Printable Durable Power of Attorney Form for the State of Ohio

In Ohio, a Durable Power of Attorney (DPOA) form is a vital legal document that empowers an individual, known as the agent or attorney-in-fact, to make decisions on behalf of another person, referred to as the principal. This document remains effective even if the principal becomes incapacitated, ensuring that their financial and healthcare decisions can continue without interruption. It covers a wide range of powers, from managing bank accounts and real estate to making medical decisions. The DPOA can be tailored to fit the principal's specific needs, allowing them to specify what powers they want to grant and under what circumstances. It’s essential for individuals to understand the implications of this form, as it places significant authority in the hands of the chosen agent. Additionally, the DPOA must be executed according to Ohio state laws, including the requirement for notarization or witnesses, to ensure its validity. Understanding these elements can help individuals make informed decisions about their future and the care of their affairs.

Check out Other Common Durable Power of Attorney Templates for Different States

What Does Dpoa Mean - Allows the attorney-in-fact to act on behalf of the principal even when the principal is incapacitated.

Illinois Durable Power of Attorney - The principal can include specific instructions for the agent’s actions.

In addition to understanding the significance of the California Form REG 262, it's important for all individuals involved in vehicle or vessel transfers to be aware of the various necessary documentation and resources available. For comprehensive guidance and access to other related documents, please refer to All California Forms.

Free Power of Attorney Form Michigan - Having a Durable Power of Attorney in place can alleviate stress during difficult times by clearly outlining decision-making authority.

Free Power of Attorney Form Nc - Review your Durable Power of Attorney regularly to keep it up to date.

Documents used along the form

When preparing a Durable Power of Attorney (DPOA) in Ohio, it is often beneficial to consider additional forms and documents that may complement or enhance the authority granted through the DPOA. Each of these documents serves a specific purpose, ensuring that your wishes are respected and that your financial and medical affairs are managed according to your preferences. Below is a list of commonly used forms alongside the Ohio Durable Power of Attorney.

- Living Will: This document outlines your preferences regarding medical treatment in situations where you are unable to communicate your wishes. It typically specifies whether you would like to receive life-sustaining treatment or palliative care in the event of a terminal illness or irreversible condition.

- Healthcare Power of Attorney: Similar to a Durable Power of Attorney, this form specifically designates an individual to make healthcare decisions on your behalf if you become incapacitated. This ensures that someone you trust is responsible for your medical care choices.

- Durable Power of Attorney: For safeguarding your financial decisions, consider the essential Durable Power of Attorney form options to ensure your wishes are honored.

- Financial Power of Attorney: While a Durable Power of Attorney can cover both financial and healthcare decisions, a separate Financial Power of Attorney can be used if you wish to designate someone specifically for financial matters, such as managing bank accounts and paying bills.

- Trust Document: Establishing a trust can be a useful estate planning tool. A trust document outlines how your assets will be managed and distributed after your death, providing a clear plan that can help avoid probate and ensure your wishes are honored.

- Will: A will is a legal document that specifies how your assets should be distributed upon your death. It allows you to appoint guardians for minor children and can help ensure that your property is handled according to your wishes.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to name beneficiaries directly. Keeping these designations updated is crucial, as they can supersede instructions in a will or trust.

- Asset Inventory List: While not a legal document, creating a detailed inventory of your assets can assist your agents and family members in managing your affairs. This list should include account numbers, property details, and other pertinent information regarding your assets.

By considering these additional forms and documents, individuals can create a comprehensive plan that addresses both their healthcare and financial needs. This proactive approach not only provides peace of mind but also ensures that your wishes are clearly communicated and legally documented.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | An Ohio Durable Power of Attorney allows an individual to appoint someone to make decisions on their behalf if they become incapacitated. |

| Governing Law | The form is governed by Ohio Revised Code § 1337.21 to § 1337.64. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated. |

| Agent Authority | The agent can be granted broad powers, including financial and healthcare decisions, depending on the principal's wishes. |

| Signing Requirements | The document must be signed by the principal and acknowledged by a notary public. |

| Revocation | The principal can revoke the power of attorney at any time as long as they are competent. |

| Limitations | Some powers, such as making a will or altering a trust, cannot be granted through this form. |

| Agent's Duties | The agent is required to act in the best interest of the principal and manage their affairs responsibly. |

| Recommended Use | This form is often recommended for individuals planning for potential future incapacity. |

More About Ohio Durable Power of Attorney

What is a Durable Power of Attorney in Ohio?

