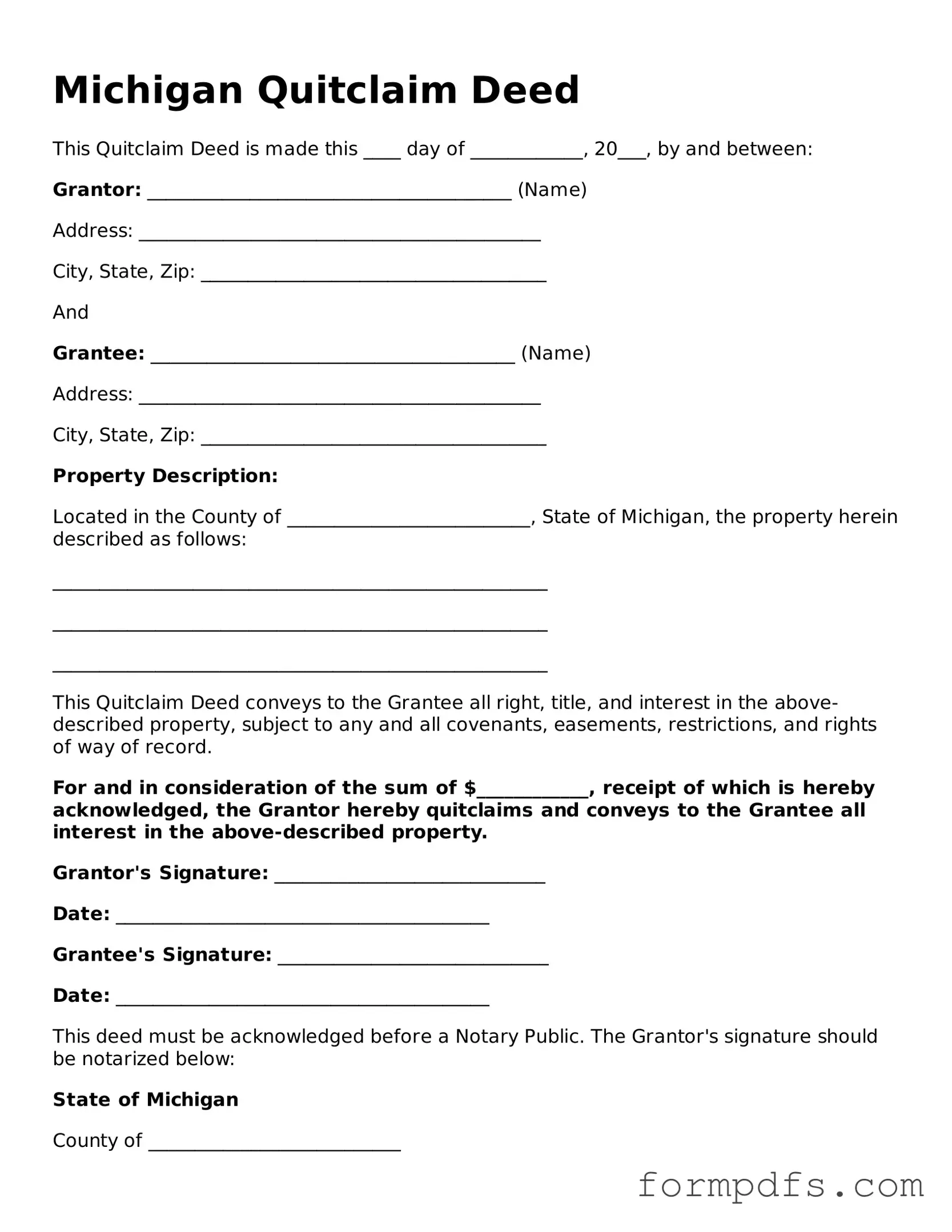

Printable Quitclaim Deed Form for the State of Michigan

The Michigan Quitclaim Deed form serves as a crucial legal instrument in real estate transactions, allowing property owners to transfer their interest in a property to another party without making any guarantees about the title's validity. This type of deed is particularly useful in situations where the parties involved have a pre-existing relationship, such as family members or friends, as it simplifies the transfer process by minimizing the need for extensive title searches or disclosures. When using a quitclaim deed, the grantor, or seller, conveys whatever interest they may have in the property, but does not assure the grantee, or buyer, that the title is free from liens or other claims. This form must be completed accurately, with all relevant details, including the names of the parties involved, a legal description of the property, and the date of transfer, to ensure its validity. Once executed, the deed must be recorded with the appropriate county register of deeds to provide public notice of the transfer. Understanding the implications of a quitclaim deed is essential, as it can impact future ownership rights and responsibilities, making it a vital consideration for anyone involved in real estate transactions in Michigan.

Check out Other Common Quitclaim Deed Templates for Different States

North Carolina Quit Claim Deed Pdf - While a quitclaim deed transfers ownership, it does not clear existing liens on the property.

Quit Claim Deed Ohio - If a quitclaim deed is executed, it generally releases the grantor from any future claims to the property.

Illinois Quit Claim Deed - Quitclaim deeds can streamline certain real estate transactions, particularly when both parties have a clear understanding.

When engaging in a boat sale in New York, it's important to utilize the New York Boat Bill of Sale form to ensure all transaction details are accurately documented. For more information on how to properly fill out this form, you can visit https://smarttemplates.net/fillable-new-york-boat-bill-of-sale/, which provides guidance and resources to facilitate a smooth transaction while ensuring compliance with state laws.

Quit Claim Deed Ga - This form is straightforward and does not involve extensive documentation or legal review.

Documents used along the form

