Printable Operating Agreement Form for the State of Michigan

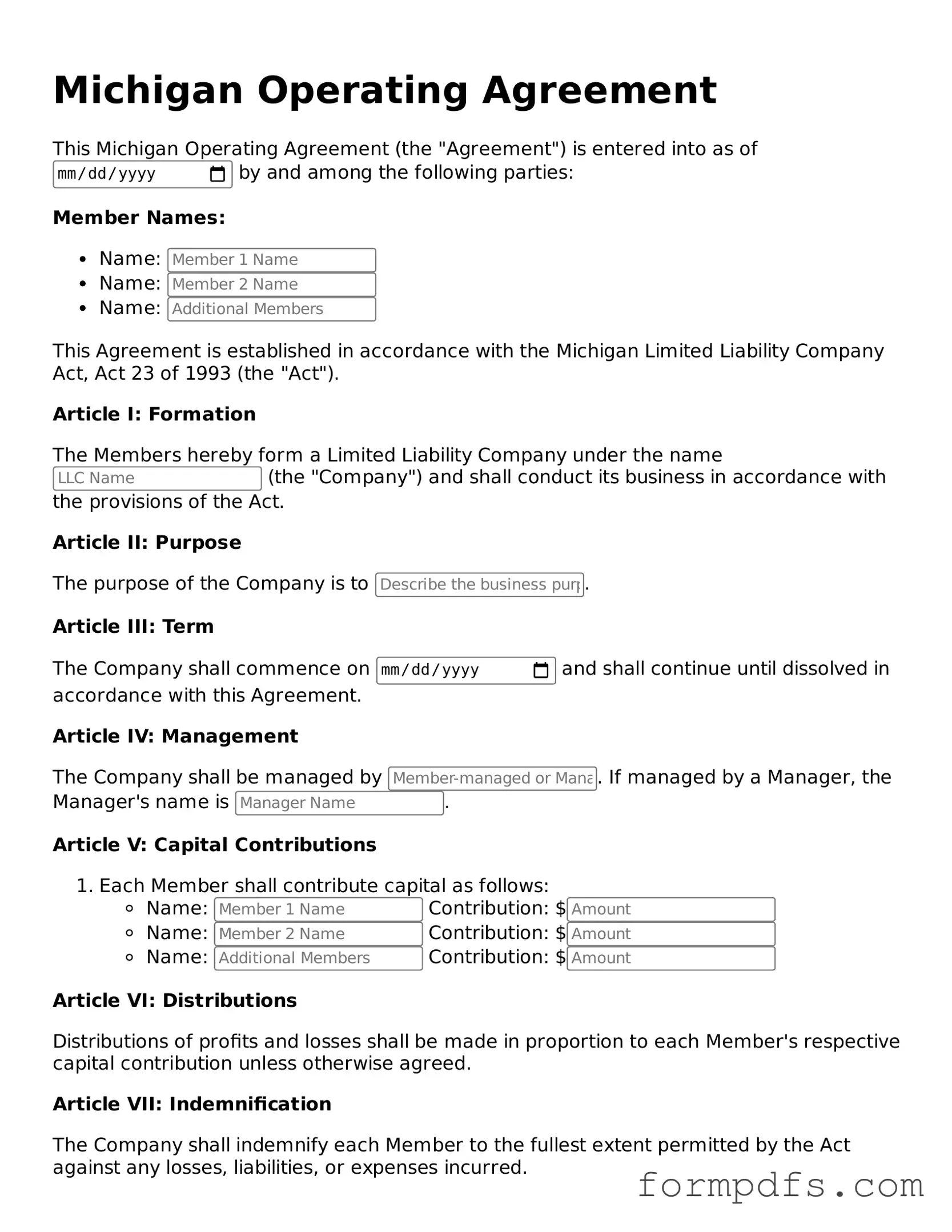

The Michigan Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal workings and management structure of the LLC, providing clarity on how the business will be run. It typically includes details such as the roles and responsibilities of members, the process for making decisions, and how profits and losses will be distributed among members. Additionally, the agreement addresses the procedures for adding new members, handling disputes, and the dissolution of the company if necessary. By establishing these guidelines, the Operating Agreement helps to protect the interests of all members and ensures smooth operations, thereby minimizing potential conflicts in the future.

Check out Other Common Operating Agreement Templates for Different States

How to Create an Operating Agreement - The Operating Agreement is vital for maintaining clear communication among members.

To simplify the process of transferring ownership, individuals can utilize the New York Boat Bill of Sale form, which can be found online at https://smarttemplates.net/fillable-new-york-boat-bill-of-sale; this ensures that all necessary information about the transaction is accurately recorded for both the buyer and seller.

How to Make an Operating Agreement - It often lays out the responsibilities for bookkeeping and tax filing obligations.

Operating Agreement for Llc Georgia - It fosters a collaborative environment by specifying decision-making roles.

Documents used along the form

When forming a limited liability company (LLC) in Michigan, an Operating Agreement is a crucial document. However, several other forms and documents are often used in conjunction with the Operating Agreement to ensure compliance with state regulations and to protect the interests of the members. Below is a list of these important documents.

