Printable Transfer-on-Death Deed Form for the State of Michigan

The Michigan Transfer-on-Death Deed form offers a straightforward way for property owners to transfer their real estate to designated beneficiaries without the need for probate. This legal tool allows individuals to retain full control of their property during their lifetime while designating who will inherit it upon their death. By completing this form, property owners can avoid the lengthy and often costly probate process, ensuring a smoother transition of assets. The form requires specific information, including the names of the property owner and the beneficiaries, as well as a clear description of the property being transferred. Importantly, the deed only takes effect upon the death of the owner, meaning that until that time, the owner can sell or modify the property as they wish. This flexibility makes the Transfer-on-Death Deed an appealing option for many, allowing for both estate planning and peace of mind regarding the future of their property. Understanding how to properly execute and record this deed is crucial for ensuring that the intended transfer occurs seamlessly, making it an essential topic for anyone considering estate planning in Michigan.

Check out Other Common Transfer-on-Death Deed Templates for Different States

Illinois Transfer on Death Instrument - This deed enables property owners to avoid court decisions regarding property distribution.

For those looking to navigate the complexities of vehicle or vessel ownership transfers in California, it's important to be familiar with the California Form REG 262, which plays a vital role in this process. Acquiring this form, alongside the title or in pursuit of a Duplicate Title, is imperative for complete and accurate ownership documentation. To further assist in this endeavor, you can access various resources and documents, including All California Forms, to ensure compliance with the state's legal requirements.

Georgia Transfer on Death Deed Form - This deed should include the legal description of the property being transferred.

How to Gift Land to Family Member - This deed can prevent your property from becoming part of a probate case.

Documents used along the form

The Michigan Transfer-on-Death Deed form is a valuable tool for estate planning, allowing individuals to transfer property to beneficiaries without the need for probate. However, several other forms and documents may be necessary to ensure a smooth transition of assets. Below is a list of commonly used documents that complement the Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets should be distributed upon their death. It can include specific bequests and appoint an executor to manage the estate.

- Revocable Living Trust: This document allows individuals to place their assets into a trust during their lifetime, providing management and distribution instructions while avoiding probate.

- Power of Attorney: A legal form that grants someone the authority to act on another person's behalf in financial or medical matters, ensuring decisions can be made if the individual becomes incapacitated.

- Boat Bill of Sale: This document is essential for recording the sale and purchase of a boat in New York, ensuring all transaction details are documented accurately, including information about the buyer and seller. For more details, visit https://smarttemplates.net/fillable-new-york-boat-bill-of-sale.

- Beneficiary Designation Forms: These forms are used for certain assets, like life insurance policies or retirement accounts, to designate who will receive the asset upon the owner's death.

- Affidavit of Heirship: This document establishes the identity of heirs when a person dies without a will, helping to clarify who is entitled to inherit the decedent's property.

- Deed of Distribution: A document used to formally transfer property from an estate to beneficiaries after the probate process is completed.

- Notice of Death: This form may be used to formally notify interested parties of a person's death, which can be important for legal and financial matters.

- Estate Inventory: A detailed list of all assets and liabilities of the deceased, often required during the probate process to provide a clear picture of the estate's value.

- Tax Forms: Various tax forms may be necessary to report the decedent's income and estate taxes, ensuring compliance with state and federal laws.

Each of these documents plays a crucial role in the estate planning process. By understanding their purposes, individuals can better prepare for the future and ensure that their wishes are honored, while also providing clarity and support for their loved ones during a difficult time.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Michigan Transfer-on-Death Deed is governed by the Michigan Compiled Laws, specifically MCL 565.25a. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Revocation | The property owner can revoke the deed at any time before their death, as long as the revocation is executed properly. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the property can be divided among them, or a single beneficiary can be designated. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the owner's lifetime, but estate taxes may apply upon death. |

More About Michigan Transfer-on-Death Deed

What is a Michigan Transfer-on-Death Deed?

A Michigan Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. This deed is revocable during the owner's lifetime, meaning the owner can change or cancel it at any time before death.

Who can use a Transfer-on-Death Deed in Michigan?

Any individual who owns real estate in Michigan can use a Transfer-on-Death Deed. This includes homeowners, property investors, and anyone holding title to real property. However, the deed cannot be used for certain types of property, such as jointly owned property or property held in a trust.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you need to fill out the appropriate form, which includes details about the property and the beneficiary. After completing the form, it must be signed by the property owner in the presence of a notary public. Finally, the deed must be recorded with the local county register of deeds to be effective.

Can I change the beneficiary after creating the deed?

Yes, you can change the beneficiary at any time while you are alive. To do this, you must execute a new Transfer-on-Death Deed that names the new beneficiary and record it with the county. The original deed will remain valid until it is revoked or replaced.

What happens if the beneficiary dies before me?

If the beneficiary named in the Transfer-on-Death Deed dies before you, the property will not automatically transfer to them. Instead, you may want to create a new deed naming a different beneficiary or specify alternate beneficiaries in the original deed to avoid complications.

Are there any tax implications for using a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. The property is not considered part of your estate for probate purposes. However, the beneficiary may be subject to property taxes and other taxes upon your death, so it's wise to consult a tax professional for specific advice.

Can a Transfer-on-Death Deed be contested?

