Valid Tractor Bill of Sale Template

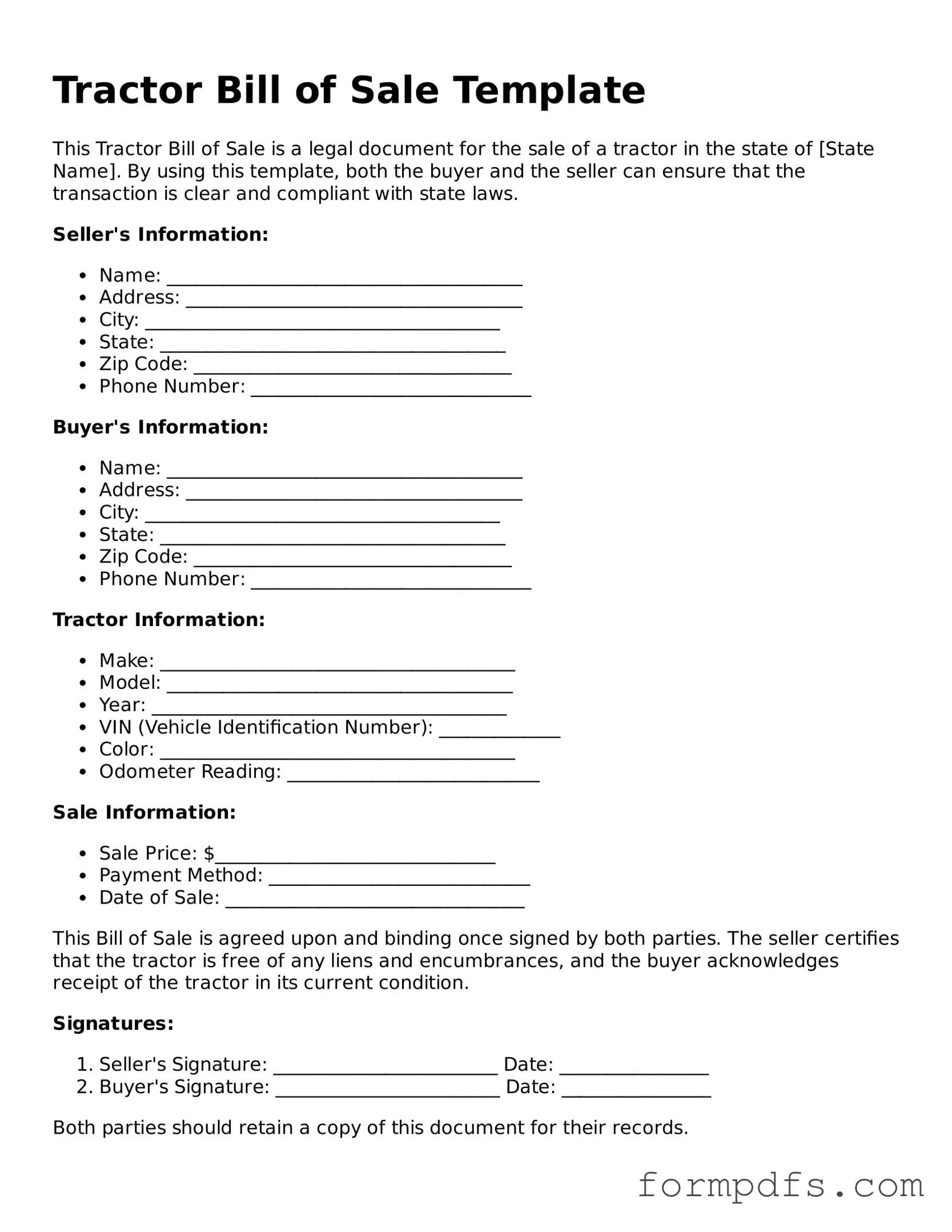

The Tractor Bill of Sale form serves as a crucial document in the process of buying or selling a tractor, ensuring that both parties are protected and that the transaction is legally recognized. This form typically includes essential details such as the names and addresses of the buyer and seller, a thorough description of the tractor, including its make, model, year, and vehicle identification number (VIN). Additionally, it outlines the sale price and any terms related to payment, which can help prevent misunderstandings later on. Signatures from both the buyer and seller are required to validate the agreement, solidifying the transfer of ownership. Furthermore, some states may require additional information or specific disclosures, making it imperative for individuals to be aware of their local regulations. By properly completing and retaining this form, both parties can ensure a smooth transaction and have a clear record of the sale for future reference.

Other Tractor Bill of Sale Templates:

Faa Bill of Sale - Buyers should obtain this form to secure their ownership rights over the aircraft.

The New York Articles of Incorporation form serves as a fundamental document required to establish a corporation within the state. It outlines the necessary information about the corporation, including its name, purpose, and the details of its incorporators. This form initiates the formal process of acknowledging a business entity's legal existence under state law, making it essential for those interested to access resources such as smarttemplates.net/fillable-new-york-articles-of-incorporation/.

Documents used along the form

When purchasing or selling a tractor, several important documents may accompany the Tractor Bill of Sale. Each of these forms serves a specific purpose in ensuring a smooth transaction and protecting the interests of both parties involved.

- Title Transfer Document: This document officially transfers ownership of the tractor from the seller to the buyer. It includes details such as the vehicle identification number (VIN), make, model, and the names of both parties.

- Odometer Disclosure Statement: This form records the tractor's mileage at the time of sale. It is often required by law to prevent fraud and ensure accurate reporting of the vehicle's condition.

- Sales Tax Form: Depending on the state, this form may be necessary to report the sale for tax purposes. It typically includes the sale price and any applicable sales tax information.

