Valid Prenuptial Agreement Template

Prenuptial agreements, often referred to as prenups, serve as vital legal documents for couples contemplating marriage. These agreements outline how assets and debts will be managed in the event of a divorce or separation. A well-crafted prenuptial agreement can address numerous aspects, including property division, spousal support, and the handling of future income. Couples may also include provisions for debt responsibility, inheritance rights, and even stipulations regarding the care of children from previous relationships. The form typically requires full financial disclosure from both parties, ensuring transparency and fairness. While some may view prenups as unromantic, they can actually foster open communication and mutual understanding about financial expectations, ultimately contributing to a healthier marital relationship. Understanding the components and implications of a prenuptial agreement is essential for anyone considering marriage, as it lays the groundwork for financial clarity and security in a partnership.

More Forms:

Intent to Buy Letter - It serves to legitimize the buyer's interest in the business.

To ensure a smooth transaction, it is essential to utilize a comprehensive document like a New York Bill of Sale form. This form not only captures the critical details of the sale but also provides both parties with legal protection. For those looking for a convenient way to obtain this document, you can find a fillable version at smarttemplates.net/fillable-new-york-bill-of-sale/, helping to streamline the process further.

Identity Verification Form - The role of the notary is neutral and impartial in the process.

Prenuptial Agreement Forms for Specific US States

Documents used along the form

When preparing for marriage, many couples consider a prenuptial agreement to clarify financial expectations and protect individual assets. However, this document often works in conjunction with several other forms and documents that help establish a comprehensive understanding of the couple's financial and legal landscape. Below are some of these important documents.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after the marriage has taken place. It outlines how assets and debts will be handled in the event of divorce or separation, allowing couples to revisit their financial arrangements as their circumstances change.

- Commercial Lease Agreement: Essential for business tenants in California, this document lays out the terms and conditions for renting commercial property, ensuring that both landlord and tenant understand their rights and obligations. For more information, check out All California Forms.

- Financial Disclosure Statement: This form requires both parties to disclose their assets, liabilities, and income. Transparency is crucial in the creation of a prenuptial agreement, and this document helps ensure that both partners are fully informed about each other's financial situation.

- Separation Agreement: In the event of a separation, this document outlines the terms regarding the division of assets, child custody, and support obligations. It serves as a roadmap for couples who are deciding to live apart but may not yet be ready to pursue divorce.

- Will: A will is a legal document that specifies how a person's assets will be distributed upon their death. Having a will in place is essential for couples, especially those with children or significant assets, to ensure their wishes are honored.

- Trust Agreement: This document establishes a trust, which can manage assets for beneficiaries. Couples may choose to create a trust as part of their estate planning to provide for children or to manage wealth during their lifetime and beyond.

- Power of Attorney: This legal document allows one partner to make financial or medical decisions on behalf of the other in the event of incapacity. It is vital for ensuring that a spouse can act in the best interests of their partner when they are unable to do so themselves.

- Living Will: A living will outlines an individual's preferences for medical treatment in the event they become unable to communicate their wishes. This document is crucial for couples to discuss and agree upon, ensuring that both partners understand each other's desires regarding healthcare decisions.

Understanding these documents can help couples navigate the complexities of marriage with clarity and confidence. By addressing financial and legal matters upfront, partners can focus on building a strong and healthy relationship, knowing that they have taken steps to protect their interests and those of their loved ones.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a legal document created before marriage that outlines the division of assets and financial responsibilities in the event of divorce or separation. |

| Purpose | The primary purpose is to protect individual assets and clarify financial rights and obligations for both parties. |

| State-Specific Forms | Many states have their own specific requirements and forms for prenuptial agreements. Always check your state's laws. |

| Governing Laws | In California, for example, the governing law is the California Family Code, specifically Sections 1600-1617. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing, signed by both parties, and entered into voluntarily. |

| Full Disclosure | Both parties must fully disclose their financial situations, including assets and debts, for the agreement to be valid. |

| Modification | A prenuptial agreement can be modified or revoked after marriage, but both parties must agree to the changes in writing. |

| Legal Counsel | It is highly recommended that each party seeks independent legal counsel to ensure their interests are protected. |

| Common Misconceptions | Many people believe prenuptial agreements are only for the wealthy, but they can benefit anyone looking to clarify financial matters before marriage. |

More About Prenuptial Agreement

What is a prenuptial agreement?

A prenuptial agreement, often referred to as a "prenup," is a legal document that a couple signs before getting married. It outlines how assets and debts will be divided in the event of a divorce or separation. This agreement can also address issues such as spousal support and the management of financial responsibilities during the marriage. By having a prenup, couples can establish clear expectations and protect their individual interests.

Who should consider a prenuptial agreement?

While any couple can benefit from a prenuptial agreement, it is particularly advisable for those with significant assets, business ownership, or children from previous relationships. Additionally, individuals who expect to inherit wealth or have substantial debts may also find a prenup beneficial. It provides a way to safeguard personal finances and clarify financial roles within the marriage.

How does a prenuptial agreement work?

A prenuptial agreement typically takes effect upon marriage. The couple will discuss and negotiate the terms, which can include the division of property, debt responsibilities, and other financial matters. Once both parties agree, the prenup must be signed in the presence of a notary public. It’s crucial that both individuals fully disclose their financial situations to ensure the agreement is fair and enforceable.

Can a prenuptial agreement be modified after marriage?

