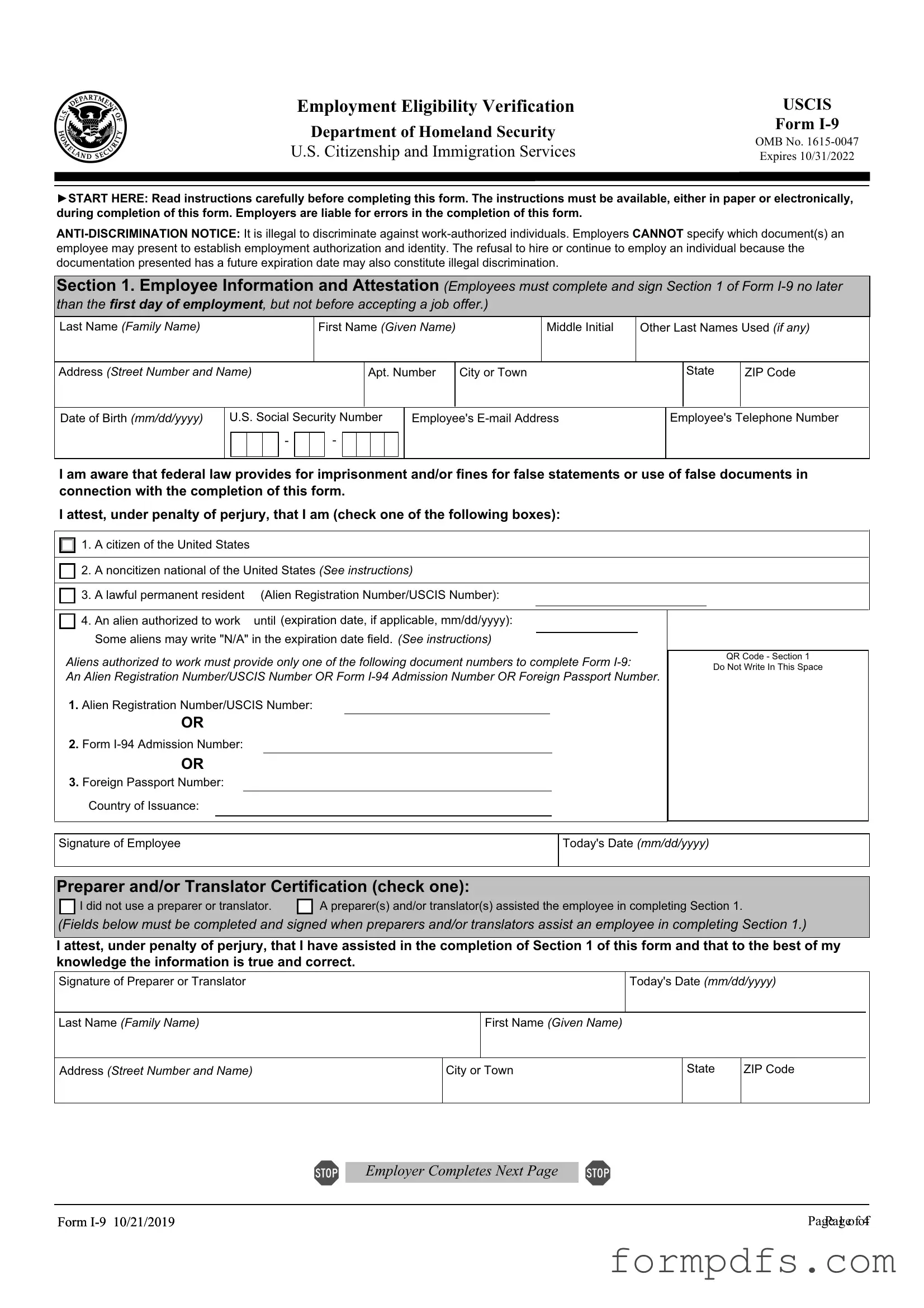

Blank USCIS I-9 PDF Form

The USCIS I-9 form is a crucial document for employers in the United States, serving as a verification tool for the employment eligibility of new hires. This form requires both the employee and employer to provide specific information, including the employee's name, address, date of birth, and immigration status. Employers must also review and document the employee's identification documents to confirm their right to work in the U.S. The I-9 form is not just a one-time requirement; it must be completed within three days of an employee's start date and kept on file for a designated period. Failure to comply with I-9 regulations can lead to penalties for employers, making it essential to understand the proper procedures. Additionally, the I-9 form is updated periodically, reflecting changes in immigration law and policy, which means staying informed is vital for compliance. Understanding the intricacies of the I-9 process ensures that both employers and employees can navigate the complexities of employment eligibility with confidence.

More PDF Templates

P-45 - Details regarding the employee’s previous employment must be clearly marked to avoid tax complications.

Completing a property sale requires careful attention to detail, and utilizing resources like the Property Sale Agreement can guide you through the process effectively, ensuring that all necessary information is captured to protect both the buyer and seller in the transaction.

What Does Continuance Mean in Court - It requires a signature to certify the request is made in good faith.

Cash Receipt Voucher - A foundational document for any financial transaction.

