Valid Release of Promissory Note Template

When it comes to financial agreements, clarity and security are paramount. The Release of Promissory Note form plays a vital role in ensuring that both parties involved in a loan transaction can move forward with confidence. This document serves as an official acknowledgment that a borrower has fulfilled their obligation to repay the loan, thereby releasing them from any further liability associated with the promissory note. It includes essential details such as the names of the parties, the amount repaid, and the date of the release. By signing this form, lenders confirm that they have received the full payment, while borrowers gain peace of mind knowing their debt has been settled. The form also protects both parties by providing a clear record of the transaction, which can be crucial in the event of future disputes. Understanding the significance of this document is key to navigating the complexities of loan agreements and ensuring that all parties are treated fairly.

Other Release of Promissory Note Templates:

Promissory Note Auto Loan - Encourages financial responsibility in car ownership.

When considering financial agreements in Arkansas, it's essential to understand the role of a Promissory Note. This document not only formalizes the loan terms but also safeguards the interests of both parties involved, ensuring that obligations are clear and legally binding. By crafting a well-defined Promissory Note, lenders can protect their investments while borrowers gain a clear understanding of their payment commitments, making it a crucial component of any loan transaction.

Documents used along the form

The Release of Promissory Note form is a crucial document used to formally acknowledge the fulfillment of a debt obligation. It signifies that the borrower has repaid the loan in full and releases them from any further liability associated with that note. Various other forms and documents often accompany this release to ensure clarity and completeness in the transaction. Below is a list of commonly used documents that may be relevant.

- Promissory Note: This is the original document that outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and consequences of default.

- Loan Agreement: This document details the specific terms and conditions of the loan, including covenants and responsibilities of both the lender and borrower.

- Payment Schedule: A breakdown of the payment plan, showing the dates and amounts due, which helps track the repayment progress.

- Amortization Schedule: This table outlines each payment over the life of the loan, showing how much goes toward principal and interest, helping borrowers understand their payment structure.

- Release of Lien: If the loan was secured by collateral, this document releases the lender's claim on the asset once the loan is paid off.

- Certificate of Satisfaction: This is a formal declaration that the borrower has fulfilled all obligations under the loan agreement, often used in real estate transactions.

- Affidavit of Payment: A sworn statement confirming that the borrower has made all required payments, providing legal proof of repayment.

- Loan Payoff Statement: A document from the lender detailing the remaining balance on the loan, including any fees, and confirming the total amount needed to pay off the loan.

- Editable Promissory Note: For those looking to customize their borrowing agreements, the newjerseyformspdf.com/editable-promissory-note/ provides a resource for creating personalized promissory notes tailored to individual financial arrangements.

- Disclosure Statement: This document provides important information about the loan, including terms, fees, and any other relevant disclosures required by law.

- Tax Documents: These may include forms related to interest paid on the loan, which can be relevant for tax purposes and should be retained for record-keeping.

Each of these documents plays a significant role in the overall loan process and ensures that both parties have a clear understanding of their rights and responsibilities. Proper documentation aids in preventing disputes and provides a comprehensive record of the transaction.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A Release of Promissory Note form is a document used to formally cancel a promissory note, indicating that the borrower has fulfilled their repayment obligations. |

| Purpose | This form serves to protect both the lender and borrower by providing written proof that the debt has been settled. |

| Governing Law | The governing law for the Release of Promissory Note may vary by state. For example, in California, it is governed by the California Civil Code. |

| Required Signatures | Both the lender and the borrower must sign the form to validate the release of the note. |

| Filing | While not always required, some states may require the form to be filed with the appropriate county office for public record. |

| Effectiveness | The release becomes effective upon signing, but it is advisable to keep a copy for personal records. |

| Additional Documentation | In some cases, additional documentation may be required to confirm that the loan has been paid in full, such as payment receipts. |

More About Release of Promissory Note

What is a Release of Promissory Note form?

The Release of Promissory Note form is a legal document used to formally acknowledge that a borrower has fulfilled their obligation to repay a loan. When a borrower pays off their debt, this form is completed by the lender to confirm that the promissory note, which outlines the terms of the loan, is no longer valid. Essentially, it serves as a receipt for the borrower, indicating that they have satisfied their financial commitment.

Why is it important to obtain a Release of Promissory Note?

Obtaining a Release of Promissory Note is crucial for several reasons. Firstly, it provides the borrower with proof that the loan has been paid in full, which can be important for their credit record. Secondly, it protects the borrower from any future claims by the lender regarding the loan, as the release document serves as evidence that the debt has been settled. Lastly, having this form can help prevent misunderstandings or disputes that might arise later concerning the status of the loan.

How do I complete a Release of Promissory Note form?

