Printable Quitclaim Deed Form for the State of Ohio

When it comes to transferring property in Ohio, the Quitclaim Deed form stands out as a straightforward option for many homeowners and property owners. This document allows one party, known as the grantor, to transfer their interest in a property to another party, the grantee, without any warranties regarding the title's validity. Essentially, it is a way to convey ownership rights quickly, often used among family members or in situations where the parties know each other well. Unlike other deed types, the Quitclaim Deed does not guarantee that the grantor holds a clear title, which means the grantee takes on the risk of any potential claims or issues related to the property. This form is particularly useful in various scenarios, such as divorce settlements, estate transfers, or when adding someone to a title. Understanding the implications and proper usage of the Quitclaim Deed is crucial for anyone looking to navigate property transfers in Ohio efficiently.

Check out Other Common Quitclaim Deed Templates for Different States

Quit Claim Deed Ga - The form must typically be signed before a notary public to be legally binding.

For anyone in need of a reliable resource, our straightforward guide on how to fill out an Arizona bill of sale is invaluable. You can find detailed steps and insights by visiting the Arizona bill of sale form guide.

Can Anyone Get a Copy of a Deed - A recognized legal tool for transferring real estate among individuals.

Illinois Quit Claim Deed - Whenever using a quitclaim deed, it’s critical to keep accurate records to support the transfer legally.

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. In Ohio, several other forms and documents are often necessary to accompany a Quitclaim Deed to ensure a smooth and legally sound transaction. Below is a list of these documents, each serving a specific purpose in the property transfer process.

- Affidavit of Title: This document affirms that the seller has the legal right to sell the property and discloses any potential claims or liens against it.

- Residential Lease Agreement: For properties being rented, the All California Forms provide essential templates and guidelines to ensure that both landlords and tenants clearly understand their rights and responsibilities.

- Property Transfer Tax Statement: This form is required by the county to document the transfer of property and assess any applicable taxes.

- Title Search Report: A title search report provides a detailed history of the property, including ownership, liens, and any encumbrances that may affect the transfer.

- Warranty Deed (if applicable): In some cases, a warranty deed may be used instead of a Quitclaim Deed, offering greater protection to the buyer by guaranteeing clear title.

- Closing Statement: This document outlines the financial details of the transaction, including costs, fees, and the final sale price.

- Power of Attorney: If the seller cannot be present for the transaction, a power of attorney allows another person to sign the Quitclaim Deed on their behalf.

These documents work together to facilitate a clear and effective property transfer. Ensuring that all necessary forms are completed accurately can help prevent disputes and protect the interests of both parties involved in the transaction.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties about the title. |

| Governing Law | The Ohio Quitclaim Deed is governed by Ohio Revised Code § 5302.20, which outlines the requirements for property transfers. |

| Purpose | This type of deed is commonly used to clear up title issues, transfer property between family members, or in situations where the buyer trusts the seller. |

| Requirements | In Ohio, a quitclaim deed must be in writing, signed by the grantor, and must include a legal description of the property. |

| Recording | To ensure the transfer is recognized, the quitclaim deed should be recorded with the county recorder's office where the property is located. |

| Limitations | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has clear title to the property, which can lead to potential issues for the grantee. |

More About Ohio Quitclaim Deed

What is a Quitclaim Deed in Ohio?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another in Ohio. Unlike a warranty deed, a quitclaim deed does not guarantee that the property is free from liens or other claims. The person transferring the property, known as the grantor, simply relinquishes any interest they may have in the property to the recipient, known as the grantee. This type of deed is often used between family members or in situations where the parties know each other well.

How do I complete an Ohio Quitclaim Deed?

To complete a Quitclaim Deed in Ohio, you will need to include specific information. Start by identifying the grantor and grantee, including their full names and addresses. Next, provide a legal description of the property being transferred. This description can typically be found on the property’s tax records or previous deeds. After filling out the form, both parties must sign it in the presence of a notary public. Finally, the deed should be filed with the county recorder's office where the property is located to make the transfer official.

Are there any fees associated with filing a Quitclaim Deed in Ohio?

Yes, there are typically fees associated with filing a Quitclaim Deed in Ohio. These fees can vary by county but generally include a recording fee for the deed. Additionally, if the property is being transferred as part of a sale, there may be other costs, such as transfer taxes. It’s a good idea to check with your local county recorder’s office for the exact fees and any other requirements that may apply.

Can a Quitclaim Deed be revoked in Ohio?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked. The transfer of property is considered final. However, if there are specific circumstances, such as fraud or undue influence, it may be possible to challenge the validity of the deed in court. If you believe you have a valid reason to contest a Quitclaim Deed, consulting with a legal professional is advisable to explore your options.

