Blank Mortgage Statement PDF Form

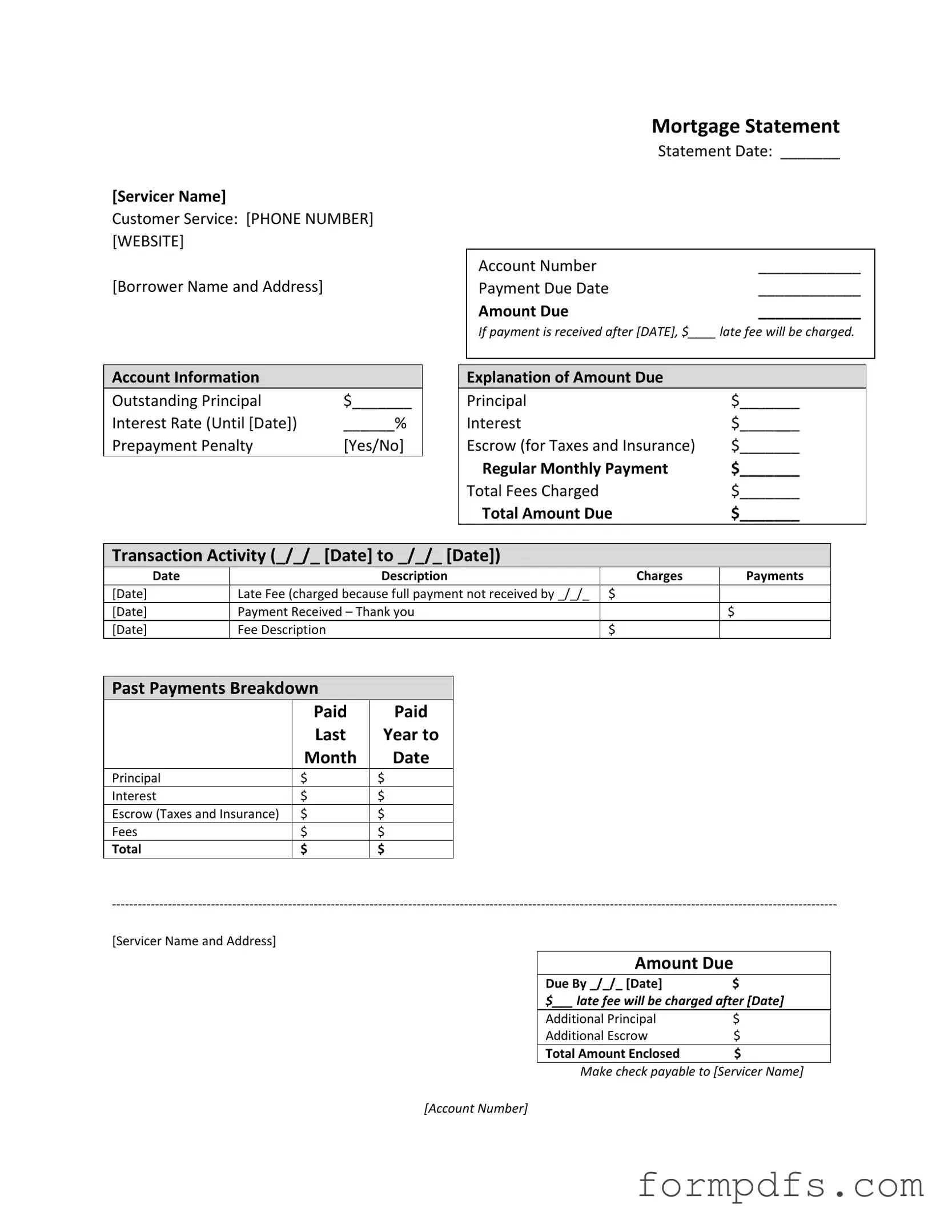

Understanding your Mortgage Statement is essential for managing your home loan effectively. This important document provides a comprehensive overview of your mortgage account, including crucial details like the servicer's name and contact information, your account number, and the payment due date. You’ll find a breakdown of the amount due, which typically includes principal, interest, and escrow amounts for taxes and insurance. Notably, the statement also highlights any late fees that may apply if your payment is received after a specified date. In addition to the current payment details, the statement offers a glimpse into your transaction activity, showing recent charges and payments made within a specific date range. You can also review a summary of past payments, making it easier to track your financial history related to the mortgage. If you’re facing challenges with your payments, the statement includes important messages about partial payments and potential consequences of delinquency, ensuring you are well-informed about your obligations and options for assistance. By familiarizing yourself with these components, you can take proactive steps in managing your mortgage and maintaining your financial health.

More PDF Templates

Dd Form 2656 March 2022 Pdf - The DD 2656 also outlines how retirees can access counseling services for benefits.

When completing a transaction, acquiring a reliable ATV Bill of Sale template can simplify the process and ensure all necessary information is recorded. For a thorough understanding of what to include, check out this valuable resource: important details for an ATV Bill of Sale.

Free Editable Utility Bill Template - The Utility Bill form can facilitate eligibility for certain government aids.