A Durable Power of Attorney is a legal document that allows you to appoint someone else, known as your agent, to make decisions on your behalf. This authority can cover financial matters, healthcare decisions, or both. The key aspect of a Durable Power of Attorney is that it remains effective even if you become incapacitated, meaning that your agent can act on your behalf when you are unable to do so yourself.

How do I create a Durable Power of Attorney in Ohio?

To create a Durable Power of Attorney in Ohio, you need to complete a specific form that outlines your wishes and the powers you are granting to your agent. You must sign the document in the presence of a notary public or two witnesses. It’s important to ensure that the form complies with Ohio law, as this will help avoid any potential disputes in the future.

Can I revoke a Durable Power of Attorney in Ohio?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To revoke the document, you should create a written notice stating that you are revoking the previous Durable Power of Attorney. Make sure to inform your agent and any relevant financial institutions or healthcare providers about the revocation to prevent any confusion.

What powers can I grant to my agent in Ohio?

You have the flexibility to grant a wide range of powers to your agent. These can include managing your financial affairs, making healthcare decisions, handling real estate transactions, and more. You can specify which powers you want to include or exclude in the Durable Power of Attorney document. Clearly outlining your wishes helps ensure that your agent acts according to your preferences.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your loved ones may need to go through a court process to obtain guardianship. This process can be time-consuming, costly, and emotionally challenging. Having a Durable Power of Attorney in place allows you to avoid this situation by designating someone you trust to make decisions for you.

Is there a specific form I must use for a Durable Power of Attorney in Ohio?

While Ohio does not require a specific form, it does provide a statutory form that you can use. This form is designed to meet legal requirements and is widely accepted. However, you can also create a custom Durable Power of Attorney, as long as it adheres to Ohio law. Consulting with a legal professional can help ensure that your document is valid and comprehensive.

Do I need a lawyer to create a Durable Power of Attorney in Ohio?

While it is not legally required to have a lawyer to create a Durable Power of Attorney, consulting one can be beneficial. A legal professional can help you understand the implications of the powers you are granting, ensure that the document complies with Ohio law, and address any specific concerns you may have. This can provide peace of mind and help prevent issues down the line.

Can my agent be held liable for their actions under a Durable Power of Attorney?

Your agent is generally not held liable for decisions made in good faith while acting on your behalf. However, if they act outside the authority granted to them or engage in fraudulent behavior, they could face legal consequences. It’s crucial to choose someone trustworthy and responsible as your agent to minimize the risk of any potential issues.

