Printable Transfer-on-Death Deed Form for the State of North Carolina

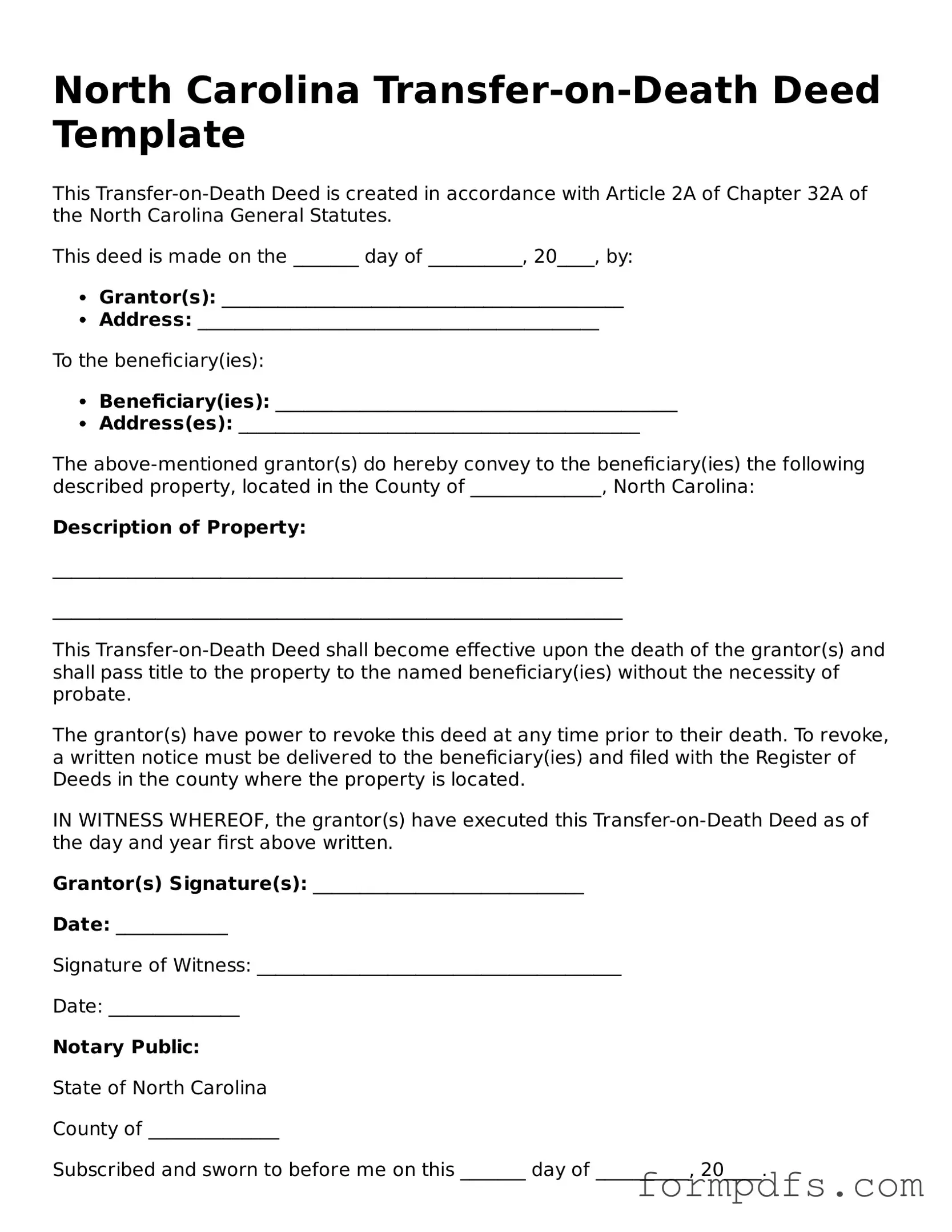

In North Carolina, the Transfer-on-Death Deed (TODD) serves as a valuable tool for property owners looking to streamline the transfer of their real estate upon death. This form allows individuals to designate a beneficiary who will automatically receive the property without the need for probate, simplifying the process for loved ones during a difficult time. The TODD must be executed with proper formalities, including notarization and recording with the local register of deeds, to ensure its validity. It provides flexibility, as property owners can revoke or modify the deed at any time while they are still alive. Importantly, the beneficiary does not have any rights to the property until the owner passes away, which protects the owner's interests during their lifetime. Understanding the nuances of this deed is crucial for anyone considering estate planning in North Carolina, as it can significantly impact how assets are managed and transferred after death.

Check out Other Common Transfer-on-Death Deed Templates for Different States

Ohio Transfer on Death Form - The Transfer-on-Death Deed is effective immediately upon the property owner's death, without delays.

When engaging in activities or agreements that may carry risks, it’s vital to complete the necessary forms to safeguard your interests. For those in Arizona, a prudent step would be to fill out the essential documentation for the Hold Harmless Agreement form. Access the form through this link for more information: necessary Hold Harmless Agreement provisions.

Title Companies and Transfer on Death Deeds - The deed only applies to real property, not personal property or financial assets.

Documents used along the form

The North Carolina Transfer-on-Death Deed allows property owners to transfer their real estate to designated beneficiaries upon their death. While this deed serves a specific purpose, several other documents often accompany it to ensure a smooth transfer process and proper documentation of intentions. Below are some key forms and documents frequently used in conjunction with the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets will be distributed upon their death. It can complement a Transfer-on-Death Deed by clarifying any additional wishes regarding other assets.

