Printable Articles of Incorporation Form for the State of Ohio

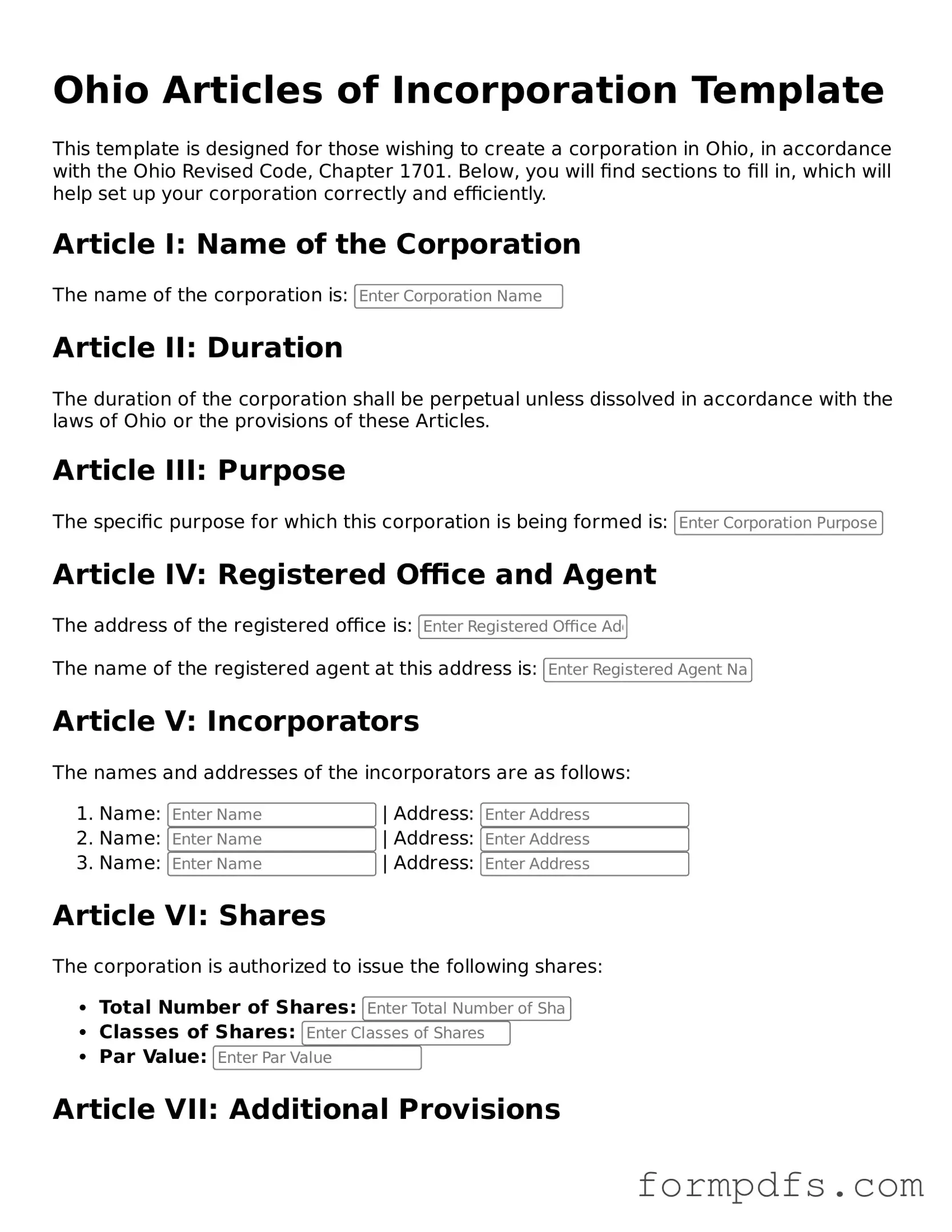

When starting a business in Ohio, one of the first steps involves filing the Articles of Incorporation. This essential document lays the groundwork for your corporation, detailing key information that defines its structure and purpose. The form requires you to provide the name of your corporation, which must be unique and not already in use by another entity in the state. Additionally, you will need to specify the principal office address and the duration of the corporation, which can be perpetual unless otherwise stated. The Articles also require listing the names and addresses of the initial directors, as well as the purpose of the corporation, which can be broad or specific. Importantly, this document must be signed by the incorporators, who are responsible for the formation of the corporation. Filing this form with the Ohio Secretary of State is a critical step that officially establishes your business as a legal entity, allowing it to operate within the state and beyond.

Check out Other Common Articles of Incorporation Templates for Different States

Articles of Organization Michigan - Sets out the rights and preferences of shareholders.

Ga Corporation - Collectively, they outline the vision and mission of the corporation as a business entity.

How to Incorporate in Nc - This document serves as a public record of the corporation's creation.

A Non-disclosure Agreement (NDA) form in Arizona is a legal document that creates a confidential relationship between parties, ensuring that sensitive information shared remains private. This tool is invaluable for businesses and individuals seeking to protect proprietary data or trade secrets. For those looking to secure their information in Arizona, filling out the Non-disclosure Agreement form is an essential step.

How to Get a Copy of Your Articles of Incorporation - Incorporation can lead to tax benefits for the business.

Documents used along the form

When forming a corporation in Ohio, the Articles of Incorporation serve as a foundational document. However, several other forms and documents are often required or beneficial during the incorporation process. Each of these documents plays a crucial role in ensuring compliance with state laws and facilitating smooth business operations.

- Bylaws: This document outlines the internal rules and regulations governing the corporation's operations. Bylaws specify the roles of officers, the process for holding meetings, and how decisions are made.

