Printable Articles of Incorporation Form for the State of North Carolina

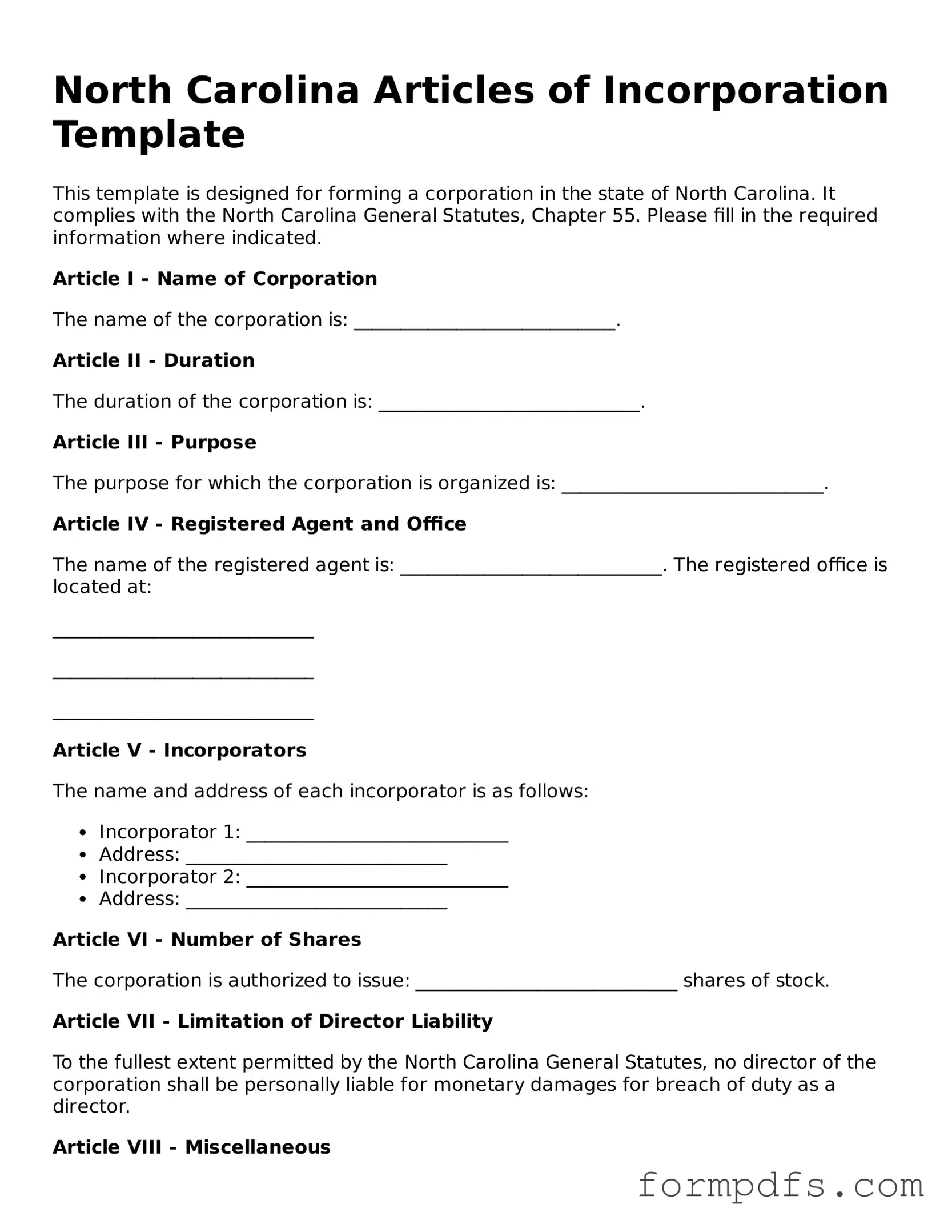

When starting a business in North Carolina, one of the first and most crucial steps is filing the Articles of Incorporation. This form serves as the foundation for your corporation, outlining essential details that define your business entity. Key aspects include the corporation's name, which must be unique and compliant with state regulations, as well as the purpose of the corporation, which should clearly state the intended business activities. Additionally, the form requires the designation of a registered agent, who will be responsible for receiving legal documents on behalf of the corporation. You’ll also need to provide information about the number of shares the corporation is authorized to issue and the names and addresses of the initial directors. Completing this form accurately is vital, as any errors could delay your business's formation or lead to legal complications down the line. Understanding these components is essential to ensure that your incorporation process goes smoothly and sets a solid foundation for your business's future.

Check out Other Common Articles of Incorporation Templates for Different States

Articles of Organization Michigan - Includes the duration of the corporation's existence.

Ga Corporation - Incorporation can potentially enhance the business’s credibility with customers and investors.

Completing the New York Boat Bill of Sale form is vital for both buyers and sellers to protect their interests in the transaction. This form can be easily accessed and customized online at smarttemplates.net/fillable-new-york-boat-bill-of-sale/, ensuring that all necessary information is accurately recorded, which is essential for legal compliance and future reference.

Ohio Llc Fees - Timely filing is crucial to avoid any potential delays in starting operations.

How to Get a Copy of Your Articles of Incorporation - It may also include restrictions on transferring shares.

Documents used along the form

When forming a corporation in North Carolina, the Articles of Incorporation is a crucial document. However, several other forms and documents are often necessary to ensure compliance with state laws and to facilitate the smooth operation of the business. Below is a list of essential documents that accompany the Articles of Incorporation.

