Valid Owner Financing Contract Template

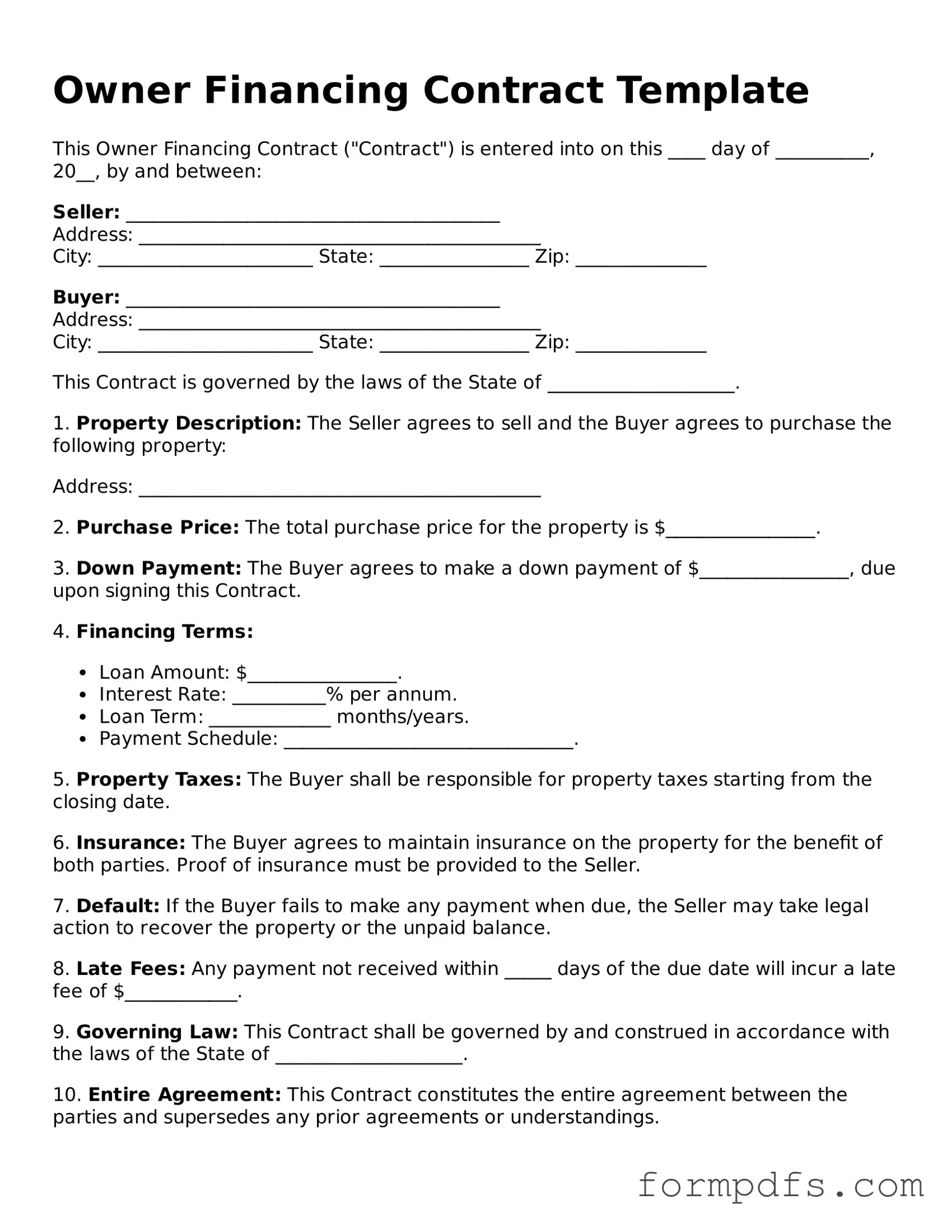

When navigating the world of real estate transactions, the Owner Financing Contract form stands out as a powerful tool for both buyers and sellers. This form facilitates a unique arrangement where the seller provides financing directly to the buyer, allowing for a more flexible approach to property acquisition. Key aspects of this contract include the purchase price, down payment, interest rate, repayment schedule, and any specific terms related to the sale. By outlining the responsibilities and rights of both parties, the contract helps to clarify expectations and reduce potential disputes. Additionally, it often includes provisions for default, ensuring that both the seller and buyer are protected throughout the duration of the agreement. Understanding these elements is crucial for anyone considering owner financing, as it can lead to more accessible home ownership options and a smoother transaction process.

Other Owner Financing Contract Templates:

Buyer's Agent Termination Letter Sample - This termination document ensures that both buyer and seller are on the same page.

The Texas Real Estate Purchase Agreement form is a legally binding document that outlines the conditions and terms under which the sale of a property will take place. It ensures that both the buyer and seller are clear on the details of the transaction, from the sales price to the closing date. For anyone looking to buy or sell property in Texas, this document is essential. To access necessary documentation, including the agreement itself, refer to All Texas Forms and get started on filling out your form.

Personal Guarantor Meaning - A personal guarantee can enhance your creditworthiness in negotiations.

Purchase Agreement Addendum - Documents additional rights or privileges granted in the agreement.

