Printable Deed Form for the State of Ohio

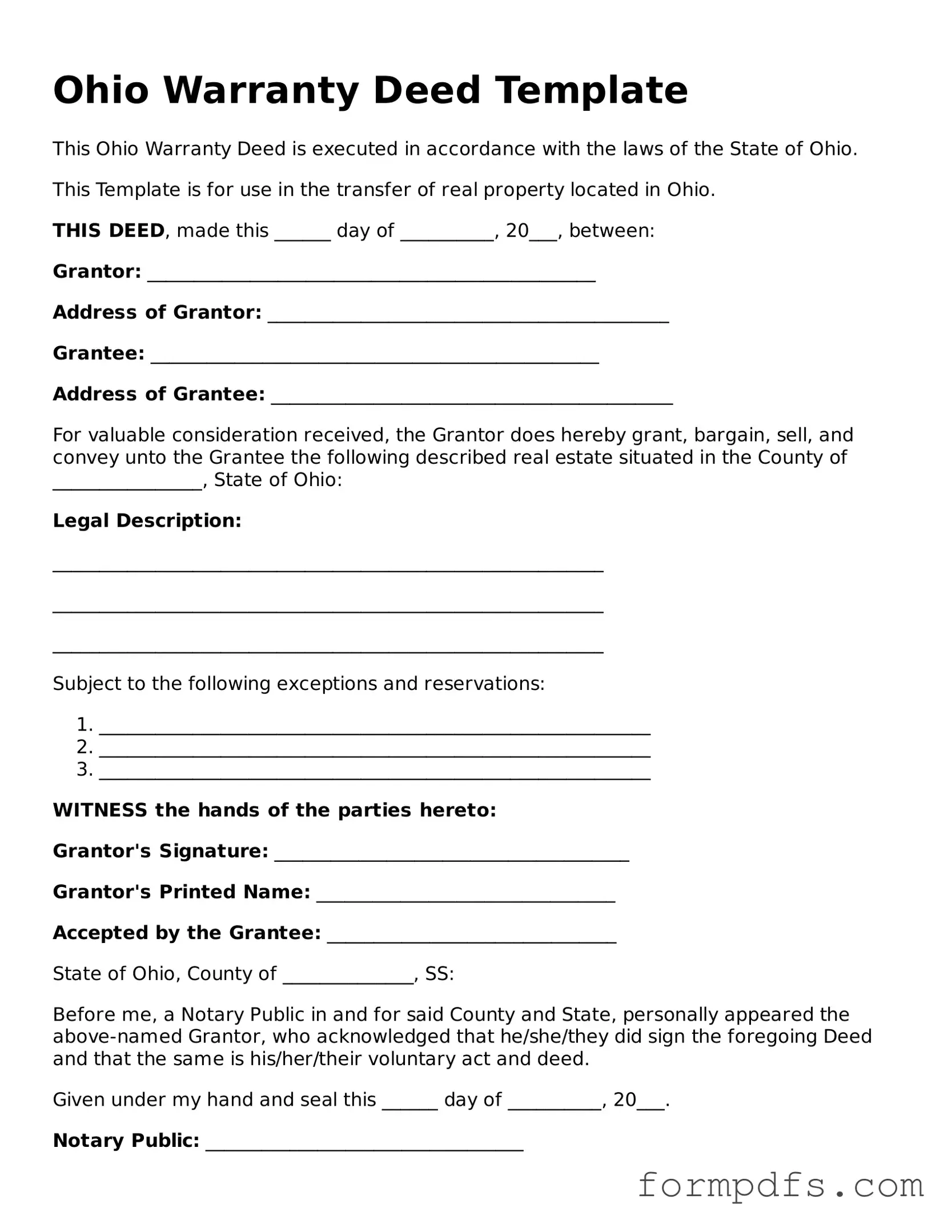

When it comes to transferring property ownership in Ohio, understanding the Ohio Deed form is essential. This legal document serves as the official record of the transfer of real estate from one party to another, ensuring that the transaction is recognized by the state. The form typically includes vital information such as the names of the grantor (the person selling or transferring the property) and the grantee (the person receiving the property), a detailed description of the property being transferred, and the purchase price, if applicable. Moreover, the Ohio Deed form may vary slightly depending on the type of deed being used—be it a warranty deed, quitclaim deed, or others—each serving different purposes and offering varying levels of protection to the parties involved. Additionally, the form must be properly executed and notarized to be legally binding, and it often needs to be filed with the county recorder's office to ensure that the change in ownership is publicly documented. Understanding these key elements can help individuals navigate the complexities of property transactions in Ohio with confidence.

Check out Other Common Deed Templates for Different States

Property Deed Form - The deed could impact future sales or refinancing of the property.

In navigating the complexities of California's legal system, understanding how to effectively utilize the California Judicial Council form is crucial. This form not only promotes standardization in legal submissions but also allows for additional pages, such as the MC-020, to be attached for clarity. For those seeking comprehensive resources, you can find essential documentation and templates at All California Forms, ensuring you have the necessary tools for your legal proceedings.

Georgia Quit Claim Deed - Customary in real estate, a deed is an essential document in ownership transfers.

