Blank Sample Tax Return Transcript PDF Form

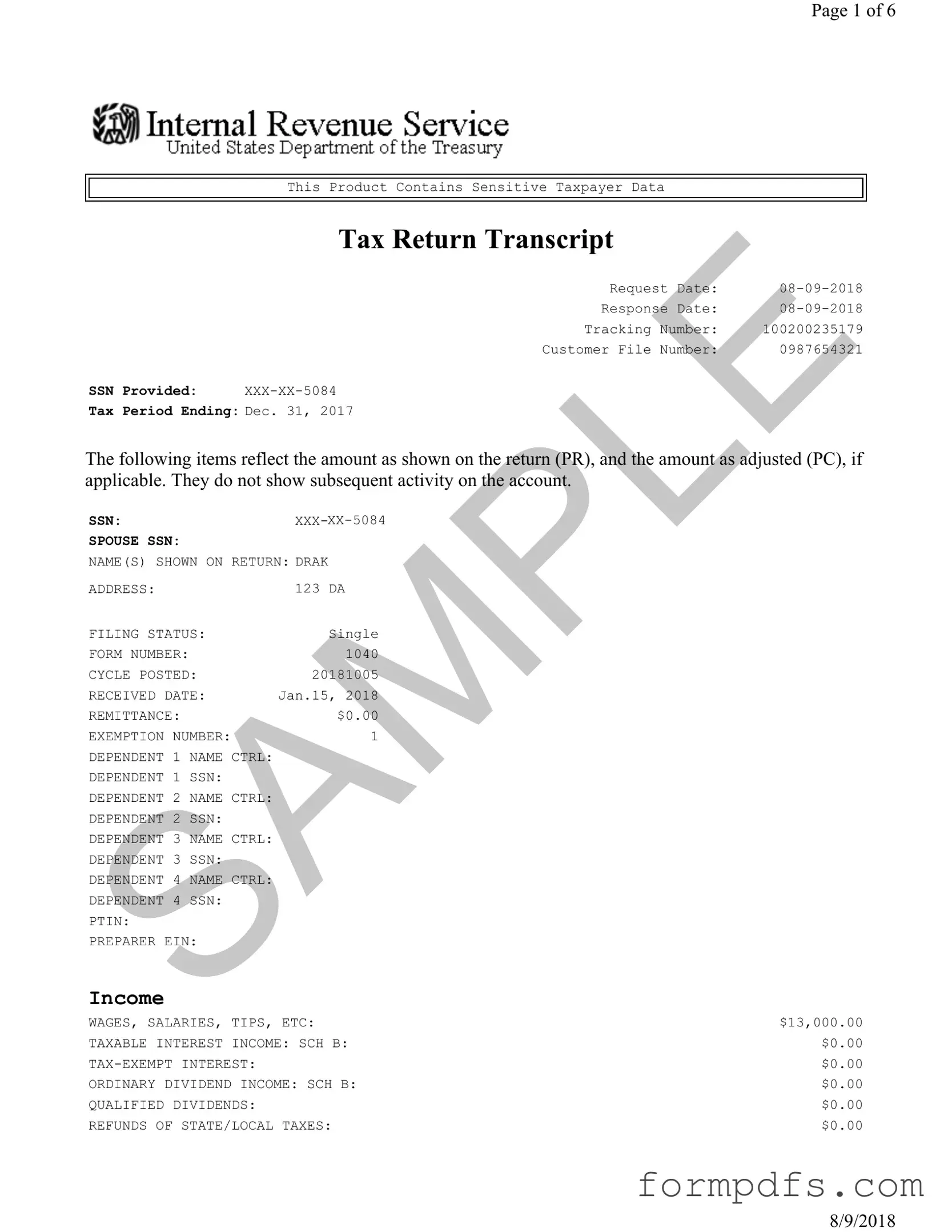

The Sample Tax Return Transcript form provides essential information regarding a taxpayer's financial status as reported on their federal tax return. This document includes critical details such as the taxpayer's Social Security Number (SSN), filing status, and income sources, which may encompass wages, business income, and various types of interest. It also outlines adjustments to income, tax liabilities, and credits, which are vital for understanding the overall tax situation. The form reflects both the amounts as originally reported and any adjustments made, allowing for a comprehensive view of the taxpayer's financial obligations. Additionally, it highlights any payments made, refunds expected, or amounts owed, ensuring that individuals can accurately assess their tax responsibilities. This transcript is particularly useful for those seeking to verify their income for loan applications, financial aid, or other purposes where proof of income is required.

More PDF Templates

Direct Deposit Form Pdf - It’s wise to follow up with your bank to confirm setup of direct deposit.

Florida Family Law Financial Affidavit Short Form - Legal representation can guide you through the affidavit's completion.

For those looking to finalize their boat transaction smoothly, it is essential to use the Bill of Sale for Boats, as it provides the necessary framework to ensure all relevant details are captured and legally recognized.

