Printable Promissory Note Form for the State of Ohio

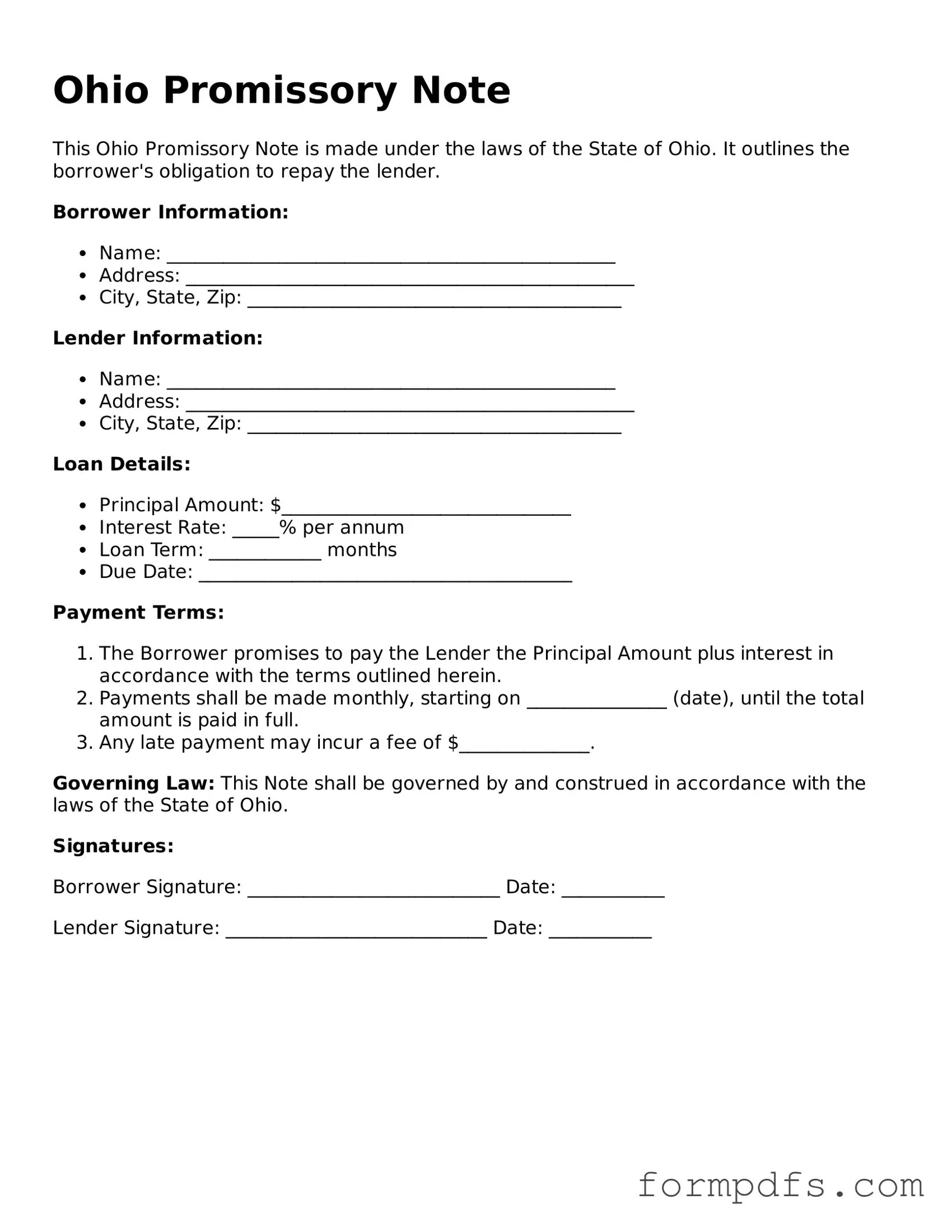

The Ohio Promissory Note form serves as a critical financial instrument in lending agreements, outlining the terms under which one party agrees to repay a specified sum of money to another. This document typically includes essential details such as the principal amount borrowed, the interest rate applicable, and the repayment schedule, which may specify monthly or quarterly payments. Additionally, it often highlights the consequences of default, providing clarity on the lender's rights in such situations. The form may also include provisions for prepayment, allowing the borrower to pay off the loan early without incurring penalties. Understanding these components is vital for both lenders and borrowers, as it ensures that both parties are aware of their obligations and rights throughout the duration of the loan agreement. Furthermore, the Ohio Promissory Note must adhere to state-specific legal requirements, making it essential to use the correct format to ensure enforceability in a court of law.

Check out Other Common Promissory Note Templates for Different States

Promissory Note Michigan - This document is an effective way to formalize loans between acquaintances or business partners.