Ohio Quitclaim Deed: Usage Steps

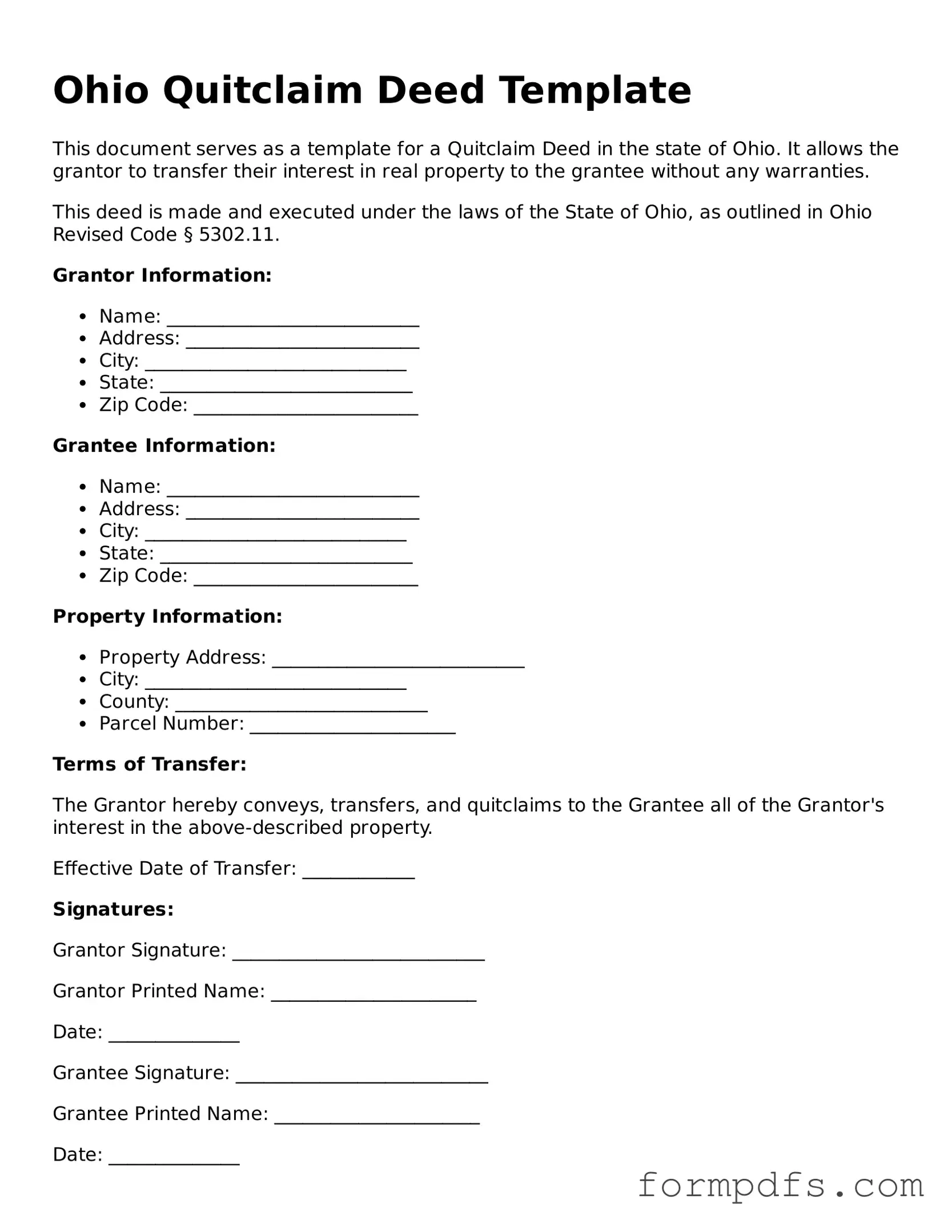

After obtaining the Ohio Quitclaim Deed form, it is essential to complete it accurately to ensure a smooth transfer of property rights. Follow the steps below to fill out the form correctly.

- Start by entering the name of the grantor (the person transferring the property) at the top of the form. Include their address and contact information.

- Next, provide the name of the grantee (the person receiving the property). Include their address and contact information as well.

- Clearly describe the property being transferred. This includes the street address, city, county, and any relevant parcel identification numbers.

- Indicate the consideration amount. This is the price or value exchanged for the property. If the transfer is a gift, you may note that as well.

- Sign and date the form in the designated area. Ensure that the signature of the grantor matches the name listed at the top.

- Have the form notarized. A notary public must witness the signing and provide their seal on the document.

- Finally, file the completed Quitclaim Deed with the appropriate county recorder's office. Check for any filing fees that may apply.