Printable Real Estate Purchase Agreement Form for the State of North Carolina

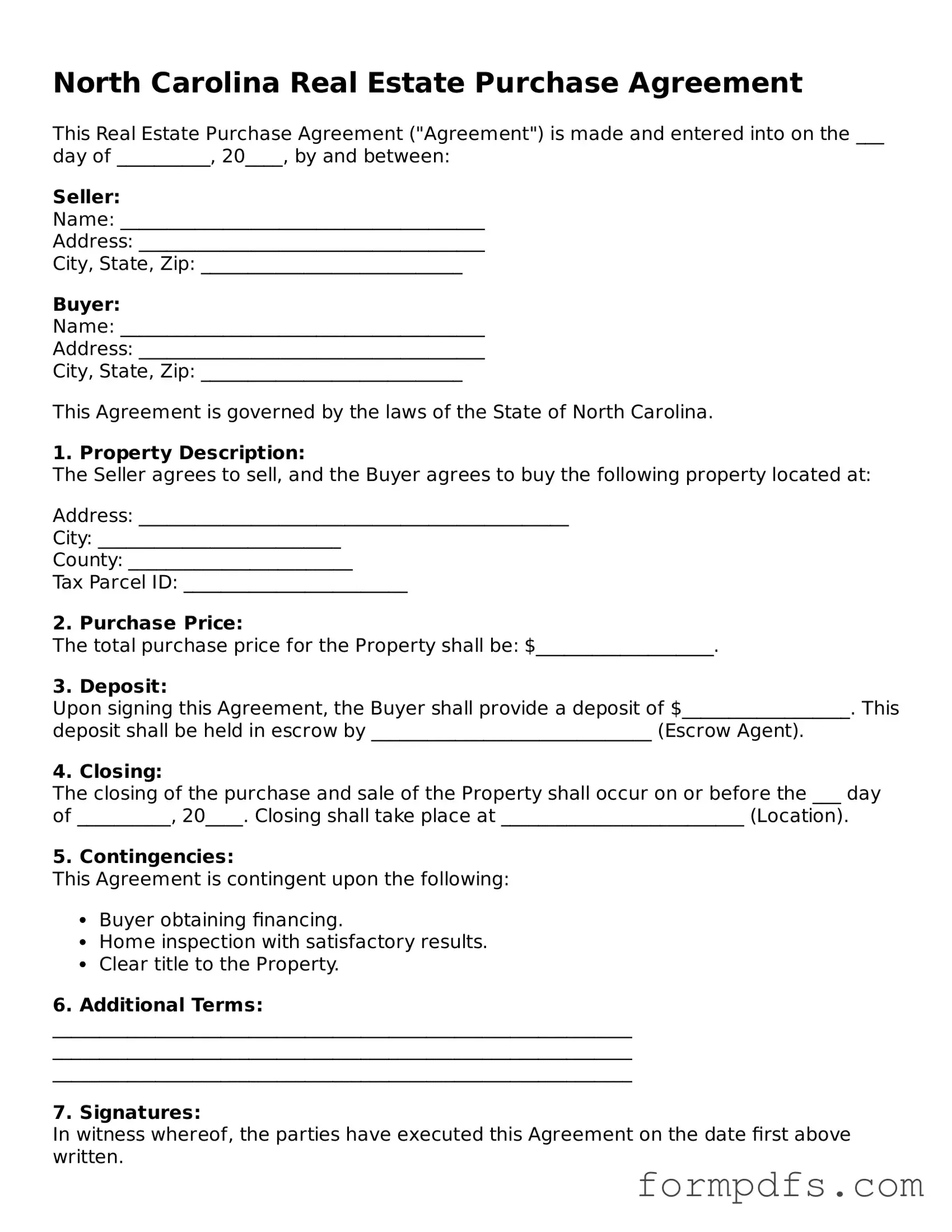

The North Carolina Real Estate Purchase Agreement form serves as a crucial document in the process of buying and selling property within the state. This legally binding contract outlines the terms and conditions agreed upon by the buyer and seller, ensuring clarity and mutual understanding. Key elements include the purchase price, financing arrangements, and closing date, which are essential for both parties to know upfront. Additionally, the form addresses contingencies, such as inspections and appraisals, that can affect the transaction's progression. It also specifies the responsibilities of each party regarding property disclosures and repairs, making it vital for a smooth transfer of ownership. By detailing these aspects, the agreement helps protect the interests of both the buyer and the seller, fostering a transparent and organized real estate transaction process.

Check out Other Common Real Estate Purchase Agreement Templates for Different States

Offer to Purchase Real Estate Form Pdf - Buyers are advised to review the terms carefully, potentially with legal advice.

When engaging in the sale of a boat in New York, utilizing the New York Boat Bill of Sale form is essential to ensure that both buyer and seller are protected throughout the transaction. This form not only captures essential details about the boat, buyer, and seller but also serves to avoid any potential disputes in the future. For a comprehensive and reliable template, you can visit smarttemplates.net/fillable-new-york-boat-bill-of-sale/.

Real Estate Contract for Sale by Owner Free Georgia - The agreement can address any potential liens or claims against the property that may affect the sale.

Free Purchase Agreement Form - Disclosures about neighborhood conditions might be included as well.

Michigan Real Estate Forms - Describes the condition of the property at the time of sale.

Documents used along the form

When buying or selling real estate in North Carolina, several documents work alongside the Real Estate Purchase Agreement. Each of these forms plays a crucial role in the transaction process. Here’s a list of common documents you may encounter:

- Due Diligence Agreement: This document outlines the buyer's right to inspect the property before finalizing the purchase. It specifies the time frame for inspections and any fees associated with this period.