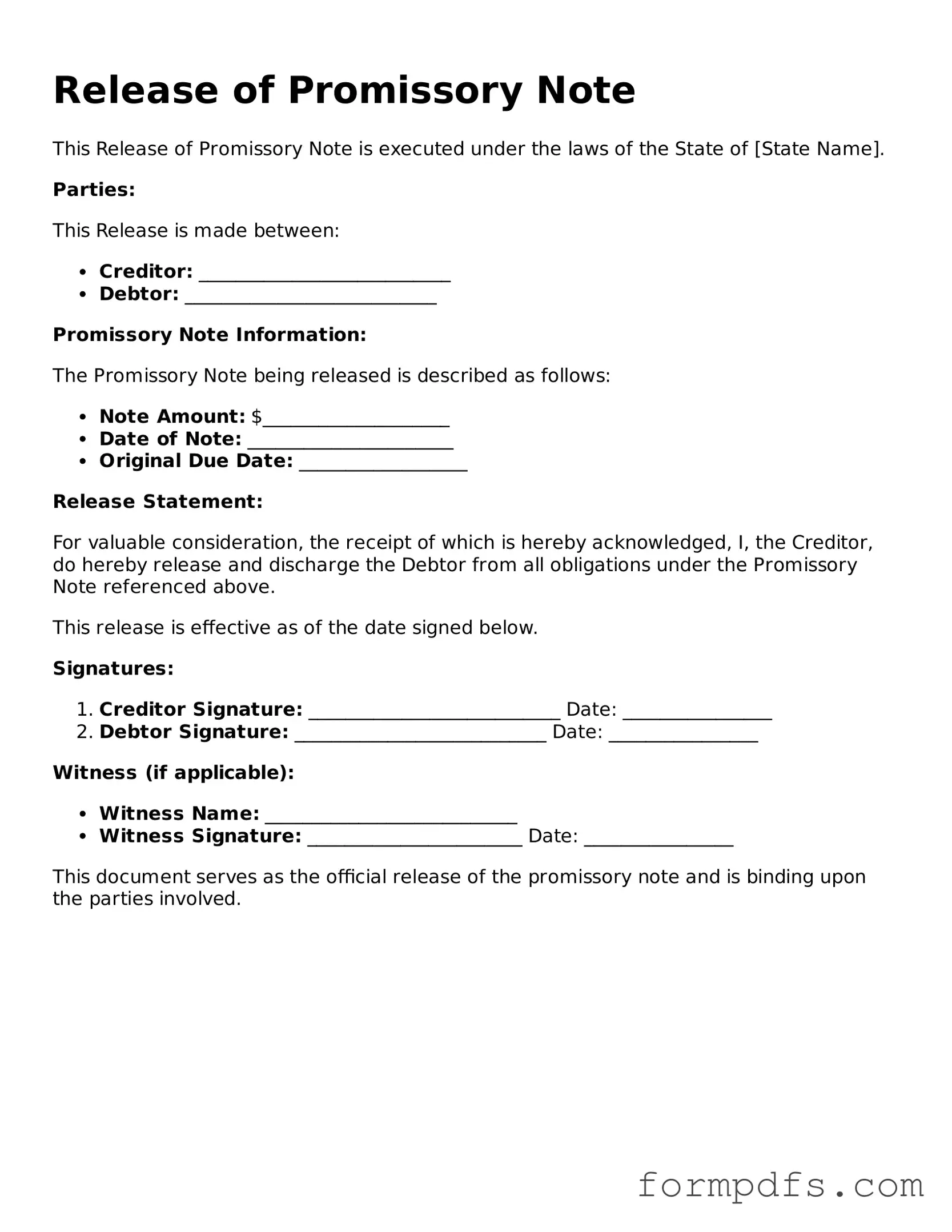

Completing a Release of Promissory Note form typically involves several steps. First, ensure that all relevant information is included, such as the names of the borrower and lender, the original loan amount, and any pertinent dates. Next, both parties should sign and date the document to validate it. It may also be advisable to have the form notarized, as this adds an extra layer of authenticity and can be helpful if any issues arise in the future. Finally, make copies of the completed form for both the borrower and lender for their records.

What should I do if I don't receive a Release of Promissory Note after paying off my loan?

If you have paid off your loan but have not received a Release of Promissory Note, it is important to take action. Start by contacting the lender directly to request the document. Keep a record of all communications, including dates and names of representatives you speak with. If the lender is unresponsive or refuses to provide the release, consider sending a formal written request. In some cases, you may need to seek legal advice to understand your rights and options for obtaining the release.

Release of Promissory Note: Usage Steps

After completing the Release of Promissory Note form, you will need to ensure it is signed and dated properly. Next, make copies for your records and send the original to the appropriate party. This step is crucial for maintaining clear documentation of the release.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of both the borrower and the lender in the designated fields.

- Clearly state the amount of the promissory note being released.

- Include any relevant details about the original promissory note, such as the date it was signed and any identifying numbers.

- Sign the form where indicated. Make sure the signature matches the name provided.

- Date the form next to your signature.

- Have the other party sign the form as well, if required.

- Make copies of the completed form for your records.

- Send the original form to the appropriate party, ensuring it is delivered securely.