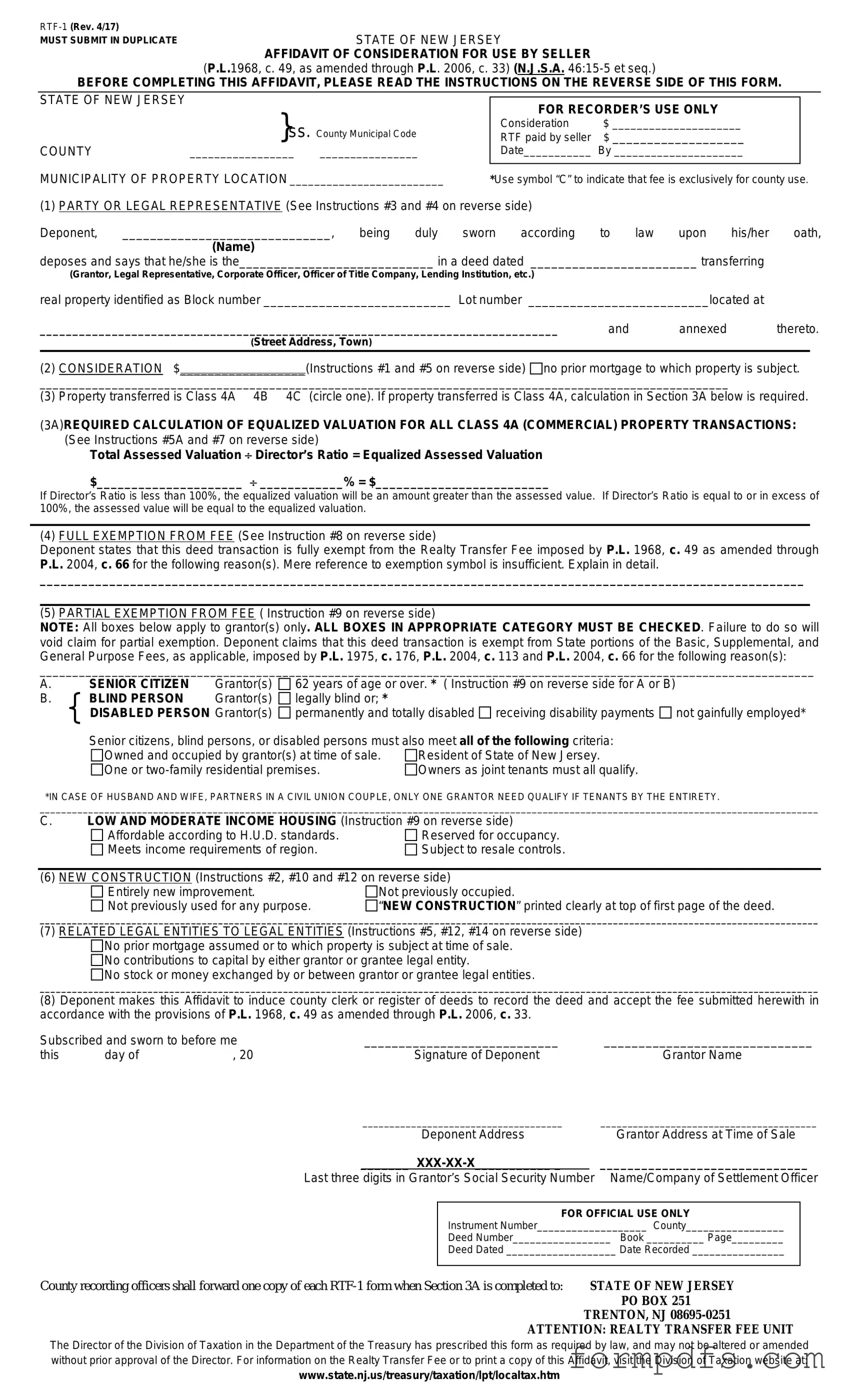

Blank New Jersey Affidavit of Consideration RTF-1 PDF Form

The New Jersey Affidavit of Consideration RTF-1 form plays a crucial role in the real estate transaction process within the state. This document serves as a declaration of the consideration, or the amount paid, for a property being transferred. It is essential for both buyers and sellers, as it helps establish the value of the property for tax assessment purposes. The form must be completed accurately to reflect the true consideration, ensuring compliance with state laws and regulations. Notably, it requires signatures from both parties involved in the transaction, thereby affirming the authenticity of the information provided. Additionally, the RTF-1 form is often submitted alongside other important documents during the closing process, making it an integral part of the overall real estate documentation. Understanding its significance can help individuals navigate the complexities of property transactions with greater ease and confidence.

More PDF Templates

Fake Doctors Note - Letter outlining the medical justification for absence from work or school.

Restroom Cleaning Sign Off Sheet - Facilitate communication through employee initials for traceability.

When an individual requires a formal verification of their absence due to health issues, utilizing a Doctor's Excuse Note form becomes essential. This document not only confirms the legitimacy of the absence but also provides vital details such as the date of the medical visit and the reasons for the excusal. For more information about obtaining this essential document, one can visit https://onlinelawdocs.com which offers comprehensive guidance and resources.

Blank Ada Claim Form - There's a space for remarks to provide additional information related to the claim.

Documents used along the form

The New Jersey Affidavit of Consideration RTF-1 form is often accompanied by various other documents that help provide context or fulfill legal requirements during property transactions. Below is a list of some common forms and documents that may be used alongside the RTF-1 form, each serving a specific purpose in the transaction process.

- Deed: This document transfers ownership of real property from one party to another. It includes details about the property and the parties involved, and it must be signed and notarized to be valid.

