Valid Promissory Note Template

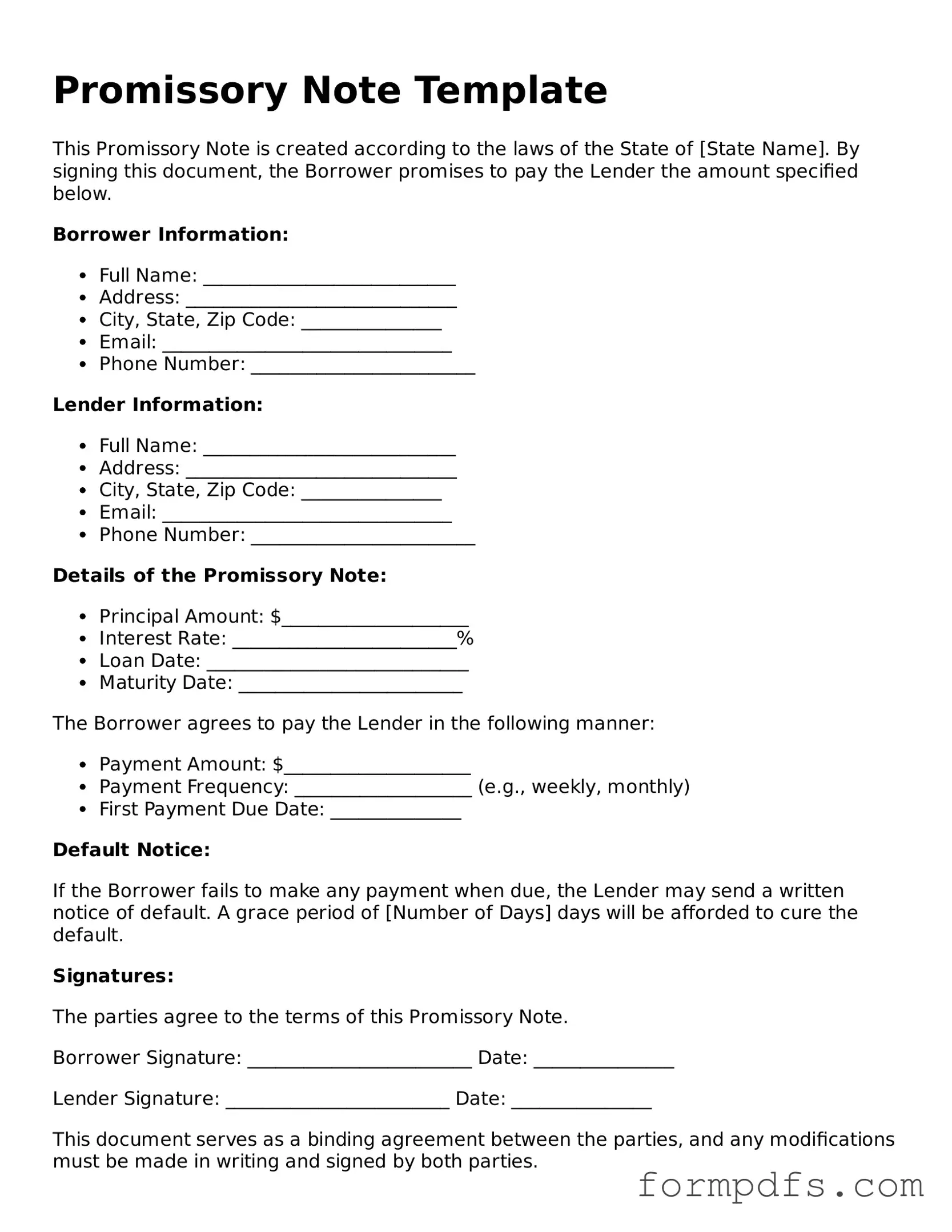

When entering into a financial agreement, a Promissory Note serves as a crucial document that outlines the terms of a loan between a borrower and a lender. This form typically includes essential details such as the principal amount borrowed, the interest rate, and the repayment schedule. It establishes the borrower's promise to repay the loan under specified conditions, ensuring both parties understand their obligations. Additionally, the Promissory Note may specify what happens in the event of default, including potential penalties or legal actions. By clearly laying out these terms, the form helps prevent misunderstandings and provides a legal framework for enforcing the agreement. Understanding the components of a Promissory Note is vital for anyone involved in lending or borrowing money, as it protects the interests of both parties and facilitates smoother financial transactions.

More Forms:

Car Accident Settlement Letter Template - Confirms receipt of compensation for vehicle damage.

