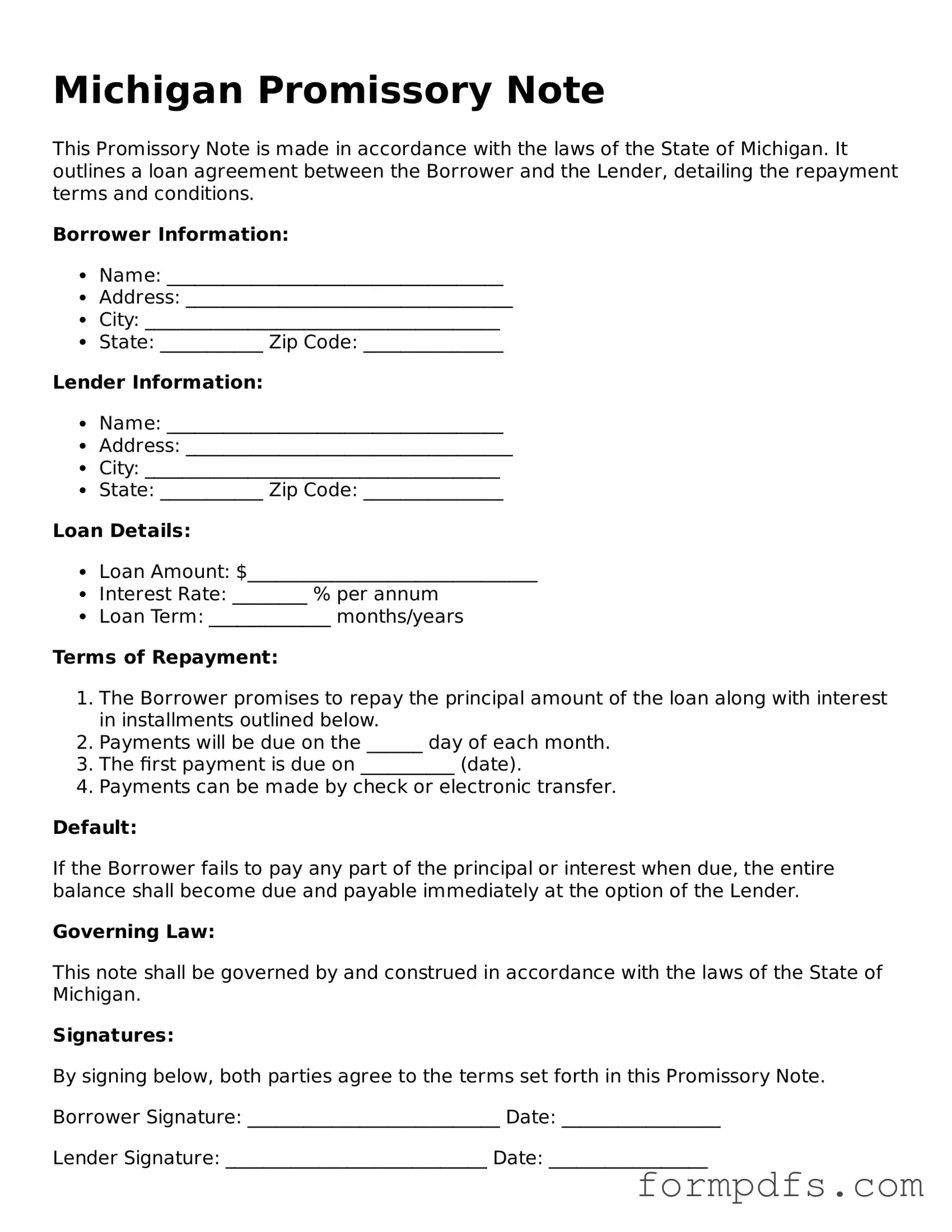

Printable Promissory Note Form for the State of Michigan

When it comes to borrowing money or lending funds, a Michigan Promissory Note serves as a crucial tool for both parties involved. This legally binding document outlines the terms of the loan, ensuring that the lender's interests are protected while providing the borrower with a clear understanding of their obligations. Key components of the form include the principal amount borrowed, the interest rate, and the repayment schedule, which can vary based on the agreement between the parties. Additionally, the note specifies any late fees or penalties for missed payments, as well as the consequences of default. Understanding these elements is essential for anyone entering into a lending arrangement in Michigan, as it helps to establish a transparent and enforceable agreement that can prevent misunderstandings and disputes down the line. With the right knowledge and preparation, both lenders and borrowers can navigate the complexities of financial transactions with confidence.

Check out Other Common Promissory Note Templates for Different States

Free Promissory Note Template Georgia - They are often used between friends or family members for informal loans.

When engaging in the buying or selling of dirt bikes, it is essential to utilize a New York Dirt Bike Bill of Sale form, which serves as an official record of the transaction. This form protects both the buyer and seller by clearly documenting ownership transfer, thereby safeguarding their rights in case of any disputes. For further information and access to the form, visit https://smarttemplates.net/fillable-new-york-dirt-bike-bill-of-sale/.