- Articles of Organization: This is the foundational document that establishes the existence of the LLC. It is filed with the Michigan Department of Licensing and Regulatory Affairs (LARA) and includes essential information such as the LLC's name, registered agent, and duration.

- Member Consent Agreements: These documents outline decisions made by the members of the LLC, particularly when formal meetings are not held. They serve as a record of important agreements and can help prevent disputes among members.

- California Form REG 262: Essential for transferring ownership of vehicles and vessels in California, this form must be filed alongside the title and ensures compliance with state regulations. For more information, visit All California Forms.

- Operating Procedures: While the Operating Agreement details the management structure, Operating Procedures provide specific guidelines on day-to-day operations. This may include processes for decision-making, financial management, and member responsibilities.

- Tax Forms: Depending on the structure and activities of the LLC, various tax forms may be required. This could include forms for federal tax identification, state tax registrations, or any necessary local business licenses.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. Issuing them can help clarify each member's stake in the business and facilitate the transfer of ownership if needed.

Each of these documents plays a vital role in the overall governance and operation of an LLC in Michigan. By understanding and utilizing these forms, members can ensure their business is well-structured and compliant with the law.

PDF Overview

| Fact Name | Details |

|---|---|

| Purpose | The Michigan Operating Agreement form outlines the management structure and operational procedures for a limited liability company (LLC). |

| Governing Law | This form is governed by the Michigan Limited Liability Company Act, specifically Act 23 of 1993. |

| Mandatory Use | While not required by law, an operating agreement is highly recommended for LLCs to clarify member roles and responsibilities. |

| Member Rights | The agreement specifies the rights and obligations of members, including voting rights and profit distribution. |

| Amendments | Members can amend the operating agreement by following the procedures outlined within the document itself. |

| Default Provisions | In absence of an operating agreement, Michigan law provides default rules that may not align with the members' intentions. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, such as mediation or arbitration. |

| Record Keeping | It is advisable to keep a signed copy of the operating agreement with the LLC’s official records for legal reference. |

More About Michigan Operating Agreement

What is a Michigan Operating Agreement?

A Michigan Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Michigan. It serves as an internal guideline for the members of the LLC, detailing their rights, responsibilities, and obligations. While not required by law, having an operating agreement can help prevent disputes and provide clarity on how the business will operate.

Is an Operating Agreement required in Michigan?

No, Michigan does not legally require LLCs to have an operating agreement. However, having one is highly recommended. It can help protect your personal assets, clarify the roles of members, and establish a clear plan for decision-making and profit distribution. Additionally, banks and investors may request an operating agreement when you seek financing.

What should be included in a Michigan Operating Agreement?

A comprehensive Michigan Operating Agreement typically includes several key elements. These include the LLC's name, purpose, and duration, as well as details on member contributions, management structure, voting rights, and how profits and losses will be distributed. It may also outline procedures for adding or removing members, handling disputes, and dissolving the LLC if necessary.

Can I create my own Operating Agreement?

Yes, you can create your own Operating Agreement. Many templates are available online that can guide you through the process. However, it’s important to ensure that the document meets Michigan’s legal requirements and accurately reflects your business needs. Consulting with a legal professional can provide additional peace of mind.

How does an Operating Agreement help in case of disputes?

An Operating Agreement can be a valuable tool in resolving disputes among members. By clearly outlining the roles, responsibilities, and processes for decision-making, it reduces ambiguity. If a disagreement arises, referring to the agreement can help members navigate the situation based on pre-established guidelines, potentially avoiding costly legal battles.

How do I amend an Operating Agreement?

Amending an Operating Agreement in Michigan typically requires a majority vote from the members, unless the original agreement specifies a different process. It’s crucial to document any changes in writing and ensure that all members agree to the amendments. This helps maintain transparency and keeps the agreement up-to-date with the business's evolving needs.

Where can I find a sample Michigan Operating Agreement?

Sample Michigan Operating Agreements can be found online through various legal resources and business websites. Many state-specific resources also offer templates tailored to Michigan’s laws. When using a sample, ensure that you customize it to fit your LLC’s specific circumstances and consult a legal professional if needed.

Michigan Operating Agreement: Usage Steps

Once you have your Michigan Operating Agreement form ready, you will need to carefully fill it out to ensure that all necessary information is included. This document is essential for outlining the structure and operating procedures of your business. Following the steps below will help you complete the form accurately.

- Begin by entering the name of your Limited Liability Company (LLC) at the top of the form.

- Provide the principal office address of your LLC. This should be a physical address where your business is located.

- List the names and addresses of all members involved in the LLC. Make sure to include their roles and ownership percentages.

- Outline the purpose of the LLC. Clearly state what business activities the company will engage in.

- Detail the management structure. Specify whether the LLC will be managed by its members or by appointed managers.

- Include provisions for meetings. State how often meetings will be held and how members will be notified.

- Address the process for adding or removing members. This should include any necessary voting procedures.

- Specify how profits and losses will be distributed among members. Clearly outline the method of distribution.

- Sign and date the form at the bottom. Ensure that all members have signed, as required.

After completing the form, review it for accuracy and completeness. Once satisfied, you can proceed with filing it according to Michigan's requirements.