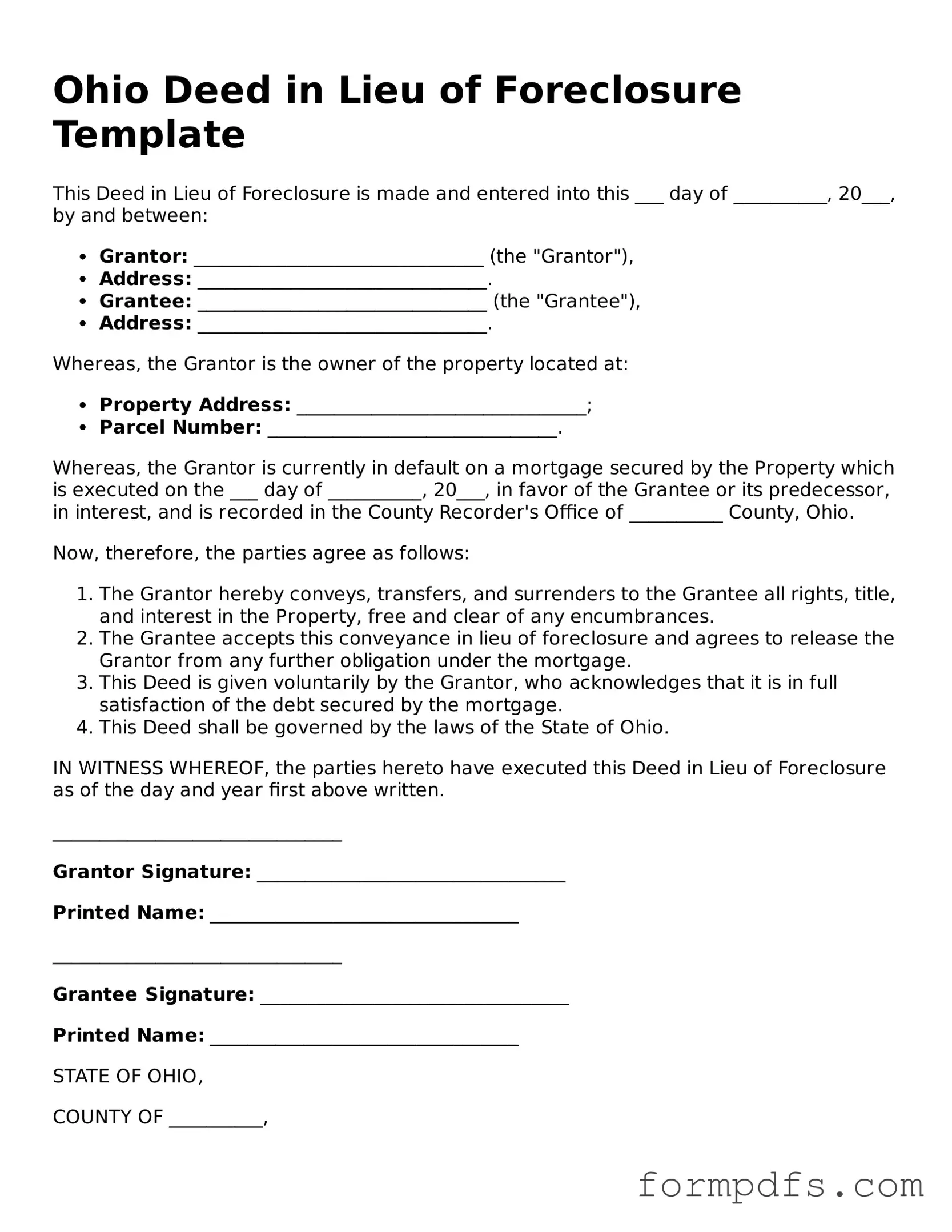

Printable Deed in Lieu of Foreclosure Form for the State of Ohio

In Ohio, homeowners facing financial difficulties may find themselves exploring various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal instrument that allows a homeowner to voluntarily transfer the title of their property back to the lender in exchange for the cancellation of the mortgage debt. This process can provide a more streamlined and less stressful alternative to the lengthy foreclosure proceedings. Homeowners who opt for this route may benefit from the potential to preserve their credit score better than they would through a foreclosure. The Deed in Lieu of Foreclosure form typically requires the homeowner to provide detailed information about the property and any outstanding liens. Additionally, it is crucial for homeowners to understand that lenders may have specific requirements and conditions that must be met before accepting the deed. Engaging in this process can be a significant step toward regaining financial stability, but it is essential to approach it with careful consideration and awareness of the implications involved.

Check out Other Common Deed in Lieu of Foreclosure Templates for Different States

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Gathering thorough documentation of income and financial hardship can support a case for a Deed in Lieu.

For individuals involved in legal matters, understanding the significance of the California Judicial Council form is crucial, as it facilitates a uniform approach to document submission in California courts. Notably, the MC-020 form provides an additional page that can be seamlessly attached to any Judicial Council form or other court filings, enhancing the clarity and organization of legal documents. To explore further details and access necessary forms, you can visit All California Forms.

