Blank P 45 It PDF Form

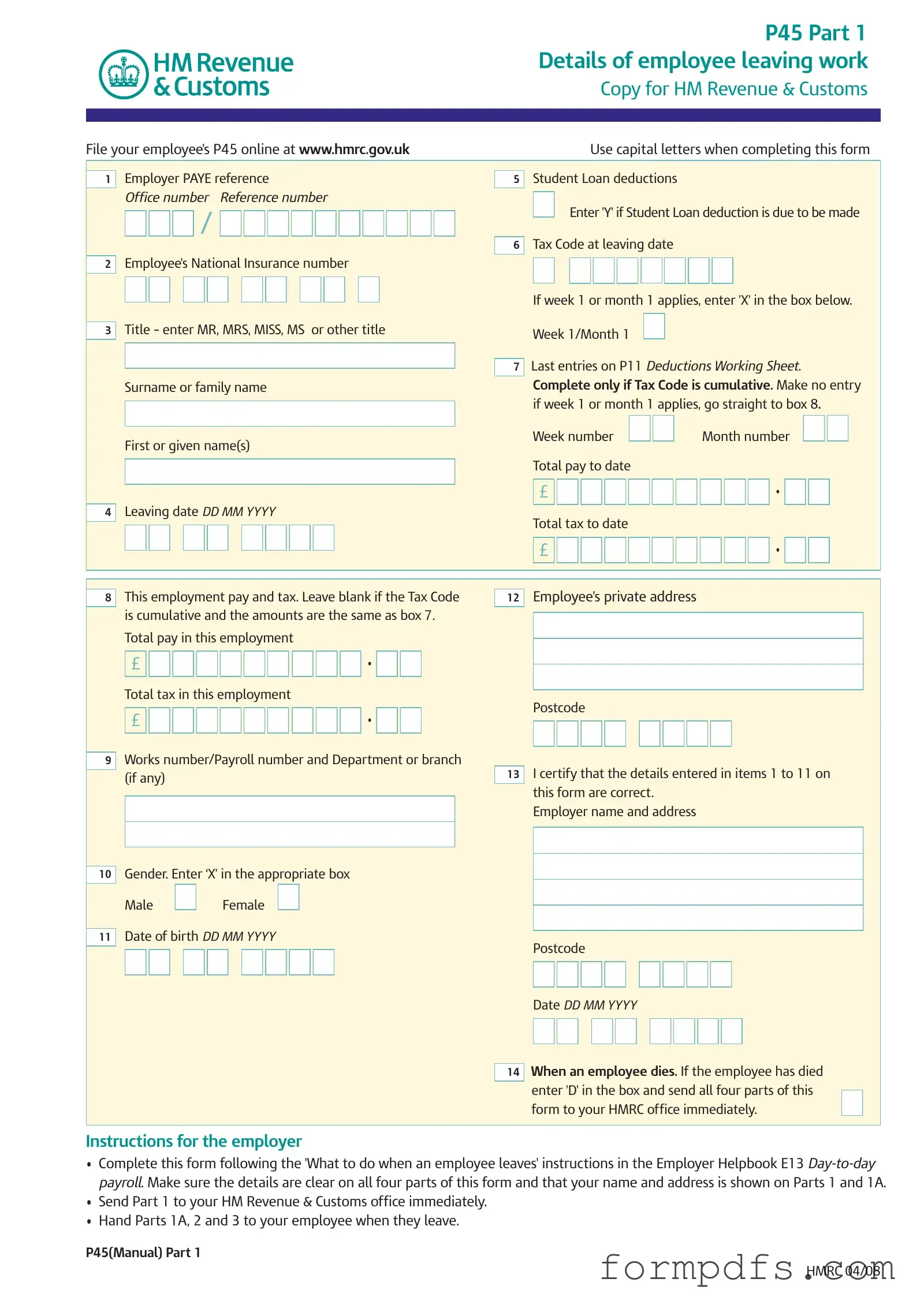

The P45 form is a crucial document in the employment landscape of the United Kingdom, serving as an official record when an employee leaves a job. This form is divided into three parts, each designed for different stakeholders: the employer, the employee, and the new employer. The first part is submitted to HM Revenue & Customs (HMRC) and contains essential information such as the employee's National Insurance number, tax code, and total pay and tax deducted during their employment. This data is vital for ensuring accurate tax calculations and for the smooth transition of tax responsibilities when an employee starts a new job. The second part, retained by the employee, serves as a reference for future tax returns and may be necessary when claiming benefits or allowances. Lastly, the third part is given to the new employer to help them set up the employee's tax code correctly and avoid any potential over-taxation. Understanding the P45 form is essential for both employees and employers, as it not only facilitates the proper management of tax obligations but also supports employees in navigating their financial responsibilities during employment transitions.

More PDF Templates

Form 14653 - Both married filing jointly spouses must understand their individual obligations under the form.

Physical Exam Form for Healthcare Workers - Include your address to ensure proper communication regarding your health care.

For those interested in joining the Trader Joe's team, completing the Trader Joe's application form is essential, and for additional guidance on the application process, you can visit OnlineLawDocs.com to find valuable resources and tips that will enhance your chances of success.

Affidavit of Custody - Completing this affidavit reflects a decision to prioritize the child's welfare above the parent's rights.

Documents used along the form

The P45 form is an essential document that employees receive when they leave a job. It provides important information about their earnings and tax deductions, which is useful for both the employee and their new employer. Alongside the P45, there are several other forms and documents that may be relevant during the transition between jobs. Below is a list of these documents, along with brief descriptions of each.

- P46: This form is used by new employers when an employee does not have a P45. It helps the employer determine the correct tax code for the employee based on the information provided.

- P60: A P60 is an annual summary of an employee's pay and tax deductions for the tax year. It is issued by the employer and is essential for tax returns and verifying income.

- P50: This form allows individuals to claim a tax refund when they stop working. It is particularly useful for those who have paid too much tax during their employment.

- P85: The P85 form is for individuals leaving the UK to live or work abroad. It helps in claiming a tax refund and provides information to HMRC about the individual's new circumstances.

