Valid Power of Attorney Template

The Power of Attorney form serves as a crucial legal document that empowers individuals to designate another person to act on their behalf in various matters, ranging from financial decisions to healthcare choices. This form is particularly significant for those who may face incapacity due to illness or injury, ensuring that their wishes are respected even when they are unable to communicate them. By appointing an agent, the principal can maintain control over their affairs while providing clear guidance on how they wish those matters to be handled. The form typically includes essential elements such as the designation of the agent, the specific powers granted, and any limitations or conditions the principal wishes to impose. Additionally, it may outline when the powers become effective, whether immediately or upon a certain event, such as the principal's incapacitation. Understanding the nuances of the Power of Attorney form is vital for anyone considering this important step in planning for their future and safeguarding their interests.

More Forms:

Guardianship Paperwork - This form is essential for ensuring the child's well-being during legal proceedings.

To ensure a smooth transaction, it's important to have a properly filled out form when selling personal property. Our user-friendly platform offers a convenient California bill of sale template for your needs. Download the document and officially record your sale by following this link: California bill of sale guidelines.

Parking Space Rental Agreement Template - Terms regarding parking hours, if applicable, are explained here.

Letter of Recommendation for Nursing - The writer discusses the candidate's effectiveness in emergency response situations.

Power of Attorney Forms for Specific US States

Documents used along the form

A Power of Attorney (POA) is a powerful document that allows one person to act on behalf of another in legal matters. However, there are several other forms and documents that are commonly used alongside a POA to ensure comprehensive management of personal and financial affairs. Below is a list of these documents, each serving a unique purpose.

- Advance Healthcare Directive: This document outlines a person's preferences regarding medical treatment and end-of-life care. It ensures that healthcare decisions align with the individual's wishes when they are unable to communicate them themselves.

- Living Will: A living will is a specific type of advance directive that details what types of medical treatments and life-sustaining measures a person does or does not want in case they become incapacitated.

- ADP Pay Stub Form: To gain clarity on your earnings and deductions, refer to the comprehensive ADP Pay Stub document which outlines essential information for each pay period.

- Durable Power of Attorney for Healthcare: Similar to a standard POA, this document specifically grants authority to a designated person to make healthcare decisions on behalf of another individual if they become unable to do so themselves.

- Financial Power of Attorney: This form allows someone to manage another person's financial affairs, including handling bank transactions, paying bills, and managing investments, particularly when the individual is unable to do so.

Understanding these documents is crucial for anyone considering a Power of Attorney. Each one plays a vital role in ensuring that an individual's wishes are respected and upheld in various aspects of life, from healthcare decisions to financial management.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Types of POA | There are several types of Power of Attorney, including General, Durable, and Medical, each serving different purposes. |

| State-Specific Forms | Each state has its own requirements for Power of Attorney forms, governed by state laws such as the Uniform Power of Attorney Act. |

| Revocation | A Power of Attorney can be revoked by the principal at any time, provided they are mentally competent to do so. |

| Agent's Authority | The agent's authority can be limited or broad, depending on the specifications outlined in the Power of Attorney document. |

More About Power of Attorney

What is a Power of Attorney?

A Power of Attorney (POA) is a legal document that allows one person, known as the principal, to appoint another person, known as the agent or attorney-in-fact, to act on their behalf. This can include making financial decisions, managing property, or handling legal matters. The authority granted can be broad or limited, depending on the principal's wishes.

Why would I need a Power of Attorney?

A Power of Attorney is useful in various situations. For instance, if you become incapacitated due to illness or injury, your agent can make decisions for you. Additionally, it can help when you are traveling or unable to handle your affairs. Having a POA in place ensures that someone you trust can manage your responsibilities without delays.

What types of Power of Attorney are there?

There are several types of Power of Attorney, including General, Limited, Durable, and Medical. A General POA grants broad powers, while a Limited POA restricts authority to specific tasks. A Durable POA remains effective even if the principal becomes incapacitated, and a Medical POA allows someone to make healthcare decisions on your behalf.

How do I choose an agent for my Power of Attorney?

Choosing an agent is a critical decision. Consider someone who is trustworthy, responsible, and capable of handling your affairs. This person should be someone you feel comfortable discussing your wishes with. It is also wise to have a conversation with them beforehand to ensure they are willing to take on this responsibility.

Can I revoke a Power of Attorney?

Yes, you can revoke a Power of Attorney at any time, as long as you are mentally competent. To do so, you must create a written revocation document and notify your agent and any institutions or individuals that may have relied on the original POA. This ensures that your wishes are clear and legally recognized.

Do I need a lawyer to create a Power of Attorney?

While it is not strictly necessary to hire a lawyer to create a Power of Attorney, consulting one can provide valuable guidance. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your intentions. If your situation is complex, legal advice may be particularly beneficial.

Is a Power of Attorney valid in all states?

Generally, a Power of Attorney is valid across states, but the specific laws governing POAs can vary. It is essential to ensure that your document complies with the laws of the state where it will be used. If you move to a different state, you may need to update or create a new POA to align with local regulations.

