Printable Deed Form for the State of North Carolina

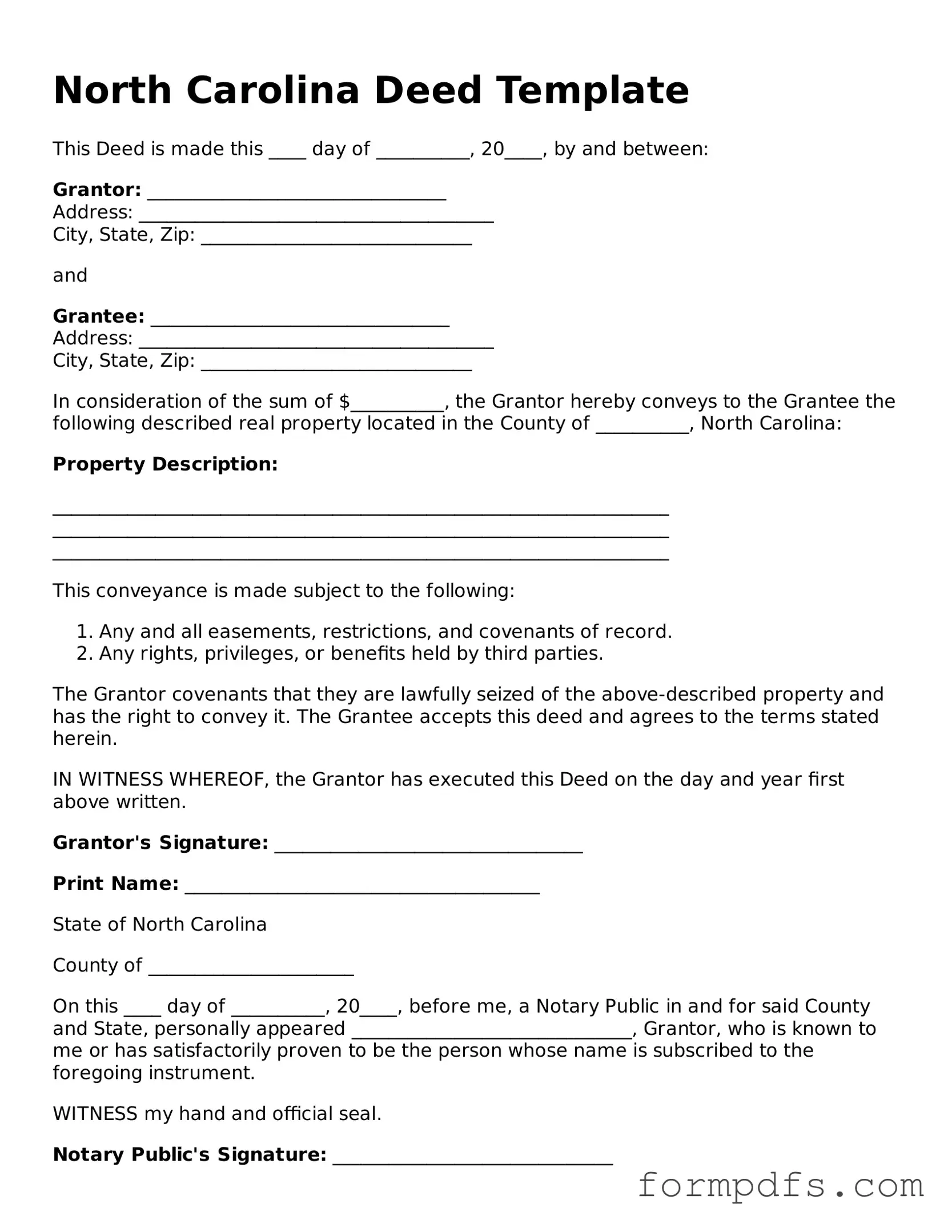

In the realm of real estate transactions, the North Carolina Deed form plays a crucial role in the transfer of property ownership. This document serves as a legal instrument that conveys title from one party to another, ensuring that the rights associated with the property are clearly defined and legally recognized. Essential components of the North Carolina Deed include the names of the grantor and grantee, a detailed description of the property being transferred, and the consideration, or payment, involved in the transaction. Additionally, the form may specify any covenants or warranties that the grantor provides to the grantee, further clarifying the terms of the transfer. Understanding the nuances of this form is vital for anyone involved in buying or selling real estate in North Carolina, as it not only protects the interests of both parties but also facilitates a smooth transition of property ownership. Furthermore, proper execution of the deed, including notarization and recording with the appropriate county office, is essential to ensure the legality and enforceability of the transfer. By grasping these fundamental aspects, individuals can navigate the complexities of real estate transactions with greater confidence.

Check out Other Common Deed Templates for Different States

How Do I Find the Deed to My House - The process involves filing the Deed with local property records offices.

Ohio Property Deed - May contain warranties regarding the title of the property.

What Does a Deed Look Like in Michigan - Allows for the tracing of ownership through public records.

Completing a Motor Vehicle Bill of Sale is essential for anyone involved in the buying or selling of a vehicle, as it formalizes the transaction and protects both parties. This important legal document can be easily obtained from various sources, including smarttemplates.net/fillable-motor-vehicle-bill-of-sale, which offers customizable templates to streamline the process.

Georgia Quit Claim Deed - A deed is a legal document that transfers property ownership from one party to another.

