Printable Operating Agreement Form for the State of Ohio

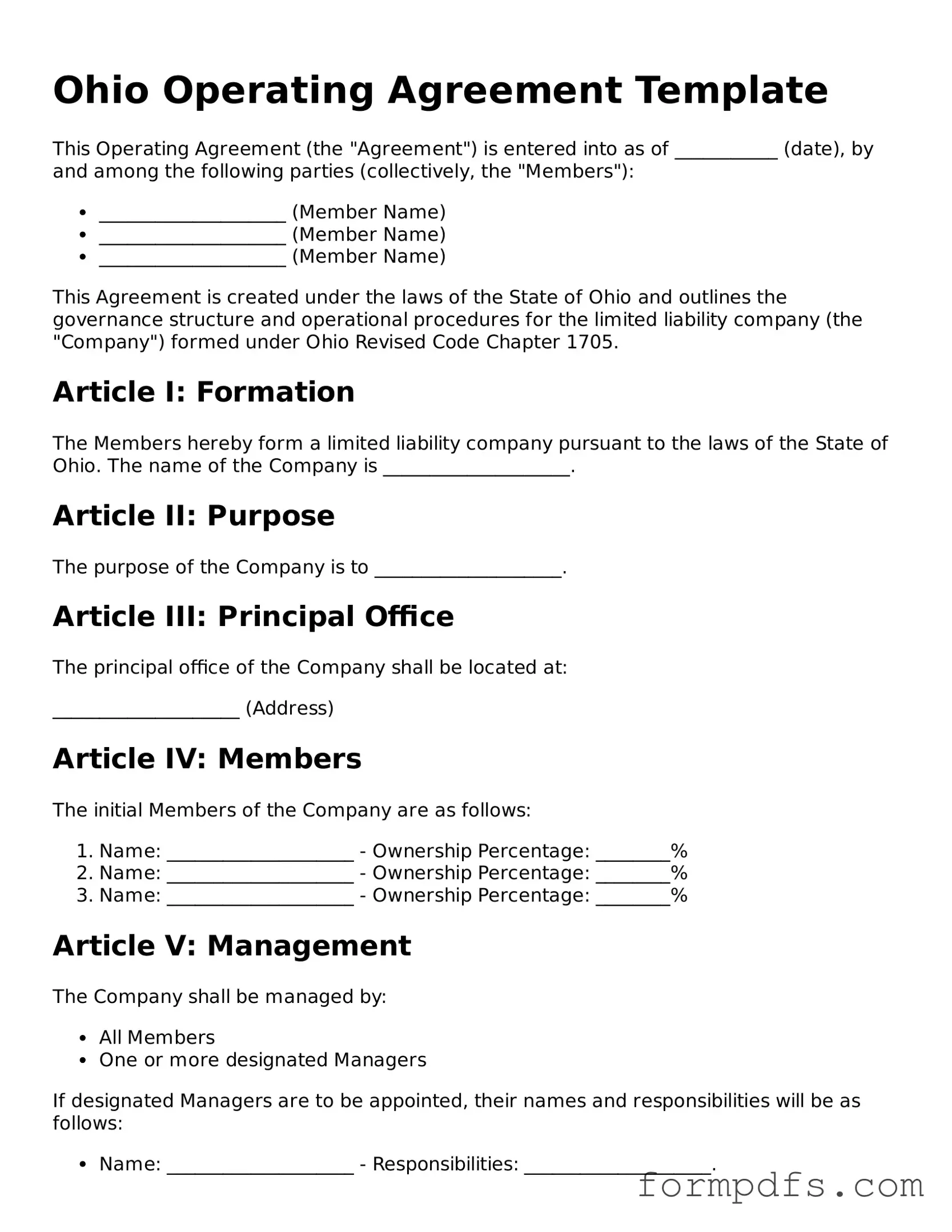

The Ohio Operating Agreement form is a crucial document for individuals looking to establish a Limited Liability Company (LLC) in Ohio. This form outlines the internal workings of the LLC, detailing the roles and responsibilities of its members. It serves as a foundational blueprint that guides decision-making processes, profit distribution, and the management structure of the company. Key components often included in the agreement are the identification of members, the percentage of ownership each member holds, and the procedures for adding or removing members. Additionally, the agreement addresses how disputes will be resolved and outlines the process for dissolving the LLC if necessary. By clearly defining these elements, the Ohio Operating Agreement helps prevent misunderstandings and provides a framework for the company’s operations. This document is not only important for compliance with state laws but also acts as a reference point for members in their day-to-day interactions and long-term planning.

Check out Other Common Operating Agreement Templates for Different States

Llc in Michigan Form - It can clarify both initial and ongoing capital contributions.

Single Member Llc Operating Agreement Illinois - The Operating Agreement can define the duties of a manager, if one is appointed.

This document serves as a vital part of any legal process, and for those looking for guidance, a reliable source is the comprehensive guide on the Affidavit of Service requirements.

How to Create an Operating Agreement - It can specify rules regarding member withdrawals and buyouts.