Blank Pdf Invoice - A simple solution for creating professional invoices.

Documents used along the form

The Mortgage Statement form is a crucial document for homeowners and lenders alike, detailing the current status of a mortgage account. In addition to this form, there are several other documents that are often used in conjunction with it to manage and understand mortgage obligations. Below is a list of related forms and documents that may be relevant.

- Loan Agreement: This document outlines the terms and conditions of the mortgage loan, including the interest rate, repayment schedule, and any fees associated with the loan. It serves as the legal contract between the borrower and the lender.

- Payment History Statement: This statement provides a detailed record of all payments made on the mortgage. It includes dates, amounts, and any late fees incurred, helping borrowers track their payment history and manage their finances effectively.

- Escrow Account Statement: This document details the funds held in escrow for property taxes and insurance. It shows how much has been collected, how much has been disbursed, and any remaining balance, ensuring that homeowners are aware of their obligations for these expenses.

- California LLC-1 Form: Essential for establishing a limited liability company in California, this form, known as the Articles of Organization, requires a filing fee of $70 and may involve an optional certification fee. For more details, visit All California Forms.

- Loan Modification Agreement: If a borrower is experiencing financial difficulties, they may seek to modify the terms of their loan. This agreement outlines any changes to the original loan terms, such as interest rate adjustments or extended repayment periods, aimed at making the loan more manageable.

Understanding these related documents can significantly enhance a homeowner's ability to manage their mortgage effectively. Each document plays a distinct role in the overall mortgage process, providing essential information and support for financial decision-making.

Form Breakdown

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website, ensuring borrowers have access to support. |

| Account Details | It provides essential account information, such as the outstanding principal, interest rate, and payment due date, allowing borrowers to stay informed about their mortgage status. |

| Late Fee Policy | If payment is not received by the due date, a late fee will be charged. This policy encourages timely payments and helps maintain financial discipline. |

| Delinquency Notice | The statement includes a delinquency notice, informing borrowers of their current status and the potential consequences of late payments, such as fees and foreclosure. |

More About Mortgage Statement

What is a Mortgage Statement?

A Mortgage Statement is a document provided by your mortgage servicer that outlines your account details. It includes information such as the outstanding principal balance, interest rate, payment due date, and any fees charged. This statement helps you keep track of your mortgage payments and manage your financial obligations effectively.

How can I read my Mortgage Statement?

Your Mortgage Statement is organized into sections. Start with the account information, which shows your outstanding principal and interest rate. Next, review the explanation of the amount due, which breaks down your monthly payment into principal, interest, and escrow for taxes and insurance. Finally, check the transaction activity for a record of recent payments and charges.

What happens if I make a late payment?

If your payment is received after the due date, a late fee will be charged. The amount of this fee is specified on your statement. It’s important to pay on time to avoid additional costs and potential negative impacts on your credit score.

What should I do if I can’t make my mortgage payment?

If you are experiencing financial difficulty, it’s crucial to reach out to your mortgage servicer. They can provide information about mortgage counseling or assistance programs. Taking action early can help you avoid falling further behind on your payments.

What is a partial payment and how does it affect my mortgage?

A partial payment is any amount less than your total monthly payment. These payments are not applied directly to your mortgage balance; instead, they are held in a separate suspense account. To have those funds applied to your mortgage, you must pay the remaining balance of the partial payment.

Mortgage Statement: Usage Steps

Completing the Mortgage Statement form is a straightforward process that ensures you have all the necessary information organized and ready for submission. Following these steps will help you fill out the form accurately, ensuring that your mortgage account remains in good standing.

- Obtain the Form: Start by downloading or printing the Mortgage Statement form from your servicer's website.

- Fill in Servicer Information: At the top of the form, enter the name of your mortgage servicer, their customer service phone number, and website.

- Enter Borrower Information: Provide your name and address in the designated fields.

- Complete Statement Date: Write the date of the statement in the space provided.

- Account Number: Fill in your mortgage account number accurately.

- Payment Due Date: Indicate the date your next payment is due.

- Amount Due: Enter the total amount due for your mortgage payment.

- Late Fee Information: Specify the amount of the late fee that will be charged if payment is received after the due date.

- Account Information: Fill in the outstanding principal, interest rate, and whether there is a prepayment penalty.

- Explanation of Amount Due: Break down the total amount due into principal, interest, escrow for taxes and insurance, regular monthly payment, total fees charged, and total amount due.

- Transaction Activity: List any transactions from the specified date range, including charges and payments.

- Past Payments Breakdown: Provide a summary of payments made last year, including principal, interest, escrow, and fees.

- Amount Due: Repeat the amount due and the date by which it should be paid, along with any late fee information.

- Total Amount Enclosed: If sending a payment, specify the total amount enclosed and make the check payable to your servicer.

- Important Messages: Read through any important messages, especially regarding partial payments and delinquency notices.

After completing the form, review all entries for accuracy. This careful attention to detail will help ensure that your mortgage payment is processed smoothly and on time.