- Affidavit of Heirship: This sworn statement helps establish the heirs of a deceased person. It can be useful in confirming the beneficiaries named in the Transfer-on-Death Deed.

- Property Deed: The original deed to the property provides legal proof of ownership. It should be referenced in the Transfer-on-Death Deed to ensure clarity about the property being transferred.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance or retirement plans. They ensure that assets outside of the property are also directed to the intended beneficiaries.

- Address Change California Form: This crucial form is necessary for updating the address of record for individuals and firms licensed under the California Board of Accountancy. It is essential to report changes promptly to avoid fines, and it also provides an option to exclude one's name from lists sold for mailing purposes. For further reference, please visit All California Forms.

- Power of Attorney: This document grants someone the authority to act on behalf of the property owner. It can be important if the owner becomes incapacitated and needs someone to manage their affairs.

- Notice of Transfer-on-Death Deed: This document serves to notify interested parties of the transfer of property upon the owner's death. It can help prevent disputes among potential heirs.

Using these documents in conjunction with the North Carolina Transfer-on-Death Deed can help ensure that your wishes are respected and that the transfer of property occurs as intended. Proper documentation is key to avoiding complications for your beneficiaries in the future.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in North Carolina to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD deed is governed by North Carolina General Statutes, specifically G.S. 32A-1.1. |

| Eligibility | Only real property, such as land and buildings, can be transferred using a TOD deed. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the TOD deed, who will receive the property after the owner's death. |

| Revocation | The deed can be revoked or changed by the property owner at any time before their death, provided proper procedures are followed. |

| Filing Requirements | The TOD deed must be recorded in the county where the property is located to be effective. |

| Tax Implications | There are no immediate tax implications for the property owner when executing a TOD deed, but beneficiaries may face tax obligations upon transfer. |

More About North Carolina Transfer-on-Death Deed

What is a Transfer-on-Death Deed in North Carolina?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to transfer their real estate to a designated beneficiary upon their death. This type of deed bypasses the probate process, making the transfer of property simpler and more efficient for the beneficiaries. It is important to note that the property owner retains full control over the property during their lifetime, including the right to sell or mortgage it without the beneficiary's consent.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in North Carolina can utilize a Transfer-on-Death Deed. This includes homeowners, landowners, and individuals who hold title to property. However, it is crucial that the property is not subject to any liens or claims that could complicate the transfer process.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, the property owner must fill out the form with accurate information. This includes the legal description of the property, the names of the beneficiaries, and the property owner's signature. It is advisable to have the document notarized to ensure its validity. After completing the form, it should be filed with the county register of deeds where the property is located.

Is there a deadline for filing a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed must be filed before the property owner's death for it to be effective. If the deed is not recorded prior to the owner's passing, the property will not transfer automatically to the designated beneficiaries and may instead be subject to probate.

Can I revoke a Transfer-on-Death Deed?

Absolutely. A property owner can revoke a Transfer-on-Death Deed at any time before their death. This can be done by executing a new deed that explicitly states the revocation or by recording a formal revocation document with the county register of deeds. It is essential to ensure that the revocation is properly documented to avoid any confusion later on.

What happens if I do not name a beneficiary in the Transfer-on-Death Deed?

If a property owner fails to name a beneficiary in the Transfer-on-Death Deed, the property will not transfer automatically upon the owner's death. Instead, it will be treated as part of the deceased's estate and will be subject to probate. This can lead to additional costs and delays for the heirs.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when executing a Transfer-on-Death Deed. The property remains part of the owner's estate until their death. However, beneficiaries may be responsible for property taxes once the property is transferred. It is advisable to consult with a tax professional to understand any potential tax consequences fully.

Can a Transfer-on-Death Deed be contested?

While a Transfer-on-Death Deed is designed to simplify the transfer of property, it can still be contested under certain circumstances. If there are claims of undue influence, lack of capacity, or if the deed was not executed properly, a challenge may arise. It is crucial to ensure that the deed is completed correctly and that the property owner is of sound mind when executing the document.

Where can I find a Transfer-on-Death Deed form for North Carolina?

Transfer-on-Death Deed forms can typically be found online through the North Carolina Secretary of State's website or at local county offices. Additionally, many legal service providers offer templates that can be customized to fit individual needs. It is important to ensure that any form used complies with North Carolina laws to avoid issues with validity.

North Carolina Transfer-on-Death Deed: Usage Steps

After obtaining the North Carolina Transfer-on-Death Deed form, it is important to fill it out accurately to ensure that your property is transferred as intended. Follow these steps carefully to complete the form.

- Gather necessary information: Collect details about the property, including the address and legal description. You'll also need the names and addresses of the beneficiaries.

- Fill out the top section: Enter your name as the grantor, along with your address. This identifies you as the current owner of the property.

- Provide property details: In the designated area, write the legal description of the property. This may include the parcel number or other identifying information.

- List beneficiaries: Write the names and addresses of the individuals who will receive the property upon your death. Ensure that this information is accurate.

- Sign the form: As the grantor, you must sign the document in the presence of a notary public. This step is crucial for the validity of the deed.

- Notarization: Have the notary public sign and stamp the form to confirm that you signed it in their presence.

- File the deed: Submit the completed deed to the appropriate county register of deeds office. There may be a filing fee, so check with the office for details.

Once the deed is filed, it becomes part of the public record. Ensure you keep a copy for your personal records. Review the form periodically to confirm that your intentions remain unchanged.