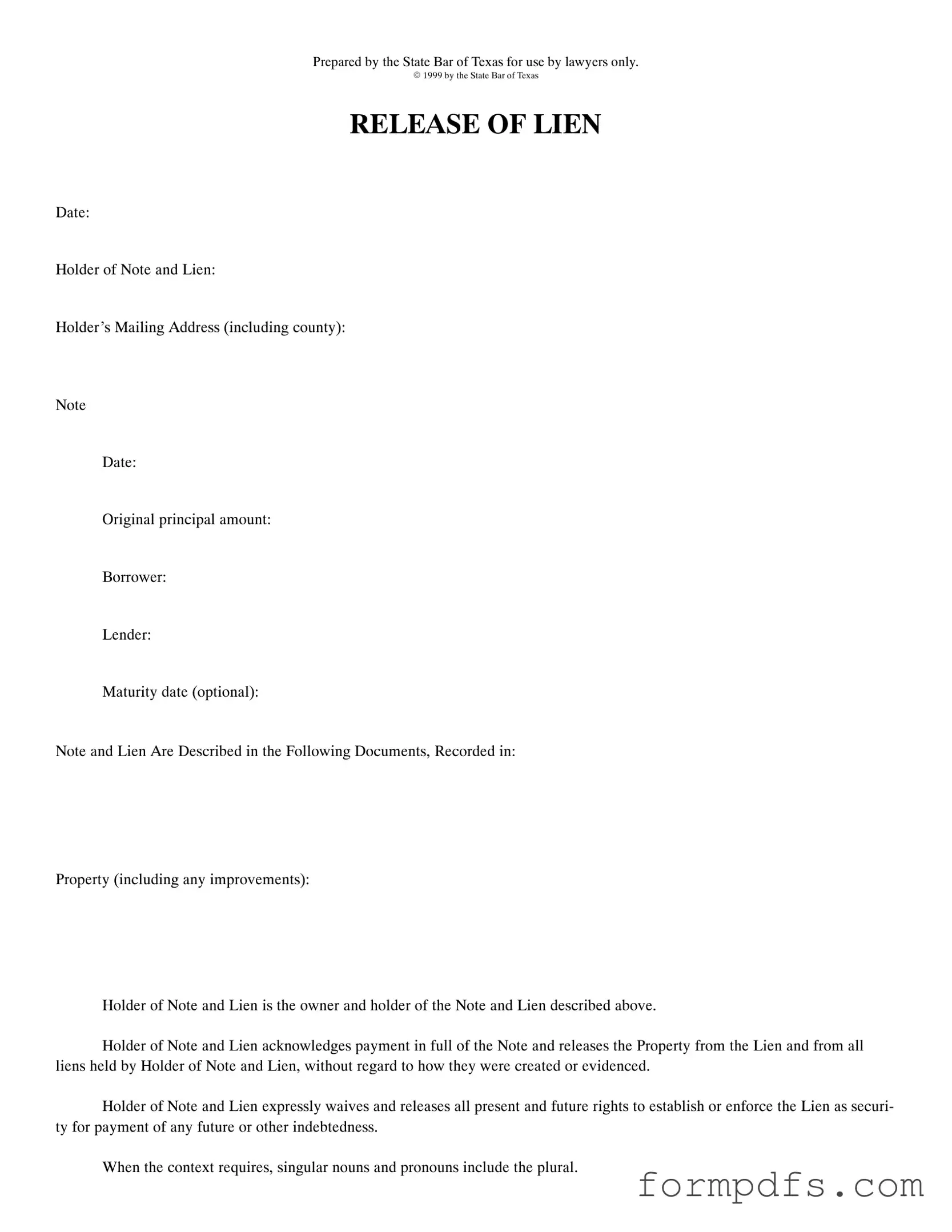

Blank Release Of Lien Texas PDF Form

The Release of Lien Texas form serves a critical function in the realm of property transactions, particularly when a borrower has fulfilled their financial obligations. This form is primarily prepared for use by legal professionals and is designed to formally document the release of a lien held by a lender against a property. Essential details included in the form encompass the date of the release, the names of the holder of the note and lien, and the borrower, along with the original principal amount and maturity date of the note. Additionally, the form specifies the property being released, which may include any improvements made to it. By signing this document, the holder of the note acknowledges receipt of full payment and relinquishes all claims to the lien, thus ensuring that the property is free from any encumbrances related to that debt. The holder also waives any future rights to enforce the lien for additional debts. Notarization is required to validate the release, with sections designated for acknowledgment by a notary public, ensuring the form’s legality and enforceability. This structured approach not only protects the interests of the borrower but also clarifies the lender's relinquishment of rights, promoting transparency in property ownership.

More PDF Templates

Donation Slips - Your donation is officially documented with this receipt.

In addition to the MC-020 form, users can access essential resources for navigating the complexities of legal documentation, including a comprehensive list of templates and guidelines available through All California Forms, which further supports the standardization of information in court proceedings.

IRS E-file Signature Authorization - The 8879 form contains critical information about your tax return and your identity.

Documents used along the form

The Release of Lien Texas form is an essential document used to formally acknowledge that a lien has been satisfied and that the property is no longer encumbered by that lien. In addition to this form, there are several other documents that may be necessary during the process of managing liens and property transactions. Below is a list of related forms and documents that are commonly used alongside the Release of Lien.

- Deed of Trust: This document secures a loan by transferring the title of a property to a trustee, who holds it as security for the loan until it is paid off. It outlines the terms of the loan and the rights of the lender and borrower.