Documents used along the form

The USCIS I-9 form is essential for verifying the identity and employment eligibility of individuals hired for work in the United States. Several other forms and documents are often used in conjunction with the I-9 to ensure compliance with employment regulations. Below is a list of some commonly associated documents.

- Form W-4: This form is used by employees to indicate their tax situation to their employer. It determines the amount of federal income tax to withhold from an employee's paycheck.

- Form I-765: This application allows individuals to request work authorization. It is typically used by certain noncitizens who are eligible to work in the U.S. under specific conditions.

- Form I-20: Issued by U.S. educational institutions, this document certifies that a student has been accepted into a program and is eligible for a student visa. It is essential for international students.

- Arizona Motorcycle Bill of Sale Form: When transferring ownership of a motorcycle, be sure to use our comprehensive Motorcycle Bill of Sale form to document the sale properly.

- Form DS-2019: This form is used for individuals participating in the J-1 Exchange Visitor Program. It provides information about the exchange program and is necessary for obtaining a J-1 visa.

- Employment Agreement: This document outlines the terms and conditions of employment between the employer and the employee. It typically includes details about job responsibilities, salary, and benefits.

These documents serve various purposes, from tax withholding to verifying eligibility for work. Proper handling and completion of these forms contribute to a smooth employment process and compliance with federal regulations.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The I-9 form is used to verify the identity and employment authorization of individuals hired for employment in the United States. |

| Who Must Complete | All employers must have their employees complete the I-9 form, regardless of citizenship status. |

| Completion Timeline | Employees must complete Section 1 of the I-9 form on or before their first day of work. Employers must complete Section 2 within three business days of the employee's start date. |

| Retention Period | Employers must retain the I-9 form for three years after the date of hire or one year after the employee's termination, whichever is later. |

| State-Specific Forms | Some states have additional requirements. For example, California requires employers to use the California I-9 form, governed by California Labor Code Section 1171. |

More About USCIS I-9

What is the USCIS I-9 form?

The USCIS I-9 form, officially known as the Employment Eligibility Verification form, is a document that employers in the United States must complete for every new employee. This form is used to verify the identity and employment authorization of individuals hired for work in the U.S. Both the employer and employee must complete specific sections of the form, ensuring compliance with federal immigration laws. Completing the I-9 is a crucial step in the hiring process, as it helps prevent unauthorized employment.

Who needs to fill out the I-9 form?

Every employer in the United States must require all newly hired employees to complete the I-9 form, regardless of their citizenship status. This includes full-time and part-time employees, as well as those who are temporary or seasonal workers. Employers must also ensure that the form is completed within three days of the employee's start date. Failure to do so can lead to penalties and fines.

What documents are acceptable for the I-9 form?

The I-9 form requires employees to present documents that establish their identity and employment authorization. There are three lists of acceptable documents: List A, List B, and List C. List A includes documents like a U.S. passport or a permanent resident card that prove both identity and employment eligibility. List B includes documents such as a driver’s license that establish identity only, while List C includes documents like a Social Security card that establish employment eligibility. Employees must provide either one document from List A or one from List B and one from List C.

How long do employers need to keep the I-9 form on file?

Employers are required to retain the I-9 form for a specific period. They must keep it for three years after the date of hire or for one year after the employee's termination, whichever is longer. This means that if an employee works for a company for two years and then leaves, the employer must keep the I-9 on file for an additional year. Proper record-keeping is essential to demonstrate compliance with immigration laws during audits or inspections.

What happens if an employer fails to complete the I-9 form?

If an employer fails to complete the I-9 form for an employee, they may face significant consequences. Penalties can range from fines to potential legal action, depending on the severity of the violation. Employers may also be subject to audits by the U.S. Immigration and Customs Enforcement (ICE), which can lead to further scrutiny of their hiring practices. It is crucial for employers to stay compliant to avoid these risks.

Can an employee correct errors on the I-9 form?

Yes, employees can correct errors on the I-9 form. If an employee notices a mistake after the form has been submitted, they should inform their employer as soon as possible. The employer can then make the necessary corrections. It’s important to note that any changes should be initialed and dated by the person making the correction. This helps maintain transparency and accuracy in the employment verification process.

USCIS I-9: Usage Steps

Filling out the USCIS I-9 form is an important step in the employment process. After completing the form, you will need to submit it to your employer, who will then verify your identity and eligibility to work in the United States. Follow these steps carefully to ensure accuracy.

- Obtain the USCIS I-9 form. You can download it from the USCIS website or ask your employer for a copy.

- Complete Section 1. Fill in your name, address, date of birth, and Social Security number. Indicate your citizenship or immigration status by checking the appropriate box.

- Sign and date Section 1. Your signature certifies that the information provided is true and correct.

- Move to Section 2. Your employer will complete this section. They will need to examine your identification documents.

- Provide the necessary documents to your employer. Acceptable documents include a U.S. passport, a permanent resident card, or a combination of other documents that prove your identity and work eligibility.

- Your employer will fill in the document title, issuing authority, document number, and expiration date in Section 2.

- Once Section 2 is completed, your employer will sign and date the form, confirming they have reviewed your documents.

- Keep a copy of the completed I-9 form for your records, if possible. It is important to have documentation of your employment eligibility.