Printable Prenuptial Agreement Form for the State of North Carolina

When planning for a future together, couples in North Carolina often consider the benefits of a prenuptial agreement. This important legal document helps partners outline their rights and responsibilities regarding property, debts, and financial matters in the event of a divorce or separation. The North Carolina Prenuptial Agreement form allows couples to specify how they want their assets to be divided, ensuring clarity and reducing potential conflicts down the road. It can cover various topics, such as the management of income, the division of property acquired during the marriage, and even spousal support. By addressing these issues before tying the knot, couples can foster open communication and mutual understanding, which are essential for a strong foundation in their relationship. Additionally, having a prenuptial agreement can provide peace of mind, allowing both parties to enter marriage with confidence about their financial future.

Check out Other Common Prenuptial Agreement Templates for Different States

Georgia Prenup Contract - Discussing a prenup can strengthen a couple's bond.

Illinois Prenup Contract - This document is valuable for couples with significant assets or careers.

To ensure a smooth transaction when buying or selling a vehicle in California, it is essential to utilize the California Vehicle Purchase Agreement form. This document not only formalizes the agreement between the seller and buyer but also includes important details such as the vehicle's specifics, sale price, and any warranties. For those interested in accessing this and other important documents, you may refer to All California Forms, which provide comprehensive resources to streamline the process.

Ohio Prenup Contract - It provides a framework for financial disputes and can streamline the divorce process.

Documents used along the form

In addition to the North Carolina Prenuptial Agreement, several other documents may be relevant for couples preparing for marriage. These documents can help clarify financial arrangements, property rights, and other important considerations. Below is a list of forms and documents commonly associated with a prenuptial agreement.

- Financial Disclosure Statement: This document outlines the financial situation of each party, including income, assets, debts, and expenses. It ensures transparency and helps both parties make informed decisions.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It addresses financial matters and property rights, often in response to changing circumstances.

- Separation Agreement: This agreement is used when a couple decides to separate. It outlines the terms of their separation, including division of assets, debts, and arrangements for children, if applicable.

- Will: A legal document that outlines how a person’s assets will be distributed upon their death. It can be important for couples to have updated wills that reflect their wishes regarding property and beneficiaries.

- Power of Attorney: This document allows one person to make legal and financial decisions on behalf of another. It can be crucial in situations where one partner is unable to make decisions due to illness or incapacitation.

- Health Care Proxy: This document designates someone to make medical decisions on behalf of another person if they are unable to do so. It is important for ensuring that a partner’s health care preferences are respected.

- Boat Bill of Sale: This document is essential when purchasing a boat in New York, as it serves as a legal record of the transaction. For more information, visit https://smarttemplates.net/fillable-new-york-boat-bill-of-sale/.

- Trust Agreement: This document establishes a trust, which can hold and manage assets for the benefit of one or more beneficiaries. Trusts can be used for estate planning and asset protection.

- Property Settlement Agreement: This agreement details the division of property and debts between spouses during divorce proceedings. It can help streamline the process and reduce conflict.

Understanding these documents can aid couples in navigating the complexities of marriage and financial planning. Each form serves a distinct purpose, contributing to a clearer understanding of rights and responsibilities within the relationship.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a contract entered into by two individuals before marriage, outlining the division of assets in case of divorce or separation. |

| Governing Law | North Carolina General Statutes Chapter 52B governs prenuptial agreements in North Carolina. |

| Written Requirement | In North Carolina, a prenuptial agreement must be in writing to be enforceable. |

| Voluntary Agreement | Both parties must enter the agreement voluntarily, without coercion or undue influence. |

| Full Disclosure | Each party should provide a full and fair disclosure of their financial situation before signing the agreement. |

| Notarization | While notarization is not required, having the agreement notarized can help in proving its authenticity. |

| Enforceability | Courts in North Carolina will enforce prenuptial agreements unless they are found to be unconscionable or were signed under duress. |

| Modification | Parties can modify a prenuptial agreement after marriage, but any changes must also be in writing. |

| Legal Counsel | It is advisable for both parties to seek independent legal counsel before signing a prenuptial agreement. |

| Common Misconception | Many believe prenuptial agreements are only for the wealthy, but they can benefit anyone looking to clarify financial rights. |

More About North Carolina Prenuptial Agreement

What is a prenuptial agreement in North Carolina?

A prenuptial agreement, often called a "prenup," is a legal document that a couple creates before getting married. It outlines how assets and debts will be divided in the event of a divorce or separation. In North Carolina, this agreement can also address issues like spousal support and property distribution. Having a prenup can provide clarity and peace of mind for both parties, ensuring that their interests are protected from the start of their marriage.

How do I create a prenuptial agreement in North Carolina?

To create a prenuptial agreement, both parties should first discuss their financial situations openly. It’s advisable to consult with an attorney who specializes in family law to ensure that the agreement complies with North Carolina laws. The document must be in writing and signed by both parties. Additionally, each person should have independent legal counsel to avoid any claims of coercion or unfairness later on.

Is a prenuptial agreement enforceable in North Carolina?

Yes, prenuptial agreements are generally enforceable in North Carolina, provided they meet certain legal requirements. The agreement must be voluntary, and both parties should fully disclose their assets and liabilities. Courts will typically uphold a prenup unless it is found to be unconscionable or was signed under duress. It’s essential to ensure that the agreement is clear and fair to both parties to enhance its enforceability.

Can a prenuptial agreement be modified or revoked?

