Blank Tax POA dr 835 PDF Form

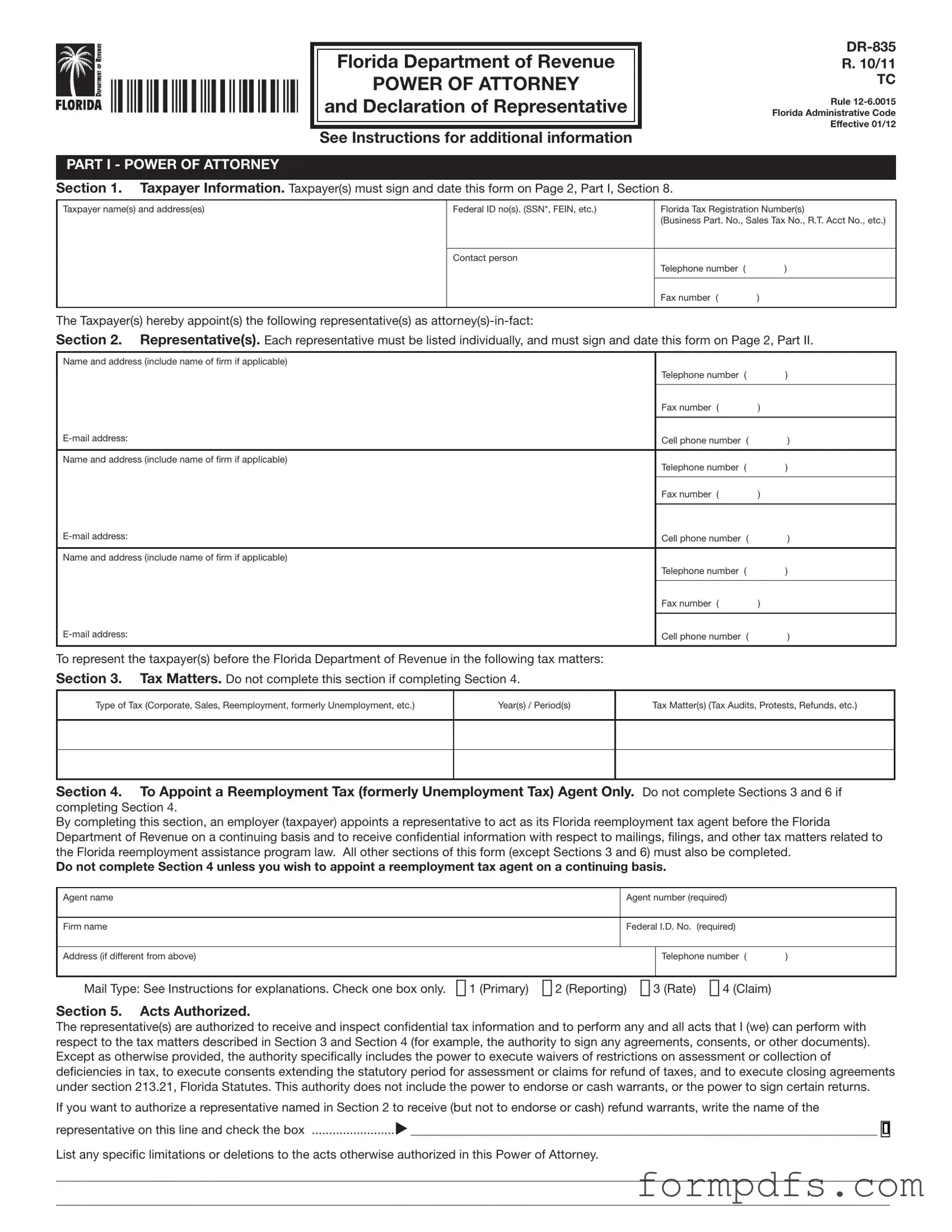

The Tax POA DR 835 form serves as an important tool for individuals and businesses in the United States when they need to authorize someone else to represent them before the tax authorities. This form allows taxpayers to designate a representative, such as an attorney or accountant, to handle tax matters on their behalf. By completing the Tax POA DR 835, individuals can ensure that their chosen representative has the authority to receive confidential tax information and communicate with the Internal Revenue Service (IRS) or state tax agencies. It is essential to provide accurate information on the form, including the taxpayer’s details and the representative’s credentials. Additionally, the form outlines the specific tax matters and periods for which the authorization is granted. Properly submitting the Tax POA DR 835 can streamline communication and help resolve tax issues more efficiently. Understanding the purpose and requirements of this form is crucial for anyone looking to navigate the complexities of tax representation.

More PDF Templates

Faa Bill of Sale - Knowing how to fill out the form properly is key to a successful transaction.

Magi for Medicare 2023 - The SSA-44 contributes to ensuring financial fairness in healthcare costs for seniors.

The New York Articles of Incorporation form is essential for any business looking to officially establish a corporation within the state. It includes key details such as the corporation's name and purpose, as well as the information of its incorporators. This form initiates the formal process of acknowledging a business entity's legal existence under state law, which can be conveniently accessed at smarttemplates.net/fillable-new-york-articles-of-incorporation/.

Excel Bar Chart - Document potential conflicts of interest.