- Articles of Incorporation: This essential document is required for forming a corporation in New York and details information such as the corporate name, purpose, and incorporators. For more details, visit smarttemplates.net/fillable-new-york-articles-of-incorporation.

- Promissory Note: A written promise from the borrower to repay a specified sum of money to the lender under agreed-upon terms. This document details the amount borrowed, interest rate, and repayment schedule.

- Notice of Default: This document informs the borrower that they have defaulted on their loan obligations. It is often a precursor to foreclosure proceedings and outlines the steps the borrower must take to remedy the default.

- Foreclosure Complaint: A legal document filed by a lender to initiate foreclosure proceedings against a property. It details the lender's claim to the property and the reasons for the foreclosure.

- Affidavit of Payment: This sworn statement confirms that a borrower has made all necessary payments on a loan. It may be used to support the release of a lien by demonstrating that the debt has been satisfied.

- Title Insurance Policy: A policy that protects the buyer and lender from any issues related to the title of the property, such as undiscovered liens or ownership disputes. It is often required during real estate transactions.

- Property Deed: This legal document transfers ownership of real estate from one party to another. It is essential in establishing who has legal rights to the property.

- Mortgage Release: Similar to a Release of Lien, this document is issued by a lender to confirm that a mortgage has been paid off and the lender no longer has a claim to the property.

- Settlement Statement: Also known as a HUD-1 form, this document outlines all the costs and fees associated with a real estate transaction. It provides a detailed breakdown of what each party is responsible for paying.

- Loan Modification Agreement: This document alters the terms of an existing loan, such as interest rates or payment schedules. It can help borrowers avoid default and keep their property.

Understanding these forms and documents can significantly aid in navigating the complexities of property transactions and lien management. Each document serves a specific purpose and contributes to the overall clarity and legality of the financial arrangements involved.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Release of Lien form is used to officially release a lien on a property once the debt has been paid in full. |

| Governing Law | This form is governed by Texas state law, specifically under the Texas Property Code. |

| Prepared By | The form is prepared by the State Bar of Texas and is intended for use by lawyers only. |

| Key Components | It includes details such as the date, holder of the note and lien, borrower, lender, and property description. |

| Acknowledgment Requirement | The document must be acknowledged before a notary public to be legally effective. |

| Waiver of Rights | The holder of the lien waives all rights to enforce the lien for future debts once the lien is released. |

| Return Instructions | After recording, the form should be returned to the specified law office for proper documentation. |

More About Release Of Lien Texas

What is a Release of Lien Texas form?

The Release of Lien Texas form is a legal document used to formally release a lien on a property. This form is typically prepared by a lawyer and acknowledges that the holder of the lien has received full payment for the debt secured by the lien. Once completed and recorded, it clears the property of the lien, allowing the owner to have clear title.

Who needs to use this form?

This form is primarily used by lenders or lien holders who have received full payment on a loan secured by a lien on real property. Borrowers may also need this form to ensure that their property is free from any claims or encumbrances related to the loan.

What information is required to complete the form?

To complete the Release of Lien form, you will need to provide details such as the date of the release, the name and address of the lien holder, the original principal amount of the loan, the borrower's name, and a description of the property. Additionally, it may include the note date and maturity date.

How does the lien holder acknowledge payment?

The lien holder acknowledges payment by signing the form, indicating that they have received full payment for the note. This acknowledgment is essential for the legal validity of the release and must be notarized to ensure authenticity.

What happens after the form is completed?

Once the Release of Lien form is completed and signed, it must be recorded with the appropriate county office where the property is located. This recording makes the release official and provides public notice that the lien has been removed.

Is notarization required for this form?

Yes, notarization is required for the Release of Lien Texas form. The signatures of the lien holder must be acknowledged by a notary public to ensure that the document is legally binding and valid.

Can this form be used for any type of lien?

This form is specifically designed for the release of liens related to real property loans. It may not be suitable for other types of liens, such as mechanic's liens or tax liens. Always consult with a legal professional to determine the appropriate form for your specific situation.

Release Of Lien Texas: Usage Steps

After completing the Release of Lien form, it is essential to ensure that all information is accurate and that the document is properly executed. This form must be signed and notarized before it can be filed with the appropriate county office. Follow these steps to fill out the form correctly.

- Date: Write the current date at the top of the form.

- Holder of Note and Lien: Enter the name of the person or entity that holds the note and lien.

- Holder’s Mailing Address: Provide the complete mailing address of the holder, including the county.

- Note Date: Fill in the date when the note was originally signed.

- Original Principal Amount: Write the original amount of the loan.

- Borrower: Enter the name of the borrower who took out the loan.

- Lender: Specify the name of the lender who issued the loan.

- Maturity Date (optional): If applicable, include the date when the loan is due.

- Note and Lien Are Described in the Following Documents, Recorded in: Provide details about the documents where the note and lien are recorded.

- Property: Describe the property that is subject to the lien, including any improvements made to it.

- Holder of Note and Lien Acknowledgment: Confirm that the holder acknowledges payment in full and releases the property from the lien.

- Acknowledgment Section: Leave space for the notary to acknowledge the signing of the document. Include the state and county.

- Notary Public: The notary will fill in their name and commission expiration date.

- Corporate Acknowledgment (if applicable): If the holder is a corporation, complete the corporate acknowledgment section similarly to the individual acknowledgment.

- After Recording Return To: Fill in the name of the law office or person to whom the document should be returned after recording.