Valid Personal Guarantee Template

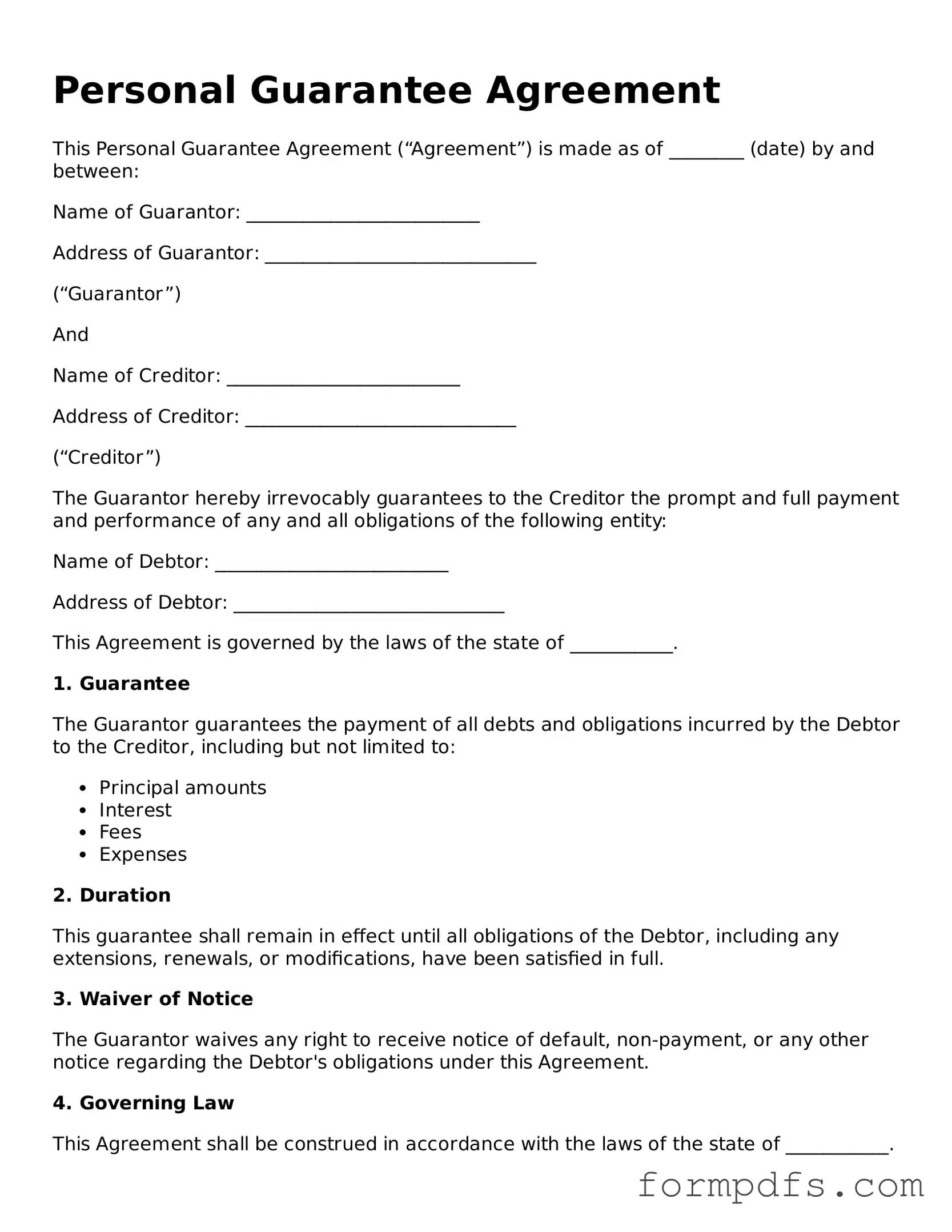

When entering into a business agreement, understanding the Personal Guarantee form is crucial for both lenders and borrowers. This document serves as a commitment from an individual to be personally responsible for the debts or obligations of a business. It provides an extra layer of security for lenders, ensuring that if the business fails to meet its financial responsibilities, the personal assets of the guarantor can be pursued. The form typically includes essential details such as the name of the guarantor, the nature of the obligation being guaranteed, and the specific terms of the guarantee. Additionally, it may outline any limitations or conditions under which the guarantee is valid. By signing this form, individuals acknowledge their willingness to back the business financially, making it an important consideration for entrepreneurs seeking loans or credit. Understanding the implications of this agreement can help protect personal finances while facilitating business growth.

Other Personal Guarantee Templates:

Proprietor Financing Agreement - Can include clauses for escrow services to assist in fund management.

When entering into a real estate transaction in Minnesota, it is essential to utilize the proper documentation to avoid misunderstandings and ensure legal protection. The Minnesota Real Estate Purchase Agreement is vital for both buyers and sellers, outlining the specific terms and conditions associated with the sale. For further assistance, you can access All Minnesota Forms, which provide additional resources and templates to aid you in this process.

Documents used along the form

When entering into agreements that require a Personal Guarantee, several other forms and documents may be necessary to support the overall transaction. Each of these documents serves a specific purpose, ensuring clarity and protection for all parties involved. Below is a list of commonly used forms that accompany a Personal Guarantee.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as the primary contract between the lender and borrower.

