Valid Promissory Note for a Car Template

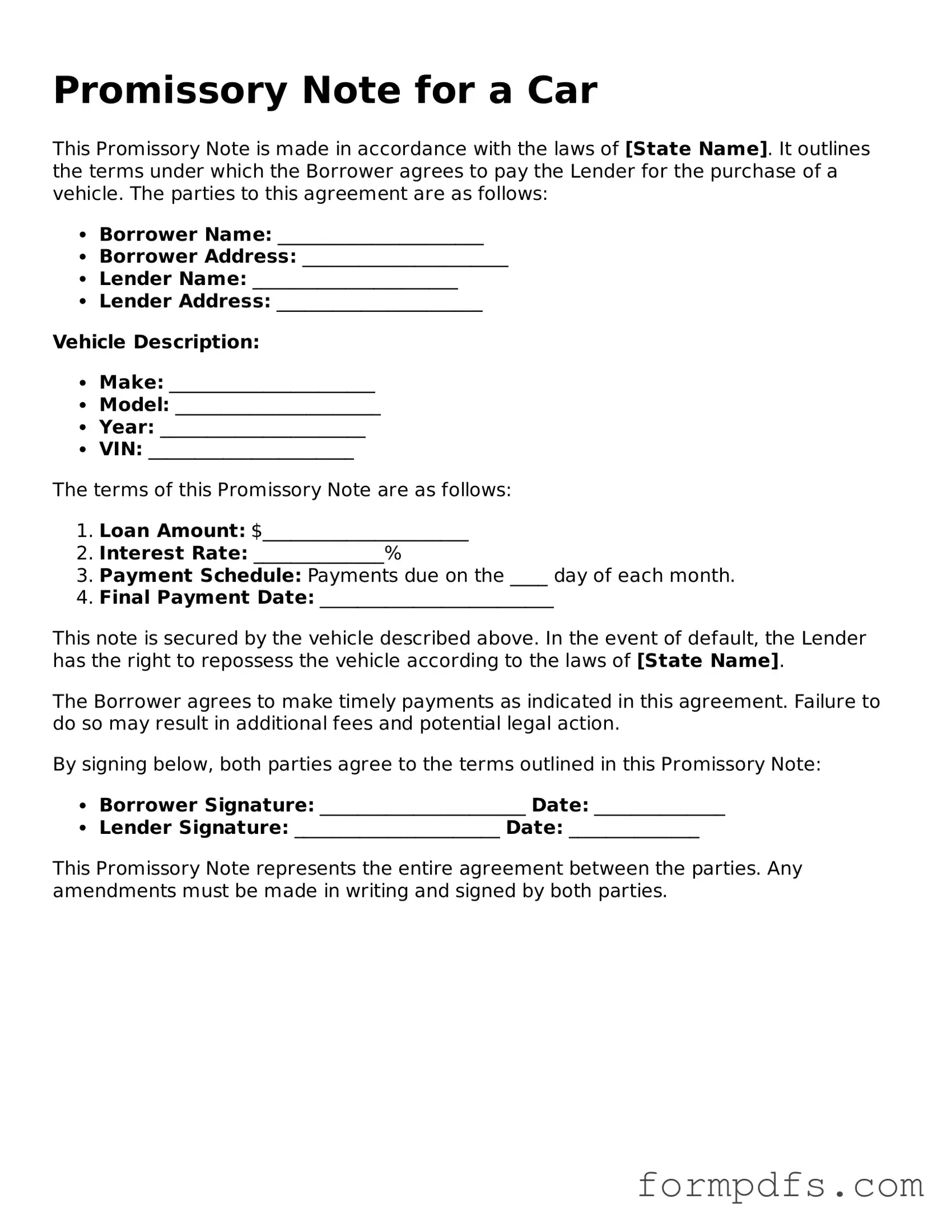

When purchasing a car, many people opt for financing options to make the process more manageable. A Promissory Note for a Car serves as a crucial document in this scenario, outlining the terms of the loan agreement between the borrower and the lender. This form details the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties understand their obligations. It also specifies the consequences of default, protecting the lender's interests while providing clarity for the borrower. Additionally, the note may include provisions for late fees and prepayment options, offering flexibility to the borrower. By clearly stating these terms, the Promissory Note helps to prevent misunderstandings and disputes, making it an essential part of the car financing process.

Other Promissory Note for a Car Templates:

Satisfaction of Promissory Note - The completion of the form can prevent misunderstandings down the line.

When creating a legally binding agreement, it is essential to use a reliable template for drafting a New York Promissory Note. This document can help ensure clarity and enforceability of the terms agreed upon by both parties involved. For an effective solution, you can find a useful template at NY PDF Forms, which can guide you through the necessary components and help you avoid any ambiguities in your agreement.

Documents used along the form

A Promissory Note for a Car is often accompanied by several other important documents that help clarify the terms of the loan and protect the interests of both the borrower and the lender. Here are four key forms and documents commonly used alongside the Promissory Note.

- Security Agreement: This document outlines the collateral for the loan, typically the car itself. It gives the lender a legal claim to the vehicle if the borrower defaults on the loan.