Yes, a Transfer-on-Death Deed can be contested in certain circumstances. If someone believes they have a valid claim to the property, they may challenge the deed in court. Common reasons for contesting include lack of capacity, undue influence, or improper execution of the deed.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. A will takes effect only after your death and goes through probate. In contrast, a Transfer-on-Death Deed transfers property directly to the beneficiary without the need for probate, simplifying the process and potentially saving time and costs.

Where can I find the Transfer-on-Death Deed form in Michigan?

You can find the Transfer-on-Death Deed form on the Michigan Department of Licensing and Regulatory Affairs (LARA) website or through your local county register of deeds office. It’s important to ensure that you are using the most current version of the form to avoid any issues.

Michigan Transfer-on-Death Deed: Usage Steps

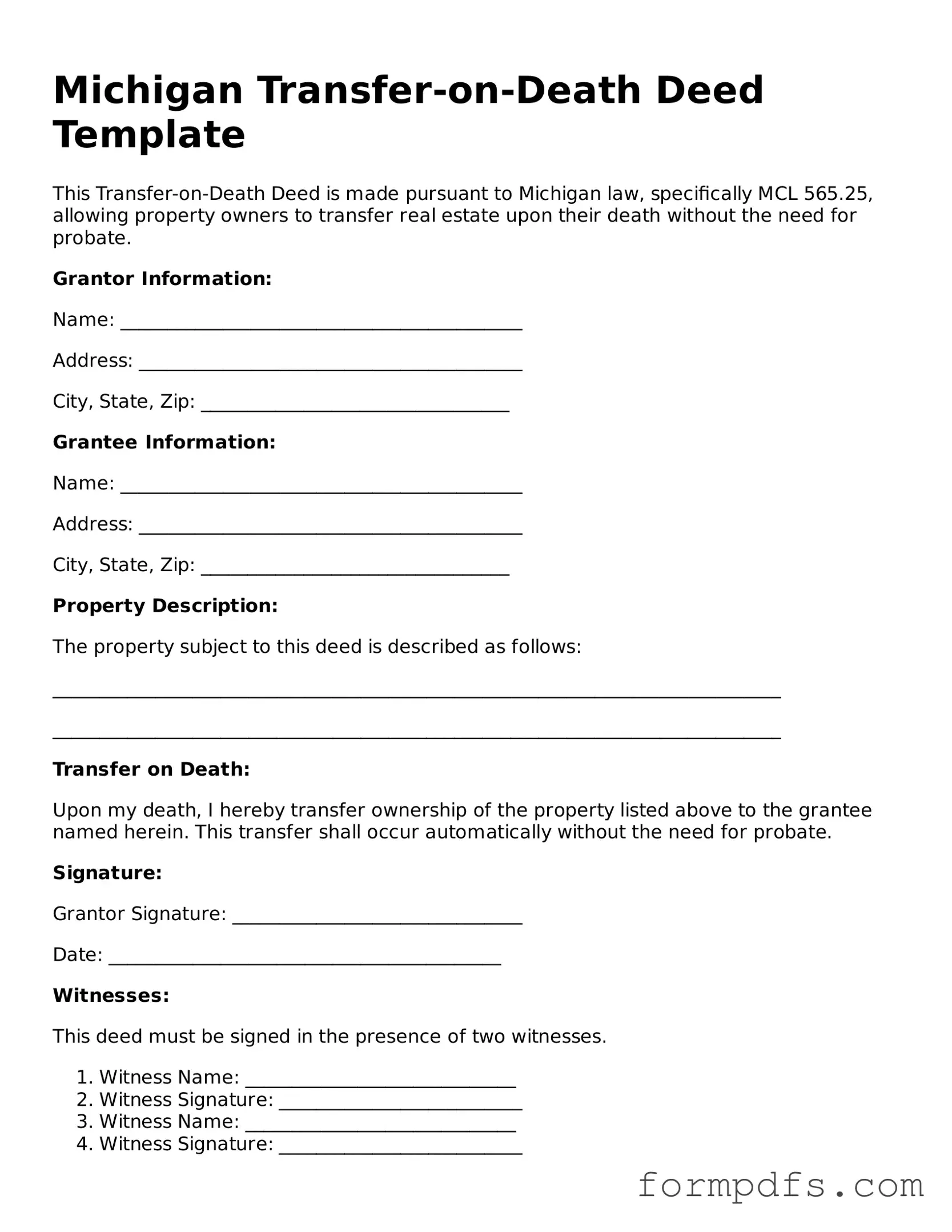

After obtaining the Michigan Transfer-on-Death Deed form, you will need to complete it accurately to ensure that your wishes regarding property transfer are clearly documented. Follow the steps below to fill out the form correctly.

- Identify the Property: Begin by providing a complete legal description of the property you wish to transfer. This may include the address and any parcel number associated with the property.

- Owner Information: Enter your full name as the current owner of the property. If the property is owned jointly, include the names of all owners.

- Beneficiary Details: Specify the name of the person or entity who will receive the property upon your death. Ensure that the name is spelled correctly and includes any necessary identifiers, such as middle initials.

- Sign the Form: Sign the deed in the presence of a notary public. Your signature must be dated, and the notary will also sign and stamp the document.

- Witnesses: Depending on Michigan law, you may need one or two witnesses to sign the deed. Ensure that they are present when you sign the form.

- File the Deed: Once completed, file the signed and notarized deed with the county register of deeds in the county where the property is located. There may be a filing fee.

After filing, keep a copy of the deed for your records. This ensures that you have proof of the transfer arrangement, should it be needed in the future.