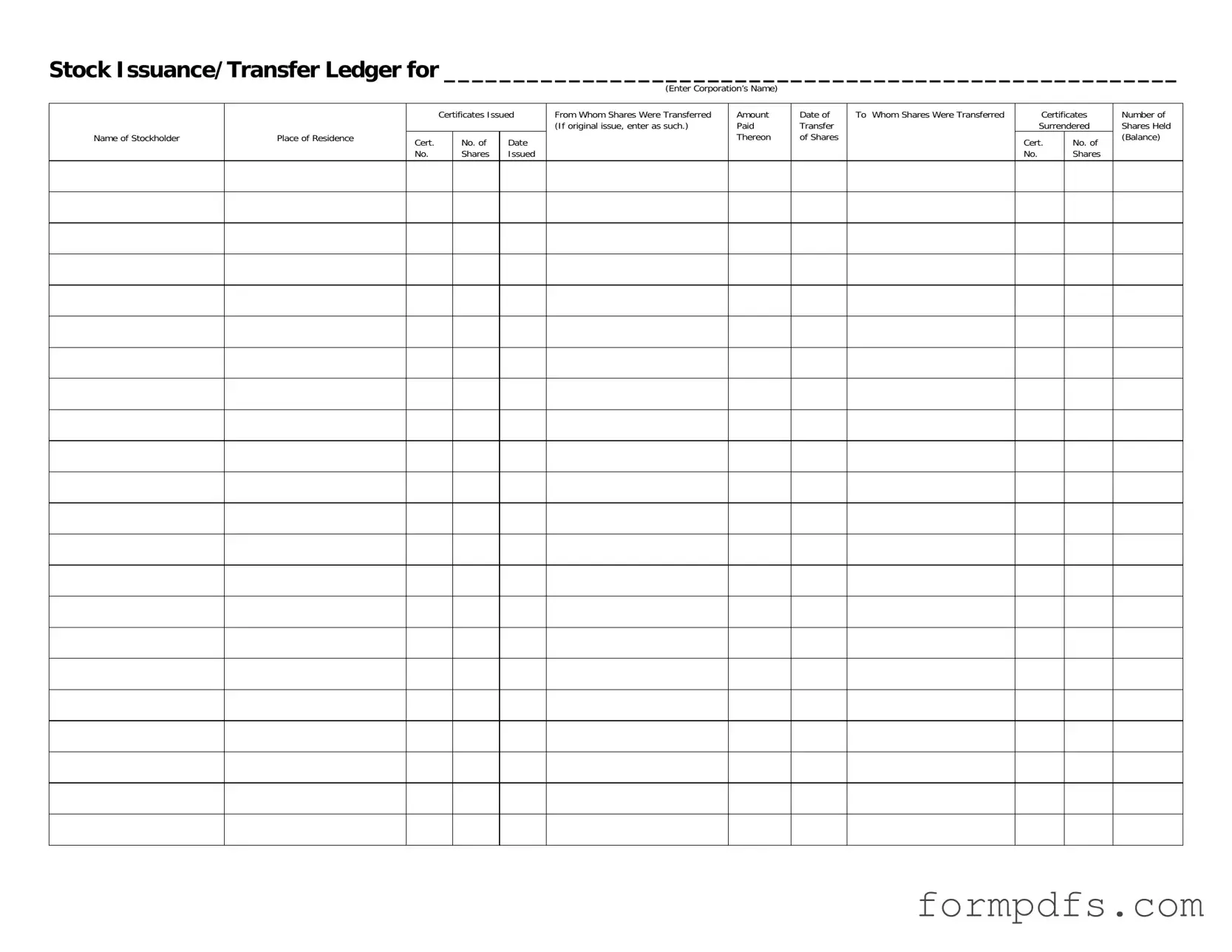

Blank Stock Transfer Ledger PDF Form

The Stock Transfer Ledger form serves as a vital record-keeping tool for corporations, documenting the issuance and transfer of stock among shareholders. This form captures essential details such as the name of the corporation, which is prominently displayed at the top. Each entry includes the name of the stockholder and their place of residence, ensuring that ownership is clearly identified. The ledger tracks the certificates issued, noting the certificate number and the date of issuance, along with the number of shares issued. When shares are transferred, the form requires information about the original issuer and the amount paid for the shares. It also records the date of transfer and the recipient of the shares, thereby maintaining a clear chain of ownership. Certificates surrendered during the transfer process are noted, along with their corresponding certificate numbers. Finally, the form concludes with a balance section that indicates the number of shares held by the stockholder after the transfer, providing a comprehensive overview of stock ownership within the corporation.

More PDF Templates

Shower Sheets for Cna - It is important to note if the resident has any skin tears observed.

For those interested in understanding the essential aspects of the ownership transfer process, the Arizona ATV Bill of Sale is crucial. You can find a helpful resource to guide you through documenting your transaction by visiting this link: valuable insights on the ATV Bill of Sale.

Roof Certification Form Florida - The form can help facilitate smooth home sales.

Documents used along the form

When dealing with stock transfers, several important documents often accompany the Stock Transfer Ledger form. Each of these documents plays a crucial role in ensuring a smooth and transparent transfer process. Below are five commonly used forms and documents.

- Stock Certificate: This document serves as proof of ownership of shares in a corporation. It includes details like the stockholder's name, the number of shares owned, and a unique certificate number.

- Transfer Agreement: A transfer agreement outlines the terms and conditions under which shares are being transferred. It typically includes the names of the parties involved, the number of shares, and any payment details.

- Shareholder Resolution: This document is often required to authorize the transfer of shares. It is a formal decision made by the board of directors or shareholders, indicating their approval of the transfer.

