Valid Transfer-on-Death Deed Template

The Transfer-on-Death Deed (TODD) form serves as a powerful estate planning tool that allows property owners to designate beneficiaries who will inherit their real estate upon their death, bypassing the often lengthy and costly probate process. This deed enables individuals to retain full control of their property during their lifetime, as it does not transfer ownership until the owner passes away. By completing a TODD, property owners can ensure that their loved ones receive their assets quickly and efficiently, while also minimizing potential disputes among heirs. The form must be properly executed and recorded to be valid, and it is important to understand the specific requirements that vary by state. Additionally, a TODD can be revoked or modified at any time before the owner’s death, providing flexibility in estate planning. This article will delve into the key components of the Transfer-on-Death Deed form, its benefits, and considerations to keep in mind when utilizing this option for estate management.

Other Transfer-on-Death Deed Templates:

Correction Deed Form California - This form helps fix errors in the title or description of a property.

In order to facilitate a smooth transaction, it's important to utilize the New York ATV Bill of Sale form, which can be found at smarttemplates.net/fillable-new-york-atv-bill-of-sale/. This legal document captures essential details about the ATV sale, ensuring both the buyer and seller are protected and have a clear record of the exchange.

Transfer-on-Death Deed Forms for Specific US States

Documents used along the form

A Transfer-on-Death Deed (TODD) allows property owners to transfer their real estate to beneficiaries upon their death, bypassing probate. While the TODD is a key document in this process, several other forms and documents are often used in conjunction to ensure a smooth transfer of ownership. Below are five important documents that may accompany a Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It may include provisions for any property not covered by the TODD.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, like life insurance or retirement accounts, directly upon the owner's death, ensuring a clear transfer of those assets.

- Affidavit of Heirship: A sworn statement used to establish the heirs of a deceased person. This document can help clarify ownership when no will exists.

- Property Deed: The legal document that formally transfers ownership of property. It may need to be updated or referenced when executing a TODD.

- California Affidavit of Service: This document is crucial for certifying the delivery of legal paperwork among parties involved in a case, ensuring transparency and accountability. For more information, check All California Forms.

- Estate Inventory: A comprehensive list of all assets owned by the deceased. This document aids in the administration of the estate and can provide clarity for beneficiaries.

Using these documents alongside a Transfer-on-Death Deed can simplify the transfer process and help ensure that your wishes are honored. It’s essential to consult with a professional to ensure all forms are completed correctly and meet legal requirements.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death, avoiding probate. |

| Governing Law | In the United States, the Transfer-on-Death Deed is governed by state law. Specific laws vary by state, so it is important to consult local regulations. |

| Revocation | The deed can be revoked at any time before the death of the grantor, allowing for changes in beneficiaries or property ownership. |

| Requirements | The deed must be signed, notarized, and recorded in the county where the property is located to be valid. |

More About Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD deed) is a legal document that allows an individual to transfer real estate property to a designated beneficiary upon the owner's death. This type of deed bypasses the probate process, making it a convenient option for those who want to ensure their property goes directly to their chosen heirs without additional legal complications.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you will need to fill out the appropriate form, which can typically be obtained from your state’s real estate or probate office. You must include details such as the property description, the name of the beneficiary, and your signature. It's important to have the deed notarized and recorded with the local county recorder's office to make it legally binding.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you simply need to create a new deed that either names a different beneficiary or states that the previous deed is revoked. Again, this new deed must be properly signed, notarized, and recorded to take effect.

What happens if the beneficiary predeceases me?

If the designated beneficiary passes away before you do, the property will not automatically transfer to them. Instead, the property will typically become part of your estate and will be distributed according to your will or, if there is no will, according to state intestacy laws. It's a good idea to regularly review your beneficiaries to ensure your wishes are accurately reflected.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when you create a Transfer-on-Death Deed. However, the property may be subject to capital gains taxes when the beneficiary sells it. Additionally, the property may be included in your estate for estate tax purposes. It’s wise to consult a tax professional for personalized advice regarding your specific situation.

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be a beneficial tool for many individuals, but it may not be suitable for everyone. Consider your unique circumstances, such as the size of your estate, your family dynamics, and your overall estate planning goals. Consulting with a legal or financial advisor can help you determine if this option aligns with your needs.

