Printable Lady Bird Deed Form for the State of North Carolina

The North Carolina Lady Bird Deed form is a valuable estate planning tool that allows property owners to transfer real estate to their heirs while retaining certain rights during their lifetime. This type of deed, also known as an enhanced life estate deed, enables the original owner to maintain control over the property, including the right to live in, sell, or mortgage it without the consent of the beneficiaries. One of the key advantages of the Lady Bird Deed is its ability to bypass the lengthy and often costly probate process, ensuring that the property passes directly to the designated heirs upon the owner's death. Additionally, this form can help protect the property from potential claims by creditors, as the transfer occurs automatically upon the owner's passing. Understanding the specific requirements and implications of the Lady Bird Deed in North Carolina is essential for anyone considering this option as part of their estate planning strategy.

Check out Other Common Lady Bird Deed Templates for Different States

Lady Bird Deed Michigan Form - One significant advantage of a Lady Bird Deed is that it can reduce the estate’s tax liability.

For anyone preparing to engage in vehicle transactions, understanding the importance of a comprehensive Motor Vehicle Bill of Sale is essential for ensuring a smooth transfer. By utilizing this accurate and legally recognized document, buyers and sellers can clearly outline the details of the vehicle involved. Explore more about this vital process on our detailed Motor Vehicle Bill of Sale guide.

Documents used along the form

When considering the North Carolina Lady Bird Deed, it is essential to understand that several other forms and documents may be necessary to complete the estate planning process effectively. These documents help clarify intentions, protect assets, and ensure a smooth transition of property ownership. Below is a list of commonly used documents that may accompany a Lady Bird Deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can include specific bequests and appoint an executor to manage the estate.

- Durable Power of Attorney: This form allows an individual to designate someone else to make financial or legal decisions on their behalf if they become incapacitated.

- Healthcare Power of Attorney: This document designates an individual to make medical decisions for someone if they are unable to do so themselves.

- Living Will: A living will specifies a person's wishes regarding medical treatment in case of terminal illness or irreversible condition, focusing on end-of-life care.

- Revocable Trust: A revocable trust allows an individual to manage their assets during their lifetime and specify how those assets will be distributed after death, bypassing probate.

- Durable Power of Attorney: This crucial document allows an individual to grant authority to another person to make decisions on their behalf, and it remains valid even if the individual becomes incapacitated. For more information, check out All California Forms.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for accounts like life insurance, retirement plans, and bank accounts, ensuring that these assets pass directly to the named individuals.

- Property Deeds: Other property deeds may be necessary to transfer ownership of additional real estate or to clarify ownership interests in properties not covered by the Lady Bird Deed.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person, particularly when no will exists, helping to clarify property ownership.

Understanding these documents and their purposes can provide clarity and peace of mind. It is advisable to consult with a legal professional to ensure that all necessary documents are prepared and executed correctly, aligning with your wishes and state laws.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | The Lady Bird Deed is a type of transfer-on-death deed that allows property owners in North Carolina to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by North Carolina General Statutes, specifically under Chapter 32A, which outlines the laws surrounding transfer-on-death deeds. |

| Benefits | One key benefit is that the property does not go through probate upon the owner's death, simplifying the transfer process for heirs. |

| Retained Rights | Property owners maintain the right to sell, mortgage, or change the deed at any time before their death, ensuring flexibility. |

| Requirements | The deed must be signed, dated, and notarized, and it must be recorded in the county where the property is located to be effective. |

More About North Carolina Lady Bird Deed

What is a Lady Bird Deed in North Carolina?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed helps avoid probate and can provide tax benefits, making it a popular choice for estate planning in North Carolina.

Who can use a Lady Bird Deed?

Any property owner in North Carolina can use a Lady Bird Deed. It is particularly beneficial for those who want to ensure their property passes directly to their heirs without going through the probate process. However, individuals should consider their specific circumstances and consult with an estate planning professional to determine if this deed is appropriate for their needs.

What are the benefits of using a Lady Bird Deed?

One of the main benefits is the avoidance of probate, which can save time and money for heirs. Additionally, the property owner retains full control of the property during their lifetime, allowing them to sell, mortgage, or change beneficiaries as needed. This flexibility can be a significant advantage in estate planning.

Are there any drawbacks to a Lady Bird Deed?

While there are many advantages, there are some potential drawbacks. For instance, if the property owner needs to qualify for Medicaid, the property may still be counted as an asset. Additionally, if the property owner wishes to change their mind about the beneficiaries, they can do so, but it may require additional legal steps. It’s essential to weigh these factors carefully.

How do I create a Lady Bird Deed?

To create a Lady Bird Deed, you will need to draft the deed, including specific language that reflects your intentions. It’s advisable to work with an attorney who specializes in estate planning to ensure that the deed complies with North Carolina laws and accurately represents your wishes. After drafting, the deed must be signed and notarized, then recorded with the county register of deeds.

Can I revoke a Lady Bird Deed?

Yes, a Lady Bird Deed can be revoked at any time during the property owner's lifetime. To revoke the deed, the property owner must execute a new deed that explicitly states the revocation and record it with the county register of deeds. This process ensures that the property is no longer subject to the terms of the original Lady Bird Deed.

Is a Lady Bird Deed the same as a regular life estate deed?