- P11D: This document is used to report benefits and expenses provided to employees. Employers must complete this form for employees who receive non-cash benefits, which may affect their tax liability.

- Last Will and Testament: This form is essential for ensuring your assets are distributed according to your wishes after death. For more information, you can visit https://smarttemplates.net/fillable-last-will-and-testament.

- Jobseeker’s Allowance (JSA) claim form: When transitioning between jobs, individuals may apply for JSA. This form is necessary for those seeking financial support while looking for new employment.

- Employment Support Allowance (ESA) claim form: Similar to JSA, the ESA claim form is used by individuals who are unable to work due to illness or disability, providing them with financial assistance.

- Self-Assessment Tax Return: Individuals who are self-employed or have other income sources may need to complete this annual tax return to report their earnings and pay any taxes owed.

Understanding these documents can help individuals navigate the complexities of employment changes more smoothly. Each form serves a specific purpose and can significantly impact an individual's tax situation and eligibility for benefits. Keeping these documents organized and readily accessible can ease the transition into new employment or other financial circumstances.

Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose of P45 | The P45 form serves as a record of an employee's tax details when they leave a job, including their total pay and tax paid up to their leaving date. |

| Parts of P45 | The P45 consists of three parts: Part 1 is for HM Revenue & Customs, Part 1A is for the employee, and Parts 2 and 3 are for the new employer. |

| Employee Information | Essential details such as the employee's name, National Insurance number, and leaving date must be filled out accurately on the form. |

| Tax Code Importance | The tax code indicates how much tax should be deducted from an employee's pay. It is crucial for the employer to record this correctly. |

| Student Loan Deductions | Employers must indicate if student loan deductions are applicable when completing the P45, ensuring compliance with regulations. |

| Filing Requirements | Employers are required to send Part 1 of the P45 to HMRC immediately after an employee leaves, while Parts 1A, 2, and 3 should be given to the employee. |

| Emergency Tax Codes | If the new employer does not receive Parts 2 and 3 of the P45, they may need to apply an emergency tax code, potentially resulting in over-taxation. |

| Keeping Records | Employees should keep Part 1A safe, as it contains important information for future tax returns or claims for tax refunds. |

| Changes in Circumstances | Tax credits may change if an employee leaves a job. It is important to report any changes in income to the relevant authorities. |

| Legal Compliance | Completing the P45 accurately is essential for compliance with UK tax laws, ensuring that both employers and employees fulfill their tax obligations. |

More About P 45 It

What is the P45 form?