- Title Search Report: A title search report reveals the legal ownership of a property and any liens or encumbrances against it. This ensures that the seller has the right to sell the property and that the buyer is aware of any issues.

- Sales Contract: Also known as a purchase agreement, this document outlines the terms of the sale, including the price, payment method, and any contingencies that must be met before the sale can proceed.

- Property Disclosure Statement: This statement requires the seller to disclose any known issues or defects with the property. It protects the buyer by ensuring they are informed about the property's condition before completing the purchase.

- Mortgage Documents: If the buyer is financing the purchase, various mortgage documents will be necessary. These include the loan application, promissory note, and mortgage agreement, which outline the terms of the loan.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document details all financial transactions involved in the closing process, including fees, taxes, and the final amount due from the buyer.

- Certificate of Occupancy: This certificate confirms that a property meets local building codes and is safe for occupancy. It is particularly important for newly constructed or significantly renovated properties.

- California Motorcycle Bill of Sale: This essential document records the transaction details when one party sells a motorcycle to another within California, serving as a receipt for the buyer and formalizing the ownership transfer. For more information, click here to get the document.

- Power of Attorney: In cases where one party cannot be present at the closing, a power of attorney allows another individual to sign documents on their behalf, ensuring that the transaction can proceed smoothly.

Each of these documents plays a vital role in ensuring a successful property transaction in New Jersey. Understanding their purposes can help all parties involved navigate the process more effectively and avoid potential pitfalls.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The New Jersey Affidavit of Consideration RTF-1 form is used to disclose the consideration paid for real estate transactions. |

| Governing Law | This form is governed by New Jersey Statutes Annotated (N.J.S.A.) 46:15-5. |

| Filing Requirement | It must be filed with the county clerk's office at the time of recording the deed. |

| Signatures | The form must be signed by the seller and notarized to ensure its validity. |

More About New Jersey Affidavit of Consideration RTF-1

What is the New Jersey Affidavit of Consideration RTF-1 form?

The New Jersey Affidavit of Consideration RTF-1 form is a legal document used in real estate transactions. It serves to disclose the consideration, or price, paid for a property when it is transferred from one party to another. This form is crucial for ensuring that the appropriate transfer taxes are calculated and collected by the state. It helps maintain transparency in property transactions and is typically required when recording a deed in New Jersey.

Who needs to complete the RTF-1 form?

The RTF-1 form must be completed by the seller or grantor of the property, or their authorized representative. If the property is being sold, the seller is responsible for providing accurate information regarding the sale price. Buyers may also need to be involved in the process to ensure that all details are correctly represented. In some cases, real estate agents or attorneys assist in filling out the form to ensure compliance with state regulations.

What information is required on the RTF-1 form?

The RTF-1 form requires several key pieces of information. This includes the names and addresses of the buyer and seller, a description of the property being transferred, and the total consideration or purchase price. Additionally, the form may ask for details about any liens or encumbrances on the property. It is essential to provide accurate and complete information, as any discrepancies can lead to delays in the transaction process.

Where can I obtain the RTF-1 form?

The RTF-1 form can be obtained from various sources. It is available online through the New Jersey Division of Taxation’s website, where you can download a copy. Many real estate offices, law firms, and title companies also have the form on hand. If you prefer a physical copy, you can visit your local county clerk's office, where they can provide you with the necessary documentation.

Is there a fee associated with submitting the RTF-1 form?

There is no direct fee for submitting the RTF-1 form itself. However, the information provided on the form is used to calculate transfer taxes, which must be paid at the time of the property transfer. These taxes are based on the consideration amount and can vary depending on the property's location and value. It is important to budget for these costs when planning a real estate transaction.

What happens if the RTF-1 form is not submitted?

If the RTF-1 form is not submitted during a property transfer, it can lead to complications. The county clerk may refuse to record the deed, which means the transfer of ownership is not legally recognized. Additionally, failing to submit the form may result in penalties or fines from the state. To avoid these issues, it is crucial to ensure that the RTF-1 form is completed and submitted in a timely manner.

Can the RTF-1 form be amended after submission?

Yes, the RTF-1 form can be amended if there are errors or changes that need to be addressed. To do this, you will typically need to submit a corrected version of the form along with an explanation of the changes. It is advisable to contact the county clerk’s office for guidance on the proper procedure for making amendments. Promptly addressing any inaccuracies helps prevent potential legal issues down the line.

New Jersey Affidavit of Consideration RTF-1: Usage Steps

After gathering the necessary information, you will need to complete the New Jersey Affidavit of Consideration RTF-1 form accurately. This form is essential for various transactions and must be filled out carefully to ensure compliance with state requirements.

- Begin by downloading the New Jersey Affidavit of Consideration RTF-1 form from the official state website or obtaining a physical copy from your local government office.

- At the top of the form, fill in the date of the transaction.

- Provide the names and addresses of both the buyer and the seller in the designated sections.

- Clearly state the property address being transferred.

- Indicate the type of consideration being exchanged (such as cash, mortgage, or other means) in the appropriate space.

- Complete the section that asks for the total consideration amount. This should reflect the full value of the transaction.

- If applicable, check any boxes that indicate exemptions or special considerations related to the transaction.

- Sign the form where indicated. Ensure that the signature matches the name provided on the form.

- Have the form notarized if required. A notary public will verify your identity and witness your signature.

- Make copies of the completed and signed form for your records before submitting it.

Once the form is filled out and notarized, it should be submitted to the appropriate county office or agency as required by New Jersey law. Ensure that you keep a copy for your records, as this document may be needed in the future.