Restroom Cleaning Sign Off Sheet - Record the condition of toilet and handwashing facilities for accountability.

Documents used along the form

The Sample Tax Return Transcript is an important document for understanding your tax situation. However, it is often used alongside other forms and documents that provide additional context and information. Here is a list of seven commonly associated documents.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers to report their annual income. It includes sections for income, deductions, and tax credits.

- W-2 Form: Employers provide this form to report wages paid to employees and the taxes withheld from them. It is essential for accurately completing your tax return.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. There are several variations, including 1099-MISC for miscellaneous income and 1099-INT for interest income.

- Schedule C: Used by self-employed individuals, this form reports income and expenses from a business. It helps determine the net profit or loss from the business.

- Schedule A: This form is used to itemize deductions instead of taking the standard deduction. It includes deductions for medical expenses, mortgage interest, and charitable contributions.

- Arizona Motor Vehicle Bill of Sale Form: To ensure a smooth vehicle transaction process, refer to the essential Arizona Motor Vehicle Bill of Sale resources that provide all necessary documentation.

- Form 8862: This form is used to claim the Earned Income Tax Credit (EITC) after it has been disallowed in a prior year. It helps taxpayers reestablish eligibility for this credit.

- Form 8888: This form allows taxpayers to request that their tax refund be split into multiple accounts or used for savings bonds. It can be useful for managing refunds effectively.

Each of these documents plays a vital role in the tax filing process. Having them on hand can simplify your tax preparation and ensure that you are compliant with IRS regulations.

Form Breakdown

| Fact Name | Details |

|---|---|

| Tax Period Ending | December 31, 2017 |

| Total Income | $15,500.00 |

| Taxable Income | $7,373.00 |

| Amount Owed | $103.00 |

More About Sample Tax Return Transcript

What is a Tax Return Transcript?

A Tax Return Transcript is a document provided by the IRS that summarizes your tax return information. It includes most line items from your original tax return, such as income, deductions, and credits. This transcript is useful for verifying income when applying for loans or financial aid, as it provides a clear overview of your tax situation without revealing sensitive details.

How can I obtain a Tax Return Transcript?

You can request a Tax Return Transcript through the IRS website, by mail, or by phone. To order online, visit the IRS website and use the "Get Transcript" tool. You will need to verify your identity by providing personal information, such as your Social Security number and filing status. If you prefer to request it by mail, you can fill out Form 4506-T and send it to the IRS. Alternatively, you can call the IRS directly to request a transcript, but be prepared for potential wait times.

What information is included in a Tax Return Transcript?

A Tax Return Transcript includes your name, Social Security number, filing status, and the income reported on your tax return. It also details adjustments made by the IRS after your return was filed, if applicable. However, it does not include any information about your tax payments or refund amounts. For a complete view of your tax situation, you may need to request additional documents.

How long does it take to receive a Tax Return Transcript?

The time it takes to receive a Tax Return Transcript can vary. If you request it online, you may receive it immediately. Requests made by mail typically take 5 to 10 business days to process and send. If you call the IRS, they can provide an estimated timeline based on current processing times. It's advisable to plan ahead, especially if you need the transcript for a time-sensitive matter.

Sample Tax Return Transcript: Usage Steps

Filling out the Sample Tax Return Transcript form requires careful attention to detail. This form contains sensitive information and is used to summarize your income, deductions, and tax liabilities for a specific tax year. After completing the form, it is crucial to review it for accuracy before submission to ensure that all information aligns with your records.

- Begin by entering the Request Date at the top of the form. This is the date you are completing the form.

- Fill in the Response Date to indicate when you received the transcript.

- Record the Tracking Number, which helps to identify your request.

- Input your Customer File Number, which is unique to your tax records.

- Provide your Social Security Number (SSN) in the designated field.

- For married individuals, include your Spouse’s SSN as well.

- Enter the Name(s) Shown on Return, ensuring correct spelling and order.

- List your Address where you currently reside.

- Select your Filing Status from the options provided (e.g., Single, Married).

- Indicate the Form Number you are using, typically 1040 for individual tax returns.

- Record the Cycle Posted date, which reflects when the IRS processed your return.

- Enter the Received Date, which is when your return was submitted to the IRS.

- Fill in the Remittance amount, if applicable, which indicates any payments made.

- Complete the Exemption Number field, if you claimed any exemptions.

- List any Dependents you claimed, including their names and SSNs.

- Document your Total Income from all sources as shown on the transcript.

- Input any Adjustments to Income that apply to your situation.

- Calculate your Adjusted Gross Income based on the total income and adjustments.

- Detail your Tax and Credits, including any applicable deductions and credits.

- Provide information regarding Other Taxes that may apply to your situation.

- Document your Total Payments made towards your tax liabilities.

- Finally, indicate whether you have a Refund or Amount Owed based on your calculations.