What happens if I do not have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, a court may need to appoint a guardian or conservator to manage your affairs. This process can be lengthy and costly, and it may not result in the person you would have chosen. Having a POA in place helps avoid this situation and ensures your preferences are honored.

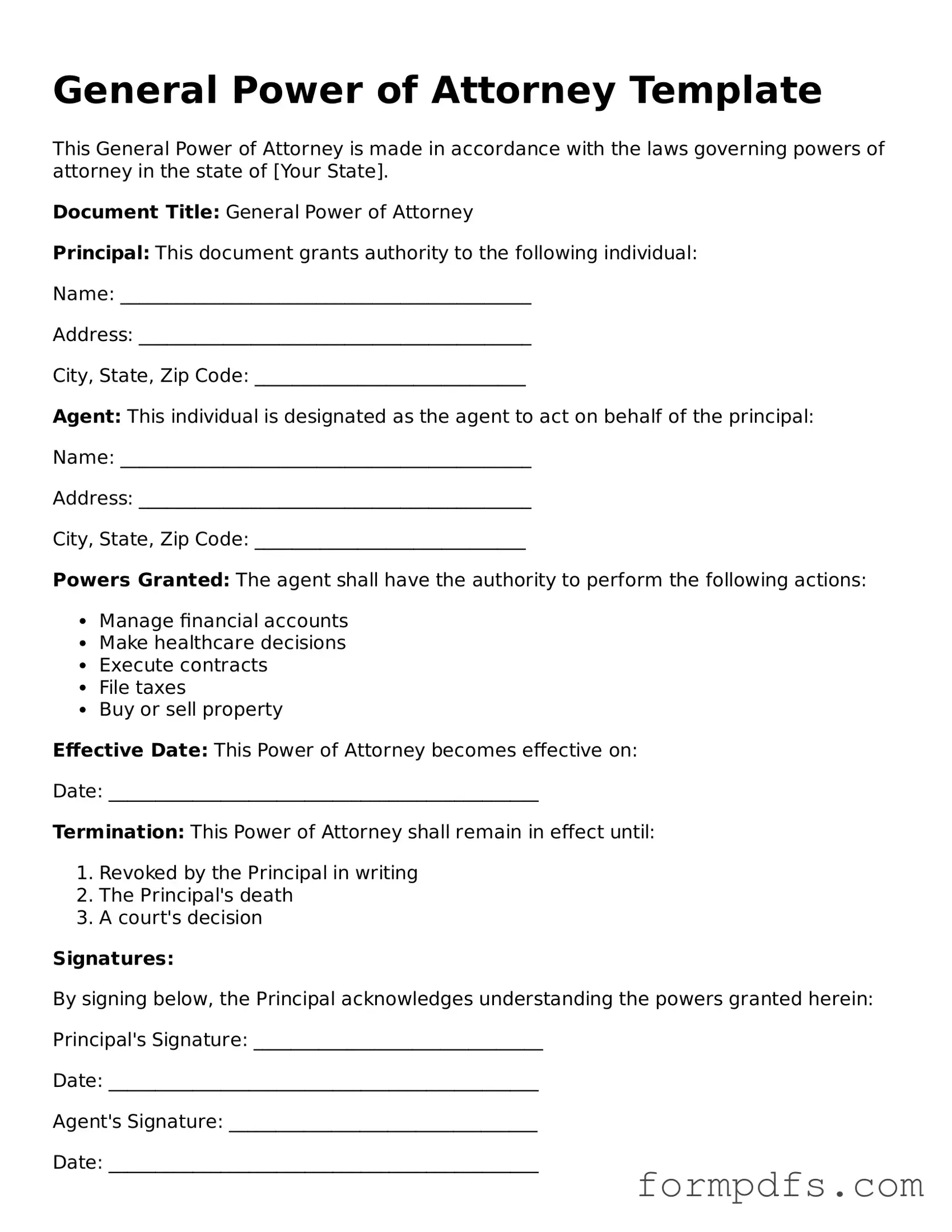

Power of Attorney: Usage Steps

Filling out a Power of Attorney form is an important task that allows you to designate someone to act on your behalf in legal and financial matters. This process requires careful attention to detail to ensure that the document is completed accurately. Follow the steps below to fill out the form correctly.

- Begin by gathering necessary information. You will need the full names, addresses, and contact details of both the principal (the person granting authority) and the agent (the person receiving authority).

- Clearly state the powers you wish to grant. This may include financial decisions, healthcare decisions, or specific tasks.

- Indicate the duration of the Power of Attorney. Decide if it will be effective immediately, upon a certain event, or for a specific period.

- Review any state-specific requirements. Some states may have additional provisions or language that must be included.

- Sign the document in the presence of a notary public, if required by your state. This step adds an extra layer of validity to the form.

- Provide copies of the signed form to your agent and any relevant institutions or individuals, such as banks or healthcare providers.

Once you have completed the form, make sure to store it in a safe place. Inform your agent and trusted family members about its location. Keeping everyone informed helps ensure that your wishes are respected when the time comes to use the Power of Attorney.