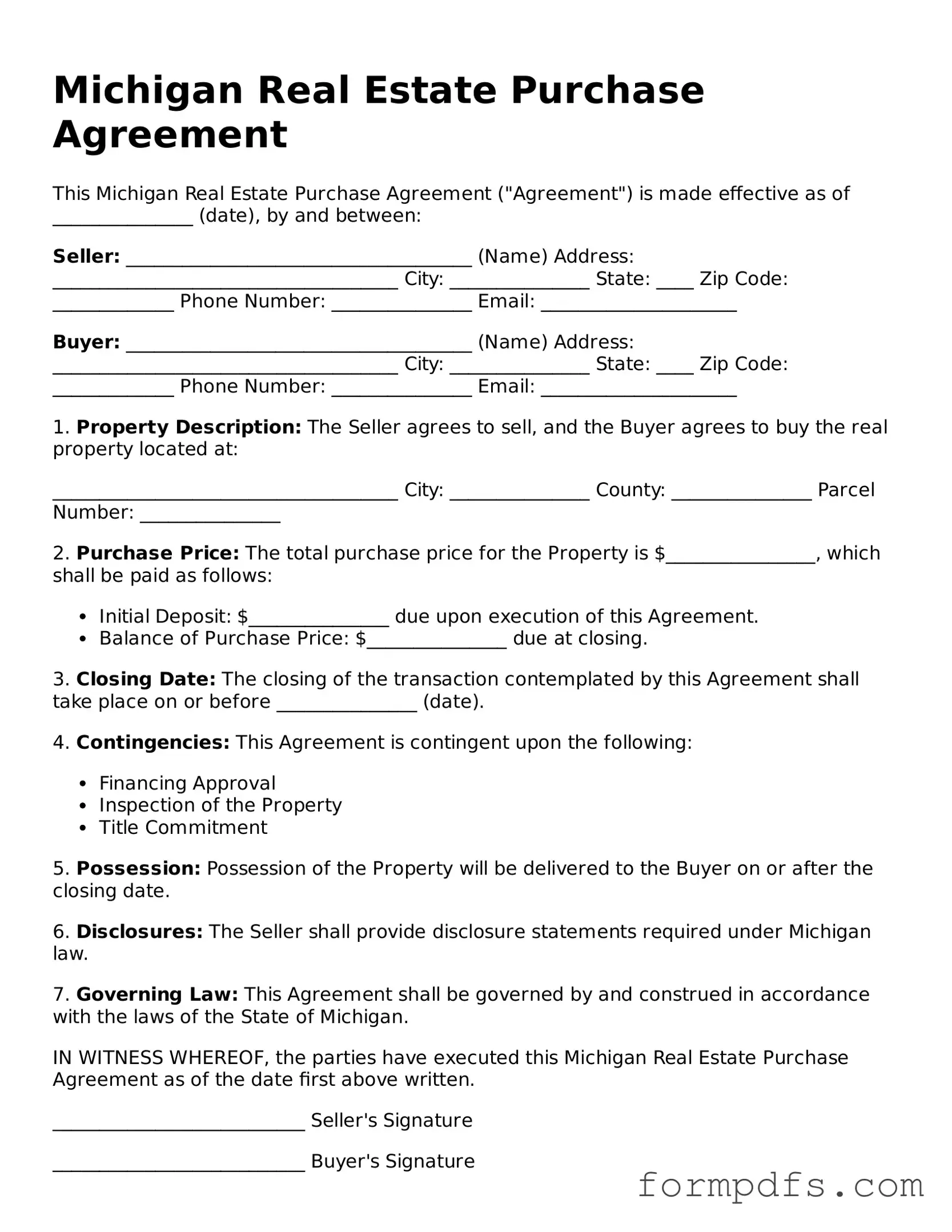

Printable Real Estate Purchase Agreement Form for the State of Michigan

The Michigan Real Estate Purchase Agreement form serves as a crucial document in the real estate transaction process, outlining the terms and conditions under which a property will be bought and sold. This form is designed to protect the interests of both buyers and sellers, ensuring that all parties are on the same page regarding the sale. Key components of the agreement include the purchase price, the closing date, and any contingencies that may affect the sale, such as financing or inspections. Additionally, it addresses the responsibilities of each party, including disclosures about the property's condition and any potential issues that may arise during the transaction. By clearly detailing these elements, the agreement helps to minimize misunderstandings and disputes, paving the way for a smoother transfer of ownership. Understanding the nuances of this form is essential for anyone involved in a real estate transaction in Michigan, whether they are seasoned investors or first-time homebuyers.

Check out Other Common Real Estate Purchase Agreement Templates for Different States

Free Purchase Agreement Form - It allows buyers to outline terms related to existing leases on the property.

When considering the California Power of Attorney for a Child form, it's crucial to understand its significance and applicability. This legal document allows a parent or guardian to delegate temporary parental rights to another adult, ensuring that the child's welfare is prioritized in their absence. For those seeking comprehensive resources on this matter, you can visit All California Forms to find additional information and related documents.

Offer to Purchase Real Estate Form Pdf - All representations made by the seller regarding the property should be included in the agreement.

