Valid Operating Agreement Template

An Operating Agreement is a crucial document for any Limited Liability Company (LLC). It outlines how the business will be run and establishes the rights and responsibilities of its members. This agreement is not just a formality; it serves as a roadmap for decision-making, profit distribution, and member roles. By detailing the management structure, it helps prevent misunderstandings among members. Additionally, the Operating Agreement can include provisions for adding new members, handling disputes, and even dissolving the company if necessary. While it may seem daunting, having a clear and comprehensive Operating Agreement can provide peace of mind and stability for your business. It protects the interests of all members and ensures that everyone is on the same page regarding the operation of the LLC.

More Forms:

Vacation Rental Contract - This agreement can specify check-in and check-out times for guests.

A Bill of Sale is a legal document that provides evidence of the transfer of ownership from one party to another, usually for goods or personal property. This form outlines the details of the transaction, including the item description, purchase price, and the names of both the buyer and seller. For additional resources, you can visit PDF Documents Hub to fill out the Bill of Sale form by clicking the button below.

California Bill of Sale - This form is often required for the transfer of vehicle titles.

Dos 1246 - A $20 fee is assessed for any checks returned by the bank.

Operating Agreement Forms for Specific US States

Operating Agreement Types

Documents used along the form

An Operating Agreement is a crucial document for LLCs, outlining the management structure and operational guidelines. However, several other forms and documents often accompany it to ensure comprehensive legal compliance and clarity among members. Below is a list of these important documents, each serving a distinct purpose.

- Articles of Organization: This document is filed with the state to officially create the LLC. It typically includes the LLC's name, address, and the names of its members or managers.

- Bylaws: Although more common in corporations, bylaws can also be relevant for LLCs. They establish the rules for the internal management of the company, including meeting procedures and voting rights.

- Member Agreement: This document outlines the rights and responsibilities of each member in the LLC. It can address issues like profit distribution and decision-making processes.

- Operating Procedures: This document details the day-to-day operations of the LLC, including how business will be conducted and specific roles of members or managers.

- RV Bill of Sale: This document is essential for recording the sale of a recreational vehicle, providing important details about the transaction. It protects both the buyer and seller by outlining the terms and specifics of the sale. Make sure to complete the RV Bill of Sale form accurately to ensure a smooth transfer of ownership.

- Initial Capital Contributions Agreement: This agreement specifies the amount of money or property each member contributes to the LLC at its formation, which is crucial for determining ownership percentages.

- Tax Election Form: LLCs often need to file a form with the IRS to choose how they will be taxed. This can impact the overall tax obligations of the business and its members.

- Annual Reports: Many states require LLCs to file annual reports to maintain good standing. These reports typically provide updated information about the business and its members.

Each of these documents plays a vital role in the establishment and ongoing operation of an LLC. Together with the Operating Agreement, they help ensure that all members are aligned on the business's structure and operational procedures, fostering a clear understanding and cooperation among all parties involved.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a key document used by LLCs to outline the management structure and operating procedures of the company. |

| Purpose | It helps to clarify the rights and responsibilities of members, reducing the potential for disputes. |

| State-Specific Forms | Each state may have specific requirements for Operating Agreements, so it's important to refer to your state's laws. |

| Governing Law | The governing law for Operating Agreements varies by state; for example, California follows the California Corporations Code. |

| Flexibility | Operating Agreements allow for flexibility in management and profit distribution, tailored to the members' needs. |

| Not Mandatory | While not required in all states, having an Operating Agreement is highly recommended for LLCs. |

| Amendments | Members can amend the Operating Agreement as needed, ensuring it remains relevant to the business's evolving needs. |

| Confidentiality | The contents of an Operating Agreement are generally private, offering confidentiality to members regarding their business operations. |

More About Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC). It serves as a guide for how the LLC will function and details the rights and responsibilities of its members. This agreement helps prevent misunderstandings and disputes among members by clearly defining roles and expectations.

Why is an Operating Agreement important?

This document is crucial for several reasons. First, it provides clarity about the ownership and management of the LLC. Second, it can protect the members' personal assets by reinforcing the limited liability status of the business. Lastly, having an Operating Agreement can help resolve disputes and provide a roadmap for decision-making, which is especially important in times of conflict.

Do all LLCs need an Operating Agreement?

While not all states require an Operating Agreement, it is highly recommended for every LLC. Even if your state does not mandate it, having an Operating Agreement can help establish the legitimacy of your business and provide a clear framework for operations. Without one, state laws will dictate how your LLC is managed, which may not align with the members' intentions.

What should be included in an Operating Agreement?

An Operating Agreement typically includes several key components. These may consist of the LLC's name and purpose, the names of the members, their ownership percentages, management structure, voting rights, and procedures for adding or removing members. Additionally, it should outline how profits and losses will be distributed and the process for dissolving the LLC if necessary.

Can an Operating Agreement be changed?

Yes, an Operating Agreement can be amended. It is important for members to agree on any changes, and the process for making amendments should be clearly outlined in the original agreement. Keeping the Operating Agreement updated ensures that it reflects the current intentions and agreements of the members, which can help avoid future conflicts.

How do I create an Operating Agreement?

