Valid Mortgage Lien Release Template

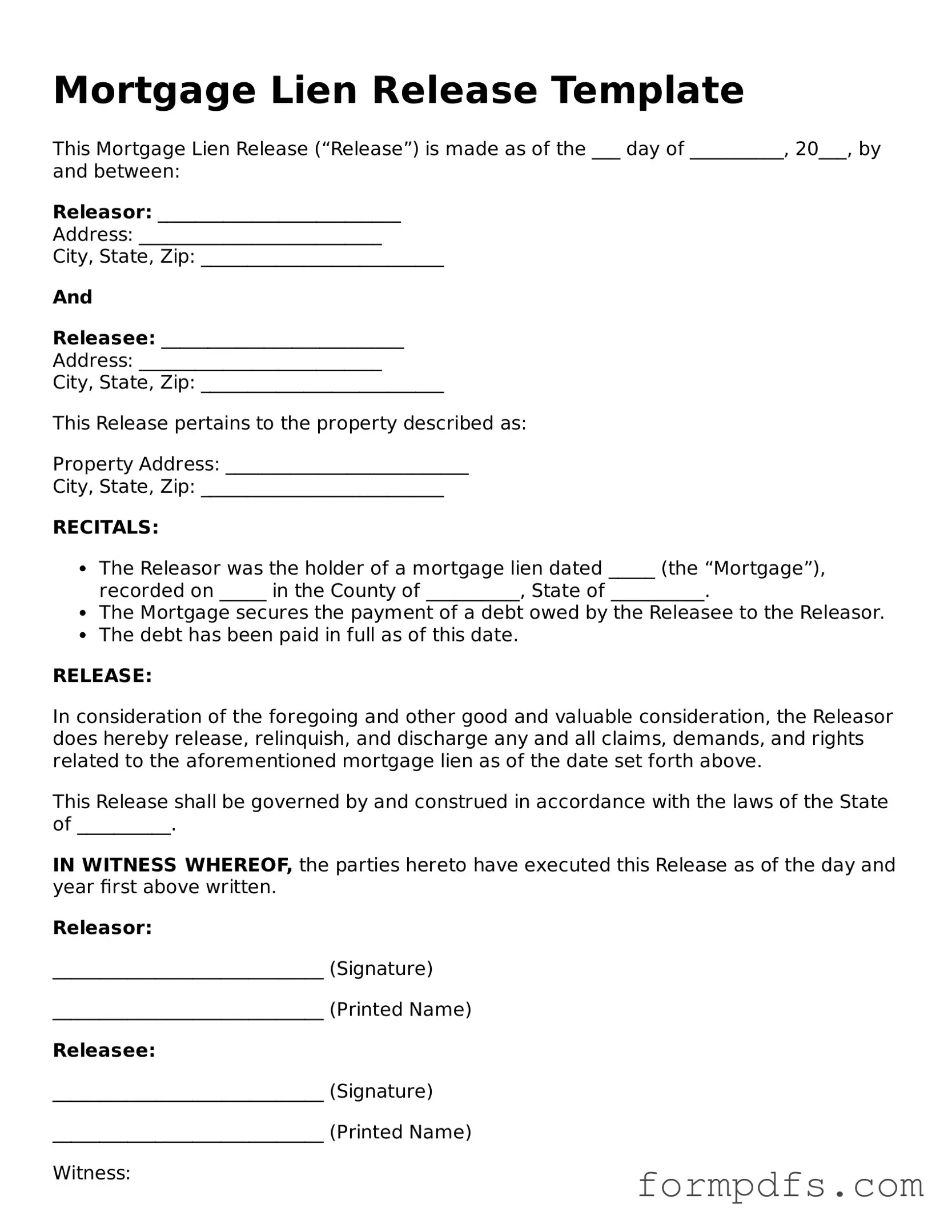

The Mortgage Lien Release form is a crucial document in the realm of real estate transactions, particularly for homeowners and lenders alike. When a mortgage is paid off, this form serves as the official notice that the lender relinquishes their claim on the property, effectively clearing the title for the homeowner. This release not only signifies the end of the borrower's obligation to the lender but also plays a vital role in protecting the homeowner's rights and interests. Typically, the form includes essential details such as the names of the parties involved, the property address, and the loan information, ensuring clarity and legal validity. Once executed, the Mortgage Lien Release must be filed with the appropriate county or local office to update public records, thereby preventing any future disputes over ownership. Understanding this form is key for anyone navigating the complexities of homeownership and mortgage agreements.

Other Mortgage Lien Release Templates:

Art Release Form - Documents consent for audio and digital platforms.

