Valid Real Estate Power of Attorney Template

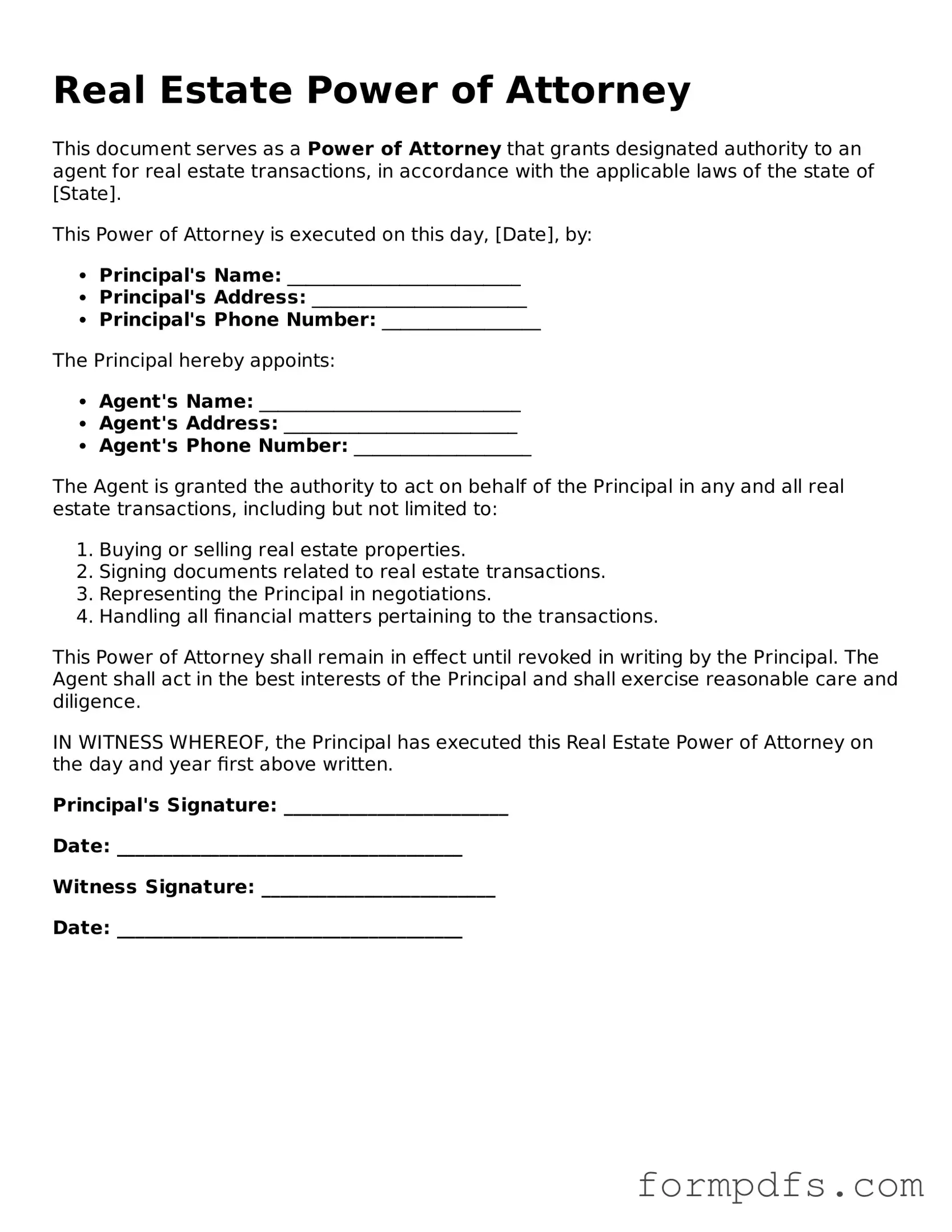

The Real Estate Power of Attorney form is a crucial legal document that empowers an individual, known as the agent or attorney-in-fact, to act on behalf of another person, referred to as the principal, in matters related to real estate transactions. This form can cover a wide range of actions, including buying, selling, leasing, or managing property. By granting this authority, the principal ensures that their interests are represented, even if they cannot be present to make decisions themselves. The form typically outlines specific powers granted to the agent, which may include the ability to sign contracts, handle negotiations, and manage financial transactions associated with the property. Importantly, the Real Estate Power of Attorney can be tailored to fit the principal's needs, whether it is for a single transaction or for ongoing management of multiple properties. Understanding the implications of this form is vital, as it not only facilitates real estate dealings but also carries significant legal responsibilities for both parties involved.

Other Real Estate Power of Attorney Templates:

When Is Power of Attorney Needed - Under this arrangement, your agent can pay bills, manage investments, and more.

Revocation of Power of Attorney Form - Encourages responsible management of one’s Power of Attorney.

In addition to understanding the significance of the Florida Power of Attorney form, it is also important to have access to the right resources for its creation and management. You can find comprehensive templates and guidelines at All Florida Forms, which will help ensure that all necessary legal requirements are met.

Ca Reg 260 - Using this form can make it easier to transfer ownership in family or friend transactions.