Ohio Durable Power of Attorney: Usage Steps

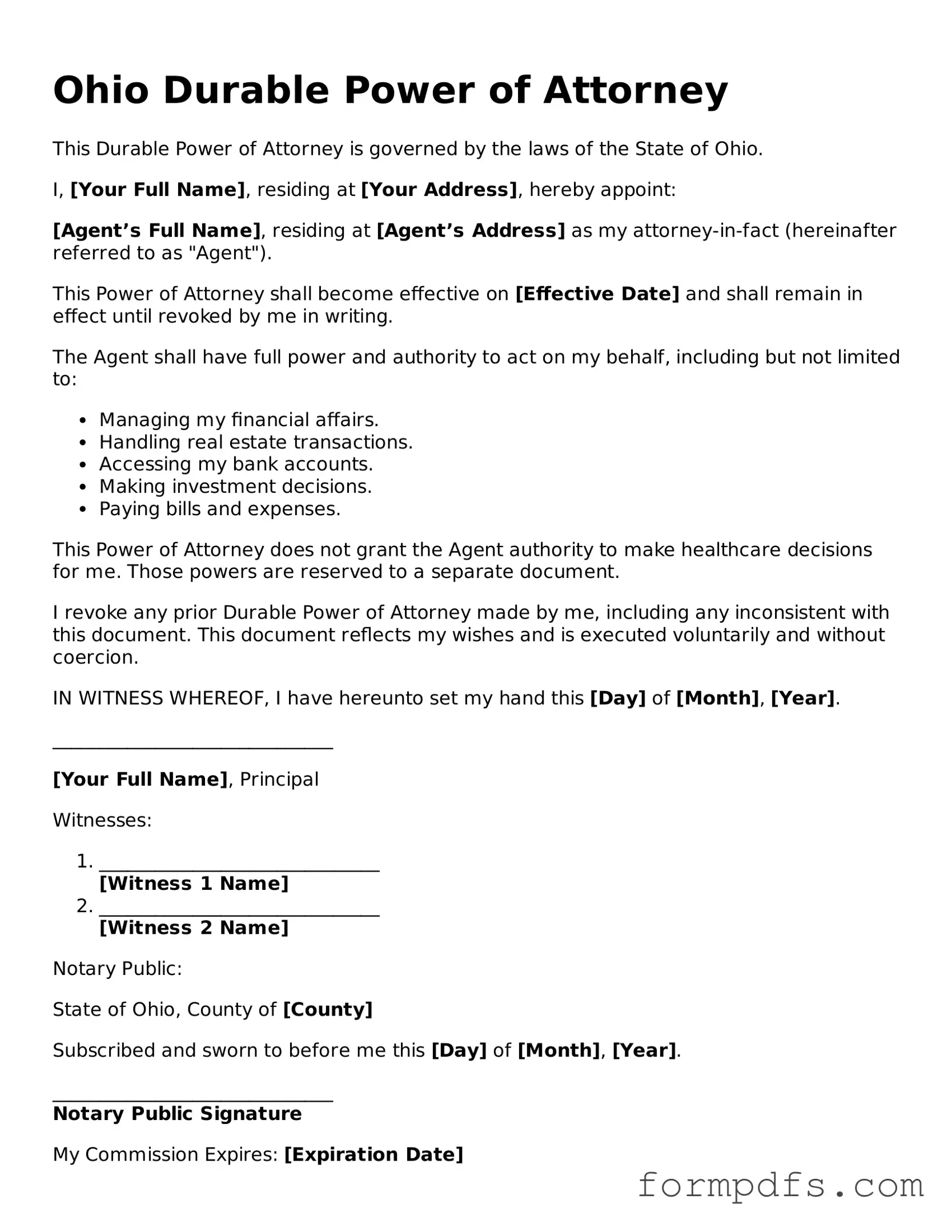

Filling out the Ohio Durable Power of Attorney form is an important step in designating someone to make decisions on your behalf. This process requires careful consideration and attention to detail. Below are the steps to guide you through completing the form accurately.

- Begin by downloading the Ohio Durable Power of Attorney form from a reliable source or obtain a physical copy from a legal office.

- At the top of the form, fill in your full name and address. This identifies you as the principal.

- Next, enter the name and address of the person you are appointing as your attorney-in-fact. This individual will act on your behalf.

- Specify the powers you wish to grant. You can choose general powers, which cover a wide range of decisions, or limited powers, which focus on specific areas.

- Indicate whether the power of attorney will be effective immediately or if it will become effective at a later date.

- Include the date when you are signing the form. This establishes the validity of the document.

- Sign the form in the designated area. Your signature is crucial as it confirms your consent.

- Have the form witnessed by at least one person. The witness should not be the attorney-in-fact or a relative.

- If required, have the document notarized. This adds an extra layer of authenticity to the form.

After completing these steps, review the form to ensure all information is correct. Keep a copy for your records and provide a copy to your attorney-in-fact. This ensures they are prepared to act on your behalf when needed.