The FedEx Release Form is a document that authorizes FedEx to leave your package at a designated location when you are not available to receive it. Completing this form ensures your shipment can still be delivered safely and securely, even in your absence. For more information on how to complete this form correctly, you can visit Top Forms Online to prevent any delivery issues.

Permission to Use Artwork Form - This document protects the interests of both the artist and the user.

Documents used along the form

The Mortgage Lien Release form is an important document that signifies the removal of a mortgage lien from a property once the debt has been paid in full. However, it is often accompanied by other forms and documents that help clarify the transaction and protect the interests of all parties involved. Below is a list of commonly used documents that may accompany the Mortgage Lien Release form.

- Mortgage Agreement: This document outlines the terms and conditions of the mortgage loan, including the amount borrowed, interest rates, and repayment schedule. It serves as the foundational agreement between the borrower and the lender.

- Promissory Note: A promissory note is a written promise from the borrower to repay the loan under specified terms. It details the repayment schedule and the consequences of defaulting on the loan.

- Vehicle Release of Liability: To solidify your vehicle transactions, consult the essential Vehicle Release of Liability form guidelines for proper documentation and compliance.

- Deed of Trust: This document secures the mortgage loan by transferring the property title to a trustee until the loan is paid off. It acts as collateral for the loan and outlines the rights of the lender in case of default.

- Closing Statement: Also known as a HUD-1 statement, this document summarizes all the financial details of the real estate transaction, including fees, costs, and the final settlement amount. It provides transparency for both the buyer and seller.

Understanding these accompanying documents can help individuals navigate the mortgage process more effectively. Each document plays a crucial role in protecting the interests of both the borrower and the lender, ensuring a clear understanding of the terms involved in the transaction.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Mortgage Lien Release form is used to officially remove a lien from a property once the mortgage has been paid in full. |

| Governing Law | Each state has specific laws governing the release of mortgage liens. For example, in California, it is governed by California Civil Code Section 2941. |

| Signatures Required | The form typically requires signatures from the lender and the borrower to validate the release. |

| Filing Process | Once completed, the form must be filed with the county recorder’s office where the property is located. |

| Timeframe | Most states require the lender to issue a release within a specific timeframe after the mortgage is paid, often within 30 days. |

| Importance of Recording | Recording the release is crucial to ensure that the property title is clear of any liens, which is important for future transactions. |

| Potential Fees | There may be fees associated with filing the release form, which vary by county and state. |

More About Mortgage Lien Release

What is a Mortgage Lien Release form?

A Mortgage Lien Release form is a legal document that officially removes a mortgage lien from a property. When a borrower pays off their mortgage, this form is necessary to clear the title, indicating that the lender no longer has a claim on the property. This release is crucial for the homeowner, as it ensures they have full ownership free from the lender's interest.

When do I need a Mortgage Lien Release form?

You need a Mortgage Lien Release form after you have fully paid off your mortgage. Once the loan is satisfied, the lender is obligated to provide this document. It is important to obtain it to prevent any future disputes regarding ownership and to facilitate the sale or refinancing of the property.

How do I obtain a Mortgage Lien Release form?

What information is included in a Mortgage Lien Release form?

The form generally includes the names of the borrower and lender, the property address, the original mortgage details, and a statement confirming that the mortgage has been paid in full. Additionally, it may require signatures from both the lender and the borrower to validate the release.

Do I need to file the Mortgage Lien Release form with the county?

What happens if I do not get a Mortgage Lien Release form?

If you do not obtain a Mortgage Lien Release form after paying off your mortgage, the lender may still have a claim on your property. This could complicate future transactions, such as selling or refinancing. It is crucial to follow up with the lender and ensure the release is obtained and recorded.

Can I create my own Mortgage Lien Release form?

Mortgage Lien Release: Usage Steps

Once you have obtained the Mortgage Lien Release form, you will need to complete it accurately to ensure the release of the lien is processed smoothly. Follow these steps carefully to fill out the form correctly.

- Begin by entering the name of the borrower at the top of the form. Make sure to use the full legal name as it appears on the mortgage documents.

- Next, provide the address of the property associated with the mortgage. This should include the street address, city, state, and ZIP code.

- In the designated section, write the name of the lender or financial institution that held the mortgage. This is the entity that originally provided the loan.

- Fill in the loan number. This number is typically found on your mortgage statement or loan documents.

- Indicate the date the mortgage was paid off. This is crucial for establishing that the lien can be released.

- Sign the form in the appropriate area. Ensure that the signature matches the name provided at the top of the form.

- Include the date of your signature. This should be the same date you are completing the form.

- Finally, provide any additional information requested at the bottom of the form, such as contact information or additional signatures if required.

After completing the form, it is important to submit it to the appropriate county or state office for processing. This will ensure that the lien is officially removed from the property records.