The P45 form is a document that an employer provides to an employee when they leave a job. It contains important information about the employee's tax and pay details. The form has several parts, with one part for the employer, one for the employee, and one for the new employer. This form helps ensure that the employee's tax records are accurate and that they do not pay too much tax when starting a new job.

Why do I need a P45?

A P45 is essential for several reasons. First, it helps you keep track of your earnings and taxes paid during your employment. Second, when you start a new job, your new employer will need this form to calculate your tax correctly. Without it, you may be placed on an emergency tax code, which could lead to overpaying taxes. Lastly, if you need to claim benefits or tax refunds, the P45 will serve as proof of your previous employment and earnings.

What information is included in a P45?

The P45 includes several key details such as your name, National Insurance number, tax code, total pay to date, and total tax deducted during your employment. It also lists your leaving date and the employer's details. This information is crucial for both you and your new employer to ensure that tax calculations are accurate moving forward.

What should I do with my P45 once I receive it?

Once you receive your P45, it's important to keep it in a safe place, as copies are not available. You should provide Parts 2 and 3 to your new employer when you start a new job. If you are not starting a new job immediately, you may need to take Part 1A to your local Jobcentre Plus office if you plan to claim Jobseeker's Allowance or Employment and Support Allowance.

What happens if I lose my P45?

If you lose your P45, you should contact your former employer to request a replacement. They are obligated to provide you with the necessary information to complete your tax records. If you cannot obtain a replacement, you may need to fill out a "starter checklist" with your new employer, who can help you with the correct tax code until your tax situation is clarified.

Can I receive a P45 if I leave my job due to death?

In the unfortunate event of an employee's death, a P45 can still be issued. The employer must complete the form and indicate the employee's death by marking 'D' in the appropriate box. This form should then be sent to HM Revenue & Customs immediately, along with all four parts of the P45.

What if my tax code is week 1 or month 1?

If your tax code is week 1 or month 1, you will need to indicate this on your P45 by marking an 'X' in the relevant box. This means that your tax calculations are based on your earnings for that specific week or month rather than cumulatively. It is important to ensure that this is correctly noted, as it can affect how much tax you pay in your new job.

P 45 It: Usage Steps

Completing the P45 It form is essential for both employers and employees when an employee leaves a job. This form helps ensure that tax information is accurately recorded and transferred. The following steps outline the process for filling out the P45 It form correctly.

- Begin with Part 1 of the form. Enter the Employer PAYE reference in the designated box.

- Fill in the Office number and Reference number.

- Provide the Employee's National Insurance number.

- Indicate the Title (MR, MRS, MISS, MS, or other) of the employee.

- Record the Surname or family name of the employee.

- Input the First or given name(s).

- Enter the Leaving date in the format DD MM YYYY.

- Complete the Total pay to date and Total tax to date fields.

- Fill in the Employee’s private address and Postcode.

- Specify the Works number/Payroll number and Department or branch if applicable.

- Indicate the Tax Code at leaving date and mark 'Y' if Student Loan deductions apply.

- If applicable, check the Week 1/Month 1 box and enter 'X' if it applies.

- Confirm the Gender by marking 'X' in the appropriate box.

- Provide the Date of birth in the format DD MM YYYY.

- Sign and date the certification statement confirming that all details are correct.

After completing Part 1, send it to HM Revenue & Customs immediately. Hand Parts 1A, 2, and 3 to the employee upon their departure. Ensure that all information is clear and accurate across all parts of the form.