Printable Promissory Note Form for the State of North Carolina

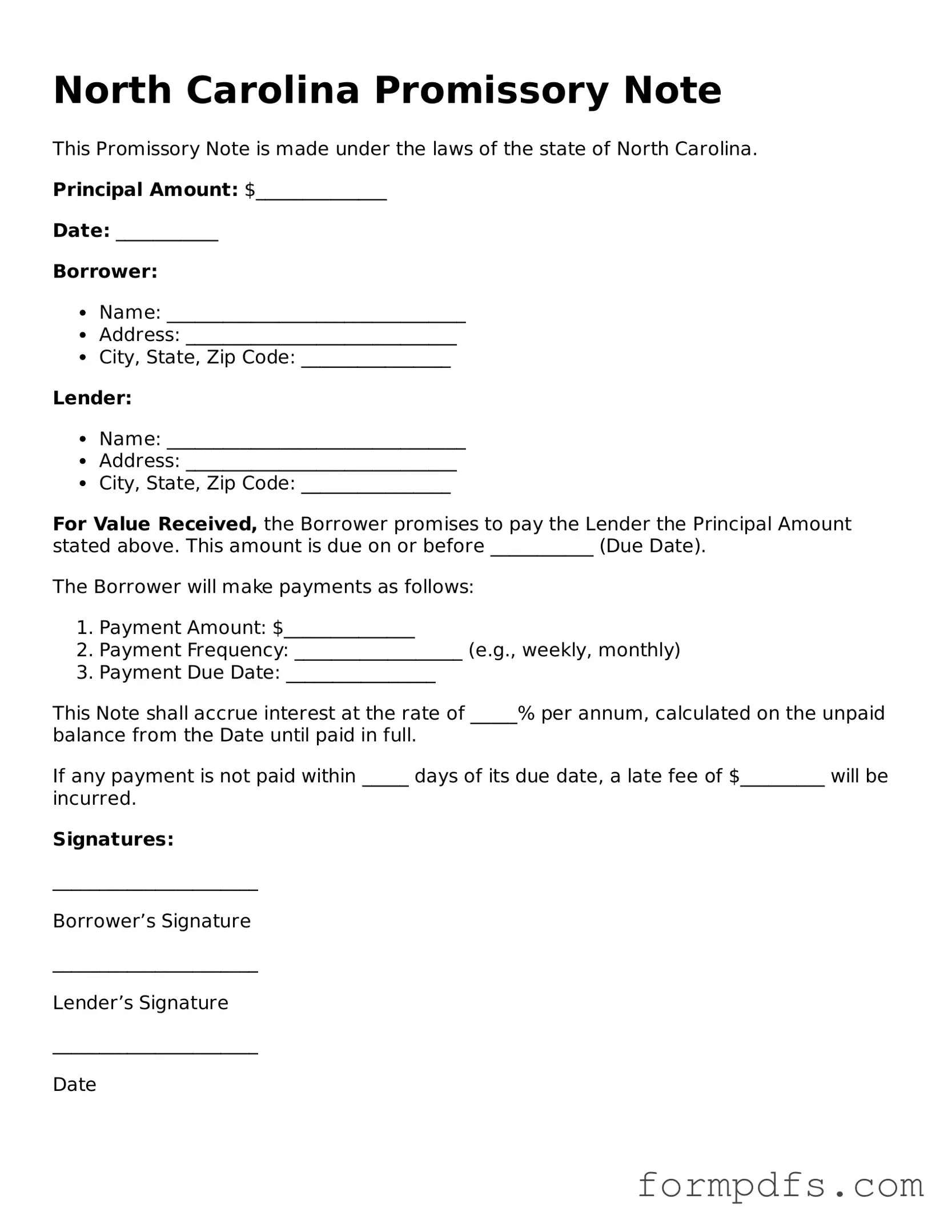

In North Carolina, a Promissory Note serves as a crucial financial document that outlines the terms of a loan between a lender and a borrower. This form details the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties have a clear understanding of their obligations. It typically includes provisions for late fees and default, which protect the lender’s interests while also offering the borrower a framework for repayment. Additionally, the note may specify whether the loan is secured or unsecured, impacting the lender's recourse in case of default. Understanding the nuances of this form is essential for anyone involved in borrowing or lending money, as it not only formalizes the agreement but also serves as a legal record should disputes arise. By adhering to the specific requirements laid out in North Carolina law, parties can ensure that their Promissory Note is enforceable and protects their rights effectively.

Check out Other Common Promissory Note Templates for Different States

Promissory Note Template Ohio - Borrowers should be mindful of their repayment schedule to avoid default.

Free Promissory Note Template Georgia - Lenders assess the creditworthiness of borrowers before issuing a promissory note.

To facilitate the verification process, employers can utilize resources like the onlinelawdocs.com/ which provides a comprehensive Employment Verification Form, ensuring that all necessary details about an employee's past employment are accurately documented.