Documents used along the form

In North Carolina, when executing a deed, several other forms and documents may be required to ensure a smooth transaction. These documents help clarify ownership, establish rights, and comply with local regulations. Below is a list of commonly used forms alongside the North Carolina Deed form.

- Property Disclosure Statement: This document provides potential buyers with important information about the property's condition. Sellers must disclose known issues, such as structural problems or pest infestations, to ensure transparency in the transaction.

- Title Search Report: A title search report details the history of ownership for the property. It identifies any liens, claims, or encumbrances that may affect the title, providing buyers with assurance that they are purchasing clear ownership.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and that there are no undisclosed liens or claims. It serves to protect the buyer by affirming the seller's legal right to sell the property.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document outlines all financial transactions involved in the sale. It includes costs such as closing fees, taxes, and any credits between the buyer and seller.

- Trailer Bill of Sale: For a secure transfer of trailer ownership, utilize the official trailer bill of sale form guide to ensure all aspects of the transaction are properly documented.

- Power of Attorney: In some cases, a seller may not be able to attend the closing in person. A power of attorney allows another individual to act on their behalf, ensuring that the transaction can proceed smoothly.

These documents work together with the North Carolina Deed form to facilitate a clear and legally binding property transfer. Understanding each form's purpose can help streamline the process for all parties involved.

PDF Overview

| Fact Name | Details |

|---|---|

| Governing Law | The North Carolina Deed form is governed by North Carolina General Statutes, specifically Chapter 47. |

| Types of Deeds | Common types of deeds in North Carolina include General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds. |

| Notarization Requirement | All deeds must be notarized by a licensed notary public in North Carolina. |

| Recording | Deeds should be recorded at the county register of deeds office to provide public notice of ownership. |

| Consideration | The deed must state the consideration, or payment, for the property being transferred. |

| Legal Description | A complete legal description of the property must be included in the deed. |

| Grantor and Grantee | The deed must clearly identify the grantor (seller) and grantee (buyer). |

| Effective Date | The effective date of the transfer is typically the date the deed is executed, unless otherwise specified. |

| Witness Requirement | North Carolina does not require witnesses for the signing of a deed, but having them can provide additional protection. |

| Tax Implications | Transfer taxes may apply when a property is conveyed, based on the sale price or value of the property. |

More About North Carolina Deed

What is a North Carolina Deed form?

A North Carolina Deed form is a legal document used to transfer ownership of real property from one party to another. It serves as proof of the transfer and outlines the rights and responsibilities associated with the property. There are various types of deeds, including warranty deeds and quitclaim deeds, each serving different purposes in the transfer process.

What information is required on a North Carolina Deed form?

To complete a North Carolina Deed form, several key pieces of information must be included. This includes the names of the grantor (the seller) and grantee (the buyer), a legal description of the property, the date of the transfer, and the signature of the grantor. Additionally, it’s important to note any consideration, or payment, exchanged for the property.

Do I need a notary for a North Carolina Deed?

Yes, a notary public must witness the signing of the North Carolina Deed form. The notary's role is to verify the identities of the parties involved and to ensure that the deed is executed willingly and without coercion. After notarization, the deed must be recorded with the local county register of deeds to be legally effective.

How do I record a North Carolina Deed?

To record a North Carolina Deed, you must take the completed and notarized deed to the local county register of deeds office. There, you will submit the document along with any required fees. Recording the deed makes the transfer public and protects the new owner's rights to the property.

What is the difference between a warranty deed and a quitclaim deed?

A warranty deed provides the grantee with a guarantee that the grantor holds clear title to the property and has the right to sell it. It offers protection against future claims. In contrast, a quitclaim deed transfers whatever interest the grantor has in the property without any guarantees. This means the grantee receives no assurances about the title's status.

Can I use a North Carolina Deed form for transferring property to a family member?

Absolutely! A North Carolina Deed form can be used to transfer property to a family member. Whether it’s a gift or a sale, the deed should clearly outline the relationship between the parties and any terms of the transfer. If no money changes hands, it’s still advisable to document the transaction to avoid any future disputes.

What happens if a North Carolina Deed is not recorded?

If a North Carolina Deed is not recorded, the transfer of ownership may not be legally recognized against third parties. This means that if someone else claims an interest in the property or if the grantor sells it again, the unrecorded deed may not protect the grantee’s rights. Recording the deed is crucial to ensure that the new owner’s claim to the property is secure.

North Carolina Deed: Usage Steps

Completing the North Carolina Deed form is an important step in transferring property ownership. After filling out the form, it will need to be signed and notarized before being filed with the appropriate county register of deeds. This ensures that the transfer is legally recognized and recorded.

- Begin by obtaining the North Carolina Deed form. This can be found online or at your local county office.

- In the top section, enter the name of the Grantor (the person transferring the property). Include their address and any other required identifying information.

- Next, fill in the name of the Grantee (the person receiving the property). Again, provide their address and any necessary details.

- Provide a description of the property being transferred. This should include the physical address and legal description, which can often be found in previous deeds or property records.

- Indicate the date of the transfer. This is typically the date on which the deed is signed.

- Specify the consideration (the amount paid for the property). If the property is a gift, you can note that as well.

- Sign the deed. The Grantor must sign in the presence of a notary public.

- Have the deed notarized. The notary will verify the identity of the Grantor and witness the signing.

- Once notarized, make copies of the deed for your records.

- Finally, file the original deed with the county register of deeds office where the property is located. There may be a filing fee, so check ahead for the amount.