- Property Disclosure Statement: Sellers provide this form to disclose any known issues with the property. It helps buyers make informed decisions by revealing the property's condition.

- Closing Disclosure: This document details the final terms of the mortgage, including loan costs, closing costs, and other financial aspects. It must be provided to the buyer at least three days before closing.

- Title Search Report: Conducted by a title company, this report confirms the legal ownership of the property and identifies any liens or claims against it. Ensuring clear title is essential for a successful transaction.

- California Civil Form: This form is essential for legal proceedings in California, facilitating various applications from filing lawsuits to responding to complaints. For those navigating civil litigation, it is critical to know the requirements of these forms, including All California Forms.

- Bill of Sale: This document transfers ownership of personal property included in the sale, such as appliances or furniture. It outlines what items are part of the transaction.

- Warranty Deed: This legal document transfers ownership of the property from the seller to the buyer. It guarantees that the seller has the right to sell the property and that it is free from claims.

- Affidavit of Title: The seller signs this document, affirming that they are the rightful owner and that there are no undisclosed issues with the title. This helps protect the buyer from future claims.

Understanding these documents can help streamline the real estate transaction process. Each form serves a specific purpose, ensuring that both buyers and sellers are protected throughout the journey.

PDF Overview

| Fact Name | Description |

|---|---|

| Governing Law | The North Carolina Real Estate Purchase Agreement is governed by the North Carolina General Statutes, specifically Chapter 47. |

| Standard Form | This agreement is a standardized form provided by the North Carolina Association of Realtors, ensuring consistency in real estate transactions. |

| Essential Elements | Key components include the purchase price, property description, and closing date, which are crucial for a clear understanding between buyer and seller. |

| Contingencies | Buyers can include contingencies, such as financing or inspection clauses, allowing them to back out of the deal under specific conditions. |

| Signatures Required | Both parties must sign the agreement for it to be legally binding, highlighting the importance of mutual consent in real estate transactions. |

More About North Carolina Real Estate Purchase Agreement

What is a North Carolina Real Estate Purchase Agreement?

The North Carolina Real Estate Purchase Agreement is a legal document used to outline the terms and conditions under which a buyer agrees to purchase a property from a seller. It serves as a binding contract that details the purchase price, closing date, and any contingencies that must be met before the sale is finalized.

Who typically uses this agreement?

This agreement is primarily used by buyers and sellers of real estate in North Carolina. Real estate agents often facilitate the process, ensuring that both parties understand the terms and their obligations under the agreement.

What key elements are included in the agreement?

Key elements of the North Carolina Real Estate Purchase Agreement include the purchase price, property description, closing date, contingencies (such as financing or inspections), and the responsibilities of both the buyer and seller. It may also outline any personal property included in the sale.

Is the agreement legally binding?

Yes, once both parties sign the North Carolina Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to fulfill the terms outlined in the agreement unless they mutually agree to modify or cancel it.

What are contingencies, and why are they important?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing approval, satisfactory home inspections, and appraisal requirements. They protect both parties by allowing the buyer to withdraw from the agreement if certain conditions are not met.

Can the agreement be modified after signing?

Yes, the North Carolina Real Estate Purchase Agreement can be modified after signing, but any changes must be agreed upon by both parties. It is advisable to document any modifications in writing to avoid misunderstandings in the future.

What happens if one party breaches the agreement?

If one party fails to uphold their end of the agreement, it may be considered a breach of contract. The non-breaching party may have the right to seek legal remedies, which could include enforcing the agreement or seeking damages. It is often best to resolve disputes amicably before pursuing legal action.

Do I need a lawyer to complete the agreement?

While it is not legally required to have a lawyer review the North Carolina Real Estate Purchase Agreement, it is highly recommended. A lawyer can help ensure that your rights are protected and that the agreement is in your best interest.

How can I obtain a copy of the agreement?

The North Carolina Real Estate Purchase Agreement can typically be obtained through real estate agents, online legal resources, or local real estate associations. Ensure that you are using the most current version of the form to comply with state regulations.

What should I do if I have questions about the agreement?

If you have questions about the North Carolina Real Estate Purchase Agreement, consider consulting with a real estate professional or an attorney. They can provide guidance specific to your situation and help clarify any terms or conditions you may find confusing.

North Carolina Real Estate Purchase Agreement: Usage Steps

After gathering the necessary information, you’re ready to fill out the North Carolina Real Estate Purchase Agreement form. This document outlines the terms of the property sale and is crucial for both the buyer and seller. Completing it accurately ensures a smooth transaction.

- Identify the Parties: Enter the full legal names of the buyer(s) and seller(s). Include any applicable middle initials or suffixes to avoid confusion.

- Property Description: Provide the complete address of the property being sold. Include any additional details like lot number or subdivision name if applicable.

- Purchase Price: State the total purchase price of the property. Be clear and precise to avoid any misunderstandings.

- Earnest Money Deposit: Specify the amount of earnest money the buyer will provide. Include details on how this money will be held.

- Financing Terms: Indicate whether the buyer will be using cash, a mortgage, or other financing methods. Include any relevant details about loan types or conditions.

- Closing Date: Set a proposed closing date for the transaction. This is typically when the buyer takes possession of the property.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections or financing approval.

- Additional Terms: Include any other agreements or terms that are specific to this transaction, such as repairs or appliances included in the sale.

- Signatures: Ensure all parties sign and date the agreement. Signatures must be original; electronic signatures may not be acceptable.

Once the form is completed, review it carefully for accuracy. Each party should keep a signed copy for their records. It’s advisable to consult with a real estate professional or attorney if any questions arise during the process.