Completing the Ca DMV DL 44 form is essential for those seeking to navigate the California licensing process effectively, and for additional resources, you can refer to All California Forms which provide comprehensive information and assistance regarding various DMV forms.

Loan Note Template - Disclosures related to late payments should be clearly outlined in the document.

Promissory Note Illinois - The terms of repayment should be clear to both parties involved.

Documents used along the form

The Ohio Promissory Note is a crucial document used to outline the terms of a loan between a lender and a borrower. However, there are several other forms and documents that often accompany this note to ensure clarity and legal compliance. Below is a list of commonly used documents that may be relevant in conjunction with the Ohio Promissory Note.

- Loan Agreement: This document details the terms and conditions of the loan, including the amount, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what the collateral is and the lender's rights in case of default.

- Disclosure Statement: This form provides borrowers with important information about the loan, such as fees, interest rates, and the total cost of borrowing.

- Motor Vehicle Bill of Sale: This important document officially records the sale of a vehicle, ensuring transparency and legal protection for both parties involved in the transaction. For more details, visit https://smarttemplates.net/fillable-motor-vehicle-bill-of-sale/.

- Payment Schedule: A detailed outline of when payments are due, the amount of each payment, and the total duration of the loan.

- Personal Guarantee: This document may be signed by a third party to guarantee the loan, providing additional security for the lender.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components, helping borrowers understand their payment obligations over time.

- Default Notice: A formal notification sent to the borrower if they fail to meet the terms of the promissory note, outlining the consequences of default.

- Release of Liability: This document is used to release the borrower from any further obligations once the loan is fully paid.

- Assignment of Note: If the lender decides to transfer the loan to another party, this document facilitates that transfer and outlines the terms of the assignment.

- Loan Modification Agreement: If the terms of the loan need to be changed, this agreement outlines the new terms and conditions agreed upon by both parties.

Understanding these accompanying documents can help both lenders and borrowers navigate the lending process more effectively. Each document serves a specific purpose and plays a vital role in ensuring that the terms of the loan are clear and enforceable.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Ohio Revised Code, specifically Section 1303.01 to 1303.70, governs promissory notes in Ohio. |

| Essential Elements | To be valid, a promissory note must include the principal amount, interest rate, payment terms, and signatures of the parties involved. |

| Types of Promissory Notes | There are various types, including secured and unsecured notes, as well as demand and installment notes. |

| Enforceability | Promissory notes are legally enforceable as long as they meet the necessary requirements outlined in Ohio law. |

| Interest Rates | Ohio law does not set a maximum interest rate for promissory notes, but it must comply with federal usury laws. |

| Transferability | Promissory notes can be transferred to another party, making them negotiable instruments under Ohio law. |

| Default Consequences | If a borrower defaults on a promissory note, the lender may pursue legal action to recover the owed amount. |

More About Ohio Promissory Note

What is an Ohio Promissory Note?

An Ohio Promissory Note is a written promise from one party to pay a specified sum of money to another party at a designated time or on demand. This document outlines the terms of the loan, including the principal amount, interest rate, payment schedule, and any applicable fees. It serves as a legal record of the agreement between the borrower and the lender.

Who can use a Promissory Note in Ohio?

Any individual or business can use a Promissory Note in Ohio. Borrowers and lenders may include friends, family members, or financial institutions. The note can be used for various purposes, such as personal loans, business financing, or real estate transactions. Both parties should understand the terms and conditions before signing the document.

What should be included in an Ohio Promissory Note?

An Ohio Promissory Note should include essential information such as the names and addresses of the borrower and lender, the principal amount, the interest rate, the payment schedule, and the due date. It may also outline any penalties for late payments, prepayment options, and any collateral involved. Clarity in these terms helps prevent misunderstandings between the parties.

Is a Promissory Note legally binding in Ohio?

Yes, a Promissory Note is legally binding in Ohio, provided it meets certain requirements. Both parties must agree to the terms, and the document should be signed and dated by the borrower and lender. While notarization is not required, it can add an extra layer of credibility and may be beneficial in case of disputes. Adhering to the state's laws ensures the enforceability of the note.

Ohio Promissory Note: Usage Steps

After gathering the necessary information, you are ready to fill out the Ohio Promissory Note form. This document requires specific details about the loan agreement between the lender and the borrower. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form. Use the format Month, Day, Year.

- Next, fill in the name and address of the borrower. Ensure that all details are correct.

- Then, provide the lender's name and address. Double-check for accuracy.

- Indicate the principal amount of the loan. This is the total amount borrowed.

- Specify the interest rate. Make sure to clearly state whether it is fixed or variable.

- Detail the repayment schedule. Include how often payments are due (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable.

- Sign and date the document at the bottom. The borrower must sign the form.

Once you have completed the form, review it for any errors or missing information. After verifying everything is correct, you can proceed with the next steps in your agreement.