Blank SSA SSA-44 PDF Form

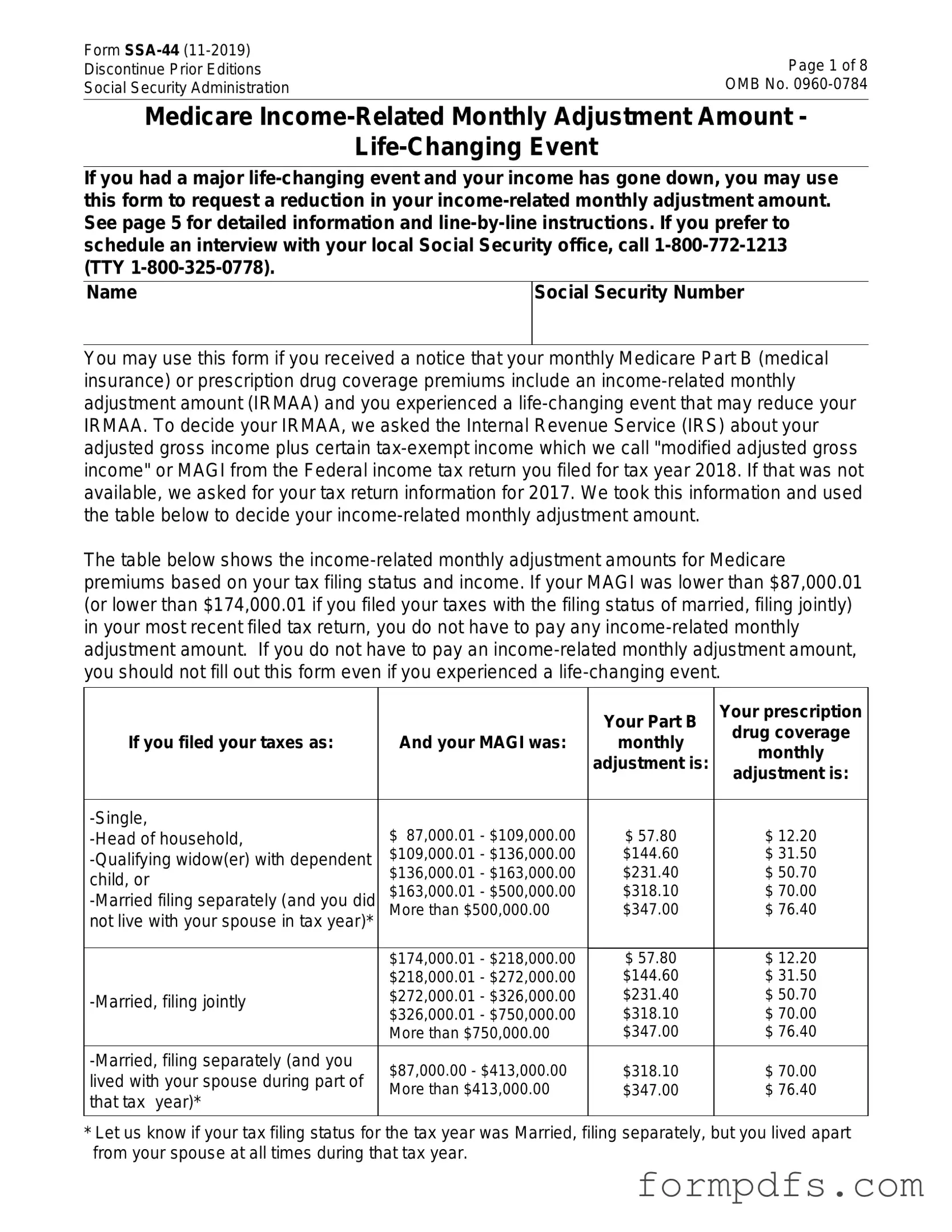

The SSA SSA-44 form plays a crucial role in the Social Security Administration's processes, particularly for individuals seeking a reconsideration of their eligibility for Supplemental Security Income (SSI) benefits. This form allows beneficiaries to report changes in their financial circumstances, which may affect their benefit amounts. By completing the SSA-44, individuals can provide updated information regarding income, resources, and living arrangements, ensuring that their benefits accurately reflect their current situation. The form is designed to facilitate communication between the Social Security Administration and beneficiaries, promoting transparency and efficiency in the management of SSI claims. Additionally, the SSA-44 serves as a tool for beneficiaries to request a review of their benefit status, helping to address any discrepancies that may arise over time. Understanding the significance of this form is essential for those navigating the complexities of Social Security benefits, as it directly impacts their financial support and overall well-being.

More PDF Templates

Da - Proper use helps prevent loss and misappropriation of government assets.

The Employment Application PDF form is a standardized document used by candidates to provide their personal, educational, and professional information when applying for a job. This form ensures that employers have consistent data on all applicants, simplifying the hiring process. For more information and access to the form, you can visit https://onlinelawdocs.com, which plays a crucial role for both employers looking to fill positions and individuals seeking employment opportunities.

Pest Control Contract Template - Document provides transparency on the pest control services offered and related costs.

Documents used along the form

The SSA SSA-44 form is used by individuals to request a reduction in their income-related monthly adjustment amount (IRMAA) for Medicare premiums. When completing this form, several other documents may be required to support the request. Below is a list of commonly used forms and documents that may accompany the SSA SSA-44 form.