- California Judicial Council Form: This form is an essential tool in legal proceedings and standardizes the submission of information. It can be paired with other documents like the All California Forms to ensure clarity and consistency in legal transactions.

- Warranty Document: If the tractor comes with a warranty, this document outlines the terms and conditions. It provides details on what is covered and the duration of the warranty.

- Inspection Certificate: An inspection certificate verifies that the tractor has undergone a safety or emissions inspection, if required by state law. This assures the buyer that the tractor meets necessary regulations.

Having these documents ready can facilitate a smoother transaction and help both parties understand their rights and responsibilities. Proper documentation is key to a successful sale.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Tractor Bill of Sale serves as a legal document to transfer ownership of a tractor from one party to another. |

| Identification | It typically includes details such as the make, model, year, and VIN (Vehicle Identification Number) of the tractor. |

| Seller Information | The form requires the seller's name, address, and contact information to establish clear ownership. |

| Buyer Information | Similar to the seller, the buyer's name and address must also be included for proper documentation. |

| Purchase Price | The sale price of the tractor must be clearly stated, indicating the agreed-upon amount between the parties. |

| As-Is Condition | Often, the bill of sale includes a clause stating that the tractor is sold "as-is," meaning no warranties are provided. |

| Governing Law | Each state may have specific laws governing the sale of vehicles; for example, in California, the relevant law is the California Vehicle Code. |

| Signatures | Both the seller and buyer must sign the document to validate the transaction and indicate agreement to the terms. |

| Record Keeping | It is advisable for both parties to keep a copy of the bill of sale for their records, as it serves as proof of the transaction. |

More About Tractor Bill of Sale

What is a Tractor Bill of Sale?

A Tractor Bill of Sale is a legal document that records the sale and transfer of ownership of a tractor from one party to another. It includes essential details such as the buyer's and seller's information, the tractor's specifications, and the sale price. This document serves as proof of the transaction and can be useful for registration and title transfer purposes.

Why do I need a Tractor Bill of Sale?

Having a Tractor Bill of Sale is important for several reasons. It protects both the buyer and the seller by providing a clear record of the transaction. This document can help resolve any disputes that may arise regarding the sale. Additionally, it may be required for registering the tractor with the state or for tax purposes.

What information should be included in a Tractor Bill of Sale?

A comprehensive Tractor Bill of Sale should include the following details: the names and addresses of the buyer and seller, the date of the sale, a description of the tractor (including make, model, year, and VIN), the sale price, and any warranties or conditions of the sale. Both parties should sign the document to validate the transaction.

Do I need to have the Tractor Bill of Sale notarized?

Notarization is not typically required for a Tractor Bill of Sale, but it can add an extra layer of authenticity and protection. Some states may have specific requirements, so it's a good idea to check local laws. Having the document notarized can help ensure that both parties are protected in case of future disputes.

Can I use a generic Bill of Sale template for my tractor?

While you can use a generic Bill of Sale template, it is advisable to use one specifically designed for tractors. This ensures that all relevant information is included and complies with local regulations. Customizing a template to fit your needs can help avoid any potential issues during the sale process.

What if the tractor has a lien on it?

If there is a lien on the tractor, it is crucial to resolve it before completing the sale. A lien indicates that the tractor is being used as collateral for a loan. Both the buyer and seller should be aware of this situation, as it can affect ownership rights. The lien should be paid off, and proper documentation should be obtained to clear the title before the sale is finalized.

How do I transfer ownership after the sale?

To transfer ownership after the sale, both the buyer and seller should complete the Tractor Bill of Sale. The seller may need to provide the buyer with the original title, signed over to the buyer. The buyer should then take the signed bill of sale and title to their local Department of Motor Vehicles (DMV) or relevant agency to register the tractor in their name.

What if I lose my Tractor Bill of Sale?

If you lose your Tractor Bill of Sale, it can be challenging, but not impossible, to recover. You can try to obtain a copy from the other party involved in the sale, if applicable. If that’s not possible, consider drafting a new bill of sale with the same details and having both parties sign it again. Always keep a copy for your records in the future.

Are there any tax implications when selling a tractor?

Yes, selling a tractor may have tax implications. Depending on your state, you might need to report the sale as income. Additionally, sales tax may apply to the transaction. It’s advisable to consult with a tax professional to understand your obligations and ensure compliance with local tax laws.

Is a Tractor Bill of Sale legally binding?

Yes, a Tractor Bill of Sale is a legally binding document once both parties have signed it. It serves as evidence of the transaction and the terms agreed upon. However, the enforceability can depend on state laws and whether all necessary details were included. Keeping a copy of the signed document is essential for both parties.

Tractor Bill of Sale: Usage Steps

Filling out the Tractor Bill of Sale form is an important step in the process of transferring ownership of a tractor. After completing the form, both the buyer and seller should keep a copy for their records. This document serves as proof of the transaction and includes essential details about the tractor and the parties involved.

- Gather Information: Collect all necessary information about the tractor, including its make, model, year, VIN (Vehicle Identification Number), and any other relevant details.

- Seller Information: Enter the seller's full name, address, and contact information in the designated fields.

- Buyer Information: Fill in the buyer's full name, address, and contact information as required.

- Sale Price: Clearly state the agreed-upon sale price for the tractor.

- Payment Method: Indicate the method of payment, whether it’s cash, check, or another form.

- Date of Sale: Write the date when the transaction is taking place.

- Signatures: Both the buyer and seller must sign the document to validate the sale.

- Witness Signature (if required): If applicable, have a witness sign the form to further authenticate the transaction.