- Credit Application: A credit application is completed by the borrower to provide the lender with essential information about their financial status, credit history, and business operations. This helps the lender assess the risk of extending credit.

- Financial Statements: These documents include balance sheets, income statements, and cash flow statements. They provide a snapshot of the borrower's financial health, which is crucial for lenders in making informed decisions.

- Personal Financial Statement: Often required from guarantors, this statement details an individual's assets, liabilities, income, and expenses. It helps lenders evaluate the guarantor's financial capability to back the loan.

- Business Plan: A business plan outlines the borrower's strategy for achieving their business goals. It typically includes market analysis, operational plans, and financial projections, giving lenders insight into the viability of the business.

- Security Agreement: This document specifies any collateral pledged by the borrower to secure the loan. It outlines the lender's rights to the collateral in case of default, providing additional assurance for the loan.

- Real Estate Purchase Agreement: A crucial document for formalizing property sales in Kentucky, which details transaction specifics such as price and closing terms; for a template, visit kentuckyform.com/real-estate-purchase-agreement-template/.

- UCC Financing Statement: Filed with the state, this document gives public notice of the lender's interest in the borrower's collateral. It protects the lender's rights and establishes priority over other creditors.

- Default Notice: This document is issued by the lender if the borrower fails to meet the terms of the agreement. It outlines the nature of the default and the actions that may be taken, including potential legal proceedings.

- Release of Guarantee: Once the obligations under the loan are fulfilled, this document formally releases the guarantor from their responsibilities. It is essential for ensuring that the guarantor is no longer liable after the loan is repaid.

Understanding these accompanying documents is crucial for anyone involved in a transaction that requires a Personal Guarantee. Each form plays a vital role in protecting the interests of both the lender and the borrower, fostering a transparent and secure lending environment.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Personal Guarantee form is a document where an individual agrees to be personally responsible for a debt or obligation of a business. |

| Purpose | This form is often used by lenders to mitigate risk when extending credit to a business. |

| Signatories | Typically, the form must be signed by an owner or a principal of the business seeking credit. |

| Legal Binding | Once signed, the individual becomes legally bound to fulfill the obligations if the business defaults. |

| State-Specific Forms | Some states have specific requirements for Personal Guarantee forms. For example, in California, it must comply with the California Civil Code. |

| Limitations | The guarantee can be limited to a specific amount or duration, depending on the agreement between the parties. |

| Revocation | A Personal Guarantee can be revoked, but only under certain conditions and typically requires written notice to the creditor. |

More About Personal Guarantee

What is a Personal Guarantee form?

A Personal Guarantee form is a document that an individual signs to agree to be personally responsible for a debt or obligation of a business. This means that if the business fails to meet its financial obligations, the individual who signed the guarantee can be held liable for the debt. It is often required by lenders or suppliers when extending credit to a business.

Who typically needs to sign a Personal Guarantee?

Business owners, partners, or key stakeholders usually sign a Personal Guarantee. Lenders want assurance that someone with personal assets is backing the business's obligations. This is common for small businesses or startups that may not have a strong credit history.

What are the risks of signing a Personal Guarantee?

By signing a Personal Guarantee, you risk losing personal assets if the business defaults on its obligations. This could include your home, savings, or other personal property. It is essential to fully understand the financial situation of the business before agreeing to this type of guarantee.

Can I limit my liability in a Personal Guarantee?

Yes, it is possible to limit your liability in a Personal Guarantee. You can negotiate terms that specify a cap on your financial responsibility. This means that you would only be liable for a certain amount rather than the full debt. Discussing these terms with a legal advisor is advisable before signing.

What happens if the business fails?

If the business fails and cannot pay its debts, creditors can pursue you for the amount owed under the Personal Guarantee. This can lead to legal action against you, and your personal assets may be at risk. It’s important to be aware of this potential outcome before signing.

Can I revoke a Personal Guarantee after signing?

Revoking a Personal Guarantee is not straightforward. Generally, once you sign the document, it remains in effect until the debt is paid off or until the creditor agrees to release you from the guarantee. It is crucial to review the terms and conditions carefully and consult with a legal professional if you wish to explore revocation options.

Is a Personal Guarantee legally binding?

Yes, a Personal Guarantee is legally binding. Once signed, it creates a legal obligation for the guarantor. If the business defaults, creditors can enforce the guarantee in court. Always read the document thoroughly and consider seeking legal advice before signing to ensure you understand your obligations.

Personal Guarantee: Usage Steps

Completing the Personal Guarantee form is a straightforward process. Once you have the form in hand, you will need to provide specific information about yourself and the agreement you are entering into. Carefully follow these steps to ensure everything is filled out correctly.

- Read the form thoroughly. Familiarize yourself with each section before you start filling it out.

- Provide your personal information. Fill in your full name, address, phone number, and email address in the designated fields.

- Enter the date. Write the date on which you are completing the form.

- Detail the agreement. Clearly describe the nature of the agreement for which you are providing the guarantee.

- Sign the form. At the bottom, sign your name in the space provided. Make sure your signature matches the name you entered earlier.

- Print your name. Below your signature, print your name to ensure clarity.

- Review your entries. Double-check all the information for accuracy and completeness.

- Submit the form. Follow the instructions for how to submit the completed form, whether electronically or by mail.