Documents used along the form

When considering a Deed in Lieu of Foreclosure in Ohio, several other documents may accompany this form to ensure a smooth process. Each of these documents serves a specific purpose and helps clarify the responsibilities and rights of the parties involved. Below is a list of commonly used forms that may be necessary.

- Loan Modification Agreement: This document outlines any changes to the original loan terms. It may include adjustments to the interest rate, payment schedule, or loan balance, allowing the borrower to keep their home while making it more affordable.

- Notice of Default: This formal notification informs the borrower that they are in default on their loan. It typically specifies the amount owed and the steps the borrower must take to remedy the situation before further action is taken.

- Property Inspection Report: This report provides an assessment of the property's condition. It may be required by the lender to determine the property's value and any necessary repairs before accepting the deed.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage after the Deed in Lieu of Foreclosure is executed. It protects the borrower from future claims by the lender regarding the loan.

- Articles of Incorporation: This crucial document is necessary for establishing a corporation in New York, detailing its name, purpose, and incorporators. For more information, visit https://smarttemplates.net/fillable-new-york-articles-of-incorporation.

- Affidavit of Title: This sworn statement confirms the borrower's ownership of the property and discloses any liens or claims against it. It assures the lender that the title is clear and free of encumbrances.

Each of these documents plays a vital role in the process surrounding a Deed in Lieu of Foreclosure. Understanding their purpose can help ensure that all parties are adequately informed and protected throughout the transaction.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This form is used to simplify the foreclosure process and can help both the borrower and lender save time and money. |

| Eligibility | Typically, the borrower must be facing financial hardship and unable to keep up with mortgage payments. |

| Governing Laws | The Deed in Lieu of Foreclosure in Ohio is governed by Ohio Revised Code Section 5301.01. |

| Benefits for Borrowers | Borrowers may benefit from a less damaging impact on their credit score compared to a foreclosure. |

| Benefits for Lenders | Lenders can recover their investment more quickly, avoiding the costs associated with foreclosure proceedings. |

| Process | The process involves negotiating terms with the lender, completing the deed, and recording it with the county. |

| Potential Drawbacks | Borrowers may still face tax implications on forgiven debt and may not be eligible for future loans easily. |

| Alternatives | Other options include loan modification, short sale, or bankruptcy, which might be more suitable in some cases. |

| Legal Advice | It is advisable for borrowers to seek legal counsel before proceeding with a Deed in Lieu of Foreclosure to understand all implications. |

More About Ohio Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Ohio?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer the title of their property to the lender to avoid foreclosure. This option can be beneficial for homeowners who are struggling to make mortgage payments and want to prevent the negative impact of foreclosure on their credit score.

How does the process work?

The homeowner and lender negotiate the terms of the deed. If both parties agree, the homeowner signs the deed, transferring ownership of the property to the lender. In return, the lender may agree to forgive the remaining mortgage debt. It’s important for homeowners to understand the implications of this decision, including potential tax consequences.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

One of the main benefits is the ability to avoid the lengthy foreclosure process. This can save time and reduce stress. Additionally, a Deed in Lieu may have less of a negative impact on the homeowner's credit score compared to a foreclosure. Homeowners may also be able to negotiate a cash incentive or relocation assistance from the lender.

Are there any risks involved?

Yes, there are risks. The lender may not agree to the deed, and the homeowner may still face foreclosure if negotiations fail. Additionally, homeowners should be aware that the forgiven debt may be considered taxable income by the IRS. It’s crucial to consult with a tax professional to understand these implications fully.

Can I still live in my home during the process?

Typically, once the deed is signed and accepted by the lender, the homeowner must vacate the property. This means that homeowners should plan for a transition period and find alternative housing arrangements. It is advisable to discuss the timeline with the lender to ensure a smooth transition.

What documents do I need to provide?

Homeowners will need to provide various documents, including proof of income, a hardship letter explaining their situation, and any relevant financial information. The lender may request additional documentation to assess the homeowner's eligibility for a Deed in Lieu of Foreclosure.

Is legal assistance recommended?

Yes, obtaining legal assistance is highly recommended. A lawyer can help navigate the complexities of the process, ensure that the homeowner's rights are protected, and provide guidance on any potential tax implications. Legal advice can be invaluable in making informed decisions during this challenging time.

Ohio Deed in Lieu of Foreclosure: Usage Steps

Once you have the Ohio Deed in Lieu of Foreclosure form ready, it’s time to fill it out accurately. Completing this form correctly is essential for a smooth process. Follow these steps to ensure you fill it out properly.

- Gather necessary information. Before you begin, collect all relevant information, such as property details, your name, and the lender's information.

- Fill in the property address. Clearly write the full address of the property involved in the deed.

- Provide your name. Enter your full legal name as the current owner of the property.

- Include the lender's name. Write the full name of the lender or the bank accepting the deed.

- Describe the property. Include a brief description of the property, such as its type and any identifying features.

- Sign the form. Make sure to sign the document in the designated area. Your signature must match the name you provided.

- Get it notarized. Take the signed form to a notary public to have it officially notarized. This step adds an extra layer of authenticity.

- Submit the form. Finally, submit the completed and notarized form to the appropriate county office or your lender, as instructed.

After completing these steps, keep a copy of the signed and notarized form for your records. This will be important for any future reference or follow-up actions.