When transferring property in Michigan, the Quitclaim Deed is a common choice. However, several other forms and documents may accompany it to ensure a smooth transaction. Understanding these documents can help clarify the process and protect the interests of all parties involved.

- Property Transfer Affidavit: This document provides the local assessor with information about the property's transfer. It helps determine property taxes and ensures accurate records are maintained.

- Seller's Disclosure Statement: Required in many real estate transactions, this statement discloses known issues with the property. It protects buyers by informing them of potential problems before they finalize the sale.

- Title Insurance Policy: This policy protects the buyer from potential disputes over property ownership. It offers peace of mind by ensuring that the title is clear and free of claims.

- Purchase Agreement: This legally binding contract outlines the terms of the sale, including price and conditions. It serves as the foundation for the transaction and ensures both parties are on the same page.

- Warranty Deed: Unlike a Quitclaim Deed, a Warranty Deed guarantees that the seller holds clear title to the property. It offers additional protection to the buyer against future claims.

- Affidavit of Title: This sworn statement confirms the seller’s ownership of the property and discloses any encumbrances. It adds an extra layer of assurance for the buyer.

- Closing Statement: Also known as a HUD-1, this document itemizes all closing costs and credits involved in the transaction. It provides transparency and clarity to both parties.

- Mortgage Documents: If the buyer is financing the property, various mortgage documents will be required. These include the mortgage agreement and promissory note, detailing the loan terms.

- California Form REG 262: This essential form is used to document the transfer of vehicle or vessel ownership in California, ensuring proper legal compliance. For more details, visit All California Forms.

- Deed of Trust: In some cases, a Deed of Trust may be used instead of a mortgage. It secures the loan by transferring the property title to a trustee until the loan is paid off.

Each of these documents plays a vital role in the property transfer process in Michigan. By being aware of them, individuals can navigate real estate transactions more confidently and effectively. Ensuring all necessary paperwork is in order will help protect your investment and streamline the process.