Promissory Note Illinois - It may also outline the conditions for early repayment, if applicable.

Documents used along the form

The North Carolina Promissory Note is a critical document for establishing a loan agreement between a lender and a borrower. However, several other forms and documents are often used in conjunction with this note to ensure clarity and legal compliance. Below is a list of related documents that may be beneficial in the context of a loan transaction.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both parties.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral and the rights of the lender in case of default. It provides legal protection for the lender's interests.

- Disclosure Statement: This document provides borrowers with important information about the loan, including fees, interest rates, and terms. It ensures transparency and helps borrowers make informed decisions.

- Address Change California Form: A necessary document for updating the address of record with the California Board of Accountancy, ensuring you receive important correspondence. For more information, visit All California Forms.

- Personal Guarantee: A personal guarantee may be required from the borrower or a third party, ensuring that the lender can pursue the guarantor's personal assets if the borrower defaults.

- UCC Financing Statement: This form is filed to perfect a security interest in the collateral. It provides public notice of the lender's claim and protects their rights in case of borrower bankruptcy.

- Amortization Schedule: This document breaks down each payment into principal and interest components over the life of the loan. It helps borrowers understand their payment obligations.

- Default Notice: If the borrower fails to meet their obligations, this notice serves as a formal communication regarding the default and outlines potential consequences.

- Loan Modification Agreement: Should the borrower need to change the terms of the loan, this document outlines the new terms and conditions, ensuring both parties agree to the modifications.

- Release of Lien: Once the loan is fully repaid, this document releases the lender's claim on the collateral, providing assurance to the borrower that they own the asset free and clear.

Using these documents in conjunction with the North Carolina Promissory Note can help protect the interests of both the lender and the borrower. Each document plays a unique role in ensuring that the loan process is clear, transparent, and legally sound.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time or on demand. |

| Governing Law | North Carolina General Statutes, Chapter 25, Article 3 governs the use and enforcement of promissory notes in North Carolina. |

| Requirements | The note must include the amount to be paid, the interest rate (if any), and the terms of repayment. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and delivered to the payee. |

More About North Carolina Promissory Note

What is a North Carolina Promissory Note?

A North Carolina Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payment. This document serves as a binding agreement between the two parties involved in the transaction.

Who can use a Promissory Note in North Carolina?

Any individual or business can use a Promissory Note in North Carolina. This includes personal loans between friends or family, as well as more formal agreements between businesses and clients. It’s important that both parties understand the terms outlined in the note to ensure clarity and prevent disputes.

What information is required in a North Carolina Promissory Note?

A Promissory Note in North Carolina should include the names and addresses of both the borrower and the lender, the principal amount being borrowed, the interest rate, the repayment schedule, and any late fees or penalties. It may also include provisions for default and any collateral if applicable.

Is a Promissory Note legally binding?

Yes, a Promissory Note is legally binding in North Carolina as long as it meets certain requirements. It must be signed by both parties, and the terms must be clear and specific. If either party fails to adhere to the terms, the other party may have legal grounds to enforce the agreement.

Do I need a lawyer to create a Promissory Note?

While it’s not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A lawyer can help ensure that the document is properly structured, complies with state laws, and adequately protects your interests. If the loan amount is significant or the terms are complex, legal advice is highly recommended.

Can I modify a Promissory Note after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It’s best to document any modifications in writing, and both parties should sign the revised note to avoid any confusion or disputes in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They may pursue legal action to recover the owed amount, which could involve filing a lawsuit. The Promissory Note may outline specific remedies in case of default, such as late fees or acceleration of the loan, which means the entire balance becomes due immediately.

How can I enforce a Promissory Note in North Carolina?

To enforce a Promissory Note, the lender may need to file a lawsuit in the appropriate court if the borrower fails to repay. The lender should have a copy of the signed note and any relevant documentation, such as payment records, to support their case. It’s advisable to consult with a legal professional to navigate the enforcement process effectively.

North Carolina Promissory Note: Usage Steps

Once you have the North Carolina Promissory Note form in front of you, it’s essential to fill it out accurately to ensure it serves its intended purpose. Follow the steps outlined below to complete the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, identify the borrower. Write the full legal name of the person or entity borrowing the money.

- Provide the address of the borrower. Include street address, city, state, and zip code.

- Identify the lender. Write the full legal name of the person or entity lending the money.

- Enter the lender's address. Include street address, city, state, and zip code.

- Specify the principal amount. Write the total amount of money being borrowed in both numerical and written form.

- Detail the interest rate. Indicate the annual interest rate as a percentage.

- State the payment schedule. Specify when payments are due (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees. If applicable, indicate the amount of any late fees that will apply if a payment is missed.

- Sign the form. The borrower must sign and date the document. If there are multiple borrowers, all must sign.

- Have the lender sign the form. The lender must also sign and date the document.

After completing the form, ensure that both parties retain a copy for their records. This document will serve as a formal agreement outlining the terms of the loan.