- SSA-1099: This form provides a summary of Social Security benefits received during the year. It helps verify income levels for the IRMAA adjustment.

- New York Dirt Bike Bill of Sale - A vital document for buyers and sellers in New York, acting as proof of purchase and transfer of ownership, which can be found at smarttemplates.net/fillable-new-york-dirt-bike-bill-of-sale/.

- Tax Returns: Personal tax returns from the previous year may be necessary to demonstrate income levels. These documents provide a comprehensive overview of an individual's financial situation.

- W-2 Forms: These forms report annual wages and are essential for confirming income from employment. They can be used to supplement information provided on tax returns.

- Bank Statements: Recent bank statements may be requested to show current financial status. They help illustrate ongoing income and expenses.

- Pay Stubs: Current pay stubs from employers can provide evidence of ongoing income. This information is important for determining eligibility for the IRMAA reduction.

- Proof of Life Changes: Documentation that verifies life changes, such as divorce or loss of employment, may be required. These changes can significantly affect income and eligibility.

- Social Security Award Letter: This letter details the amount of Social Security benefits awarded. It serves as an important reference point for income verification.

- Medicare Premium Statements: Statements detailing current Medicare premiums can help establish the basis for the IRMAA adjustment request.

- Financial Hardship Documentation: Any documents that demonstrate financial hardship may be necessary. These could include medical bills or other expenses that impact financial stability.

Gathering these documents can facilitate the review process for the SSA SSA-44 form. It is important to ensure that all information is accurate and complete to avoid delays in processing the request for an IRMAA reduction.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The SSA-44 form is used to request a reduction in the amount of Social Security benefits due to financial hardship. |

| Eligibility | Individuals who receive Social Security benefits and are experiencing financial difficulties can apply using this form. |

| Submission Method | The form can be submitted online, by mail, or in person at a local Social Security office. |

| Processing Time | Typically, it takes about 30 to 90 days for the Social Security Administration to process the SSA-44 form. |

| State-Specific Forms | Some states may have additional forms or requirements. Check local laws for specific regulations. |

| Governing Laws | The SSA-44 form is governed by federal laws under the Social Security Act. |

More About SSA SSA-44

What is the SSA SSA-44 form?

The SSA SSA-44 form, also known as the "Request for Reconsideration of a Reduced Benefit Amount," is used by individuals who wish to appeal a decision made by the Social Security Administration (SSA) regarding their benefits. If your benefit amount has been reduced and you believe this decision is incorrect, this form allows you to formally request a review of that decision. It is an essential step in ensuring that you receive the benefits you deserve.

Who should fill out the SSA SSA-44 form?

This form is intended for anyone who has experienced a reduction in their Social Security benefits and feels that the reduction was made in error. Whether you are receiving retirement, disability, or survivor benefits, if your benefit amount has changed and you disagree with the SSA's determination, you should consider filling out this form to initiate the appeal process.

How do I complete the SSA SSA-44 form?

Completing the SSA SSA-44 form involves providing your personal information, including your Social Security number, and detailing the reasons for your appeal. Be clear and concise about why you believe the reduction is incorrect. It’s important to include any supporting documents that can strengthen your case. Ensure that you double-check your entries for accuracy before submitting the form to avoid delays.

Where do I send the completed SSA SSA-44 form?

Once you have filled out the SSA SSA-44 form, you must submit it to the Social Security Administration. The address for submission can vary based on your location, so it’s crucial to check the SSA’s official website or contact your local SSA office for the correct mailing address. Submitting the form to the wrong address can lead to unnecessary delays in your appeal.

What happens after I submit the SSA SSA-44 form?

After you submit your SSA SSA-44 form, the SSA will review your appeal. This process may take several weeks or even months. During this time, you may receive communication from the SSA requesting additional information or documentation. It is vital to respond promptly to any requests to ensure your appeal is processed efficiently. Once the review is complete, you will receive a written decision regarding your appeal.

Can I get help with the SSA SSA-44 form?

Yes, assistance is available for those who need help completing the SSA SSA-44 form. You can reach out to local advocacy groups, legal aid organizations, or even the SSA itself for guidance. Additionally, trusted family members or friends may also provide support. Seeking help can be beneficial, especially if you find the process overwhelming or confusing.

SSA SSA-44: Usage Steps

Completing the SSA-44 form is an important step in the process of requesting a reconsideration of your Social Security benefits. The form requires personal information and specific details related to your situation. Following the steps below will help ensure that you fill out the form accurately and completely, making the process smoother.

- Begin by downloading the SSA-44 form from the Social Security Administration's official website or obtain a physical copy from your local Social Security office.

- At the top of the form, provide your name, Social Security number, and contact information, including your address and phone number.

- In the next section, indicate the type of benefits you are appealing. This could include retirement, disability, or other benefits.

- Provide details about the specific decision you are appealing. Include the date of the decision and any relevant case numbers.

- Explain why you believe the decision should be reconsidered. Be clear and concise, providing any evidence or reasons that support your case.

- Sign and date the form at the bottom. This certifies that the information you have provided is true and complete to the best of your knowledge.

- Make a copy of the completed form for your records before submitting it.

- Submit the form to the appropriate Social Security office. You can do this either by mailing it or delivering it in person, depending on your preference.

Once your SSA-44 form is submitted, the Social Security Administration will review your appeal. They may reach out for additional information or clarification, so it’s important to keep an eye on any correspondence from them. Patience is key, as this process can take some time.