Blank Netspend Dispute PDF Form

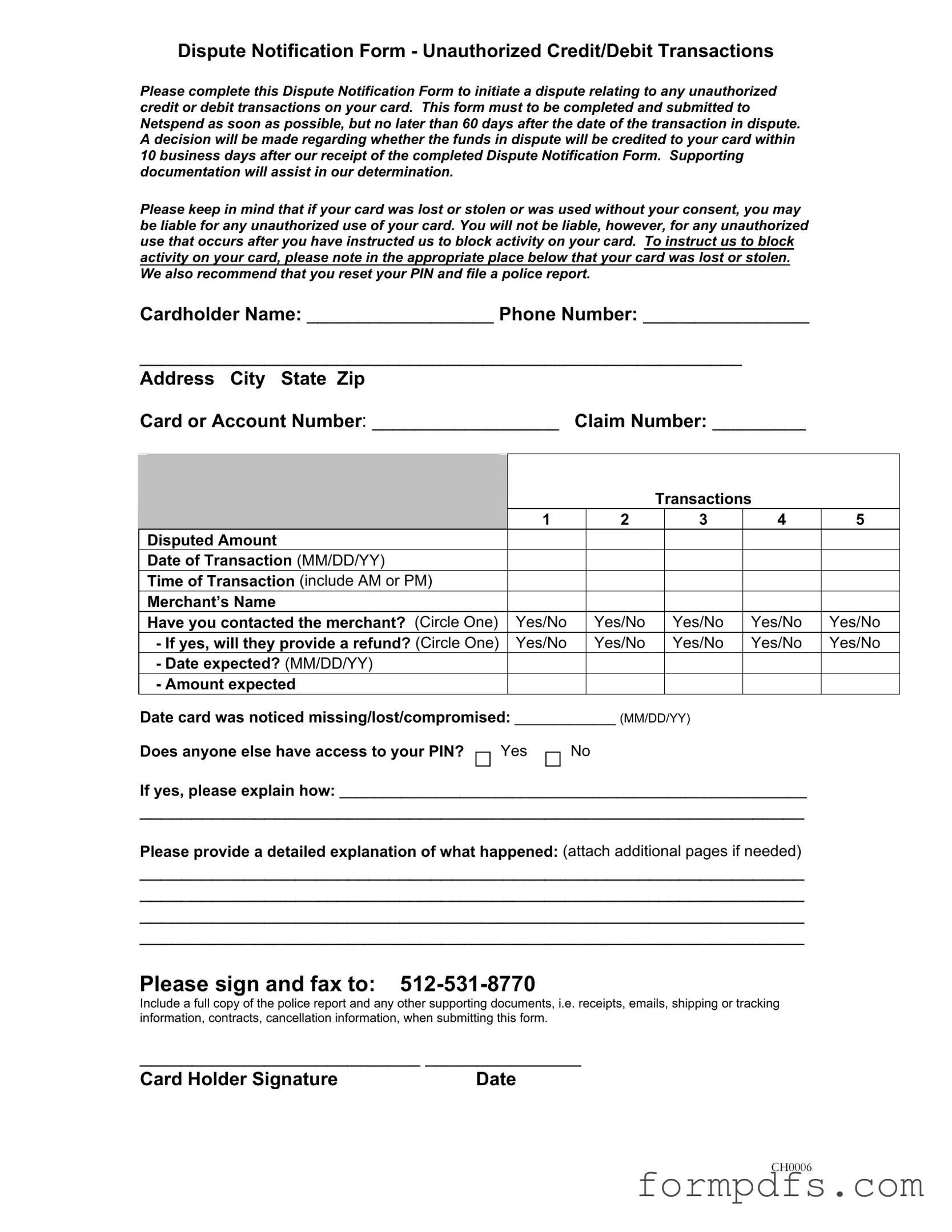

When faced with unauthorized transactions on a Netspend card, the Dispute Notification Form serves as a crucial tool for cardholders seeking resolution. This form is designed to initiate a formal dispute process regarding any credit or debit transactions that were not authorized by the cardholder. Timeliness is essential; the form must be completed and submitted to Netspend within 60 days from the date of the disputed transaction. Upon receipt of the completed form, Netspend commits to making a decision about the disputed funds within 10 business days. To strengthen the claim, it is advisable to include supporting documentation, which may include receipts, emails, or police reports, as these can significantly aid in the determination process. Cardholders must also be aware of their liability; while unauthorized use of a lost or stolen card may incur some responsibility, this liability ceases once the cardholder has reported the issue and requested to block further activity. The form requests essential information, such as the cardholder's name, contact details, and specifics about the disputed transactions, including amounts, dates, and merchant names. Additionally, it prompts the cardholder to provide a detailed explanation of the situation, ensuring that all relevant circumstances are documented. To facilitate the process, cardholders are encouraged to reset their PIN and provide a thorough account of events leading to the dispute. Ultimately, this form not only serves as a means to reclaim funds but also empowers cardholders to take control of their financial safety.

More PDF Templates

Western Union Form - Engage with local representatives for community support.

How to Print Payroll Checks - Aids in maintaining clear payroll records.

Before applying for a marriage license, couples should ensure they have completed the Florida Marriage Application Form, as this is an essential requirement for getting married in Florida. This form contains critical information needed by state authorities and highlights the importance of securing the license within 60 days of the planned ceremony. To assist you in this process, resources such as All Florida Forms can be invaluable in helping you find the required documentation.

How to Get a Pay Stub From Adp - You can find your employer's name and contact information on the pay stub.