Documents used along the form

When engaging in real estate transactions, a Real Estate Power of Attorney form is often accompanied by several other important documents. Each of these documents serves a specific purpose and can help ensure that the transaction proceeds smoothly. Below is a list of commonly used forms and documents that complement the Real Estate Power of Attorney.

- Property Deed: This legal document transfers ownership of real estate from one party to another. It includes details about the property and the parties involved in the transaction.

- Sales Contract: This agreement outlines the terms of the sale, including the purchase price, contingencies, and closing date. It is essential for defining the obligations of both the buyer and seller.

- Disclosure Statements: Sellers are often required to provide disclosures about the property's condition. These statements inform buyers of any known issues, helping to prevent disputes later.

- Title Insurance Policy: This document protects the buyer and lender from potential disputes over property ownership. It ensures that the title is clear of any liens or encumbrances.

- Closing Statement: Also known as a settlement statement, this document itemizes all costs associated with the transaction, including fees, taxes, and the final purchase price.

- Power of Attorney Form: To empower your real estate transactions, ensure you understand the relevant Power of Attorney form options that grant necessary decision-making authority.

- Mortgage Agreement: If the buyer is financing the purchase, this document outlines the terms of the loan, including interest rates, repayment schedules, and consequences of default.

- Inspection Reports: These reports provide an assessment of the property's condition, highlighting any repairs that may be needed. They can influence negotiations and buyer decisions.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and asserts that there are no undisclosed liens or claims against it.

- Power of Attorney Revocation: If a party wishes to cancel a previously granted power of attorney, this document formally revokes the authority given, ensuring clarity in future transactions.

Understanding these documents can significantly enhance the real estate transaction process. Each one plays a vital role in protecting the interests of all parties involved, ensuring transparency and legal compliance throughout the process.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Power of Attorney form allows one person to authorize another to manage real estate transactions on their behalf. |

| Authority Granted | The agent can buy, sell, lease, or manage real estate as specified in the document. |

| State-Specific Forms | Each state may have its own specific form or requirements for a Power of Attorney. |

| Governing Law | The laws governing Power of Attorney vary by state. For example, in California, it is governed by the California Probate Code. |

| Durability | A Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent. |

| Witnesses and Notarization | Many states require the form to be signed in the presence of witnesses or notarized to be valid. |

| Limitations | Some actions may require additional legal documents or approvals, depending on state laws and the nature of the transaction. |

More About Real Estate Power of Attorney

What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that allows one person, known as the agent or attorney-in-fact, to act on behalf of another person, referred to as the principal, in real estate transactions. This document grants the agent the authority to make decisions regarding the sale, purchase, or management of real estate property. It is particularly useful when the principal is unable to be present for the transaction or wishes to delegate responsibilities to a trusted individual.

When should I consider using a Real Estate Power of Attorney?

You might consider using a Real Estate Power of Attorney in several situations. For example, if you are traveling abroad and need to sell or buy property, this document allows someone you trust to handle the transaction in your absence. It is also beneficial for individuals who may be facing health issues or other circumstances that prevent them from managing their real estate affairs. Additionally, if you are involved in a complex real estate deal that requires extensive negotiation or paperwork, having an agent can simplify the process.

What are the key elements to include in a Real Estate Power of Attorney?

When creating a Real Estate Power of Attorney, several key elements should be included to ensure its effectiveness. First, clearly identify the principal and the agent, including their full names and addresses. Next, specify the powers granted to the agent, such as the ability to buy, sell, or manage property. It is also important to include any limitations on those powers, if applicable. Lastly, ensure the document is signed and dated by the principal, and consider having it notarized to enhance its legal validity.

Can a Real Estate Power of Attorney be revoked?

Yes, a Real Estate Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent to do so. To revoke the power, the principal should create a written document stating their intention to revoke the previous Power of Attorney. It is advisable to notify the agent and any third parties who may have relied on the original document. Additionally, it is wise to formally cancel the document with any relevant institutions, such as banks or real estate offices, to prevent any potential misuse of the authority granted.

Real Estate Power of Attorney: Usage Steps

Filling out the Real Estate Power of Attorney form is an important step in delegating authority for real estate transactions. This process involves providing specific information about the parties involved and the powers granted. Careful attention to detail will ensure that the form is completed correctly and serves its intended purpose.

- Begin by obtaining the Real Estate Power of Attorney form from a reliable source.

- Identify the principal, the person granting the authority. Write their full name and address at the top of the form.

- Next, provide the name and address of the agent, the individual who will be given the authority to act on behalf of the principal.

- Clearly state the specific powers that the agent will have. This may include buying, selling, or managing real estate properties.

- Include the effective date of the power of attorney. This indicates when the agent's authority begins.

- If applicable, specify an expiration date for the power of attorney. This will limit how long the agent can act on behalf of the principal.

- Both the principal and the agent should sign and date the form. Ensure that the signatures are clear and legible.

- Have the form notarized. This step adds an extra layer of verification and is often required for the document to be valid.

- Make copies of the completed form for both the principal and the agent. Keep the originals in a safe place.