Blank Payroll Check PDF Form

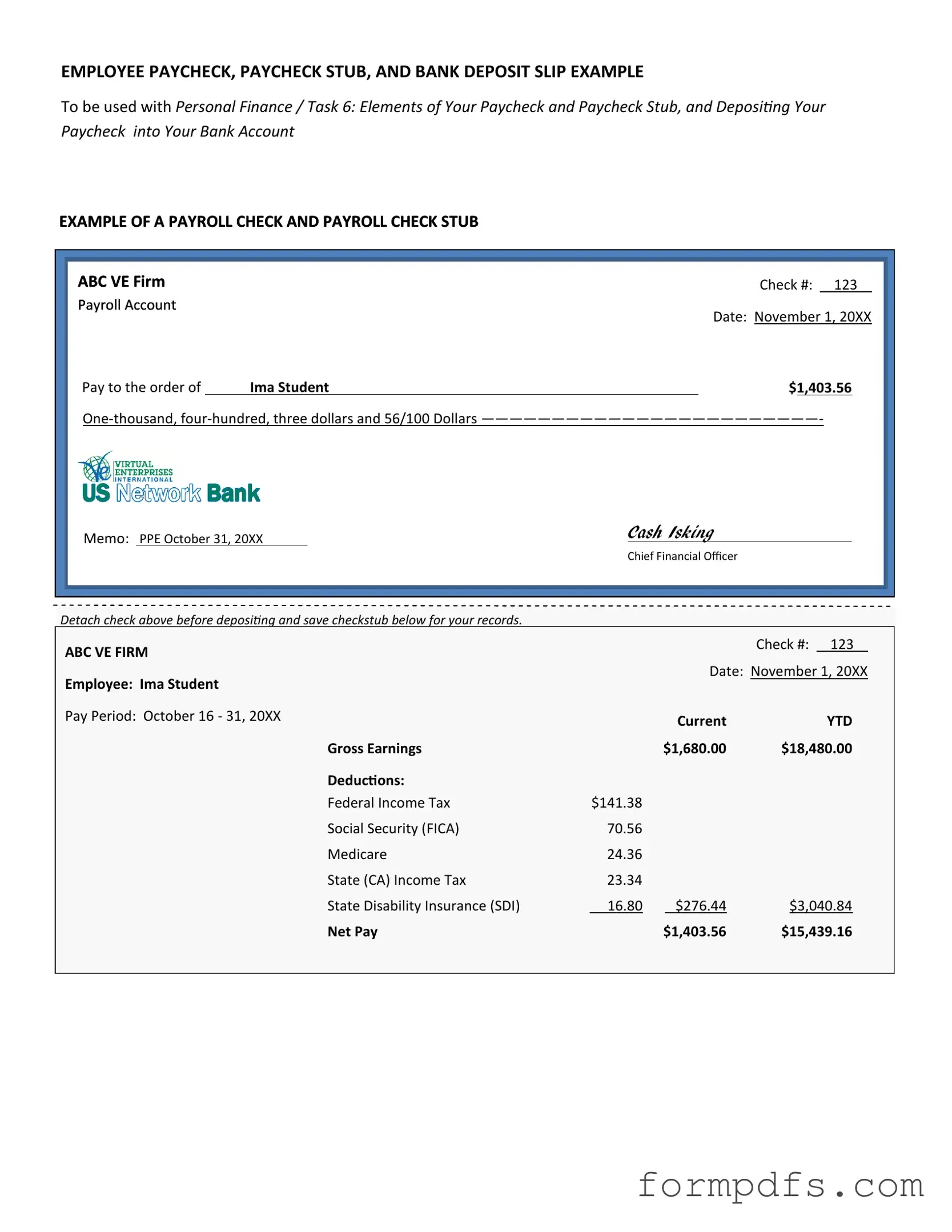

The Payroll Check form serves as a crucial document in the payroll process, ensuring that employees receive their compensation accurately and on time. This form typically includes essential information such as the employee's name, identification number, and pay period dates. Additionally, it outlines the gross pay, deductions, and net pay, providing a clear breakdown of how the final amount is calculated. Employers often use this form to maintain compliance with tax regulations and labor laws, making it an important tool for both financial management and employee transparency. By detailing each component of an employee's earnings, the Payroll Check form not only facilitates payment but also fosters trust between the employer and employee, reinforcing the importance of clear communication in workplace relationships.

More PDF Templates

Roof Inspection Reports - Records of past inspections emphasize the roof's condition trends over time.