Documents used along the form

When initiating a dispute regarding unauthorized transactions with Netspend, it's important to be prepared with additional forms and documents that can support your case. These documents help clarify your situation and provide necessary details to expedite the resolution process. Below are some commonly used forms and documents that may accompany the Netspend Dispute form.

- Police Report: If your card was lost or stolen, a police report serves as official documentation of the incident. This report can help establish the legitimacy of your claim and may be required by Netspend for processing your dispute.

- Lease Agreement Form: To formalize your rental arrangement in Arizona, utilize the necessary Lease Agreement documentation to ensure both parties are protected under the law.

- Transaction Receipts: Providing receipts for disputed transactions can substantiate your claim. These documents show the original purchase details and can clarify any discrepancies regarding unauthorized charges.

- Email Correspondence: Any emails exchanged with the merchant regarding the disputed transaction can be valuable. They may contain information about refund requests or acknowledgments of the issue, which can support your case.

- Shipping or Tracking Information: If the dispute involves an item that was ordered online, including shipping or tracking details can help demonstrate that the item was never received or was not as described.

- Cancellation Confirmation: If you canceled a service or order that led to a dispute, providing proof of cancellation can be crucial. This documentation shows that you took steps to resolve the issue before disputing the charge.

Having these documents ready can significantly enhance your dispute process with Netspend. By providing thorough and clear information, you increase the chances of a favorable outcome, allowing for a smoother resolution to your concerns.

Form Breakdown

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form is used to dispute unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | It must be submitted within 60 days of the disputed transaction date. |

| Decision Timeline | Netspend will make a decision regarding the dispute within 10 business days after receiving the form. |

| Supporting Documentation | Providing supporting documents can help in the determination of the dispute. |

| Liability for Unauthorized Use | If the card is lost or stolen, the cardholder may still be liable for unauthorized transactions. |

| Blocking Card Activity | Cardholders can instruct Netspend to block card activity if the card is lost or stolen. |

| PIN Reset Recommendation | Cardholders are advised to reset their PIN and file a police report if their card is compromised. |

| Transaction Information | The form allows for up to five disputed transactions to be submitted at once. |

| Police Report Requirement | A full copy of the police report must be included with the submission of the form. |

| State-Specific Laws | Governing laws may vary by state, affecting liability and reporting requirements. |

More About Netspend Dispute

What is the purpose of the Netspend Dispute form?

The Netspend Dispute form is designed to help cardholders report unauthorized credit or debit transactions. By completing this form, you initiate a dispute process for transactions that you believe were not authorized by you. It’s important to act quickly, as the form must be submitted within 60 days of the disputed transaction.

How do I submit the Netspend Dispute form?

To submit the form, fill out all required fields, including your contact information and details about the disputed transactions. Once completed, sign the form and fax it to 512-531-8770. Be sure to include any supporting documents, such as a police report or receipts, to strengthen your claim.

What happens after I submit the form?

After Netspend receives your completed Dispute Notification Form, they will review the information provided. A decision regarding whether the disputed funds will be credited to your card will typically be made within 10 business days. You will be informed of the outcome of your dispute via the contact information you provided.

What information do I need to provide for each disputed transaction?

You need to provide several details for each transaction you are disputing. This includes the disputed amount, the date and time of the transaction, the merchant’s name, and whether you have contacted the merchant regarding the issue. If you have contacted the merchant, you should also indicate if they will provide a refund and the expected date and amount.

What if my card was lost or stolen?

If your card was lost or stolen, it is crucial to indicate this on the form. You may also want to reset your PIN and file a police report. By notifying Netspend that your card was compromised, you can limit your liability for unauthorized transactions that occur after you report the loss.

Am I liable for unauthorized transactions?

Generally, you may be liable for unauthorized transactions if your card was used without your consent. However, you will not be held responsible for any transactions that occur after you have reported your card as lost or stolen and requested that activity be blocked.

What supporting documents should I include with the form?

It’s beneficial to include any supporting documentation that can help substantiate your claim. This may include a full copy of the police report, receipts, emails, shipping or tracking information, and any relevant contracts or cancellation information. These documents can assist in the determination of your dispute.

How many transactions can I dispute on one form?

You can dispute up to five transactions on a single Netspend Dispute form. Be sure to provide all necessary details for each transaction to ensure a thorough review of your claim.

Netspend Dispute: Usage Steps

Once you have gathered all necessary information, you are ready to fill out the Netspend Dispute form. Completing this form accurately is crucial for resolving your issue. After submission, Netspend will review your dispute and make a decision regarding your claim.

- Write your Cardholder Name in the designated space.

- Fill in your Phone Number.

- Provide your Address, including City, State, and Zip code.

- Enter your Card or Account Number.

- Write your Claim Number if you have one.

- For each transaction you are disputing, fill in the following details (up to 5 transactions):

- Disputed Amount

- Date of Transaction (MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Have you contacted the merchant? (Circle One: Yes/No)

- If yes, will they provide a refund? (Circle One: Yes/No)

- If yes, Date expected? (MM/DD/YY)

- Amount expected

- Fill in the Date card was noticed missing/lost/compromised (MM/DD/YY).

- Indicate if anyone else has access to your PIN by circling Yes or No.

- If yes, provide an explanation of how they have access.

- In the designated area, write a detailed explanation of what happened. Attach additional pages if needed.

- Sign the form and write the Date next to your signature.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any other supporting documents, such as receipts or emails, when submitting the form.