Documents used along the form

When transferring property in Ohio, several forms and documents accompany the Ohio Deed form to ensure a smooth transaction. Each of these documents serves a specific purpose, contributing to the legal clarity and protection of both the buyer and seller.

- Title Search Report: This document outlines the history of ownership of the property, confirming that the seller has the right to transfer the title and that there are no outstanding liens or claims against the property.

- Articles of Incorporation - Essential for establishing a corporation in New York, this document includes the corporation's name, purpose, and details of its incorporators. For more information, visit https://smarttemplates.net/fillable-new-york-articles-of-incorporation.

- Property Disclosure Statement: Sellers provide this form to disclose any known issues with the property, such as structural problems or environmental hazards, ensuring transparency in the transaction.

- Purchase Agreement: This contract details the terms of the sale, including the purchase price and any contingencies. It serves as the foundation for the transaction between the buyer and seller.

- Affidavit of Title: This sworn statement by the seller affirms that they hold clear title to the property and outlines any encumbrances that may exist.

- Closing Statement: This document summarizes the financial aspects of the transaction, including closing costs, fees, and the final amount due from the buyer.

- IRS Form 1099-S: This tax form reports the sale of real estate to the Internal Revenue Service, ensuring that any capital gains taxes are properly accounted for.

- Power of Attorney: In cases where one party cannot be present at closing, this document allows another individual to act on their behalf in executing the necessary documents.

- Mortgage Documents: If the buyer is financing the purchase, various mortgage documents will be required, including the promissory note and mortgage agreement.

- Title Insurance Policy: This policy protects the buyer and lender against any future claims or disputes regarding the property's title.

Understanding these documents is crucial for anyone involved in a real estate transaction in Ohio. Each form plays a vital role in safeguarding the interests of all parties, ensuring that the transfer of property is both legal and efficient.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Ohio recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Governing Law | The Ohio Revised Code, specifically sections 5301.01 to 5301.99, governs the use and requirements of deeds. |

| Signature Requirements | The grantor must sign the deed for it to be valid. The signature must be notarized. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county recorder’s office. |

| Consideration | While a monetary exchange is common, a deed can be executed without consideration. |

| Property Description | A legal description of the property must be included in the deed to identify it clearly. |

| Tax Implications | Transfer taxes may apply when a property changes hands, depending on local regulations. |

| Revocation | Once executed and delivered, a deed cannot be revoked without the consent of all parties involved. |

More About Ohio Deed

What is an Ohio Deed form?

An Ohio Deed form is a legal document used to transfer ownership of real property from one party to another. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and the terms of the transfer. It is essential for ensuring that the change in ownership is officially recorded and recognized by the state.

What types of deeds are available in Ohio?

Ohio recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. A warranty deed provides the highest level of protection to the buyer, guaranteeing that the seller has clear title to the property. A quitclaim deed transfers whatever interest the seller has in the property without any guarantees. A special warranty deed offers some protection, but only for the time the seller owned the property.

How do I complete an Ohio Deed form?

To complete an Ohio Deed form, you will need to provide specific information, such as the names of the grantor (seller) and grantee (buyer), the legal description of the property, and any relevant details about the transaction. It is important to ensure all information is accurate and clearly written. After filling out the form, both parties must sign it in the presence of a notary public.

Do I need to have the deed notarized?

Yes, in Ohio, the deed must be signed in front of a notary public to be legally valid. The notary will verify the identities of the parties involved and witness the signing of the document. This step is crucial for ensuring that the deed can be recorded with the county recorder's office.

Where do I file the Ohio Deed form?

The completed and notarized Ohio Deed form must be filed with the county recorder's office in the county where the property is located. Filing the deed officially records the transfer of ownership and makes it a matter of public record. There may be a filing fee, so check with the local recorder's office for specific details.

Are there any taxes associated with transferring property in Ohio?

Yes, when transferring property in Ohio, there may be transfer taxes due. The amount can vary based on the value of the property and the county where it is located. It is advisable to check with the local county auditor or treasurer for the exact rates and any exemptions that may apply.

Can I create my own Ohio Deed form?

While it is possible to create your own Ohio Deed form, it is recommended to use a standard form or consult with a legal professional to ensure compliance with state laws. Using a standard form can help avoid errors and ensure that all necessary information is included for a valid transfer of ownership.

Ohio Deed: Usage Steps

Once you have the Ohio Deed form in hand, you are ready to begin the process of transferring property ownership. This step is crucial, as it ensures that all necessary information is accurately recorded. Following these instructions will help you complete the form correctly.

- Obtain the Ohio Deed form: Make sure you have the correct version of the form, which can be found online or at your local county recorder's office.

- Identify the parties involved: Clearly list the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide property details: Fill in the legal description of the property. This may include the address, parcel number, and any other identifying information.

- Include consideration: State the amount of money or value exchanged for the property. This is often referred to as the "consideration" for the deed.

- Sign the form: The grantor must sign the deed in front of a notary public. Ensure that the signature is clear and matches the name provided.

- Notarization: After signing, the notary will complete their section, verifying the identity of the grantor and witnessing the signature.

- Record the deed: Submit the completed deed to the county recorder's office in the county where the property is located. There may be a fee for recording.

- Obtain a copy: After recording, request a certified copy of the deed for your records.