Valid Single-Member Operating Agreement Template

When establishing a single-member LLC, one of the most crucial documents to consider is the Single-Member Operating Agreement. This agreement serves as the foundational blueprint for your business, outlining the structure, management, and operational procedures of your LLC. It details the owner's rights and responsibilities, delineates how profits and losses will be handled, and clarifies the process for making key business decisions. Additionally, this document can provide protection against personal liability, ensuring that your personal assets remain separate from your business obligations. While it may seem straightforward for a single-member entity, having a well-drafted operating agreement can prevent misunderstandings and disputes in the future. It also enhances the credibility of your business in the eyes of banks and potential investors. In essence, this agreement is not just a formality; it is an essential tool for safeguarding your interests and ensuring the smooth operation of your LLC.

Other Single-Member Operating Agreement Templates:

How to Set Up an Operating Agreement for Llc - Establishes the authority of members over financial management.

For those looking to understand the intricacies of their business framework, the detailed California Operating Agreement provides an invaluable resource for outlining the operational procedures of an LLC, ensuring all aspects are clearly defined to foster effective management.

Documents used along the form

A Single-Member Operating Agreement is a crucial document for a single-member LLC. It outlines the management structure and operational procedures of the business. In addition to this agreement, several other forms and documents may be necessary to ensure proper legal and operational compliance. Here are four common documents that are often used alongside the Single-Member Operating Agreement:

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes essential information such as the business name, address, and the registered agent's details.

- Employer Identification Number (EIN): An EIN is required for tax purposes. It serves as the business's Social Security number and is necessary for opening a bank account and hiring employees.

- Membership Certificate: Although it may not be required in all states, this certificate serves as proof of ownership for the single member. It can be useful for personal records and in dealings with banks or investors.

- Texas Operating Agreement Form: Safeguard your business structure by utilizing our comprehensive Texas Operating Agreement form process to ensure clarity in member operations.

- Bylaws: While not mandatory for single-member LLCs, bylaws can outline the rules for managing the business. They may cover topics such as decision-making processes and meeting protocols.

Each of these documents plays a vital role in establishing and maintaining your LLC. Together, they help ensure that your business operates smoothly and complies with all legal requirements. Proper documentation fosters clarity and protects your interests as a business owner.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management and operational procedures for a single-member LLC. |

| Purpose | This document helps to establish the legal status of the LLC and protect the owner's personal assets. |

| Governing Law | The laws of the state where the LLC is formed govern the agreement. For example, in California, the California Corporations Code applies. |

| Flexibility | The agreement allows the owner to customize management rules, profit distribution, and decision-making processes. |

| Tax Benefits | Single-member LLCs are often treated as disregarded entities for tax purposes, simplifying tax filings. |

| Record Keeping | Having an operating agreement is essential for maintaining proper records and ensuring compliance with state requirements. |

| Dispute Resolution | The agreement can outline procedures for resolving disputes, helping to avoid potential conflicts. |

| Amendments | Owners can amend the agreement as needed, allowing for changes in business structure or operations. |

More About Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a document that outlines the structure and operational procedures of a single-member limited liability company (LLC). This agreement serves as an internal guideline for the owner, detailing how the business will be run. It typically includes information about management, financial arrangements, and the rights and responsibilities of the owner. While not always legally required, having this agreement can help clarify the owner's intentions and protect their personal assets from business liabilities.

Why is it important to have a Single-Member Operating Agreement?

Having a Single-Member Operating Agreement is crucial for several reasons. Firstly, it helps establish the LLC as a separate legal entity, which can protect the owner's personal assets in case of legal issues or debts. Secondly, it provides a clear framework for how the business will operate, which can prevent misunderstandings or disputes in the future. Additionally, it can be beneficial when dealing with banks or investors, as they often want to see that the business has a formal structure in place.

What should be included in a Single-Member Operating Agreement?

A well-crafted Single-Member Operating Agreement should include several key elements. These typically cover the name and purpose of the LLC, the owner's information, and the management structure. Financial provisions, such as how profits and losses will be handled, should also be outlined. Additionally, the agreement may address procedures for adding new members in the future or how the LLC can be dissolved. It’s important to tailor the agreement to fit the specific needs of the business.

Can I create a Single-Member Operating Agreement on my own?

Yes, you can create a Single-Member Operating Agreement on your own. There are many templates available online that can guide you through the process. However, while it is possible to draft the agreement independently, seeking legal advice is often beneficial. A lawyer can help ensure that the agreement complies with state laws and adequately protects your interests. This can provide peace of mind as you move forward with your business.

