Printable Transfer-on-Death Deed Form for the State of Ohio

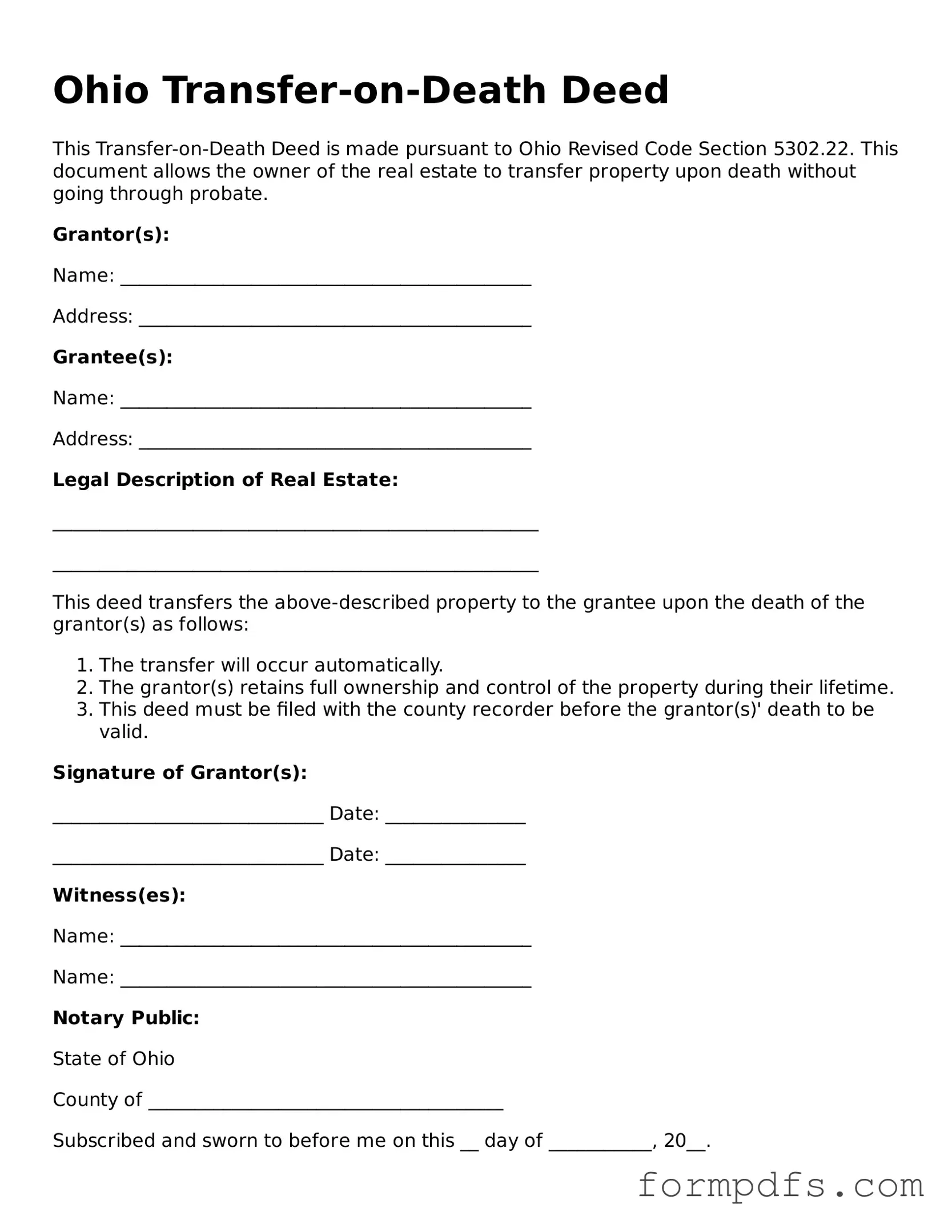

The Ohio Transfer-on-Death Deed (TOD) form provides a straightforward way for property owners to transfer their real estate to designated beneficiaries upon their death, avoiding the complexities of probate. This legal document allows individuals to retain full ownership of their property during their lifetime while ensuring a seamless transfer to heirs without the need for court involvement. By completing the TOD form, property owners can specify who will receive their property, offering clarity and peace of mind for both the owner and the beneficiaries. The form must be properly executed and recorded with the county recorder's office to be valid. Additionally, it is important to note that the transfer occurs automatically upon death, meaning that beneficiaries do not need to take any action to receive the property. Understanding the requirements and implications of the TOD deed can help property owners make informed decisions about their estate planning and ensure that their wishes are honored after their passing.

Check out Other Common Transfer-on-Death Deed Templates for Different States

Illinois Transfer on Death Instrument - Using this deed can prevent potential family conflicts over property post-death.