Documents used along the form

The Ohio Operating Agreement form is a crucial document for limited liability companies (LLCs) in Ohio. It outlines the management structure, member roles, and operational procedures of the company. Alongside this form, several other documents are often utilized to ensure comprehensive legal compliance and effective business management. Below is a list of related forms and documents commonly used with the Ohio Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create an LLC. It includes basic information about the company, such as its name, address, and the names of its members.

- Bylaws: While not always required for LLCs, bylaws outline the internal rules governing the company’s operations, including meetings, voting procedures, and member responsibilities.

- California Civil Form: Essential for legal proceedings in California, this form is crucial for those navigating civil litigation, covering various applications from lawsuits to legal complaints. For a comprehensive resource, visit All California Forms.

- Member Resolution: This document records decisions made by the members of the LLC. It serves as formal documentation for actions taken, such as approving new members or significant business decisions.

- Operating Procedures: This document details the day-to-day operational processes of the LLC, providing clarity on how various tasks should be performed and responsibilities assigned.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

- Tax Identification Number (EIN) Application: This application is submitted to the IRS to obtain an Employer Identification Number, which is necessary for tax purposes and hiring employees.

- Bank Resolution: This document authorizes specific individuals to open and manage bank accounts on behalf of the LLC, ensuring proper financial management.

- Non-Disclosure Agreement (NDA): An NDA may be utilized to protect sensitive information shared among members or with third parties, ensuring confidentiality in business dealings.

- Membership Agreement: This agreement outlines the terms of membership, including capital contributions, profit sharing, and the process for transferring ownership interests.

Each of these documents plays a significant role in the formation and operation of an LLC in Ohio. Properly preparing and maintaining these forms helps ensure that the business runs smoothly and complies with legal requirements.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC) in Ohio. |

| Governing Law | This agreement is governed by the Ohio Revised Code, specifically sections related to LLCs, primarily Chapter 1705. |

| Flexibility | Ohio law allows LLCs to customize their operating agreements to suit their specific needs, which can include provisions for profit distribution, decision-making processes, and member roles. |

| Not Mandatory | While having an operating agreement is not legally required in Ohio, it is highly recommended to prevent disputes and clarify expectations among members. |

| Amendments | Members can amend the operating agreement as needed, provided that the process for amendments is outlined within the agreement itself. |

More About Ohio Operating Agreement

What is an Ohio Operating Agreement?

An Ohio Operating Agreement is a legal document that outlines the internal management structure and operational procedures of a limited liability company (LLC) in Ohio. This agreement serves as a foundational blueprint for how the LLC will function, detailing the roles and responsibilities of its members, how profits and losses will be distributed, and the procedures for making important business decisions. While Ohio law does not require an LLC to have an Operating Agreement, having one is highly advisable as it helps prevent misunderstandings among members and provides a clear framework for operations.

Who should create an Operating Agreement in Ohio?

All members of an LLC in Ohio should consider creating an Operating Agreement, regardless of the size of the company. This includes single-member LLCs, where the sole owner can outline their own operational guidelines. For multi-member LLCs, the agreement becomes even more crucial as it helps to clarify each member's rights and responsibilities. By establishing clear expectations, the Operating Agreement can prevent conflicts and provide a structured approach to decision-making and profit-sharing.

What should be included in an Ohio Operating Agreement?

An effective Ohio Operating Agreement should cover several key elements. First, it should identify the members of the LLC and their respective ownership percentages. Next, it should outline the management structure, specifying whether the LLC will be member-managed or manager-managed. Additionally, the agreement should detail how profits and losses will be allocated, the process for adding or removing members, and the procedures for resolving disputes. It is also wise to include provisions for amending the agreement in the future, ensuring that the document remains relevant as the business evolves.

Is an Operating Agreement legally binding in Ohio?

Yes, an Operating Agreement is legally binding in Ohio, provided it is properly drafted and executed by all members of the LLC. This means that once the agreement is signed, it holds the same weight as any other contract. However, it is important to ensure that the agreement complies with Ohio law and accurately reflects the intentions of the members. If disputes arise, a well-structured Operating Agreement can serve as a critical reference point for resolving issues and enforcing the rights of the members.

Ohio Operating Agreement: Usage Steps

Filling out the Ohio Operating Agreement form is an important step in establishing the framework for your business. Once you have completed the form, you will have a clear understanding of the roles, responsibilities, and rights of the members involved in your company.

- Begin by entering the name of your limited liability company (LLC) at the top of the form.

- Provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members of the LLC. Ensure that each member's information is accurate and complete.

- Specify the purpose of the LLC. Describe the business activities the company will engage in.

- Detail the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Outline the capital contributions of each member. Include the amount each member is contributing to the LLC.

- Describe the distribution of profits and losses among the members. Clarify how and when profits will be shared.

- Include any additional provisions that may be relevant to your LLC, such as buyout agreements or voting rights.

- Review the completed form for accuracy. Ensure that all information is correct and clearly stated.

- Have all members sign and date the form. Each member’s signature indicates their agreement to the terms outlined in the document.

After completing the form, keep a copy for your records and consider filing it with the appropriate state agency if required. This will help ensure that your LLC operates smoothly and in compliance with Ohio law.