- Bill of Sale: A Bill of Sale serves as proof of the transaction between the buyer and seller. It includes details such as the purchase price, vehicle identification number (VIN), and the date of sale.

- Promissory Note: A written promise to pay for the vehicle, this document outlines the repayment terms and conditions necessary for the financing process. For more information and to access a template, visit promissorynotepdf.com/printable-alabama-promissory-note.

- Title Transfer Document: This document is necessary for transferring ownership of the vehicle from the seller to the buyer. It ensures that the new owner has legal title to the car.

- Loan Agreement: The Loan Agreement outlines the terms of the loan, including the interest rate, payment schedule, and consequences for default. It is a comprehensive document that serves as a reference for both parties.

These documents work together to create a clear framework for the loan, ensuring that both the lender and borrower understand their rights and responsibilities. Properly completing and retaining these forms can help prevent disputes and facilitate a smooth transaction.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money for the purchase of a vehicle. |

| Parties Involved | The document typically involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Interest Rate | The note may specify an interest rate, which is the cost of borrowing money, and can be fixed or variable. |

| Payment Terms | It outlines the payment schedule, including the amount and frequency of payments until the loan is fully repaid. |

| Security Interest | Often, the car itself serves as collateral, meaning the lender can repossess the vehicle if payments are not made. |

| Governing Law | The laws of the state where the transaction takes place govern the note. For example, in California, it is governed by the California Commercial Code. |

| Default Clauses | It includes terms regarding default, explaining what happens if the borrower fails to make payments. |

| Signatures Required | Both parties must sign the note for it to be legally binding, affirming their agreement to the terms. |

| Amendments | Any changes to the terms of the note must be documented in writing and signed by both parties to be enforceable. |

More About Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the terms of a loan used to purchase a vehicle. It serves as a written promise from the borrower to repay the lender a specified amount of money, usually with interest, over a predetermined period. This document protects both parties by clearly stating the obligations involved in the transaction.

Who typically uses a Promissory Note for a Car?

This document is commonly used by individuals who are borrowing money to buy a car, whether from a bank, credit union, or private seller. It can also be utilized by sellers who wish to finance the sale of their vehicle, allowing the buyer to make payments over time instead of paying the full amount upfront.

What information is included in a Promissory Note for a Car?

The note typically includes the names and addresses of both the borrower and lender, the principal amount of the loan, the interest rate, the repayment schedule, and any late fees or penalties for missed payments. Additionally, it may specify the vehicle's details, such as make, model, and VIN (Vehicle Identification Number).

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding contract. Once both parties sign the document, they are obligated to adhere to the terms outlined within it. If either party fails to comply, the other party may seek legal remedies, which could include pursuing the debt in court.

Do I need a lawyer to create a Promissory Note for a Car?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can ensure that the document meets all legal requirements and adequately protects your interests. Many templates are available online, but it is important to customize the note to fit the specific terms of your agreement.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised note to avoid confusion or disputes in the future.

What happens if I miss a payment on my Promissory Note?

If a payment is missed, the lender may impose late fees as specified in the note. Continuous failure to make payments could lead to default, allowing the lender to take legal action to recover the owed amount. It's crucial to communicate with the lender if financial difficulties arise.

Can I use a Promissory Note for a car purchased from a private seller?

Yes, a Promissory Note can be used for a car purchased from a private seller. In this case, the seller acts as the lender, and the note outlines the terms of repayment. Both parties should ensure they understand the terms before signing.

What is the difference between a Promissory Note and a loan agreement?

A Promissory Note is a simpler document that focuses on the borrower's promise to repay a loan, while a loan agreement is more comprehensive and may include additional terms, conditions, and protections for both parties. A loan agreement often covers aspects such as collateral, warranties, and specific legal remedies in case of default.

Is a Promissory Note for a Car the same as a title loan?

No, a Promissory Note for a Car is not the same as a title loan. A title loan typically involves borrowing against the equity of a vehicle, where the lender holds the title as collateral. In contrast, a Promissory Note is simply a promise to repay a loan and may not involve the transfer of title or ownership rights.

Promissory Note for a Car: Usage Steps

Filling out the Promissory Note for a Car form is a straightforward process that requires attention to detail. Once you have completed the form, it will serve as a written agreement between the borrower and the lender, outlining the terms of the loan for the vehicle. Follow these steps carefully to ensure all necessary information is accurately provided.

- Begin by entering the date at the top of the form. This should reflect the date you are filling out the note.

- Next, write the full name and address of the borrower. Make sure to include the street address, city, state, and zip code.

- Then, provide the lender's full name and address in the same format as the borrower's information.

- In the designated section, specify the total amount of the loan. This is the principal amount that will be borrowed.

- Indicate the interest rate for the loan, if applicable. This should be expressed as a percentage.

- State the repayment terms. Include how often payments will be made (e.g., monthly, bi-weekly) and the duration of the loan.

- Include any late fees that may apply if a payment is not made on time. Clearly state the amount or percentage that will be charged.

- Lastly, both the borrower and the lender should sign and date the form at the bottom to make the agreement official.