Promissory Note Template Ohio - Promissory notes can be used for personal loans, business loans, and financial transactions.

Promissory Note Illinois - A promissory note can influence credit scores if payments are reported.

Documents used along the form

When entering into a loan agreement in Michigan, a Promissory Note is often accompanied by several other forms and documents. Each of these documents serves a specific purpose in the lending process, helping to clarify terms and protect the interests of both parties involved.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any fees. It serves as a comprehensive guide to the loan's conditions.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used. It explains the lender's rights to the collateral if the borrower defaults on the loan.

- Disclosure Statement: This document provides important information about the loan, including the annual percentage rate (APR), total finance charges, and payment terms. It ensures that borrowers understand the costs associated with the loan.

- Personal Guarantee: In some cases, a personal guarantee may be required from an individual, ensuring that they will repay the loan if the borrowing entity defaults. This adds an extra layer of security for the lender.

- California LLC-1 Form: Essential for registering a limited liability company (LLC) in California, the California LLC-1 form, also known as the Articles of Organization, is required to contain specific details about the LLC and must be filed with a fee. For more information, visit All California Forms.

- Payment Schedule: This document outlines when payments are due, how much each payment will be, and the total duration of the loan. It helps borrowers keep track of their obligations.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components. It shows how the loan balance decreases over time, providing clarity on repayment progress.

- Default Notice: If the borrower fails to meet their obligations, this notice informs them of the default. It typically outlines the steps the lender may take to remedy the situation.

- Release of Lien: Once the loan is paid off, this document releases any claims the lender had on the collateral. It confirms that the borrower has fulfilled their obligations under the loan agreement.

These documents work together to create a clear understanding between the lender and borrower. They help ensure that both parties are aware of their rights and responsibilities throughout the loan process.

PDF Overview

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a specified time or on demand. |

| Governing Law | The Michigan Uniform Commercial Code (UCC) governs promissory notes in Michigan. |

| Parties Involved | The note involves at least two parties: the maker (borrower) and the payee (lender). |

| Key Components | Essential components include the principal amount, interest rate, maturity date, and payment terms. |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the document. |

| Signature Requirement | The maker must sign the note for it to be legally binding. |

| Enforceability | To be enforceable, the note must be in writing and contain all necessary terms. |

| Default Consequences | If the borrower defaults, the lender may pursue legal action to recover the owed amount. |

More About Michigan Promissory Note

What is a Michigan Promissory Note?

A Michigan Promissory Note is a written agreement between a borrower and a lender. It outlines the terms under which the borrower agrees to repay a specific amount of money, typically with interest, over a defined period. This document serves as a legal promise to pay and can be used in various situations, such as personal loans, business transactions, or real estate purchases. It is important to ensure that the note includes all necessary details to protect the interests of both parties involved.

What key elements should be included in a Michigan Promissory Note?

When drafting a Michigan Promissory Note, several key elements must be included to make it valid and enforceable. First, the names and addresses of both the borrower and the lender should be clearly stated. Next, specify the loan amount, the interest rate, and the repayment schedule, including due dates. Additionally, it’s wise to include any late fees or penalties for missed payments. Finally, both parties should sign and date the document to confirm their agreement to the terms outlined in the note.

Is a Michigan Promissory Note legally binding?

Yes, a Michigan Promissory Note is legally binding as long as it meets certain criteria. For it to be enforceable, the note must be clear and unambiguous in its terms. Both parties should have the legal capacity to enter into the agreement, and there must be mutual consent. If these conditions are met, the lender can take legal action if the borrower fails to repay the loan according to the agreed terms. It is advisable to keep a copy of the signed note for your records.

Can a Michigan Promissory Note be modified after it is signed?

Yes, a Michigan Promissory Note can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing, and both the borrower and lender should sign the revised terms. This ensures that there is a clear record of the changes made to the original agreement. It's important to note that informal verbal agreements may not be enforceable, so written documentation is crucial for clarity and legal protection.

Michigan Promissory Note: Usage Steps

After obtaining the Michigan Promissory Note form, it is important to fill it out accurately. This document will require specific details about the loan agreement. Follow the steps below to ensure all necessary information is provided correctly.

- Begin by entering the date at the top of the form.

- In the first section, write the name and address of the borrower. Make sure to include any relevant identification numbers if required.

- Next, fill in the lender's name and address in the designated area.

- Specify the principal amount of the loan in the appropriate field. This is the total amount being borrowed.

- Indicate the interest rate, if applicable. This should be clearly stated as a percentage.

- Provide the repayment terms. Include the due date and any details about payment frequency, such as monthly or quarterly.

- In the next section, outline any late fees or penalties for missed payments.

- Sign and date the form at the bottom. Ensure that both the borrower and lender sign where indicated.

Once the form is filled out, review it for any errors or missing information. After confirming everything is correct, you can proceed with the next steps in your loan process.