Blank Profit And Loss PDF Form

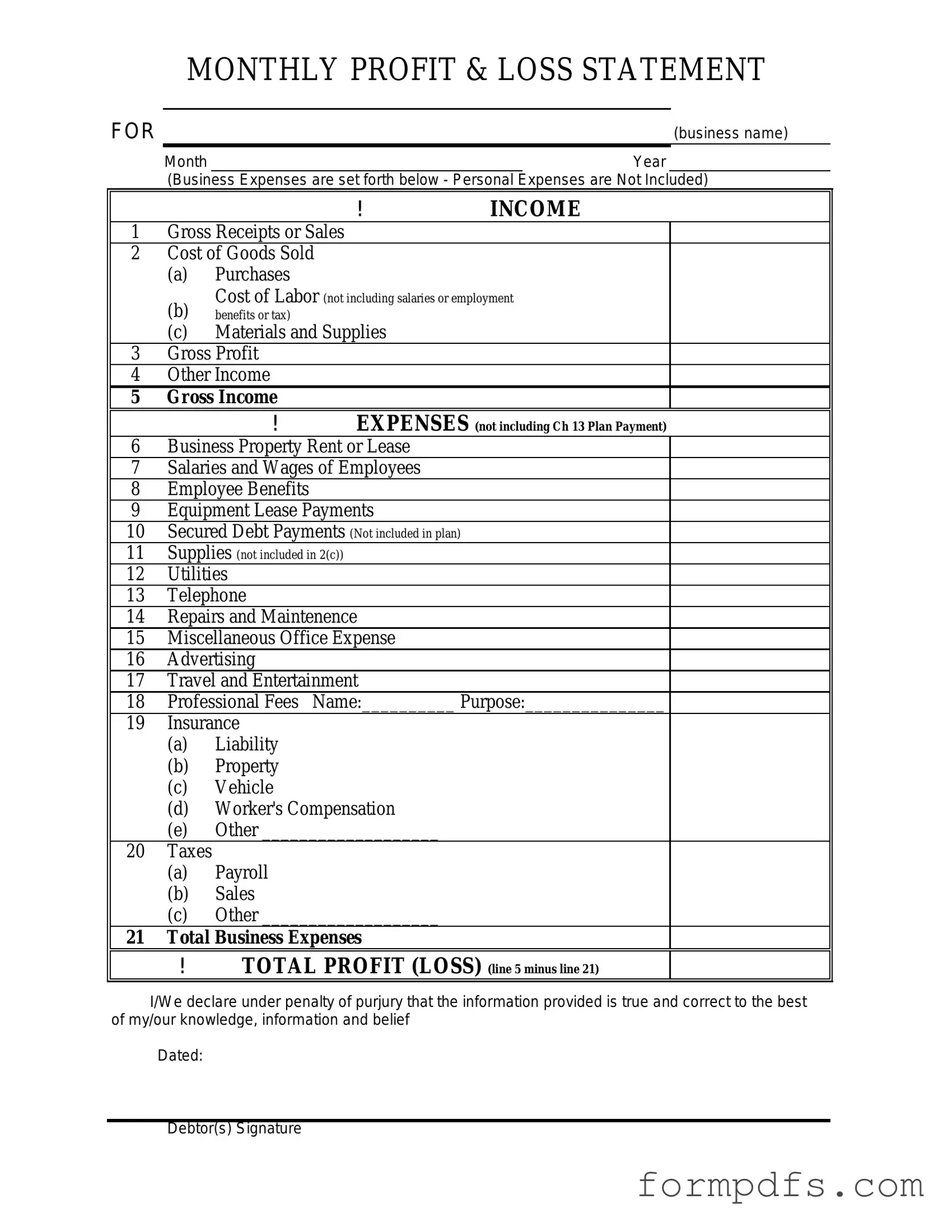

The Profit and Loss form, often referred to as an income statement, serves as a crucial financial document for businesses of all sizes. This form provides a detailed summary of revenues, costs, and expenses incurred during a specific period, typically a fiscal quarter or year. By outlining income generated from sales and subtracting the costs associated with producing goods or services, the Profit and Loss form helps in determining the overall profitability of a business. Key components of the form include total revenue, cost of goods sold, gross profit, operating expenses, and net income. Understanding these elements is essential for business owners and stakeholders, as they provide insights into financial health and operational efficiency. Additionally, the Profit and Loss form is often used for tax purposes, financial reporting, and strategic planning, making it a vital tool for effective business management.

More PDF Templates

Hiv Negative Report Sample - A section for invalid test results indicates additional steps may be needed in those cases.

For individuals looking to ensure that their transactions are legally recognized, the streamlined Alabama bill of sale form is invaluable. This document not only provides necessary proof of purchase but also includes essential details regarding the item exchanged. To get started, you can fill out the form by visiting this efficient Alabama bill of sale form option.

Sports Physical Form Printable - Medical professionals signing the form must be licensed M.D. or D.O.

Documents used along the form

The Profit and Loss form is a vital tool for understanding a business's financial health. However, several other documents complement it, providing a more comprehensive view of a company’s financial situation. Below are five essential forms and documents that often accompany the Profit and Loss statement.

- Balance Sheet: This document provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It helps stakeholders assess the financial stability and liquidity of the business, revealing what the company owns versus what it owes.

- Cash Flow Statement: The Cash Flow Statement tracks the flow of cash in and out of the business over a specific period. It highlights how well the company generates cash to meet its obligations, making it easier to understand the operational efficiency and cash management practices.