Documents used along the form

The Tax POA DR 835 form is a critical document for granting power of attorney related to tax matters. It allows individuals to authorize someone else to represent them before tax authorities. Alongside this form, several other documents may be required to ensure a comprehensive approach to tax representation. Below is a list of commonly used forms and documents that complement the Tax POA DR 835.

- Form 2848: This is the IRS Power of Attorney and Declaration of Representative form. It allows taxpayers to appoint someone to represent them before the IRS and can be used for various tax matters.

- Form 4506: The Request for Copy of Tax Return form enables individuals to obtain copies of their past tax returns, which may be necessary for the representative to effectively assist with tax issues.

- Form 8821: This form is used to authorize an individual to receive and inspect confidential tax information. It is less comprehensive than a power of attorney but can be useful for specific inquiries.

- State POA Forms: Many states have their own power of attorney forms for tax matters. These forms may be required in addition to the federal forms when dealing with state tax authorities.

- Form 1040: The U.S. Individual Income Tax Return is essential for filing taxes. It may be needed by the representative to understand the taxpayer's situation fully.

- California DMV DL 44 Form: Essential for obtaining a driver’s license or ID in California, it includes applications for new licenses, renewals, and updates. Ensure you provide accurate information, as well as any changes to voter registration or organ donation preferences. For more information, refer to All California Forms.

- Form 8862: This is the Information to Claim Certain Refundable Credits After Disallowance form. It is necessary if a taxpayer wants to claim credits that were previously denied.

- Tax Returns: Copies of previous years' tax returns can provide valuable context for the representative. They help in understanding the taxpayer's history and potential issues.

Each of these documents plays a vital role in ensuring that tax matters are handled efficiently and effectively. Having the right forms ready can streamline the process and provide peace of mind during tax representation.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Tax POA DR 835 form is used to designate a representative to act on behalf of a taxpayer in matters related to state taxes. |

| Governing Law | This form is governed by state tax laws, specifically under the Colorado Revised Statutes, Title 39. |

| Eligibility | Any individual or business entity can appoint a representative using this form, provided they are in good standing with the state tax authority. |

| Submission Method | The completed form can be submitted electronically or mailed to the appropriate state tax office. |

| Duration of Authority | The authority granted by the Tax POA DR 835 form remains effective until revoked by the taxpayer or until the specific tax matter is resolved. |

More About Tax POA dr 835

What is the Tax POA DR 835 form?

The Tax POA DR 835 form is a Power of Attorney document used in the state of Colorado. It allows individuals to authorize someone else, typically a tax professional, to represent them in tax matters before the Colorado Department of Revenue. This form ensures that the designated representative can access the taxpayer's information and act on their behalf regarding tax issues.

Who should use the Tax POA DR 835 form?

This form is suitable for anyone who needs assistance with their tax affairs in Colorado. Individuals, businesses, and organizations can use it when they want to grant authority to a tax advisor, accountant, or attorney to handle their tax-related matters. If you find tax processes overwhelming or complex, this form can provide peace of mind.

How do I complete the Tax POA DR 835 form?

To complete the form, you will need to provide your personal information, including your name, address, and taxpayer identification number. You must also include the representative's information. Be clear about the scope of authority you are granting. After filling out the form, sign and date it. Ensure that your signature matches the one on file with the Department of Revenue.

Is there a fee to file the Tax POA DR 835 form?

No, there is no fee associated with filing the Tax POA DR 835 form. It is a straightforward process that does not require payment. However, you may incur fees if you hire a tax professional to assist you with your tax matters.

How long is the Tax POA DR 835 form valid?

The Tax POA DR 835 form remains valid until you revoke it or the representative withdraws. You can revoke the Power of Attorney at any time by submitting a written notice to the Colorado Department of Revenue. It is advisable to keep a copy of the revocation for your records.

Can I revoke the Tax POA DR 835 form once it is submitted?

Yes, you can revoke the Tax POA DR 835 form at any time. To do so, you must provide a written notice to the Colorado Department of Revenue. This notice should include your personal information and the details of the representative you are revoking. Once the Department receives your revocation, the previous Power of Attorney will no longer be in effect.

Where do I send the completed Tax POA DR 835 form?

After completing the Tax POA DR 835 form, you should send it to the Colorado Department of Revenue. The mailing address is typically provided on the form itself. You may also have the option to submit it electronically, depending on the Department's current procedures. Always check for the most up-to-date submission guidelines to ensure your form is processed correctly.

Tax POA dr 835: Usage Steps

After obtaining the Tax POA DR 835 form, you will need to fill it out accurately to ensure that your tax matters are handled appropriately. This form allows you to designate someone to act on your behalf regarding tax issues. Follow the steps below to complete the form correctly.

- Obtain the Form: Download the Tax POA DR 835 form from the appropriate state tax authority's website or obtain a physical copy from their office.

- Fill in Your Information: At the top of the form, enter your name, address, and Social Security number or taxpayer identification number.

- Identify the Representative: Provide the name, address, and contact information of the person you are authorizing to represent you.

- Specify the Authority: Indicate the specific tax matters for which you are granting authority. This may include income tax, sales tax, or other types of tax issues.

- Set the Duration: If applicable, specify the duration for which this authorization is valid. You can choose a specific date or indicate that it remains in effect until revoked.

- Sign the Form: Sign and date the form at the designated area to validate your authorization.

- Submit the Form: Send the completed form to the appropriate tax authority. Ensure you keep a copy for your records.