Documents used along the form

When engaging in real estate transactions in Michigan, several forms and documents are often used alongside the Michigan Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth process. Below is a list of common forms you may encounter.

- Seller's Disclosure Statement: This document provides information about the condition of the property. It includes details on any known issues or repairs that have been made.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead-based paint hazards in the property.

- Property Inspection Report: Conducted by a professional inspector, this report outlines the condition of the property, including any repairs needed.

- Title Commitment: This document is issued by a title company and outlines the legal ownership of the property, including any liens or encumbrances.

- Closing Statement: Also known as a HUD-1, this document summarizes the financial details of the transaction, including fees and costs for both the buyer and seller.

- Affidavit of Title: This document certifies that the seller has the legal right to sell the property and that there are no undisclosed liens or claims against it.

- Buyer's Mortgage Application: If the buyer is financing the purchase, this application is submitted to secure a loan from a lender.

- ATV Bill of Sale: This document is essential for the transfer of ownership of an all-terrain vehicle (ATV) in New York, providing a detailed account of the transaction, including the vehicle's specifics and the sale price. For more information, visit smarttemplates.net/fillable-new-york-atv-bill-of-sale/.

- Deed: This legal document transfers ownership of the property from the seller to the buyer at closing.

Each of these documents is essential in the real estate transaction process. Understanding their purposes can help ensure that all parties are informed and protected throughout the buying or selling journey.

PDF Overview

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Real Estate Purchase Agreement form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of Michigan, specifically under the Michigan Compiled Laws. |

| Parties Involved | The form identifies the buyer and seller, ensuring that both parties are clearly defined and understood. |

| Property Description | A detailed description of the property being sold is included, which typically encompasses the address and legal description. |

| Purchase Price | The agreement specifies the purchase price, outlining how much the buyer will pay for the property. |

| Contingencies | Common contingencies, such as financing and inspections, can be included to protect the interests of both parties. |

| Signatures | Both the buyer and seller must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

More About Michigan Real Estate Purchase Agreement

What is a Michigan Real Estate Purchase Agreement?

The Michigan Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a real estate transaction. It serves as a contract between a buyer and a seller, detailing the property being sold, the purchase price, and any contingencies that must be met before the sale can proceed.

Who uses the Michigan Real Estate Purchase Agreement?

This form is used by individuals and entities involved in buying or selling real estate in Michigan. Real estate agents, buyers, and sellers all rely on this document to ensure that the transaction is conducted fairly and legally.

What information is included in the agreement?

The agreement typically includes the names of the parties involved, a description of the property, the purchase price, the closing date, and any conditions that must be satisfied before the sale can be finalized. It may also address issues like earnest money deposits and contingencies related to financing or inspections.

Is the Michigan Real Estate Purchase Agreement legally binding?

Yes, once both parties sign the agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to fulfill the terms outlined in the document. If either party fails to comply, they may face legal consequences.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified, but both parties must agree to any changes. It’s important to document these changes in writing and have both parties sign the amended agreement to ensure clarity and legality.

What are contingencies in the agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include obtaining financing, passing a home inspection, or the sale of the buyer's current home. If a contingency is not met, the buyer may have the right to back out of the agreement without penalty.

How does earnest money work in the agreement?

Earnest money is a deposit made by the buyer to show their commitment to purchasing the property. This amount is typically held in escrow and applied to the purchase price at closing. If the buyer backs out without a valid reason, the seller may keep the earnest money as compensation for the time the property was off the market.

What should I do if I have questions about the agreement?

If you have questions about the Michigan Real Estate Purchase Agreement, it’s wise to consult a real estate attorney or a qualified real estate agent. They can provide guidance specific to your situation and help ensure that you understand your rights and obligations.

Can I use a generic purchase agreement instead of the Michigan form?

While you can technically use a generic purchase agreement, it’s not advisable. State-specific forms, like the Michigan Real Estate Purchase Agreement, are tailored to comply with local laws and regulations. Using the appropriate form can help protect your interests and ensure a smoother transaction.

Where can I obtain a Michigan Real Estate Purchase Agreement?

You can obtain a Michigan Real Estate Purchase Agreement from a licensed real estate agent, legal professionals, or online legal document services. It’s essential to ensure that the version you use is current and complies with Michigan law.

Michigan Real Estate Purchase Agreement: Usage Steps

Once you have the Michigan Real Estate Purchase Agreement form in hand, you will need to provide specific details about the transaction. Each section of the form requires careful attention to ensure accuracy and compliance with state laws. Follow these steps to complete the form correctly.

- Enter the date: Fill in the date when the agreement is being signed.

- Identify the parties: Clearly state the names and addresses of both the buyer and the seller.

- Property description: Provide a detailed description of the property being sold, including the address and any relevant parcel number.

- Purchase price: Specify the total purchase price for the property.

- Earnest money: Indicate the amount of earnest money the buyer will deposit and the terms regarding its handling.

- Financing terms: Describe how the buyer intends to finance the purchase, including any loan details.

- Closing date: Set a proposed closing date for the transaction.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections or financing approval.

- Signatures: Ensure both parties sign and date the agreement to validate it.