- Initial Report: Some states require corporations to file an initial report shortly after incorporation. This report typically includes basic information about the corporation and its officers.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes and is required for hiring employees. This application is submitted to the IRS to obtain the unique number assigned to the business.

- Operating Agreement: While more common for LLCs, some corporations also draft an operating agreement to clarify the management structure and operational procedures, particularly if multiple stakeholders are involved.

- Shareholder Agreements: These agreements are essential for corporations with multiple shareholders. They define the rights and responsibilities of shareholders, including how shares can be transferred.

- Business Licenses and Permits: Depending on the nature of the business, various local, state, or federal licenses and permits may be required to operate legally.

- Annual Report: Many states require corporations to file an annual report that updates the state on the corporation’s status, including changes in address, officers, or business activities.

- California 1285.65 Form: This critical document allows for the modification of an existing Wage and Earnings Assignment Order, addressing changes such as custody or support payments, and can be accessed through All California Forms.

- Resolution of Incorporation: This document is often created by the board of directors to formally adopt the Articles of Incorporation and set forth initial actions taken by the corporation.

- Minutes of Organizational Meeting: After incorporation, the first meeting of the board of directors should be documented. Minutes serve as a record of decisions made during this meeting.

Incorporating a business is a significant step that requires careful attention to detail. Ensuring that all necessary documents are prepared and filed correctly is crucial for establishing a solid legal foundation for the corporation. Each document serves a specific purpose and collectively contributes to the effective governance and operation of the business.

PDF Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Ohio Articles of Incorporation are governed by the Ohio Revised Code, specifically Chapter 1701. |

| Purpose | This form is used to legally establish a corporation in the state of Ohio. |

| Filing Requirement | To create a corporation, the Articles of Incorporation must be filed with the Ohio Secretary of State. |

| Information Needed | Key information required includes the corporation's name, principal office address, and registered agent details. |

| Fees | A filing fee is required, which varies depending on the type of corporation being formed. |

| Effective Date | The corporation can specify an effective date for the Articles of Incorporation, which may be immediate or a future date. |

More About Ohio Articles of Incorporation

What are the Articles of Incorporation in Ohio?

The Articles of Incorporation is a legal document that establishes a corporation in Ohio. It outlines essential details about the business, including its name, purpose, and structure. Filing this document is a crucial step in forming a corporation, as it provides the state with the necessary information to recognize the business as a legal entity.

Who needs to file the Articles of Incorporation?

Any individual or group looking to start a corporation in Ohio must file the Articles of Incorporation. This includes for-profit businesses, non-profit organizations, and professional corporations. It is important to ensure that the correct type of corporation is chosen based on the intended purpose of the business.

What information is required in the Articles of Incorporation?

The form requires several key pieces of information. This includes the corporation's name, the principal office address, the purpose of the corporation, the number of shares authorized, and the names and addresses of the incorporators. Providing accurate and complete information is vital to avoid delays in processing.

How do I file the Articles of Incorporation?

Filing can be done online or by mail. If you choose to file online, you can visit the Ohio Secretary of State’s website. For mail filings, you will need to download the form, complete it, and send it to the appropriate address along with the required filing fee. Ensure that all documents are signed and dated correctly to prevent any issues.

What is the filing fee for the Articles of Incorporation?

The filing fee varies depending on the type of corporation you are forming. Generally, the fee is around $99 for a standard for-profit corporation. Non-profit organizations may have different fees. It is advisable to check the latest fee schedule on the Ohio Secretary of State’s website to ensure you have the correct amount.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, online filings are processed faster, often within a few business days. Mail filings may take longer, sometimes up to several weeks. If you need your corporation established quickly, online filing is the preferred method.

Can I amend the Articles of Incorporation after filing?

Yes, amendments can be made to the Articles of Incorporation after they have been filed. If there are changes to the corporation’s name, purpose, or structure, you will need to file an amendment form with the Ohio Secretary of State. There may be additional fees associated with this process.

Do I need an attorney to file the Articles of Incorporation?

While it is not legally required to have an attorney, consulting with one can be beneficial. An attorney can provide guidance on the best structure for your business and help ensure that all legal requirements are met. If you feel confident in completing the form yourself, you can proceed without legal assistance.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, your corporation will officially exist as a legal entity. You will receive a confirmation from the state, which may include a certificate of incorporation. After this, it is essential to comply with ongoing requirements, such as filing annual reports and maintaining good standing with the state.

What are the next steps after incorporating in Ohio?

After incorporating, you should take several important steps. First, obtain an Employer Identification Number (EIN) from the IRS for tax purposes. Next, set up a corporate bank account to keep your business finances separate from personal ones. Additionally, consider drafting bylaws and holding an initial board meeting to establish governance for your corporation.

Ohio Articles of Incorporation: Usage Steps

After you complete the Ohio Articles of Incorporation form, you will need to submit it to the appropriate state office. This process is essential for officially establishing your corporation in Ohio. Make sure to have all necessary information ready before you start filling out the form.

- Begin by downloading the Ohio Articles of Incorporation form from the Ohio Secretary of State’s website.

- Read through the form carefully to understand what information is required.

- Fill in the name of your corporation. Ensure that the name is unique and complies with Ohio naming rules.

- Provide the purpose of your corporation. This should be a brief statement about what your business will do.

- Enter the address of your corporation's principal office. This must be a physical address in Ohio.

- List the name and address of the registered agent. This person or business will receive legal documents on behalf of your corporation.

- Indicate the number of shares your corporation is authorized to issue. If applicable, specify the par value of the shares.

- Include the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Sign and date the form. Ensure that all incorporators sign where required.

- Review the form for any errors or missing information before submission.

- Submit the completed form along with the required filing fee to the Ohio Secretary of State’s office.