Creating an Operating Agreement can be done in several ways. Members can draft one from scratch, use templates available online, or consult with a legal professional for assistance. It is important to ensure that the agreement meets state requirements and accurately reflects the members' intentions. Having all members review and sign the document is essential for its validity.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by the default rules set by the state. These rules may not align with the members' preferences and can lead to unexpected outcomes. Without a clear agreement, members may face challenges in decision-making, profit distribution, and conflict resolution, which can ultimately jeopardize the business's success.

Operating Agreement: Usage Steps

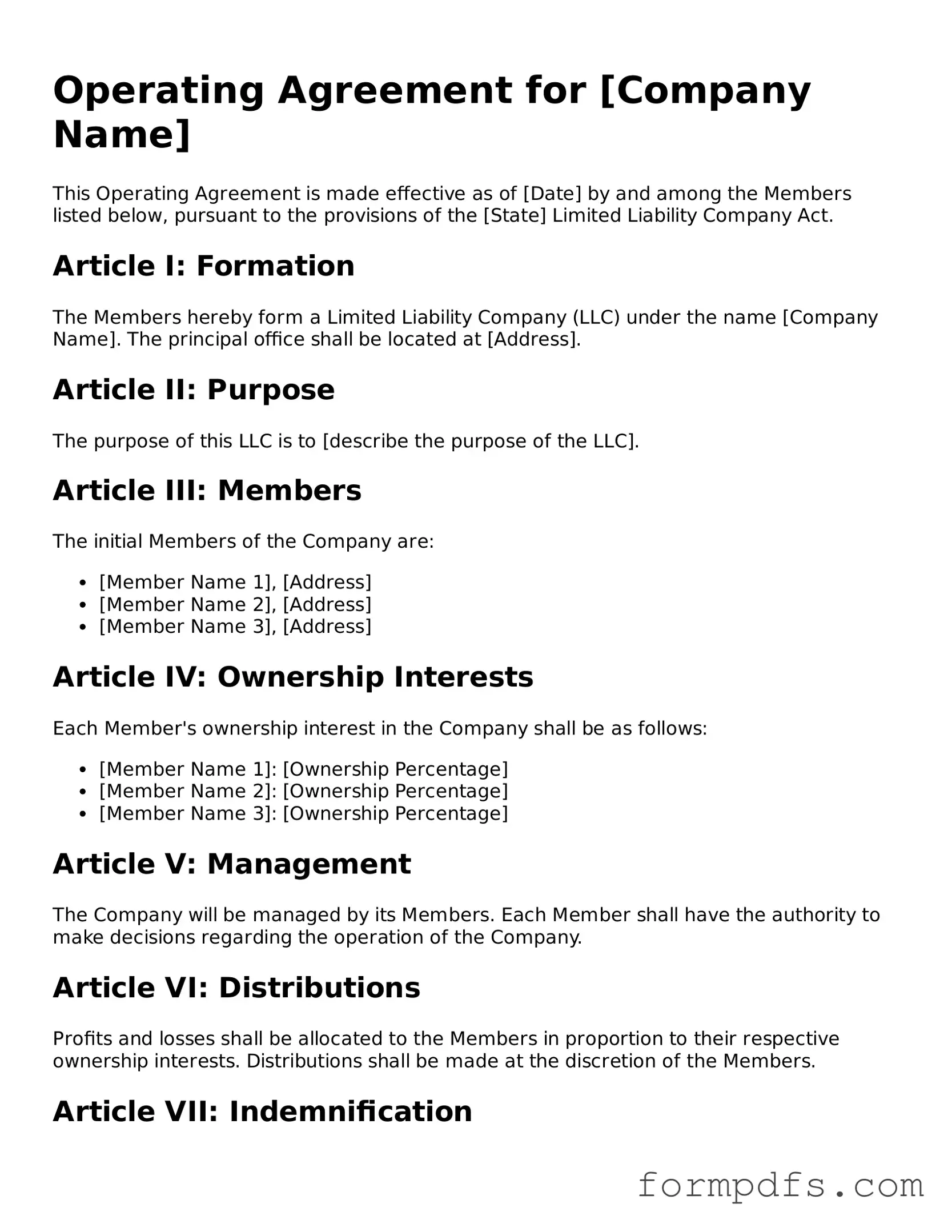

After obtaining the Operating Agreement form, it is crucial to complete it accurately to ensure that all necessary information is included. This document will outline the management structure and operational procedures of your business. Follow the steps below carefully to fill out the form correctly.

- Begin by entering the name of your business at the top of the form. Make sure to use the exact name as registered with the state.

- Next, provide the principal address of the business. This should be the main location where business activities will take place.

- List the names and addresses of all members involved in the business. Ensure that each member's information is complete and accurate.

- Indicate the percentage of ownership for each member. This reflects their share in the business and should total 100%.

- Outline the management structure. Specify whether the business will be member-managed or manager-managed.

- Detail the voting rights of each member. Clearly state how decisions will be made and what percentage is required for approval.

- Include provisions for adding or removing members. This section should explain the process for changes in membership.

- Describe how profits and losses will be distributed among members. Be specific about the method of distribution.

- Review the entire form for accuracy and completeness. Double-check all names, addresses, and percentages.

- Finally, have all members sign and date the form to validate it. Make sure to keep a copy for your records.