Yes, a prenuptial agreement can be modified or revoked after marriage. Both parties must agree to the changes, and the modifications should be made in writing. It’s wise to involve legal counsel during this process to ensure that any changes are legally binding and that both parties understand their rights and obligations.

What happens if we don’t have a prenuptial agreement?

If a couple does not have a prenuptial agreement, North Carolina’s laws regarding property division and spousal support will apply in the event of a divorce. This means that assets acquired during the marriage may be subject to equitable distribution, which does not always mean equal division. Without a prenup, the court will have the authority to make decisions regarding asset division, which may not align with the couple's wishes.

When should we consider getting a prenuptial agreement?

Couples should consider a prenuptial agreement if they have significant assets, own a business, or have children from previous relationships. Additionally, if one partner has a much higher income or debt, a prenup can help protect both parties. It’s beneficial to discuss the idea of a prenup early in the engagement process to ensure that both partners feel comfortable and informed about their financial future together.

North Carolina Prenuptial Agreement: Usage Steps

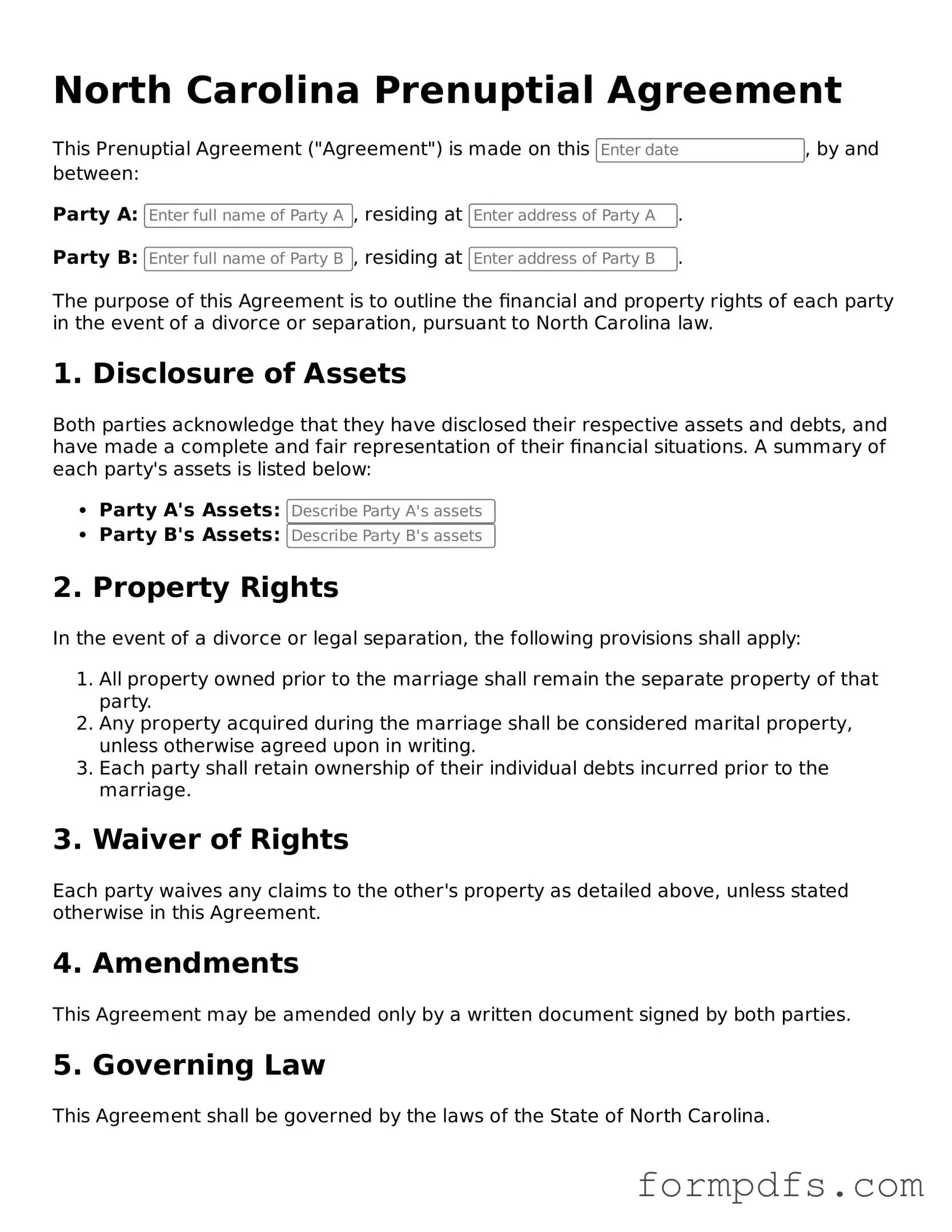

Completing the North Carolina Prenuptial Agreement form requires careful attention to detail. After gathering the necessary information, you will be ready to fill out the form accurately to reflect the intentions of both parties.

- Begin by entering the full legal names of both parties at the top of the form.

- Provide the date on which the agreement is being executed.

- List each party's current address, ensuring accuracy.

- Detail the assets and liabilities of each party. This may include bank accounts, real estate, vehicles, and debts.

- Include any specific terms regarding property division, spousal support, or other financial arrangements that both parties agree upon.

- Both parties should review the form for accuracy and completeness before signing.

- Sign the form in the presence of a notary public to ensure it is legally binding.

- Each party should retain a copy of the signed agreement for their records.