Yes, a prenuptial agreement can be modified after marriage, but both parties must agree to the changes. It’s important to document any modifications in writing and have them signed by both spouses. This ensures that the updated terms are legally binding. Couples may choose to amend their prenup as their financial situations or life circumstances change.

Are prenuptial agreements enforceable in court?

Generally, prenuptial agreements are enforceable in court, provided they meet certain legal requirements. These include full disclosure of assets by both parties, voluntary agreement without coercion, and a fair and reasonable distribution of assets. However, courts may not enforce terms that are deemed unconscionable or that violate public policy. Consulting with a legal expert can help ensure that the agreement is valid and enforceable.

What happens if we don’t have a prenuptial agreement?

If a couple does not have a prenuptial agreement, the division of assets and debts will be determined by state laws in the event of a divorce. This can lead to uncertainty and potential disputes, as state laws may not align with the couple’s personal wishes. Without a prenup, each spouse may not have control over how their assets are handled, which can complicate the divorce process.

Prenuptial Agreement: Usage Steps

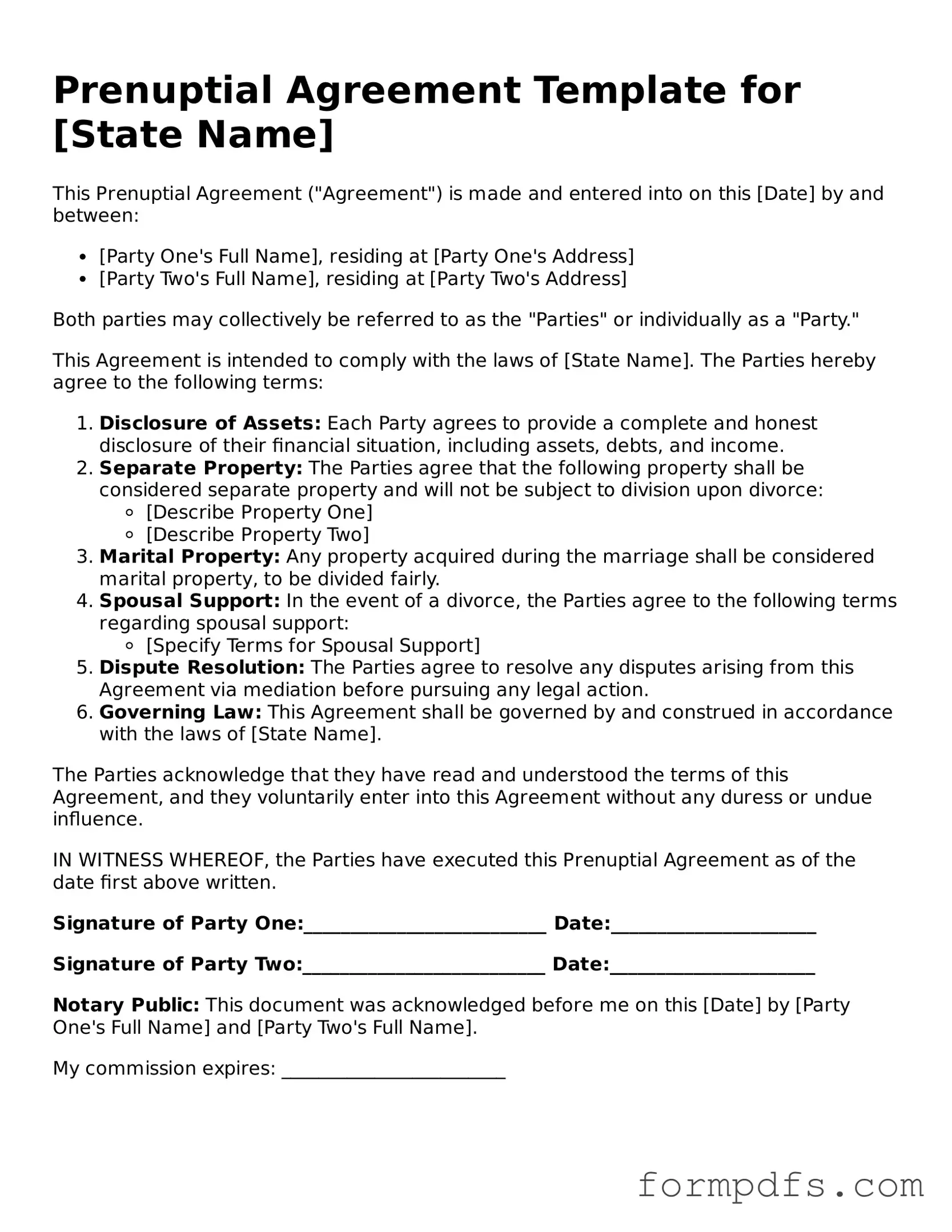

Completing the Prenuptial Agreement form requires careful attention to detail. Follow these steps to ensure that all necessary information is accurately provided.

- Start by entering the full names of both parties at the top of the form.

- Provide the current addresses for both individuals.

- Specify the date of the marriage in the designated section.

- List all assets owned by each party before the marriage, including property, bank accounts, and investments.

- Detail any debts that each party has incurred prior to the marriage.

- Include a section for future earnings and any potential inheritances.

- Discuss and outline how assets will be divided in the event of a divorce.

- Review the terms together to ensure mutual understanding and agreement.

- Sign and date the form in the presence of a notary public.