How to Gift Land to Family Member - You can specifically limit what the beneficiary can do with the property.

The California Trailer Bill of Sale form is essential for anyone looking to buy or sell a trailer, as it provides a clear record of the transaction and protects both parties involved. For more information on how to properly complete this form, you can visit https://onlinelawdocs.com/, which offers valuable resources and guidance on the process.

Title Companies and Transfer on Death Deeds - The deed may be beneficial for avoiding family disputes over property after death.

Documents used along the form

The Ohio Transfer-on-Death Deed is a valuable tool for estate planning, allowing property owners to designate beneficiaries who will receive their property upon their death without going through probate. However, several other forms and documents often accompany this deed to ensure a smooth transfer process and proper legal standing. Here are four important documents to consider:

- Last Will and Testament: This document outlines how a person wishes to distribute their assets after death. It can complement a Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Motorcycle Bill of Sale: The California Motorcycle Bill of Sale form serves as an essential document that records the transaction details when one party sells a motorcycle to another within the state of California. It functions not only as a receipt for the buyer but also establishes a formal agreement between the seller and the buyer pertaining to the transfer of ownership. This document, crucial for legal and registration purposes, becomes a pivotal record for both parties involved in the transaction. You can find the form here.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies. They specify who will receive the funds or benefits upon the account holder's death, ensuring that these assets are transferred directly to the beneficiaries.

- Power of Attorney: This legal document grants someone the authority to make decisions on behalf of another person. It can be crucial for managing property and financial matters if the property owner becomes incapacitated.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased person, particularly when there is no will. It can help clarify ownership of property and facilitate the transfer process.

Using these documents in conjunction with the Ohio Transfer-on-Death Deed can help ensure that your estate is handled according to your wishes. Proper planning can prevent confusion and disputes among heirs, making the transition smoother for everyone involved.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | The Ohio Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Ohio Revised Code Section 5302.22. |

| Eligibility | Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can designate one or more beneficiaries, including individuals or entities. |

| Revocation | The deed can be revoked at any time before the owner's death by filing a new deed or a revocation document. |

| Filing Requirements | The deed must be signed by the owner and recorded with the county recorder's office where the property is located. |

| Effect on Taxes | Transfer-on-Death Deeds do not affect property taxes during the owner's lifetime. |

| Limitations | This deed cannot be used for transferring property subject to a mortgage or other liens without addressing those obligations. |

More About Ohio Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TOD) allows property owners in Ohio to transfer real estate to beneficiaries upon their death without going through probate. This deed is a straightforward way to ensure that your property passes directly to your chosen beneficiaries, simplifying the transfer process and reducing costs.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Ohio can utilize a Transfer-on-Death Deed. This includes homeowners, landowners, and individuals holding title to property. However, it is essential to ensure that the deed is executed correctly to be valid.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, you must fill out the form with specific information, including your name, the names of the beneficiaries, and a legal description of the property. After filling out the form, it must be signed in front of a notary public and then recorded with the county recorder’s office where the property is located.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must create a new deed that either names different beneficiaries or explicitly states that the previous deed is revoked. This new deed must also be signed and recorded to be effective.

What happens if a beneficiary predeceases me?

If a beneficiary named in your Transfer-on-Death Deed passes away before you, their share of the property will typically go to their heirs, unless the deed specifies otherwise. It is a good practice to review your deed periodically to ensure that it reflects your current wishes.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. The property is not considered part of your estate for estate tax purposes. However, beneficiaries may be responsible for property taxes once the transfer occurs, and it’s advisable to consult with a tax professional for specific guidance.

Is legal assistance necessary to create a Transfer-on-Death Deed?

While legal assistance is not required to create a Transfer-on-Death Deed, it can be beneficial. An attorney can help ensure that the deed is completed correctly and meets all legal requirements. This can prevent potential issues in the future and provide peace of mind.

Ohio Transfer-on-Death Deed: Usage Steps

After gathering the necessary information, you are ready to fill out the Ohio Transfer-on-Death Deed form. This form allows property owners to designate beneficiaries who will receive the property upon the owner's death. Follow these steps carefully to ensure accurate completion.

- Begin by entering the date at the top of the form.

- Provide the name of the property owner(s) in the designated section. Ensure the names are spelled correctly.

- List the address of the property being transferred. Include the street address, city, state, and zip code.

- Identify the beneficiaries by providing their full names. Include their relationship to you, if applicable.

- Specify whether the beneficiaries will receive the property equally or in specified shares.

- Sign the form in the presence of a notary public. The notary will then sign and stamp the document.

- Make copies of the completed form for your records.

- File the original form with the appropriate county recorder's office where the property is located.

Once the form is completed and filed, it becomes part of the public record. Ensure you keep track of any changes in your beneficiaries or property details, as you may need to update the deed in the future.