- Budget: A budget outlines a company’s financial plan for a future period, detailing expected revenues and expenses. It serves as a roadmap for financial decision-making and helps in setting performance benchmarks against which actual results can be measured.

- ADP Pay Stub: This document offers a detailed breakdown of employee earnings and deductions for a specific pay period, allowing for better financial transparency. Additionally, it can be beneficial to access templates from Free Business Forms to ensure proper documentation.

- Tax Returns: Tax returns are documents filed with the government that report income, expenses, and other relevant financial information. They provide insight into a company’s profitability and compliance with tax regulations, serving as a historical record of financial performance.

- Sales Reports: These reports detail sales activities over a specific period, including revenue generated, products sold, and customer acquisition. They help businesses analyze market trends and sales performance, which can influence future strategies and financial forecasts.

Incorporating these documents alongside the Profit and Loss form creates a fuller picture of a company's financial landscape. Together, they empower business owners and stakeholders to make informed decisions that drive growth and sustainability.

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Profit and Loss form summarizes a company's revenues and expenses over a specific period, showing the net profit or loss. |

| Purpose | This form helps businesses assess their financial performance and make informed decisions. |

| Components | It typically includes sections for revenue, cost of goods sold, gross profit, operating expenses, and net income. |

| Frequency | Businesses often prepare this form monthly, quarterly, or annually, depending on their reporting needs. |

| State-Specific Forms | Some states require specific formats or additional disclosures on the Profit and Loss form, governed by local business regulations. |

| Tax Implications | The information on this form is crucial for tax reporting, influencing how much tax a business may owe. |

| Analysis Tool | Investors and stakeholders often use the Profit and Loss form to evaluate a company's profitability and operational efficiency. |

More About Profit And Loss

What is a Profit and Loss form?

A Profit and Loss form, often referred to as a P&L statement, is a financial document that summarizes a company's revenues, costs, and expenses during a specific period. This form provides insights into the company’s ability to generate profit by comparing revenue against its costs. It is a crucial tool for assessing financial performance and making informed business decisions.

Why is the Profit and Loss form important?

The Profit and Loss form serves multiple purposes. It helps business owners understand their financial health by showing how much money is made and spent. Investors and stakeholders often review this document to evaluate the viability and profitability of a business. Additionally, it plays a vital role in tax preparation and compliance, as it provides necessary information for reporting income and expenses.

How often should a Profit and Loss form be prepared?

Typically, businesses prepare a Profit and Loss form on a monthly, quarterly, or annual basis. Monthly reports can provide timely insights into financial performance, allowing for quick adjustments. Quarterly and annual reports are often used for broader analysis and are essential for tax reporting and strategic planning.

What components are included in a Profit and Loss form?

A standard Profit and Loss form includes several key components: total revenue, cost of goods sold (COGS), gross profit, operating expenses, and net profit. Each component plays a role in determining the overall profitability of the business. Additional items, such as taxes and interest, may also be included to provide a comprehensive view of financial performance.

How do I calculate net profit from the Profit and Loss form?

To calculate net profit, start with total revenue and subtract the cost of goods sold to find the gross profit. From the gross profit, subtract operating expenses, taxes, and any other expenses. The resulting figure is the net profit, which indicates the actual profit earned by the business after all expenses have been accounted for.

Can the Profit and Loss form help in budgeting?

Yes, the Profit and Loss form is an invaluable tool for budgeting. By analyzing past performance, businesses can identify trends in revenue and expenses. This historical data can inform future budgetary decisions, helping to set realistic financial goals and allocate resources more effectively.

What is the difference between gross profit and net profit?

Gross profit is the revenue remaining after deducting the cost of goods sold. It reflects the efficiency of production and sales processes. In contrast, net profit is the amount left after all expenses, including operating expenses, taxes, and interest, have been subtracted from total revenue. Net profit provides a clearer picture of a company's overall profitability.

How can I improve my Profit and Loss results?

Improving Profit and Loss results can be achieved through various strategies. Increasing sales revenue, reducing costs, and optimizing operational efficiency are key areas to focus on. Additionally, reviewing pricing strategies, managing inventory more effectively, and controlling overhead expenses can contribute to better financial outcomes.

Is the Profit and Loss form the same as the income statement?

Yes, the Profit and Loss form is often synonymous with the income statement. Both documents serve the same purpose of detailing a company’s revenues and expenses over a specific period. However, terminology may vary depending on industry practices or regional preferences.

Where can I find a template for a Profit and Loss form?

Templates for Profit and Loss forms can be found through various online resources, including accounting software, financial websites, and business management platforms. Many of these templates are customizable, allowing businesses to tailor the form to their specific needs and ensure all relevant financial data is captured.

Profit And Loss: Usage Steps

Completing the Profit and Loss form is an essential step in assessing financial performance. Accurate information is crucial for understanding income and expenses over a specific period. The following steps will guide you through the process of filling out the form effectively.

- Gather all necessary financial documents, including income statements and expense receipts.

- Begin with the revenue section. Enter total income generated from sales or services provided during the specified period.

- Document any additional income sources, such as interest or investments, in the appropriate section.

- Proceed to the expenses section. List all operating expenses, including salaries, rent, utilities, and supplies.

- Include any non-operating expenses, such as interest paid on loans or losses from asset sales.

- Calculate the total expenses by summing all entries in the expenses section.

- Subtract total expenses from total income to determine the net profit or loss.

- Review all entries for accuracy and completeness before finalizing the form.

- Submit the completed form to the appropriate department or individual as required.