Before submitting your paperwork, it is vital to ensure that you have all the necessary forms and requirements. One important resource for this is All California Forms, which provides comprehensive guidance on the California LLC-1 form and other essential documents needed to successfully establish your LLC in the state.

Trucking Companies With Lease Purchase - The terms ensure clarity in compensation and payment schedules between the parties.

Documents used along the form

When managing payroll, several forms and documents work alongside the Payroll Check form to ensure accurate and compliant processing. Each of these documents serves a specific purpose, contributing to the overall efficiency of payroll management. Below is a list of commonly used forms that you may encounter.

- W-4 Form: Employees fill out this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from each paycheck.

- Time Sheet: This document records the hours worked by an employee during a specific pay period. It can be used to calculate wages based on hourly rates.

- Pay Stub: A pay stub accompanies the Payroll Check and provides a detailed breakdown of an employee’s earnings, deductions, and net pay for the pay period.

- I-9 Form: Required for verifying an employee's identity and eligibility to work in the United States, this form must be completed by all new hires.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their pay directly into their bank account, offering a convenient alternative to physical checks.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes. Employees must complete it to ensure the correct amount of state income tax is withheld from their paychecks.

- Dirt Bike Bill of Sale: A smarttemplates.net/fillable-new-york-dirt-bike-bill-of-sale is essential for New York State transactions, providing proof of purchase and ownership transfer for dirt bikes.

- Employee Handbook Acknowledgment: This document confirms that an employee has received and understood the company’s policies and procedures as outlined in the employee handbook.

Each of these forms plays a crucial role in the payroll process, helping both employers and employees navigate their financial responsibilities effectively. Keeping them organized and up-to-date is essential for smooth payroll operations.

Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Payroll Check form is used by employers to pay employees for their work, detailing the amount earned and deductions made. |

| Components | This form typically includes the employee's name, pay period, gross pay, deductions, and net pay. |

| Governing Laws | In the United States, payroll checks must comply with federal laws like the Fair Labor Standards Act (FLSA) and state-specific regulations. |

| Record Keeping | Employers are required to keep payroll records for a minimum of three years to comply with tax and labor laws. |

More About Payroll Check

What is a Payroll Check form?

A Payroll Check form is a document used by employers to issue payments to employees for their work. It includes details such as the employee's name, payment amount, and the pay period. This form serves as an official record of payment and ensures that employees receive their wages accurately and on time.

Who needs to fill out the Payroll Check form?

The Payroll Check form must be filled out by the employer or the payroll department. It is essential for documenting employee payments and maintaining accurate financial records. Employees do not fill out this form; instead, they receive it once the employer processes payroll.

What information is required on the Payroll Check form?

The form typically requires the employee's name, address, Social Security number, the amount being paid, the pay period dates, and the employer's information. It may also include deductions for taxes and other withholdings. Accurate information is crucial to avoid errors in payment.

How often should Payroll Check forms be issued?

Payroll Check forms should be issued according to the employer's payroll schedule. This could be weekly, bi-weekly, or monthly. Consistency in issuing these checks helps employees manage their finances effectively and ensures compliance with labor laws.

What should I do if I notice an error on my Payroll Check form?

If you notice an error on your Payroll Check form, contact your employer or the payroll department immediately. Provide them with the details of the error, such as incorrect amounts or missing information. Prompt reporting helps resolve issues quickly and ensures you receive the correct payment.

Can Payroll Check forms be issued electronically?

Yes, Payroll Check forms can be issued electronically. Many employers now use direct deposit, which allows funds to be transferred directly to employees' bank accounts. However, if an employee prefers a physical check, employers should still provide that option.

How should Payroll Check forms be stored?

Payroll Check forms should be stored securely to protect sensitive employee information. Employers must keep these records for a specific period, often several years, to comply with tax laws and regulations. Digital storage solutions with encryption can provide added security.

Payroll Check: Usage Steps

Filling out the Payroll Check form is an important step in ensuring that employees receive their compensation accurately and on time. By following the steps below, you can complete the form efficiently and avoid any potential errors that could delay payment.

- Begin by entering the date at the top of the form. This should be the date the check is being issued.

- Next, fill in the employee's name in the designated space. Ensure the name matches the records on file.

- In the address section, write the employee's current address. This is important for record-keeping and tax purposes.

- Specify the amount being paid. Write this amount in both numerical and written form to prevent any discrepancies.

- Indicate the pay period for which the payment is being made. This helps in tracking payments over time.

- Sign the form in the signature area. This validates the check and confirms that the payment is authorized.

- Finally, make a copy of the completed form for your records. This ensures you have documentation in case of any future inquiries.