No, a Lady Bird Deed differs from a regular life estate deed in key ways. While both allow for a life estate, a Lady Bird Deed grants the property owner the right to sell or mortgage the property without the consent of the remaindermen. This flexibility is not typically available with a standard life estate deed, making the Lady Bird Deed a more advantageous option for many property owners.

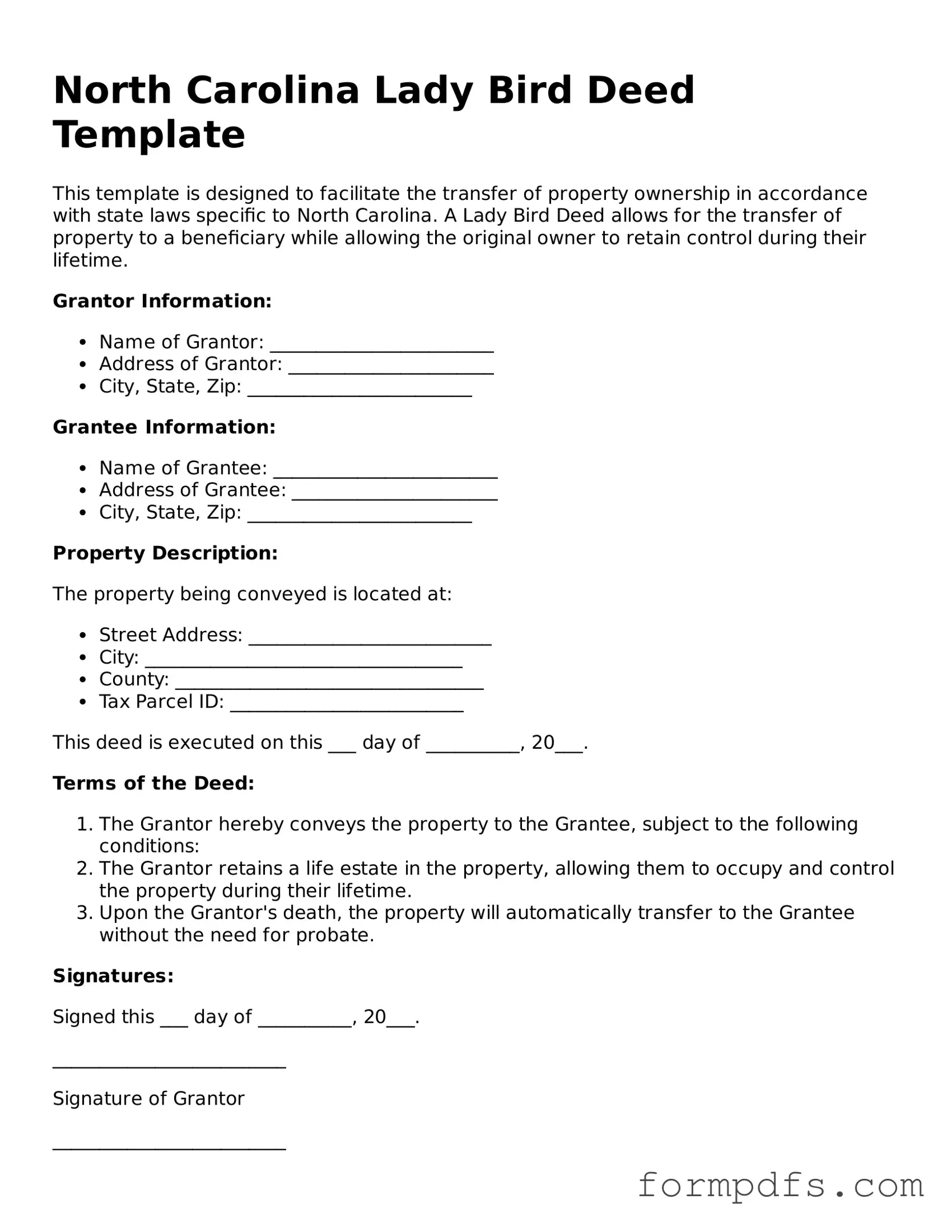

North Carolina Lady Bird Deed: Usage Steps

Completing the North Carolina Lady Bird Deed form is an important step in the estate planning process. This form allows property owners to transfer real estate to their beneficiaries while retaining certain rights during their lifetime. Once you have gathered the necessary information, you can proceed to fill out the form accurately.

- Begin by obtaining the North Carolina Lady Bird Deed form. You can find it online or at a local legal office.

- Fill in the name of the property owner. This should be the person currently holding the title to the property.

- Provide the address of the property. Ensure that the address is complete and accurate to avoid any confusion.

- List the names of the beneficiaries. These are the individuals who will inherit the property upon the owner’s passing.

- Include the relationship of each beneficiary to the property owner. This helps clarify the intent behind the transfer.

- Indicate whether the property owner wishes to retain the right to sell, transfer, or mortgage the property during their lifetime. This is a crucial aspect of the deed.

- Sign and date the form in the designated areas. Ensure that the signature matches the name provided at the beginning of the form.

- Have the form notarized. A notary public will verify the identity of the signer and witness the signing of the document.

- Finally, record the completed deed with the local county register of deeds. This step is essential to ensure the deed is legally recognized.

After completing these steps, you will have a legally binding document that reflects your wishes regarding the transfer of your property. It is always advisable to keep a copy of the deed for your records and consult with a legal professional if you have any questions or concerns.