PDF Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate in Michigan without any warranties. |

| Governing Law | Michigan Compiled Laws, Act 7 of 1953, Section 565.25 governs the use of quitclaim deeds. |

| Purpose | It is commonly used to transfer property between family members or to clear up title issues. |

| Consideration | The deed may be executed with or without consideration, meaning no payment is necessary for the transfer. |

| Form Requirements | The quitclaim deed must be in writing, signed by the grantor, and notarized to be legally valid. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county register of deeds. |

| Tax Implications | Transfer taxes may apply, and it is important to consult local regulations regarding potential tax liabilities. |

| Limitations | The quitclaim deed does not guarantee that the grantor has clear title; it merely transfers whatever interest the grantor has. |

| Revocation | Once executed, a quitclaim deed cannot be revoked unilaterally; a new deed is required to reverse the transfer. |

More About Michigan Quitclaim Deed

What is a Quitclaim Deed in Michigan?

A Quitclaim Deed is a legal document used to transfer ownership of real property in Michigan. Unlike a warranty deed, it does not guarantee that the grantor has clear title to the property. Instead, it simply conveys whatever interest the grantor may have in the property at the time of the transfer.

When should I use a Quitclaim Deed?

This type of deed is commonly used in situations where the parties know each other well, such as between family members, divorcing spouses, or in cases of property transfers without a sale. It is often employed to clear up title issues or to transfer property as part of an estate settlement.

How do I complete a Quitclaim Deed in Michigan?

To complete a Quitclaim Deed, you need to include the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a legal description of the property, and the date of the transfer. It must be signed by the grantor in front of a notary public. Ensure all information is accurate to avoid complications.

Do I need to have the Quitclaim Deed notarized?

Yes, in Michigan, a Quitclaim Deed must be notarized. The grantor’s signature must be witnessed by a notary public to ensure the document is legally valid. This step helps prevent fraud and confirms that the grantor is willingly transferring their interest in the property.

Is there a fee to file a Quitclaim Deed in Michigan?

Yes, there is typically a fee associated with filing a Quitclaim Deed in Michigan. This fee varies by county. Additionally, there may be a fee for obtaining a copy of the deed once it has been recorded. It's advisable to check with your local county clerk's office for specific amounts.

Where do I file a Quitclaim Deed in Michigan?

You must file the Quitclaim Deed with the Register of Deeds in the county where the property is located. It is important to file the deed promptly after it has been executed to ensure the transfer is officially recorded and recognized.

Will a Quitclaim Deed affect my property taxes?

Yes, transferring property through a Quitclaim Deed may impact property taxes. When ownership changes, the local assessor's office may reassess the property value, which could lead to changes in property taxes. It is advisable to consult with your local tax authority for specific implications.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it cannot be unilaterally revoked. The grantor may only regain ownership through mutual agreement with the grantee or by executing a new deed to transfer the property back. Legal advice may be necessary in complex situations.

What if there are multiple owners of the property?

If there are multiple owners, all owners must sign the Quitclaim Deed for it to be valid. This ensures that all parties agree to the transfer of ownership. If one owner does not consent, the transfer cannot proceed without their involvement.

Can I use a Quitclaim Deed for commercial property?

Yes, a Quitclaim Deed can be used to transfer commercial property in Michigan. However, parties involved should be aware of the potential risks, as this type of deed does not provide warranties about the property’s title. Consulting with a real estate attorney is advisable to navigate the complexities of commercial transactions.

Michigan Quitclaim Deed: Usage Steps

Once you have the Michigan Quitclaim Deed form in hand, you are ready to fill it out. This form is essential for transferring property ownership. After completing the form, it will need to be signed and notarized before being filed with the appropriate county office.

- Obtain the form: Download the Michigan Quitclaim Deed form from a reliable source or visit your local county clerk's office to get a hard copy.

- Identify the parties: In the top section, clearly write the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide the property description: Include a detailed description of the property being transferred. This should include the address and legal description, which can often be found on the property tax statement.

- Fill in the consideration: Indicate the amount of money or other value being exchanged for the property. If the transfer is a gift, you can state “for love and affection.”

- Sign the form: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name as listed on the document.

- Notarization: The notary will complete the notarization section, confirming the identity of the grantor and witnessing the signature.

- File the deed: Submit the completed and notarized form to the county clerk's office where the property is located. Be prepared to pay any associated filing fees.