- Power of Attorney for a Child: This legal document enables a parent or guardian to grant temporary parental rights to another adult when necessary, ensuring the child's needs are met in the parent's absence. For more information, refer to All California Forms.

- Form 1099-DIV: For tax purposes, this form reports dividends and distributions to shareholders. It is important for both the corporation and the stockholder to ensure accurate tax reporting after a transfer.

- Notice of Transfer: This notice informs the corporation about the stock transfer. It includes details about the transferor and transferee, ensuring that the corporation updates its records accordingly.

Understanding these documents helps ensure that stock transfers are conducted properly and legally. Each form plays a vital role in maintaining clear records and protecting the interests of all parties involved.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger records the issuance and transfer of shares for a corporation. |

| Required Information | It requires details such as the corporation's name, stockholder's name, and residence. |

| Certificates Issued | The form tracks the certificates issued, including certificate numbers and dates. |

| Transfer Details | It includes information about the transferor and transferee of the shares. |

| Amount Paid | The ledger notes the amount paid for the shares during the transfer. |

| State-Specific Laws | In Delaware, the governing law for stock transfers is found in Title 8, Chapter 224. |

| Balance Tracking | The form shows the number of shares held by the stockholder after each transaction. |

| Certificate Surrender | It documents the surrender of old certificates when shares are transferred. |

More About Stock Transfer Ledger

What is the purpose of the Stock Transfer Ledger form?

The Stock Transfer Ledger form is used to document the issuance and transfer of stock shares within a corporation. It serves as an official record that tracks who owns the shares, the number of shares issued, and any changes in ownership over time. This documentation is crucial for maintaining accurate corporate records and ensuring compliance with relevant laws and regulations.

What information is required to complete the Stock Transfer Ledger form?

To complete the form, you need to provide the corporation's name, the name of the stockholder, their place of residence, details about the certificates issued (including certificate numbers and the number of shares), the amount paid for the shares, the date of transfer, and the names of both the transferor and transferee. This comprehensive information helps maintain clarity and transparency in stock ownership.

Who is responsible for maintaining the Stock Transfer Ledger?