Transfer-on-Death Deed: Usage Steps

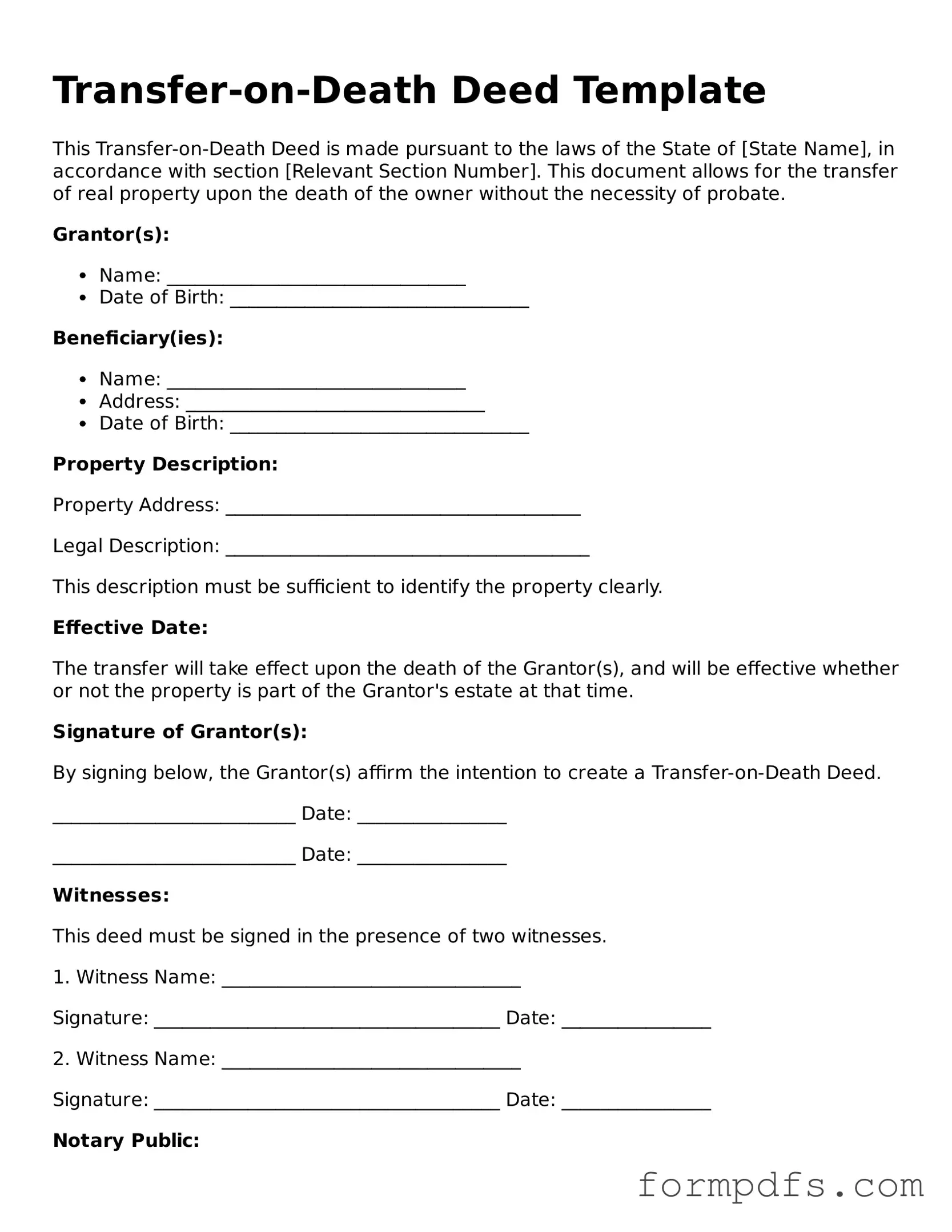

After you have gathered all necessary information, you can begin filling out the Transfer-on-Death Deed form. This document allows you to designate a beneficiary who will receive your property upon your passing. It’s important to ensure that all details are accurate to avoid any complications in the future.

- Start with the title of the form at the top. Write "Transfer-on-Death Deed".

- Provide your full name and address in the designated section. Make sure to include any relevant identification numbers if required.

- Identify the property you wish to transfer. Include the full legal description, which may be found on your property deed or tax records.

- Clearly state the name of the beneficiary. This is the person who will receive the property when you pass away.

- Include the beneficiary’s address to ensure proper identification.

- If there are multiple beneficiaries, list their names and addresses as well. Specify how the property will be divided among them.

- Sign and date the form in the appropriate section. This is often required to make the document legally binding.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- File the completed form with the appropriate local government office, such as the county recorder's office, to ensure it is legally recognized.

Once the form is completed and filed, it will be recorded in public records. This ensures that your wishes regarding the transfer of your property are honored after your passing. It is advisable to keep a copy for your records and inform your beneficiary about the deed.