For those looking to engage in a trailer sale, understanding the importance of the documentation is essential; a Trailer Bill of Sale can be found at https://toptemplates.info/bill-of-sale/trailer-bill-of-sale/, which outlines the necessary details needed to formalize the transaction and ensure a smooth transfer of ownership.

What Is an I20 - Students are required to maintain full-time enrollment as indicated on the I-20.

What Is a Form 8300 Used For? - Providing accurate information on this form is crucial for tax reporting.

Promissory Note Forms for Specific US States

Promissory Note Types

Documents used along the form

A Promissory Note is a crucial document in financial transactions, particularly when money is borrowed. However, it is often accompanied by other forms and documents that help clarify the terms of the agreement and protect the interests of both parties. Below are some common documents that are typically used alongside a Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a more comprehensive contract between the borrower and lender.

- Security Agreement: If the loan is secured by collateral, this document specifies what assets are being used as security. It details the rights of the lender in case the borrower defaults on the loan.

- Residential Lease Agreement: The California Residential Lease Agreement form serves as a legally binding contract between a landlord and a tenant, outlining the terms and conditions of renting residential property within the state of California. This document is pivotal for both parties, ensuring clarity and mutual understanding of expectations regarding the rental arrangement. For more details, check out All California Forms.

- Personal Guarantee: A personal guarantee may be required from individuals who are personally liable for the loan. This document ensures that if the borrowing entity fails to repay, the individual will be responsible for repayment.

- Disclosure Statement: This document provides important information about the loan, including fees, terms, and the total cost of borrowing. It ensures transparency and helps the borrower understand their obligations.

These documents work together with the Promissory Note to create a clear understanding between the parties involved. Properly preparing and reviewing each document can help prevent misunderstandings and protect everyone’s interests in the transaction.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Parties Involved | There are typically two parties: the maker (borrower) and the payee (lender). |

| Governing Law | Each state has its own laws governing promissory notes, often found in the Uniform Commercial Code (UCC). |

| Interest Rates | Promissory notes can include an interest rate, which must comply with state usury laws. |

| Types | There are various types, including secured and unsecured promissory notes. |

| Default Terms | Terms for default should be clearly outlined, including any penalties or fees. |

| Transferability | Promissory notes can often be transferred to another party, depending on the terms included. |

| Signatures | Both parties must sign the note for it to be legally binding. |

| Enforceability | A properly executed promissory note is generally enforceable in court. |

| State Variations | Each state may have specific requirements for the form and content of a promissory note. |

More About Promissory Note

What is a Promissory Note?

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. It outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments. This document serves as a legal record of the debt and can be enforced in court if necessary.

Who uses a Promissory Note?

Promissory notes are commonly used by individuals and businesses. They can be used in personal loans between friends or family members, as well as in formal lending situations involving banks or financial institutions. Businesses might use them to secure financing or to document transactions with suppliers or clients.

What are the key components of a Promissory Note?

Key components of a promissory note include the names of the borrower and lender, the principal amount, the interest rate, the payment schedule, and the maturity date. It may also include terms regarding late fees, prepayment options, and any collateral securing the loan. Clear and precise wording is crucial to avoid misunderstandings.

Is a Promissory Note legally binding?

Yes, a promissory note is legally binding as long as it meets certain criteria. It must be signed by the borrower and should include all essential terms. If the borrower fails to repay the loan as agreed, the lender has the right to take legal action to recover the owed amount. Having the document properly executed strengthens its enforceability.

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both the borrower and lender agree to the changes. This may involve altering the payment terms, interest rate, or other conditions. It’s important to document any modifications in writing and have both parties sign the amended note to ensure clarity and legal validity.

Promissory Note: Usage Steps

Once you have the Promissory Note form in front of you, it's important to ensure all sections are completed accurately. This document serves as a binding agreement between the borrower and lender, outlining the terms of repayment. Follow these steps to fill out the form correctly.

- Enter the Date: Begin by writing the date on which the note is being created at the top of the form.

- Identify the Borrower: Clearly write the full name and address of the borrower. This identifies who is responsible for repaying the loan.

- Identify the Lender: Next, include the full name and address of the lender. This is the individual or entity providing the loan.

- Loan Amount: Specify the exact amount of money being borrowed. This should be written both in numerical form and spelled out in words to avoid any confusion.

- Interest Rate: If applicable, indicate the interest rate for the loan. This can be expressed as a percentage.

- Payment Terms: Describe the repayment schedule. Include how often payments are due (e.g., monthly, quarterly) and the due date for the first payment.

- Late Fees: If there are any penalties for late payments, outline these fees clearly.

- Signatures: Finally, both the borrower and lender should sign the document. Ensure that the signatures are dated as well.