The responsibility for maintaining the Stock Transfer Ledger typically falls on the corporation's secretary or designated officer. This individual ensures that all entries are accurate and up-to-date, reflecting any changes in stock ownership as they occur. Proper maintenance of the ledger is essential for legal compliance and shareholder communication.

How does one transfer shares using the Stock Transfer Ledger form?

To transfer shares, the current owner must fill out the Stock Transfer Ledger form, providing details about the shares being transferred, including the certificate number and the number of shares. The form must then be signed by the transferor and submitted to the corporation. The corporation will update the ledger to reflect the new ownership and issue new certificates if necessary.

What happens if the Stock Transfer Ledger is not properly maintained?

If the Stock Transfer Ledger is not properly maintained, it can lead to disputes regarding ownership and potentially result in legal complications. Inaccurate records may affect shareholder rights and the corporation’s ability to comply with regulatory requirements. Maintaining an accurate ledger is vital for protecting both the corporation and its shareholders.

Can a Stock Transfer Ledger be amended after it has been completed?

Yes, a Stock Transfer Ledger can be amended, but it should be done with caution. Any changes must be documented properly, including the reason for the amendment and the date it was made. It is advisable to keep a record of all amendments to maintain transparency and accuracy in the corporation's records.

Is there a specific format for the Stock Transfer Ledger form?

The Stock Transfer Ledger form typically follows a standard format that includes specific fields for entering information about the corporation, stockholder, shares issued, and transfers. While there may be variations depending on the corporation's needs, it is important to ensure that all necessary information is captured in a clear and organized manner.

What should be done if a stock certificate is lost or destroyed?

If a stock certificate is lost or destroyed, the stockholder should notify the corporation immediately. The corporation may require a formal declaration of loss and may issue a replacement certificate after verifying ownership. It is important to follow the corporation's specific procedures to ensure that the stockholder's rights are protected.

How can shareholders access the Stock Transfer Ledger?

Shareholders typically have the right to access the Stock Transfer Ledger upon request. The corporation may have specific policies regarding how and when shareholders can view the ledger. It is advisable for shareholders to contact the corporation directly to understand the process and any requirements for accessing this important document.

What role does the Stock Transfer Ledger play in corporate governance?

The Stock Transfer Ledger plays a critical role in corporate governance by providing a clear record of ownership and facilitating communication between the corporation and its shareholders. It helps ensure that shareholders can exercise their rights, such as voting and receiving dividends, and it supports the corporation's compliance with legal and regulatory obligations.

Stock Transfer Ledger: Usage Steps

Completing the Stock Transfer Ledger form is essential for accurately documenting stock transactions. After filling out this form, you will be able to maintain a clear record of stock ownership and transfers within your corporation. Follow these steps to ensure the form is filled out correctly.

- Begin by entering the name of the corporation at the top of the form where indicated.

- In the section labeled "Name of Stockholder," write the full name of the individual or entity transferring or receiving the shares.

- Next, provide the "Place of Residence" for the stockholder. This should include the city and state.

- In the "Certificates Issued" section, indicate the number of stock certificates being issued.

- For "Cert. No. of," enter the certificate number assigned to the shares being transferred.

- Record the "Date" on which the shares were issued.

- In the "No. Shares Issued From Whom" section, note the name of the party from whom the shares were transferred. If this is the original issue, write "original issue" instead.

- Document the "Amount Paid Thereon," indicating the total amount paid for the shares being transferred.

- Next, fill in the "Date of Transfer of Shares," specifying the exact date when the transfer took place.

- In the "To Whom Shares Were Transferred" section, write the name of the individual or entity receiving the shares.

- For "Certificates Surrendered," note the certificate number of the shares that are being surrendered as part of the transfer.

- In the "No. Shares" section, enter the total number of shares being transferred.

- Finally, record the "Number of Shares Held (Balance)" to reflect the remaining shares held by the stockholder after the transfer.