Single-Member Operating Agreement: Usage Steps

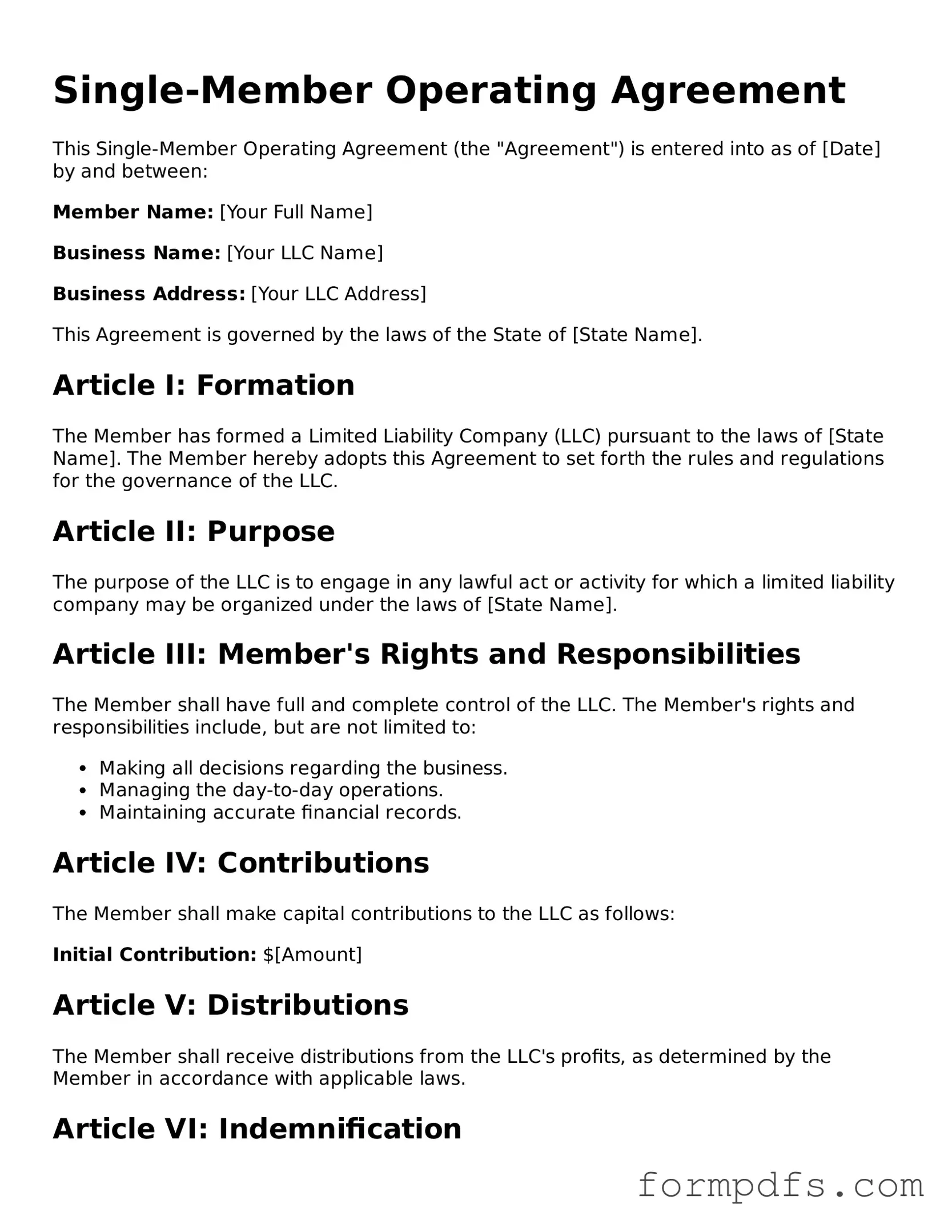

After obtaining the Single-Member Operating Agreement form, you are ready to fill it out. This document is essential for outlining the structure and rules governing your single-member LLC. Completing this form accurately ensures that your business operates smoothly and in compliance with state regulations.

- Begin by entering the name of your LLC at the top of the form. Make sure it matches the name registered with the state.

- Provide the principal office address of the LLC. This should be a physical address where the business is located.

- Fill in the name of the single member. This is the individual who owns the LLC.

- Include the date the agreement is being executed. This is the date you are completing the form.

- Outline the purpose of the LLC. Briefly describe what business activities the LLC will engage in.

- Specify the management structure. Indicate that the single member will manage the LLC.

- Detail the capital contributions made by the member. List any initial investments or assets contributed to the LLC.

- Include provisions for profit and loss distribution. State how profits and losses will be allocated to the member.

- Sign and date the agreement at the bottom. Ensure that your signature is clear and legible.

Once you have completed the form, review it for accuracy. Make any necessary corrections before finalizing your document. Keeping a copy for your records is also advisable.