Documents used along the form

When entering into an owner financing agreement, several other documents may be useful to ensure clarity and protection for both parties involved. Here are some commonly used forms that complement the Owner Financing Contract.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It includes details like the loan amount, interest rate, and repayment schedule.

- Real Estate Purchase Agreement: This legally binding contract between a buyer and a seller for the purchase of real estate property in Minnesota is crucial for ensuring clarity in the transaction. For more information and to access necessary forms, visit All Minnesota Forms.

- Deed of Trust: This form secures the loan by placing a lien on the property. It involves a third party, known as the trustee, who holds the title until the loan is paid off.

- Purchase Agreement: This document details the terms of the sale between the buyer and seller. It includes information about the property, sale price, and any contingencies that must be met.

- Disclosure Statement: This form provides important information about the property and the financing terms. It helps ensure that the buyer is fully informed before finalizing the agreement.

Using these documents together with the Owner Financing Contract can help create a clear understanding of the transaction and protect the interests of both parties involved.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract allows a buyer to purchase property directly from the seller without traditional bank financing. |

| Payment Structure | Payments can be structured as monthly installments, a lump sum, or a combination of both. |

| Interest Rates | Interest rates in owner financing agreements are often higher than conventional loans, reflecting the increased risk to the seller. |

| Down Payment | A down payment is typically required, which can vary based on the agreement between the buyer and seller. |

| Legal Considerations | Each state has specific laws governing owner financing contracts. For example, in California, the California Civil Code applies. |

| Default Terms | The contract should clearly outline the terms of default, including potential remedies for the seller. |

| Title Transfer | Title to the property may not transfer until the buyer has fulfilled all payment obligations, depending on the contract terms. |

| Disclosure Requirements | Sellers may be required to disclose certain information about the property, including any liens or defects. |

| Duration of Contract | The duration of the contract can vary, but it typically ranges from 5 to 30 years. |

| State-Specific Forms | States may have their own specific forms or requirements for owner financing contracts. For instance, Texas has a specific Owner Financing Addendum. |

More About Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement between a seller and a buyer where the seller provides financing directly to the buyer for the purchase of a property. Instead of the buyer obtaining a mortgage from a bank or other financial institution, the seller allows the buyer to make payments over time, often with interest, until the purchase price is paid in full.

What are the benefits of using an Owner Financing Contract?

One of the main benefits is that it can make purchasing a home easier for buyers who may not qualify for traditional financing. This arrangement can also provide sellers with a steady stream of income. Additionally, it allows for more flexible terms, such as down payment amounts and interest rates, which can be tailored to meet both parties' needs.

What terms should be included in the contract?

The contract should clearly outline the purchase price, down payment, interest rate, payment schedule, and the duration of the loan. It should also specify what happens in case of default, any late fees, and whether the seller retains the title until the loan is paid off. Including these details helps protect both parties and ensures clarity in the agreement.

Is an Owner Financing Contract legally binding?

Yes, an Owner Financing Contract is legally binding as long as it meets the necessary legal requirements. Both parties must sign the agreement, and it should comply with state laws. It is advisable to have the contract reviewed by a legal professional to ensure that it is enforceable and protects the interests of both the buyer and the seller.

What happens if the buyer defaults on the loan?

If the buyer defaults, the seller typically has the right to initiate foreclosure proceedings, similar to a bank. The specific terms regarding default should be clearly defined in the contract. This may include grace periods, late fees, and the process for reclaiming the property. Understanding these terms is crucial for both parties.

Can the buyer sell the property before the loan is paid off?

Yes, but this usually requires the seller's consent. The contract may include a clause that allows the buyer to sell the property, often stipulating that the loan must be paid off in full at the time of sale. Clear communication between the buyer and seller regarding any potential sale is essential to avoid misunderstandings.

Are there tax implications for the seller?

Yes, there can be tax implications. The seller may need to report the interest income received from the buyer as taxable income. Additionally, if the seller does not receive the full payment for the property in the year of sale, they may need to consider capital gains tax. Consulting a tax professional is recommended to understand the specific tax responsibilities involved.

Is it necessary to have a lawyer review the contract?

While it is not legally required to have a lawyer review the contract, it is highly advisable. A legal professional can ensure that the contract complies with state laws and protects both parties' interests. This step can help prevent disputes and misunderstandings in the future, providing peace of mind for both the buyer and seller.

Owner Financing Contract: Usage Steps

Completing the Owner Financing Contract form is an important step in facilitating a real estate transaction where the seller provides financing to the buyer. This process requires careful attention to detail to ensure that all necessary information is accurately recorded.

- Begin by entering the date at the top of the form.

- Provide the names and contact information of both the seller and the buyer.

- Clearly state the property address that is being financed.

- Indicate the total purchase price of the property.

- Specify the amount of the down payment that the buyer will make.

- Detail the financing terms, including the interest rate and repayment schedule.

- Include any additional terms and conditions that both parties have agreed upon.

- Ensure that both the seller and buyer sign and date the form at the designated areas.

After completing the form, it is advisable to keep copies for both parties. This ensures that all involved have access to the agreed-upon terms and conditions. It is also recommended to consult with a legal professional to review the document for completeness and compliance with local regulations.