- Bylaws: These are the internal rules governing the management of the corporation. Bylaws outline the roles and responsibilities of directors and officers, meeting procedures, and how decisions are made within the organization.

- Initial Report: This document provides information about the corporation's initial activities and must be filed shortly after incorporation. It often includes details about the corporation's address, registered agent, and the names of the initial directors.

- Registered Agent Appointment: This form designates a registered agent to receive legal documents on behalf of the corporation. A registered agent must have a physical address in North Carolina and be available during business hours.

- Employer Identification Number (EIN) Application: This application, often referred to as Form SS-4, is submitted to the IRS to obtain an EIN. An EIN is necessary for tax purposes, hiring employees, and opening a business bank account.

- Emotional Support Animal Letter: This document, prescribed by a licensed mental health professional, certifies the need for the companionship of an emotional support animal (ESA) and can be obtained from sources like onlinelawdocs.com, ensuring legal protections for individuals and their ESAs.

- Business License Application: Depending on the nature of the business, various local or state licenses may be required. This application ensures compliance with local regulations and permits the corporation to operate legally.

Incorporating a business involves several steps, and understanding the necessary documents can streamline the process. By preparing these forms alongside the Articles of Incorporation, you can lay a solid foundation for your new corporation and ensure compliance with all legal requirements.

PDF Overview

| Fact Name | Details |

|---|---|

| Purpose | The Articles of Incorporation form is used to establish a corporation in North Carolina. |

| Governing Law | The form is governed by the North Carolina General Statutes, specifically Chapter 55. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. As of 2023, this fee is $125. |

| Required Information | The form requires the corporation's name, principal office address, and details of the registered agent. |

| Duration | The corporation can be established for a specific duration or can exist perpetually. |

| Share Structure | Information about the number of shares the corporation is authorized to issue must be included. |

| Submission Method | The completed form can be submitted online or by mail to the North Carolina Secretary of State. |

More About North Carolina Articles of Incorporation

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in North Carolina. They serve as the foundational charter for your business, outlining essential details such as the corporation's name, purpose, and structure. This document is filed with the North Carolina Secretary of State to officially create your corporation.

What information is required to complete the Articles of Incorporation?

When filling out the Articles of Incorporation, you will need to provide several key pieces of information. This includes the corporation's name, the address of its principal office, the name and address of the registered agent, the purpose of the corporation, and details about the shares the corporation is authorized to issue. Additionally, you may need to include the names and addresses of the initial directors.

How do I choose a name for my corporation?

Choosing a name for your corporation is an important step. The name must be unique and not already in use by another business entity in North Carolina. It should also include a designator such as “Corporation,” “Incorporated,” or an abbreviation like “Inc.” To ensure your chosen name is available, you can conduct a name search on the North Carolina Secretary of State's website.

What is a registered agent, and why do I need one?

A registered agent is a person or business designated to receive legal documents on behalf of your corporation. This includes service of process, tax notices, and other official communications. Having a registered agent is a legal requirement in North Carolina, ensuring that your corporation has a reliable way to receive important information.

How much does it cost to file the Articles of Incorporation?

The filing fee for the Articles of Incorporation in North Carolina is typically around $125. However, this amount can vary based on the specific type of corporation you are forming. It is advisable to check the North Carolina Secretary of State's website for the most current fee schedule before submitting your application.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary, but generally, the North Carolina Secretary of State’s office aims to process Articles of Incorporation within a few business days. If you choose to expedite your filing, additional fees may apply, allowing for faster processing. Always check the current processing times for the most accurate information.

Can I amend my Articles of Incorporation after they are filed?

Yes, you can amend your Articles of Incorporation after they have been filed. If there are changes to your corporation's name, purpose, or structure, you will need to file an amendment with the Secretary of State. This process typically involves submitting a form and paying a fee. Keeping your Articles of Incorporation up to date is crucial for maintaining compliance with state regulations.

Do I need a lawyer to file my Articles of Incorporation?

While it is not legally required to hire a lawyer to file your Articles of Incorporation, seeking legal advice can be beneficial. A lawyer can help ensure that all necessary information is included and that your corporation complies with state laws. This can save you time and potential legal issues down the road.

North Carolina Articles of Incorporation: Usage Steps

Once you have gathered the necessary information, you can begin filling out the North Carolina Articles of Incorporation form. Completing this form accurately is essential for establishing your corporation in the state. After submission, you will receive confirmation from the state, allowing you to proceed with your business operations.

- Begin by downloading the North Carolina Articles of Incorporation form from the North Carolina Secretary of State's website.

- Enter the name of your corporation. Ensure that the name complies with state regulations and is not already in use by another entity.

- Provide the principal office address. This should be a physical address where the corporation will conduct business.

- Designate a registered agent. This individual or business entity will receive legal documents on behalf of the corporation.

- Specify the purpose of the corporation. A brief description of the business activities will suffice.

- Indicate the number of shares the corporation is authorized to issue. If applicable, include details about different classes of shares.

- List the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Include the effective date of incorporation if it differs from the filing date. This allows for flexibility in the corporation's start date.

- Review the form for accuracy. Ensure that all information is complete and correct to avoid delays in processing.

- Sign and date the form. The incorporators must provide their signatures to validate the document.

- Submit the completed form to the North Carolina Secretary of State along with the required filing fee. This can typically be done online or by mail.